The historical evidence shows that shareholders usually greatly benefit from mergers. − Stephen Moore

Foley Trasimene Acquisition Corp. II (BFT) is a SPAC styled as a merger and acquisition company formed to scout around for companies with hidden potential or companies having strong market positions in the financial technology or business process outsourcing space.

BFT had no operations until September 30, 2020. In December 2020, a merger was achieved with Paysafe, a global online payments company. The implied enterprise value of Paysafe was estimated at $9 billion as of the date of the merger. The transaction is estimated to close by the first half of 2021. The entity will list on the NYSE and trade under the ticker PSFE.

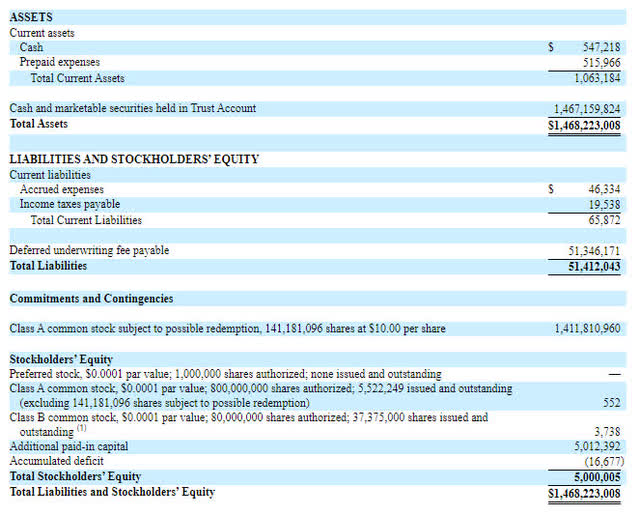

Image Source: BFT's SEC Filing

As of September 30, 2020, almost all of BFT's assets worth $1.47 billion were parked in marketable securities on which it earned an interest income of $126,374 for the period July 15, 2020, to September 30, 2020. The assets were balanced by $1.47 billion worth of stockholders' equity.

As BFT's future is directly connected to the forthcoming PSFE, it makes more sense to analyze the PSFE-BFT combine's growth prospects - but before that, a word about Bill Foley, BFT's founder.

Bill Foley

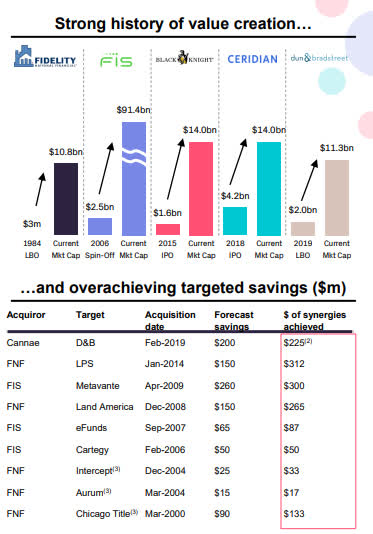

Bill Foley, even at 75, is a relentless - and successful - dealmaker. He has made his greenbacks by buying, splitting up, and hawking public companies. Since 1984, Foley has been involved in more than 100 acquisitions and many spinoffs. His business secret is simple - he and his team of six managers are experienced financial wizards and every company that gets associated with Foley gets access to a team of highly experienced people with a successful track record.

His success stories include Fidelity & Guaranty Life, which he took over in 1984 and made it a Fortune 500 company, Black Knight, Dun & Bradstreet, and Foley Family Wines (created out of vineyard acquisitions).

Image Source: Paysafe's Presentation

So, the first thing investors should know is that Paysafe is in very safe and capable hands.

Paysafe's Post-Merger Prospects

Paysafe owns and operates B2B and B2C online payment networks, which offer eCash, digital wallets, POS, and eCommerce processing solutions to clients. The company has established itself in iGaming payments and is hungry for growth.

Its digital wallets Skrill and Neteller are present in more than 120 markets, its iGaming eCash network is used in more than 50 markets, and its POS and eCommerce payments solutions are present in the U.S., Canada, and Europe.

Paysafe estimates that its partnership with BFT will help it accelerate organic revenue growth, expand its iGaming presence, enhance platform integration business, and boost its merger and acquisition strategies. In particular, Paysafe estimates its U.S. iGaming business to grow at a phenomenal CAGR of 52% until 2025.

Image Source: Paysafe's Presentation

Paysafe estimates that it will clock $103 billion in transactions in 2021. Its overall take rate is 1.5%, and therefore it is likely to report $1.5 billion in organic revenues and a gross profit of $963 million in 2021, implying a healthy gross profit margin of 63%. It believes that it will report an EBITDA margin of between 30% and 35%. The company also projects that its organic revenues will grow at a CAGR of 11% between 2020 and 2025.

Summing Up

Paysafe is in a hot and growing sector and it has projected very healthy gross profit and EBITDA margins going forward. The partnership with Bill Foley is the icing on the cake and I believe that Foley and his competent team of managers will be successful in taking BFT/PSFE to newer highs.

Another thing - BFT'S QUOTING AT $15.23 as of December 24, 2020. Its market capitalization is $2.79 billion and PSFE's enterprise value is pegged at $9 billion. After the merger, Paysafe will gain $150 million in cash and receive $2 billion in funding from private investors. Even after considering future equity dilution, and cash retention, I estimate there is scope for the stock to appreciate.

BFT/PSFE is all about the hot online payments sector teaming up with a very successful dealmaker, Bill Foley, and I am bullish on the stock in the medium to long term.