Stockhouse mining investors often hear the same catch phrase no matter what metals sector they choose to invest in – the best deposits have already been discovered and (in many cases) have already been mined to near or total depletion. But there is a mining-friendly region in the African subcontinent that holds some of the world’s richest existing ore deposits and the prospect of even more.

Now, a Vancouver-based, mid-stage copper and cobalt exploration company is making a major “elephant country” exploration move into…

actual elephant country!

Midnight Sun Mining Corp. (

TSX-V.MMA,

OTCMKTS: MDNGF,

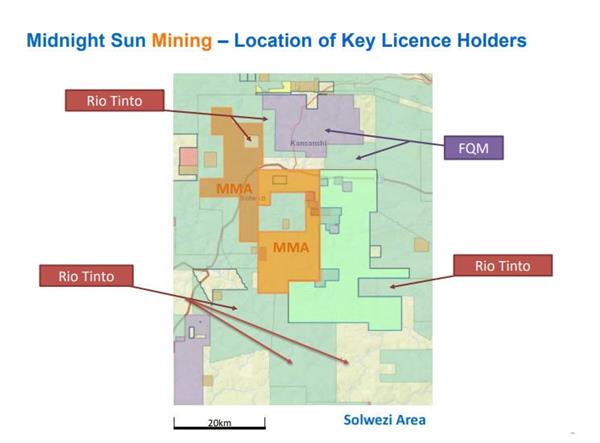

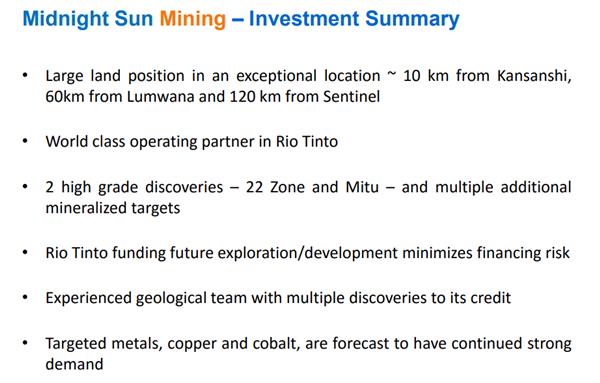

Forum) is focused on discovering copper and cobalt in Zambia – one of earth’s most prolific, yet underexplored, copper producing regions. The Company currently owns a 60% interest in the Solwezi Licences in the Zambian-Congo Copperbelt, located in the mineral-rich North-Western Province of Zambia.

Controlling an impressive land package in one of the largest copper producing areas in the world, and located adjacent to the largest copper mine in Africa –

First Quantum Minerals Ltd’s (

TSX.FM) Kansanshi Mine – Midnight Sun boasts a number of target areas which have proven mineralization and offer exciting potential.

In a

Stockhouse exclusive article detailing the future global demand for copper (especially given the electric vehicle revolution and the ramping up of electrification projects in third world countries) the price of copper is predicted to increase as demand is expected to exceed supply moving forward through 2021.

Midnight Sun says they expect Phase One of their exploration and drilling program to commence in the summer of 2020.

(Click image to enlarge)

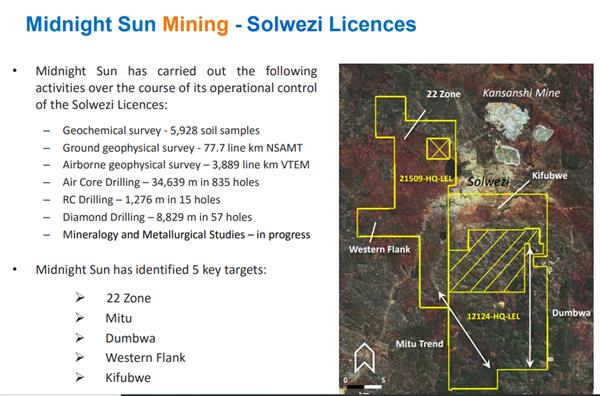

(Click image to enlarge) Midnight Sun breaks the Solwezi Licenses into five target areas:

22 Zone Drill discovery of 14.2 metres of 5.71% Cu near surface oxide material with SX/EW production potential as well as deep sulphide potential. Located 10 Km from Kansanshi mining complex, viewed as a possible lookalike.

Dumbwa Multiple oxide copper/cobalt intercepts along a 14 kilometre soil anomaly. Soil samples as high as 0.72% (7,280 Cu ppm) and economic oxide intervals located in drill holes.

Mitu Copper-cobalt-nickel-gold intercepts in ore shale including 11.6 metres of 4.29% Cu Eq* Air core drilling and VTEM geophysics have confirmed the favourable geological unit for over 17 kilometres.

Kifubwe Large nickel soil anomaly over 6 kilometres in strike length. Further exploration work required.

Western Flank VTEM geophysics have identified a continuous conductive trend that is approximately 5km by 2km and occurs in the same geology which surrounds the Kansanshi Mine

(Click image to enlarge) Mining in Zambia: The Here, Now and History

(Click image to enlarge) Mining in Zambia: The Here, Now and History The Zambian-Congo Copper Belt is host to some of the world’s richest mines, with mega operators that include Barrick Gold Corporation (BC) (

TSX.ABX), Rio Tinto Mining PLC (

ASX.RIO), Glencore PLC (

GLNCY), Ivanhoe Mines Ltd. (

TSX.IVN), and First Quantum Minerals Ltd. Zambia is a traditionally safe and secure mining jurisdiction (think the DRC’s geology but without the political risk). The country boasts modern infrastructure and a good transportation system for moving raw materials to market.

Since independence in from the U.K. in 1964, Zambia’s mining industry has provided the traditional base for the country’s foreign exchange earnings and continues to be the major contributor to export receipts, accounting for more than 70% of Zambia’s export earnings as of 2017. The mining sector and its support industries provide major employment and the infrastructure backbone to areas that would otherwise lack the incentive for sustained development. In 2010, the World Bank named Zambia “one of the world’s fastest economically reformed countries.”

Currently, five big mines dominate Zambia’s copper production, complemented by several smaller players who also play an important role. All of the mines are backed by a wide array of respected international investors.

The “Big Five” are Barrick’s Lumwana, FQM’s Kansanshi, FQM’s Sentinel, Glencore/FQM’s Mopani, and Vedanta’s Konkola Copper Mine. These mines are world class and account for over 80% of Zambia’s annual copper production.

In the News On April 27th, Midnight Sun Mining Corp. made a major announcement, reporting it had entered into an earn-in and joint venture agreement with mining giant

Rio Tinto Mining PLC in which Rio Tinto can earn up to a 75% interest in Midnight Sun’s Solwezi Licences.

Investor Alert: The deal includes a significant USD$51 million earn-in agreement with Rio Tinto. The size of the investment is a clear indication of the confidence Rio Tinto has in the project’s strong potential. The immediate benefit to Midnight Sun and its shareholders is the significant de-risking of the project and also the elimination of the risk of future dilution to Midnight Sun investors.

The Solwezi Licences are comprised of two individual exploration licences totalling 506 square kilometres, situated in the North-Western Province of Zambia, adjacent to First Quantum’s Kansanshi Mine – Africa's largest copper mining complex – on the prolific Zambia-Congo Copper Belt.

Summarized Terms of the Midnight Sun-Rio Tinto Agreement Initial Cash Payment: A cash payment in the amount of USD$700,000 will become payable by Rio Tinto to Midnight Sun upon removal of conditions.

Initial Work Program: Rio Tinto can fund an initial work program on the Solwezi Licenses by spending USD$3,000,000, of which USD$2,000,000 is a firm commitment, within the next two field season. After completing the firm commitment, a further USD$300,000 will become payable by Rio Tinto to Midnight Sun before Rio Tinto proceeds with the additional expenditures.

- Stage 1: After completing the Initial Work Program, Rio Tinto can earn 51% ownership of the Solwezi Licenses by incurring a further USD$16,000,000 in work expenditures within four years and making a total of USD$1,000,000 in additional scheduled cash payments to Midnight Sun.

- Stage 2: Rio Tinto can earn an additional 14% ownership of the Licences by incurring a further USD$14,000,000 in work expenditures or completing a Feasibility Study within three years of starting Stage 2 and making an additional USD$1,000,000 cash payment to Midnight Sun.

- Stage 3: Rio Tinto can earn an additional 10% ownership of the Licences by incurring a further USD$15,000,000 in work expenditures within two years.

The Company’s CEO, Al Fabbro, commented on the ground-breaking partnership:

"I am excited to be partnering with one of the preeminent leaders in the mining industry. Rio Tinto's enthusiasm towards the Solwezi Licences reflects my own. Their expertise combined with their aggressive exploration plans are precisely want I want to see for this project." And on

May 26th, Midnight Sun completed a $1 million-plus private placement which ensures that the Company’s financing needs are looked after while Rio Tinto continues with their work on the property.

(Click image to enlarge)

(Click image to enlarge) For more information, visit

www.midnightsunmining.com FULL DISCLOSURE: This is a paid article produced by Stockhouse Publishing.