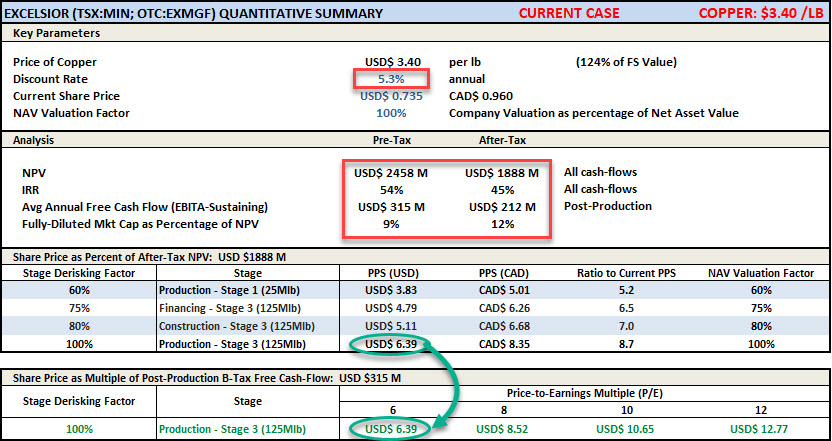

NPV Valuation to match 6X P/E Ratio ValuationHere's an interesting exercise. What Discount Rate would we need to make the valuation of Excelsior based on NPV match the valuation based on 6X P/E Ratio using current copper prices?

Turns out we'd use a

5.3% discount rate for an eye-popping $US1.89B ATax NPV (45% ATax IRR). That's right...$1.89B NPV! That's a lot of zeros after that number.

A quick refresher on Discount Rate

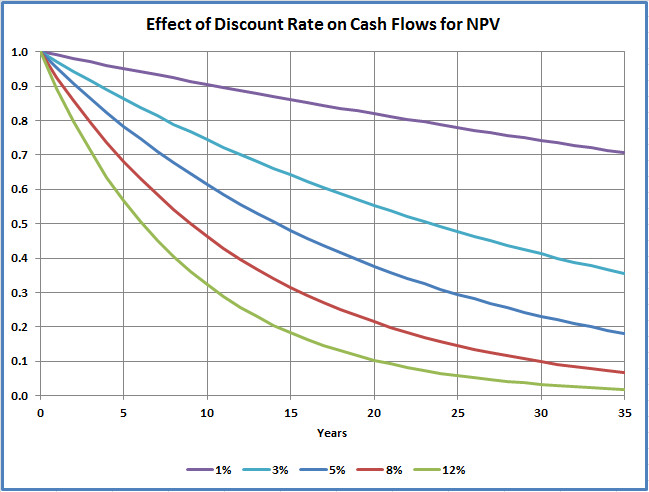

A quick refresher on Discount Rate If someone offered to give you $1000 today or $1000 a year from now, which would you rather have? Obviously, we'd choose to have the $1000 today. So we intuitively know that $1000 today has more value than $1000 a year from now. Discount rate is an elegant method of assigning a discounted valuation to future cashflows. What it says is that the value of money a year from now is discounted by the Discount Rate; i.e., using a 5% discount rate, the $1000 a year from now would be worth $50 less at $950. A 10% discount rate would knock off $100 from the value, for a discounted value of $900.

Net Present Value (NPV) then sums these future discounted cashflows.

So, cashflows from each year are discounted at the Discount Rate on a year by year basis. Here are some comparisons of what effect different discount rates have on future cashflows.