The past few months have been quite volatile for the Gold Juniors Index (GDXJ), with the ETF down 27% from its highs, nearly doubling the price correction in the gold (GLD) price. While this is frustrating as several Canadian explorers have continued to improve their projects the past few months, it's a blessing for those looking to put new money to work in the sector. This is because some of the best names are trading well below Q3 levels, even though we've seen new discoveries made at their projects in some cases. However, there are still some juniors trading at frothy valuations despite the sector-wide carnage in rare cases. This article compares valuations across the sector currently, outlining which juniors justify a premium and which names should be discounted or appear overvalued currently. All figures are in US dollars unless otherwise noted.

(Source: Osisko Mining Company Presentation)

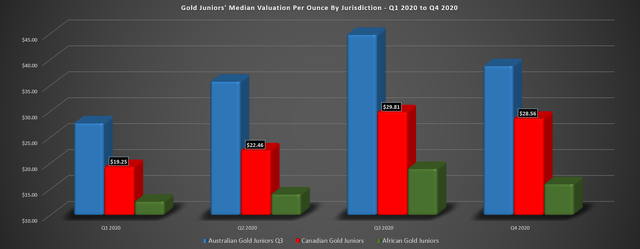

The chart below compares the progression of valuations per ounce in the junior sector across different jurisdictions. We can see that the Australian juniors continue to get all the love as of Q4. Currently, the median Australian gold junior is valued at $38.71/oz, while the average Canadian gold junior is valued at just $28.56/oz. This relates to Australia's position as the #1 mining jurisdiction in the world currently and the fact that we've seen many massive discoveries in the continent this year. Meanwhile, the Canadian gold juniors have actually held up quite well since Q3, though we have seen a slight dip in valuations from $29.81/oz to $28.56/oz. It's worth noting that this dip would be more pronounced, but a couple of names have actually risen since Q3, offsetting the decline in valuations across the majority of Canadian explorers. Let's take a closer look below:

(Source: Author's Chart)

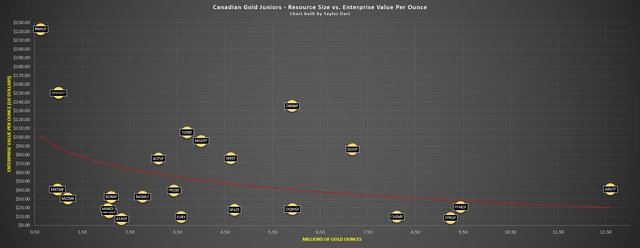

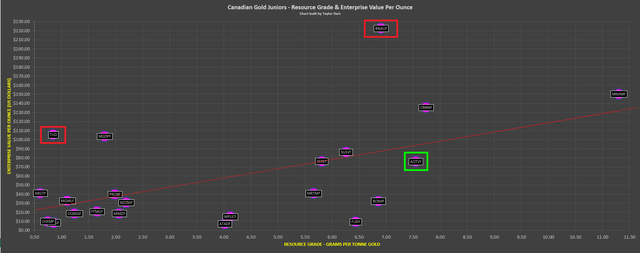

The chart below compares Canadian gold explorers by resource size and enterprise value per ounce, and we can see that the majority of names trade well below $100.00/oz despite their resource size. In fact, resource size does not have a direct linear relationship with a gold junior's valuation, and this is because all ounces are not created equal. In fact, the lowest grade explorers tend to be valued below $50.00/oz no matter what, even if they are sitting on massive deposits like Artemis Gold's (OTCPK:ARGTF) Blackwater deposit. Currently, the range for enterprise per ounce among Canadian gold juniors oscillates between $7.25/oz for ATAC Resources (OTCPK:ATADF) and $223.75/oz for Battle North Gold (OTCQX:BNAUF), a far cry from the current gold price of $1,800/oz. Some investors would suggest that anything below $250.00/oz at current gold prices is undervalued, but this is absolute nonsense.

(Source: Author's Chart)

Those investors in the space that simply calculate the value of the metal in the ground seem to overlook the fact that permits must be issued, a plant and often tailings facility must be built, and even after all that, salaries have to be paid, and equipment has to be up-kept frequently to get gold out of the ground and processed on a daily basis. Besides, even after the mine is built, the mill is running, and the workers are busy mining each day, there's no guarantee that the actual results will look anything like the mine plan. A good example of this is McEwen Mining's (NYSE:MUX) Gold Bar Mine, which was supposed to be producing gold at below $850/oz and is instead producing gold at above $1,600/oz. After factoring all of this in and the fact that many juniors are reliant on a partner or a lender that's confident in them even to get a mine built, it's no surprise that most ounces are worth less than $100.00/oz even in Tier-1 jurisdictions like Canada. Therefore, while the above chart helps get a quick glimpse at valuations for Canadian gold juniors, it only tells part of the story, as each ounce has a varying probability of actually being mined any time soon.

(Source: Author's Chart)

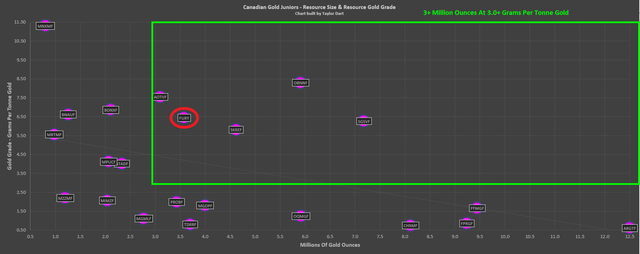

The above chart goes one step further, and it shows us which ounces might be worth a premium, especially if these companies have economic studies already in place. This chart shows Canadian gold juniors compared by resource size and resource grade to separate the standout companies better. Generally, anything above 5 million ounces that's above 1.25 grams per tonne gold is exceptional as long as this is all located at one project. There are only five names on the list that have this distinction currently, and they are First Mining (OTCQX:FFMGF), Marathon Gold (OTCQX:MGDPF), SKEENA RESOURCES (OTCQX:SKREF), Sabina Gold & Silver (OTCQX:SGSVF), and Osisko Mining (OTCPK:OBNNF). The chart might suggest that O3 Mining (OTCPK:OQMGF) and Fury Gold Mines (FURY) also belong on this list, but it's important to note that while these companies have large resources, it's spread out across more than one project. It's also worth noting that while First Mining is technically in the group, the company's Springpole Project has an upfront capex bill that would make most lenders faint ($809 million), so it is heavily discounted for a reason.

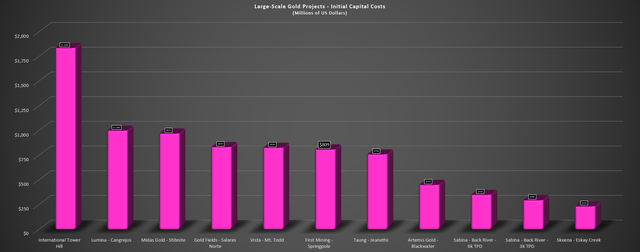

(Source: Author's Chart)

If we take a closer look at this list, there is a sweet spot in terms of resources, with the combination of a solid resource size combined with relatively high grades typically generating exceptional project economics. This sweet spot I've defined is 3 million-ounce gold projects with an average grade above 3.0 grams per tonne gold. There are just four names that fit in the group currently: Ascot Resources (OTCQX:AOTVF), Osisko Mining, Sabina Gold & Silver, and Skeena Resources. Of these four, Skeena Resources and Ascot Resources have the most reasonable upfront capex, at $106 million and $233 million, respectively. Sabina Gold & Silver and Osisko Mining still have solid economics with their Windfall and Back River projects. Still, I would expect an initial capex bill of $285 million minimum for both projects. The chart shows that Fury Gold Mines belongs in this group, but I have circled it in red because these resources are spread across several projects, meaning that it technically does not meet these requirements.

(Source: Author's Chart)

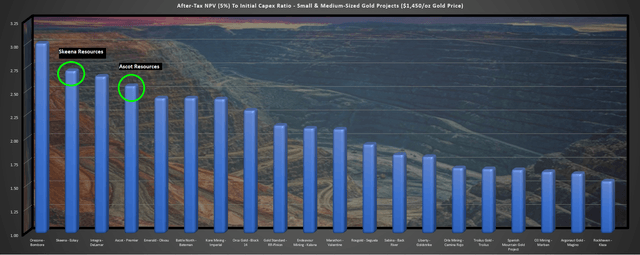

Not surprisingly, Skeena Resources and Ascot Resources also rank very well in terms of After-Tax NPV (5%) to Initial Capex [ATNIC] ratios among the sector, as they are ranked #2 and #4 among over 25 names. The ATNIC ratio tells us the bang per buck investors are getting for a project, and generally, a ratio above 2.25 at a conservative $1,450/oz gold price is outstanding. Skeena sits at 2.72, and Ascot sits at 2.56 currently. Therefore, these are two very solid bets in the sector that benefit from low operating costs, very modest upfront capex, and impressive ATNIC ratios even at relatively low gold prices.

(Source: Author's Chart)

Finally, the last chart shows us what juniors might be overvalued and undervalued. Like the other charts, some other factors come into play that can justify premiums in some cases. As shown below, any stocks above the red trendline that don't have world-class projects could be defined as overvalued, and exceptional projects below the trendline would be considered undervalued. There are currently two large anomalies in the overvalued area, with these being Tudor Gold and Battle North Gold. While Battle North Gold's enterprise value per ounce makes some sense as it's not a capital intensive project at all, I still see the stock as fully valued at over $220.00/oz per ounce. As I pointed in a previous article, Battle North has exceptional economics and a straightforward path to production with just $82 million in upfront capex and roughly $50 million in cash. However, in Tudor's case, the valuation here is perplexing.

(Source: Author's Chart)

Tudor Gold is exploring a large-scale gold system in the Golden Triangle of British Columbia and currently has less than 1 million ounces in its inventory, but it could prove up over 3 million ounces within 12 months when it commissions a resource estimate. However, I have given the company credit for 3.7 million ounces of low-grade gold within two years, and even based on this estimate, the company is trading at over $100.00/oz. Meanwhile, the median gold junior is trading at a valuation on current resources of $29.86/oz, and even the best names are trading below $100.00/oz in most cases. In fact, Marathon Gold is currently trading at a lower valuation despite a larger resource that's likely to grow to 4.8 million ounces that's at twice the grades and is significantly more advanced with a Feasibility Study on the way. Therefore, if Tudor can't prove up at least 4 million ounces in its maiden resource estimate, I don't see how the stock will justify the current valuation. For this reason, I would view any rallies above $2.60 for the stock as selling opportunities.

(Source: Company Presentation)

In the undervalued column, we have Ascot Resources, which I discussed above due to its high-grade and very low capex project in British Columbia. While the stock is not heavily overvalued as it's sitting just below the trendline, it is slightly undervalued at current levels, and I have a fair valuation of $1.15 currently. Finally, while Osisko Mining might look overvalued, sitting well above the trendline, this company is expensive for a reason. This is because it's one of the only juniors in the sector with the potential to prove up 7.5 million ounces above 7.5 grams per tonne gold long-term, and they've got experienced mine builders at their helm. For those unfamiliar, "Osisko 1.0" and their Malartic Mine were acquired by Yamana Gold (AUY) and Agnico Eagle (AEM) in 2014 in one of the largest deals in the past decade. Their goal with Osisko 2.0 is to build a mine, and their five million-ounce Windfall resource suggests that they'll likely have a monster mine in the making here.

(Source: Osisko Mining Company Presentation)

The gold juniors space can be challenging to navigate, and this is why it helps to occasionally take a glance at the sector to see where valuations are and how each company is valued relative to peers. The above charts suggest that Marathon Gold, Ascot Resources, and Skeena Resources are all solid bets in the sector, and Osisko Mining would be a decent bet if it pulls back closer to the trendline to a share price of $2.40. Meanwhile, the worst bet in my view is Tudor Gold because large low-grade gold deposits rarely get much premium in the market, and they are a dime a dozen even in Tier-1 jurisdictions. While money can be made in the rest of this list, and there are some solid names with decent projects, most of the names are unlikely to ever transition to revenue-generating producers. Hence, they are better suited as trading vehicles.

Disclosure: I am/we are long GLD, SKREF, MGDPF. I wrote this article my