Ascot Resources (OTCQX:AOTVF) is one of only a handful of gold juniors with an advanced-stage (almost shovel-ready) development project in a safe jurisdiction. The feasibility study for its 100%-owned Premier-Red Mountain project was released back in April. Right now, the company is working on completing the financing package and obtaining the final permits. According to recent news, both the processes are well advanced and should be completed soon.

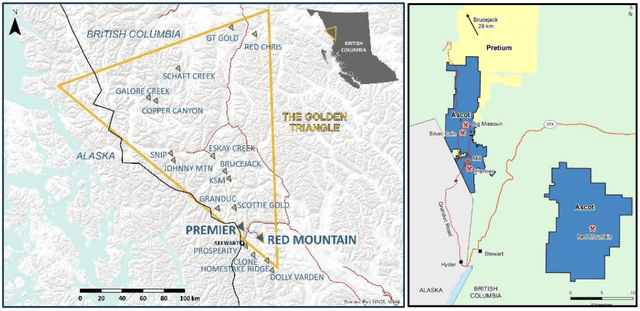

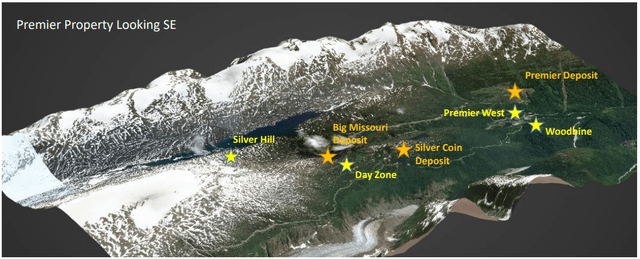

The Premier-Red Mountain project is located in the Golden Triangle region of British Columbia. The combined project consists of two brownfield projects, Premier and Red Mountain. Therefore, the infrastructure is good and also some of the facilities are already in place (although some refurbishments are needed). According to the feasibility study, the mining operation will include a centralized facility that will process ore from Premier, Big Missouri, Silver Coin, and Red Mountain deposits (map below). The current reserves contain 1.171 million toz gold and 3.916 million toz silver, with gold grades of 5.89 g/t and silver grades of 19.72 g/t. However, the measured, indicated, and inferred resources contain 3.1 million toz gold and 11.61 million toz silver and the current drill campaign keeps on delivering great results. It means that there is a very high probability that more resources and reserves will be outlined soon.

Source: Ascot Resources

Source: Ascot Resources

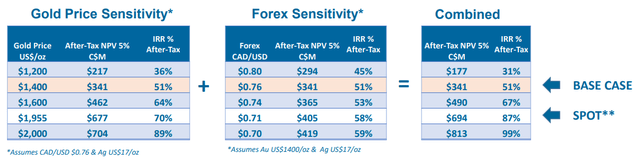

Over the 8-year mine life, the mine should be able to produce 132,000 toz gold and 370,000 toz silver per year on average. The AISC should be only $769/toz gold. What is important, as Premier-Red Mountain is a brownfield project, the initial CAPEX should be low. The feasibility study projects it at C$146.6 million ($111.4 million). At a base-case gold price of $1,400/toz and CAD/USD exchange rate of 0.76, the after-tax NPV(5%) was projected at C$341 million ($259 million), and the after-tax IRR was projected at 51%. However, at the current gold prices, the after-tax NPV(5%) should be around C$650 million ($490 million) and the after-tax IRR should be over 80%.

Source: Ascot Resources

Source: Ascot Resources

The economics of the project are great. And the exploration results achieved over the recent months indicate that further improvements are highly probable. On July 29, Ascot released drill results from the Premier West area located directly to the west of the existing Premier pit. The best results included 20.06 g/t gold over 3.23 meters, or 9.21 g/t gold over 6 meters. On August 19, further drill results from Premier West were released. They included 13.47 g/t gold over 24.15 meters, 15.75 g/t gold over 4.5 meters or 9.91 g/t gold over 4.25 meters. On September 14, Ascot released drill results from the Day Zone, only 300 meters from the Big Missouri deposit. This batch of results included 20.62 g/t gold over 4.1 meters or 54.6 g/t gold over 2.05 meters. And on October 8, drill results from the Silver Hill zone were released. The results were very good once again, including 1,320 g/t silver over 1 meter or 154.3 g/t silver over 7.12 meters.

Source: Ascot Resources

Source: Ascot Resources

In June, Ascot completed a C$25 million ($18.8 million) bought deal financing. It issued 29.412 million new shares, priced at C$0.85. The proceeds are used for further exploration and project development. On October 15, the company announced placement of an order for SAG and Ball mills needed for refurbishment of the existing facilities. This means an important milestone, as these long lead time items are important for the construction time-frame.

Also the permitting seems to be progressing well. The company is in the middle of the permit amendment process. The applications should be prepared and submitted by the end of this year. Moreover, the project has the support of the local Nisga'a Nation.

One of the last, but key, pieces of the puzzle is funding the CAPEX needs. Although the CAPEX is low and there's no doubt that Ascot will be able to finance the project, the exact structure of the financing package is only to be seen. The latest corporate presentation mentions a combination of debt, royalties and equity. Assuming that Ascot will try to raise $120 million, the debt should cover at least 60%, or $70 million. In the worst-case scenario, the remaining $50 million will have to be covered by an equity financing. At the current share price of $0.8, 62.5 million new shares would have to be issued. It would mean an approximately 23% share dilution, which is not a tragedy.

The problem is that the whole financing process lasts longer than expected, due to the COVID-19-related travel restrictions that prevent the interested parties from making an on-site due dilligence. Ascot believes that the financing could be completed by the end of this year, but anything can happen. Moreover, the price chart doesn't look good and it is possible that the equity financing will be made well below the current share price, which means higher dilution.

As can be seen in the chart above, for the last four months, Ascot's share price has been moving in the $0.8-1.05 range. But now, it is standing at the major support line. The 10-day moving average crossed the 50-day moving average to the downside. And the current gold and stock market weakness indicates that the support will be most probably broken. Another support should be found down in the $0.6 area.

As can be seen in the chart above, for the last four months, Ascot's share price has been moving in the $0.8-1.05 range. But now, it is standing at the major support line. The 10-day moving average crossed the 50-day moving average to the downside. And the current gold and stock market weakness indicates that the support will be most probably broken. Another support should be found down in the $0.6 area.

Conclusion

Ascot Resources develops an advanced-stage brownfield gold project located in the safe jurisdiction of British Columbia. The economics are good and the recent exploration results indicate that they will improve further. The permitting and financing are well advanced. At the current gold price, the after-tax NPV(5%) of the project should equal approximately $490 million. And the cash flows generated by the mine should be over $140 million per year on average. Both numbers show that the current market capitalization of approximately $220 million is low, and Ascot's shares offer significant upside potential in the mid-to-long-term. However, the technical analysis indicates some share price weakness in the near-term. This could lead to a very attractive opportunity to initiate a new position or to add to the old one.

Disclosure: I am/we are long AOTVF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.