Warren Buffett famously said, ‘Volatility is far from synonymous with risk.’ When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that THC Biomed Intl Ltd. (CSE:THC) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of ‘creative destruction’ where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for THC Biomed Intl

What Is THC Biomed Intl’s Debt?

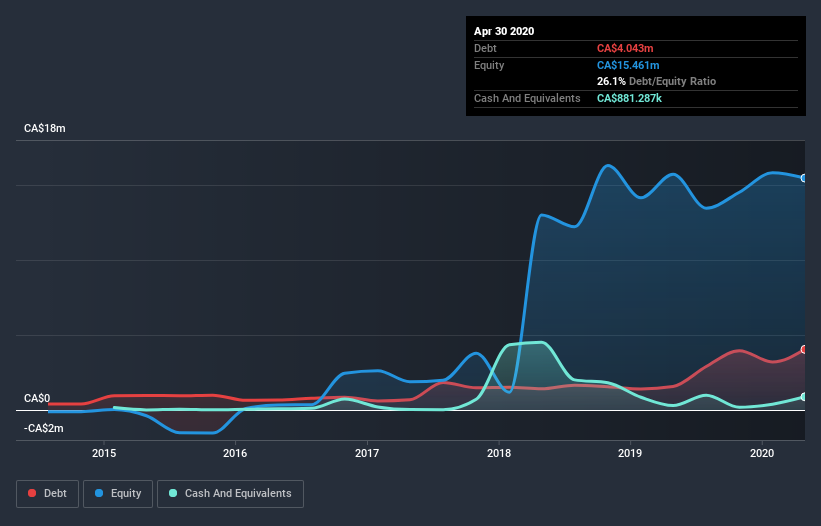

As you can see below, at the end of April 2020, THC Biomed Intl had CA$4.04m of debt, up from CA$1.57m a year ago. Click the image for more detail. However, it also had CA$881.3k in cash, and so its net debt is CA$3.16m.

CNSX:THC Debt to Equity History September 23rd 2020

CNSX:THC Debt to Equity History September 23rd 2020 How Strong Is THC Biomed Intl’s Balance Sheet?

The latest balance sheet data shows that THC Biomed Intl had liabilities of CA$3.67m due within a year, and liabilities of CA$2.68m falling due after that. Offsetting these obligations, it had cash of CA$881.3k as well as receivables valued at CA$286.1k due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CA$5.18m.

This deficit isn’t so bad because THC Biomed Intl is worth CA$22.2m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But it’s clear that we should definitely closely examine whether it can manage its debt without dilution. When analysing debt levels, the balance sheet is the obvious place to start. But you can’t view debt in total isolation; since THC Biomed Intl will need earnings to service that debt. So if you’re keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year THC Biomed Intl wasn’t profitable at an EBIT level, but managed to grow its revenue by 180%, to CA$3.6m. So its pretty obvious shareholders are hoping for more growth!

Caveat Emptor

Despite the top line growth, THC Biomed Intl still had an earnings before interest and tax (EBIT) loss over the last year. Indeed, it lost a very considerable CA$3.7m at the EBIT level. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. However, it doesn’t help that it burned through CA$3.3m of cash over the last year. So in short it’s a really risky stock. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet – far from it. Be aware that THC Biomed Intl is showing 6 warning signs in our investment analysis , and 2 of those are potentially serious…

If, after all that, you’re more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Promoted

When trading THC Biomed Intl or any other investment, use the platform considered by many to be the Professional’s Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account.