In the years following the Global Financial Crisis, no one would've ever accused me of being a "goldbug". I went long on real estate, homebuilders, and even a yacht dealer, but I thought gold was a bubble. I greatly annoyed my goldbug friends with predictions of a gold crash. At one point in 2011, I even shorted gold as a professional money manager.

In 2021, my view is quite different. In the Age of Bitcoin, I believe boring, old, traditional gold is undervalued, even after a pretty great 5-year run. Moreover, the gold miners, in particular, may be one of the most attractive investment opportunities out there.

Gold is currently selling around $1,900 per ounce. Based on our research, gold should be priced closer to the $2,400 - 3,000 price range, and well-run gold miners will reap the rewards of rising gold prices.

Gold's Historical Performance

I have deep criticisms of the way gold is frequently analyzed by both bulls and bears. Bulls often find weird metrics that allow them to justify outlandish positions such as "GOLD TO $20,000!" Bears, on the other hand, often tend to believe gold is inherently worthless; alternatively, some now believe Bitcoin will replace gold. My position is that gold is a proven store of value that is sometimes overpriced and sometimes underpriced; and we should analyze from a quantitative perspective to understand when it is mispriced.

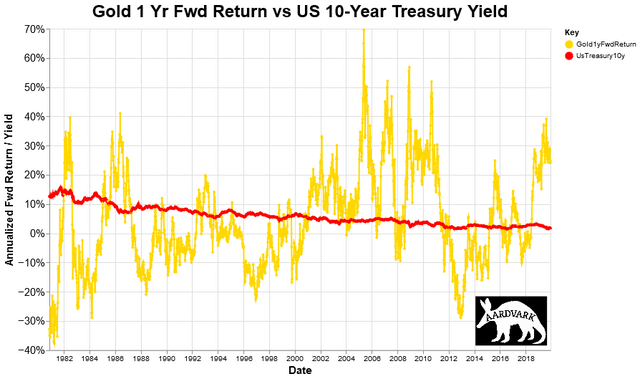

We can see how gold has performed in relative terms by comparing the forward 1 year returns on gold with the yield on the 10-year US treasury.

In the chart above, we can see many periods of both outperformance (1985 - 87, most of 2000 - 2011, 2018 - present) as well as underperformance (1982 - 85, most of 1987 - 92, 1995 - 98, 2011 -15).

So why is this a period where gold is undervalued?

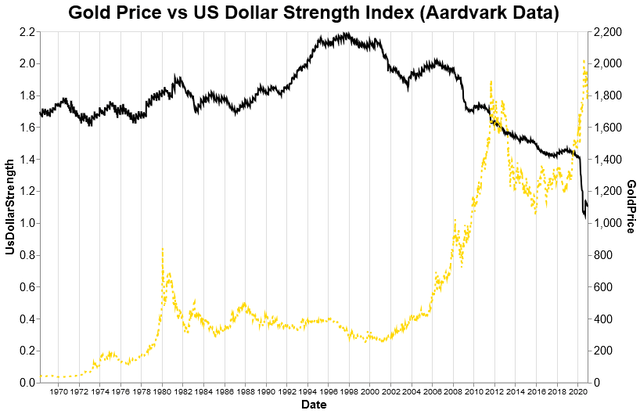

The first question we must answer is how do we value gold to begin with? I think there are a wide variety of methods; some much better than others. I've been analyzing dozens of different metrics relative to gold. In this article, I'm primarily going to focus on money supply, the strength of the US Dollar, and how that relates to the price of gold.

Money Supply and Dollar Strength

If gold is a store of value and a currency, its value should be closely aligned with money supply and the strength of the Dollar (or any other currency).

So let's examine money supply. There are a few paths we can take here, as there are a wide variety of money supply metrics. I opted to use M2 money supply over some alternatives due to its timeliness. However, there are a few issues with raw M2.

M2 only tells us the supply of money; it doesn't tell us how that supply relates to the underlying strength of the American economy. Money supply should increase as the US economy grows.

Given this, I created a US Dollar Strength index. This examines NGDP units relative to M2. The idea is that if NGDP is rising due to real economic growth, M2 should also be rising, without the Dollar weakening. However, if M2 is increasing rapidly and NGDP is not keeping pace, then the US Dollar should be weakening.