Tilray: Don't Sell Your Stock NowJan. 6, 2021 12:48 PM ET

Summary

Tilray is being acquired by Aphria at a modest premium to create the leading cannabis company in Canada and globally.

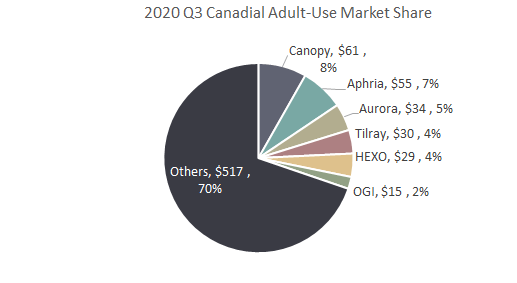

The combined company has the largest market share in Canada, one of the most profitable, and is well-funded with a large cash balance.

Tilray shareholders should hold on to their shares because the combined entity provides the best exposure to global cannabis markets, which should be combined with more U.S. leading MSOs.

Tilray (TLRY) is being acquired by Aphria (APHA) in a reverse takeover that will see the combined company maintaining the Tilray brand and stock ticker. We think the acquisition represents a very good outcome for Tilray shareholders as the combined company will become the leading Canadian LP by market share and cultivation capacity. While the price is below Tilray's IPO price of US$17 in July 2018 (versus trading around US$8 now), Tilray shareholders should keep their shares because the combined company will become, in our opinion, the leading global cannabis company that trades at a significant discount to Canopy Growth (CGC) and Cronos (CRON).

(All amounts in US$)

The Acquisition

Aphria is acquiring Tilray in a reverse takeover that will see Aphria shareholders owning 62% of the combined company. Aphria CEO will run the new company and Aphria's existing Board will control the new Board. We think the deal is a good outcome for both companies as it accomplishes two things.

First of all, the combined company will become the undisputed market leader in Canada. Based on our estimates, Aphria and Tilray combined will have ~11% of the Canadian recreational market, the largest among all LPs. The combined entity will leapfrog ahead of Canopy Growth despite trading at a large discount. Also, the combined entity would hold the largest cultivation capacity in Canada with a capacity of at least 300,000 kg per year. We think there is an opportunity to shut down some of Tilray's cultivation facilities to save money given Aphria's capacity is likely large enough to meet the demand for both companies. Other operational synergies are obvious such as sales and marketing, back office, and various other operations.

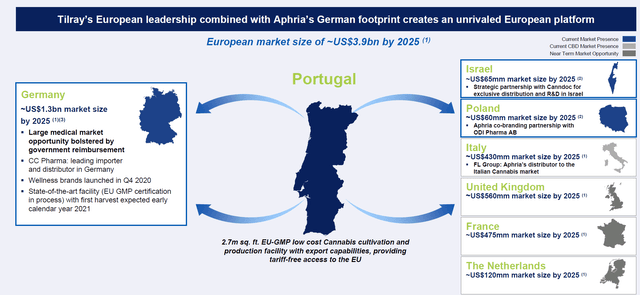

The second purpose for the acquisition is to further boost Aphria's business outside Canada given Tilray's investment in Europe. We all know that the Canadian market is small (much smaller than California alone) and will likely be oversupplied for some time which translates into depressed pricing and lower profitability. Canadian companies must find growth elsewhere and two options are available: international markets and U.S. CBD market. The latter is facing a crisis of its own due to oversupply and FDA regulatory uncertainty. That leaves the international markets the most promising place to continue building the global cannabis story to support the share price.

Most of the small Canadian LPs have been decimated in the stock market as shown in the one-year share price performance chart below (Aphria is the blue area line). Aphria is up ~40% in one year while all the small Canadian LPs as shown lost a significant portion of their market cap. The Canadian market has limited upside potential for companies like Aphria and it needs to seek out better narratives in the international markets.

(Source: CNBC)

Why You Shouldn't Sell Now

Our rationale is simple and centers on two reasons. First of all, the combined Aphria/Tilray offers the best way to gain exposure to the global cannabis markets. Secondly, the combined company could become more profitable due to synergies and savings; Aphria's recent acquisition of SweetWater Brewing will improve Aphria's overall profitability - while not value-creating in a fundamental way it does improve the consolidated margins and make the entire company look cheaper on paper.

Aphria was our top-pick in the Canadian sector. While we have a muted outlook for the Canadian sector as a whole, we think Aphria is the only company that is worth owning in someone's cannabis portfolio. To be clear, we still think a number of U.S. MSOs offer significantly better upsides than Aphria such as Trulieve (OTCQX:TCNNF), Cresco Labs (OTCQX:CRLBF), and Ayr Strategies (OTCQX:AYRWF), to name a few. However, Aphria offers international exposure which is something the U.S. cannabis firms cannot offer and should be a good supplement to the U.S. stocks. While the U.S. markets are massive and recent growth has been explosive, Aphria/Tilray will offer the most compelling way to get exposure to the international markets. In an industry like cannabis, it is important to position oneself early on before the masses decide to pile on. Another potential catalyst is that Aphria still doesn't have cornerstone investors and such a deal would surely send its shares soaring (Tilray's partnership with AB InBev has limited scope).

(Source: IR Deck)

Aphria and Tilray traded at very similar levels on an EV/Sales basis before the deal (Aphria paid a 23% premium to Tilray). Importantly, the combined company would still trade at a significant discount to Canopy and Cronos which trade at 30x EV/Sales. Aphria/Tilray would have C$579M of cash after the SweetWater deal which is the largest in Canada without a major sponsor like Canopy and Cronos did. We would argue that Aphria should trade at a premium to Canopy and Cronos because its business is stronger in Canada and it also has a strong international business (much better than Cronos). By discarding the stained Aphria brand, the combined company could compete with Canopy and Cronos in most business areas and come out on top.

(Source: Public Filings)

Conclusion

We think Tilray shareholders should hold on to their shares because the combined entity is a clear leader in the domestic Canadian market and internationally. Its balance sheet is solid with a large cash position and strong access to capital. The convertible debentures can be dealt with by issuing shares and the stock market has proven to pay little attention to dilution and does not punish the stock. With the valuation gap, Aphria/Tilray looks very cheap relative to Canopy and Cronos and has better assets in Canada and abroad. We reiterate our call from 2019 that Aphria is the best-of-breed in Canada and the combined entity is the clear leader in Canada trading at a discount relative to the inflated share prices of Canopy and Cronos.

https://seekingalpha.com/article/4397602-tilray-dont-sell-your-stock-now?utm_medium=email&utm_source=seeking_alpha&mail_subject=cornerstone-investments-tilray-don-t-sell-your-stock-now&utm_campaign=rta-author-article&utm_content=link-1