It's been a rough few months for the precious metals sector (GLD), and the Gold Juniors Index (GDXJ) is now down nearly 30% from its highs, with some pre-revenue juniors like Freegold Ventures (FGOVF) down over 60%. However, Golden Minerals (AUMN) is one of the few juniors that is actually up in Q4 and continues to outperform its benchmark with a 70% return year-to-date. The catalyst for this outperformance might be the news that the company will be becoming a small-scale producer in early 2021, with the company recently receiving final permits for its Rodeo Project. Assuming operations go as planned, the company should be able to generate over $20 million in revenue next year at a market cap of just US$70 million after cash. Therefore, even though there is much better value out there in the sector, Golden Minerals is an interesting speculative name to keep an eye on in FY2021. All figures are in US Dollars.

(Source: Company Presentation)

(Source: Company Presentation)

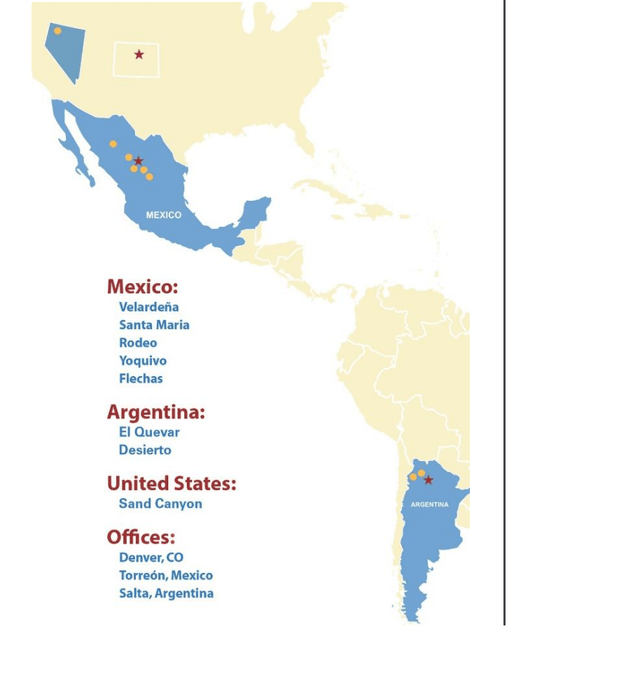

For those unfamiliar, Golden Minerals' flagship project is the Velardena Project in Mexico, but the company has received little attention from the market after it was forced to suspend the operation in 2015 as metallurgical issues and low metals price made operations unprofitable. Since that time, the company has been generating a small stream of revenue by processing Hecla's (NYSE:HL) material at its Velardena oxide plant, with FY2019 revenue coming in at $7.7 million. However, with no real hope of growing revenue near term and an un-mineable resource at Velardena, there's been no real reason for the market to take a second look at the company. Fortunately, higher metals prices, final permits at Rodeo, and an updated Preliminary Economic Assessment (PEA) at Velardena has breathed some new life into the company. Let's take a closer look below:

(Source: Company Presentation)

(Source: Company Presentation)

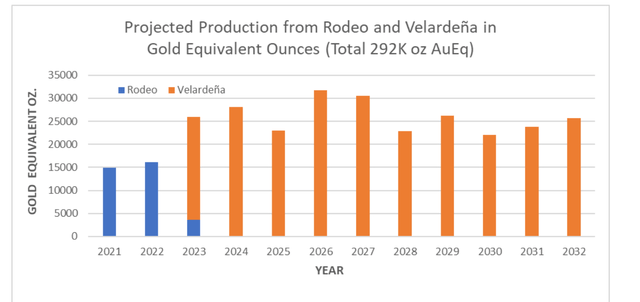

As noted earlier, it's been a busy year for Golden Minerals, with a PEA released at its Velardena Project in Mexico in April and a PEA at its Rodeo Project, which lies 115 kilometers away from Velardena just two weeks later. While mining based on PEAs can be riskier, the PEA results at Rodeo envision a two-year mine life with a very modest upfront capital of $1.5 million and average annual gold-equivalent production of roughly 14,000~ gold-equivalent ounces (GEOs). This is an extremely small-scale operation that otherwise wouldn't even be feasible at today's metals prices, but the proximity to an already operational oxide plant at Velardena has made mining Rodeo possible. Early estimates are that all-in sustaining costs will come in at $843/oz net of by-product credits, roughly 13% below the FY2019 industry average of $990/oz.

(Source: Company Presentation)

(Source: Company Presentation)

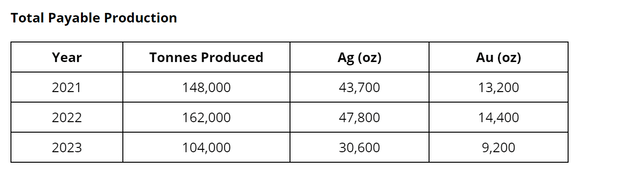

The expectation is that the mine will benefit from a low strip ratio of 1.70 to 1, and the oxide plant will process roughly 480 tonnes per day. Based on relatively high average grades of 3.31 grams per tonne gold, this should allow for a reasonable operation for a smaller name like Golden Minerals. In fact, at conservative metals prices of $1,700/oz gold and $22.00/oz silver (SLV), I believe Golden Minerals should be able to generate $21.0~ million in revenue in FY2021. This is based on my estimates of 11,800 ounces of gold being produced and sold at $1,700/oz gold, and 40,000 ounces of silver being produced and sold at $22.00/oz. It's worth noting that these estimates are roughly 10% below the FY2021 payable production estimates, but I have purposely used lower metals prices and lower production statistics to be ultra-conservative.

(Source: Company Presentation)

(Source: Company Presentation)

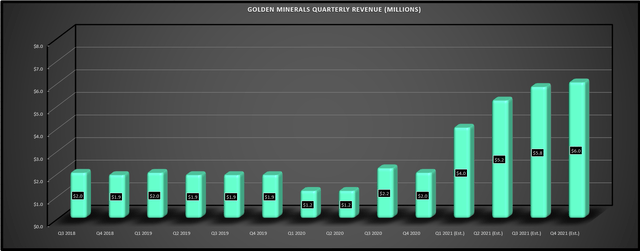

We can see below that we've seen minimal growth in quarterly revenue over the past two years because the company has only been able to realize revenue from Hecla with none of its own operations in production. However, this is expected to change dramatically in Q1 2021, and I expect revenue to more than double year over year from $1.2 million to $4.0 million. This is based on the company's guidance that mining and processing will begin in January 2021. Meanwhile, I would expect revenue to ramp up throughout the year as the company benefits from a full quarter of operations and more experience mining the deposit at Rodeo. As shown below, this should lead to a 150% growth rate in revenue from FY2020 to FY2021 based on my FY2020 revenue estimates of $6.6~ million and FY2021 revenue estimates of $21.0~ million. These figures could differ materially if we see more volatility in metals prices. Still, I would expect an upside surprise if anything because I have used metals prices well below current levels ($1,700/oz gold and $22.00/oz silver).

(Source: YCharts.com, Author's Chart)

(Source: YCharts.com, Author's Chart)

Based on estimated FY2021 revenue of $21.0~ million at $1,700/oz gold and $22.00/oz silver, Golden Minerals is trading at roughly 3.2x FY2021 revenues. This is based on a share price of $0.50, 152 million shares outstanding, and $8 million in cash. This is a little bit steep when we compare this to other junior producers that are trading at barely 2x trailing-twelve-month revenue like Northern Vertex (OTCPK:NHVCF), but it's important to note that Golden Minerals is likely receiving a premium given that mining at Velardena might be back on the table long term. I have calculated Golden Minerals' enterprise value by multiplying 152 million shares by a share price of $0.50 and then subtracting $8 million in cash, giving it an enterprise value of $68 million.

(Source: Company Presentation)

(Source: Company Presentation)

As mentioned earlier, Golden Minerals completed a new PEA earlier this year on its Velardena Project exploring the use of bio-oxidation and leaching of pyrite concentrates and achieved gold recovery rates of 90% and silver recovery rates of 92% from pyrite-arsenopyrite concentrates. This is a material improvement from the past recoveries of barely 30% without BIOX testing. The updated PEA envisions a relatively modest capex of $10.3 million and a 10-year mine life, with total metals production of 19.7 million silver-equivalent ounces.

While this is a relatively small production profile with barely 25,000~ gold-equivalent ounces per year at an 80 to 1 silver/gold ratio, the costs are expected to be quite low at just $3.48 per silver ounce net of by-product credits. This has the potential to increase production to over 25,000 ounces per year by FY2023, though I would much prefer to see a Feasibility Study done to confirm these economics. At prices of $1,324/oz gold and $16.23/oz silver, the project has a Pre-Tax NPV (8%) of just over $85.9 million. This improves to well over $100 million at today's metals prices.

(Source: Company Presentation)

(Source: Company Presentation)

Therefore, while Golden Minerals might seem expensive based on strictly Rodeo and a 14,000~ ounce per year production profile for less than three years, it's likely the market is now giving some weight to a Velardena restart. This is especially true if gold prices can stay above $1,600/oz and silver prices stay above $20.00/oz. In summary, I believe the valuation here is reasonable at $0.50 and would become attractive below $0.44.

So, what are the risks?

The first risk worth noting is that both of these studies are based on PEA results, and I do not like mines based on Preliminary Economic Assessments. Obviously, there is low risk in fast-tracking Rodeo due to the very low capex of less than $2~ million, but we will have to see if production comes out looking like the study's projections. Meanwhile, Velardena is also based on a PEA at this time, so it's hard to assign full value for the new study.

(Source: Company News Release)

(Source: Company News Release)

The other major risk is the lack of focus of this management team, as it has several projects, and it doesn't have the most impressive track record. In fact, the team announced it was exploring the sale of its Mexican properties and plants (Velardena and Rodeo) for US$22 million last year, and this deal nearly went through. Given that Rodeo should be able to generate US$21.0 million in revenue alone and is the smaller project, this is a questionable move by management. This is especially true because gold prices were breaking out at the time of this announcement (June 2019). Assuming the sale went through, the plan was to begin focusing on other projects like Sand Canyon, Yoquivo, and El Quevar, with CEO Warren Rehn noting that the company's efforts were best directed towards these other projects. This is inconsistent with the company now leading with the projects it almost sold for next to nothing, so I am not elated with the track record here. Due to this, I would label Golden Minerals a trading vehicle and not an investment vehicle, as I have to be extremely pleased with management's track record to invest long term.

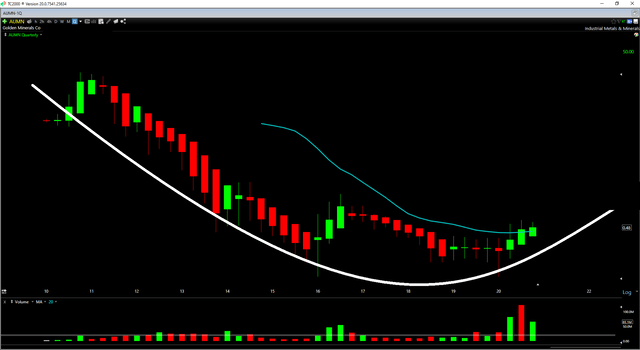

(Source: TC2000.com)

(Source: TC2000.com)

So, why even bother looking at Golden Minerals?

As noted earlier, the company is expected to more than double revenue in FY2021, and Velardena is finally back on the table if we can see a positive Feasibility Study. Meanwhile, the long-term chart for Golden Minerals is beginning to improve, with a massive rounded bottom and significant buying volume showing up the past three quarters. This suggests that the stock might finally be bottoming out, and we could see a significant move higher if the stock can get through $0.62 on volume. However, as noted earlier, this is a momentum play and not an investment play, which is why I see Golden Minerals as high risk, high reward.

(Source: Company Presentation)

(Source: Company Presentation)

Golden Minerals is a name I've avoided for years, but higher metals prices and the expectation of production next year have finally made the thesis here at least satisfactory for trading. While it isn't cheap at just over 3x FY2021 revenue, the stock is quite cheap if it can bring Velardena back into production by Q4 2022 without dilution. I would hope that the company would use cash flow from Rodeo to fund Velardena's upfront capex to avoid any further dilution here. Finally, the technical picture is improving as long as the stock can hold above $0.40. In summary, for investors looking for a high-risk, high-reward speculative play, Golden Minerals is a name worth keeping an eye on next year. Personally, I prefer Anaconda Mining (OTCQX:ANXGF) and Northern Vertex in the junior producer space, and I have no plans to go long here.

Disclosure: I am/we are long GLD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.