MJ Sector in 2021Back again as this is worthwhile reading. My thanks to UnderTheRadar. Arizona looks good. GLTA

TOP TEN HOLDINGS

Aphria Inc.

AstraZeneca PLC, Sponsored ADR

Cresco Labs Inc.

Curaleaf Holdings Inc.

Green Thumb Industries Inc.

Procter & Gamble Company

TerrAscend Corp

Trulieve Cannabis Corp.

UnitedHealth Group Incorporated

Village Farms International Inc.

We would like to wish everyone a very Happy New Year. Stay Safe out there!

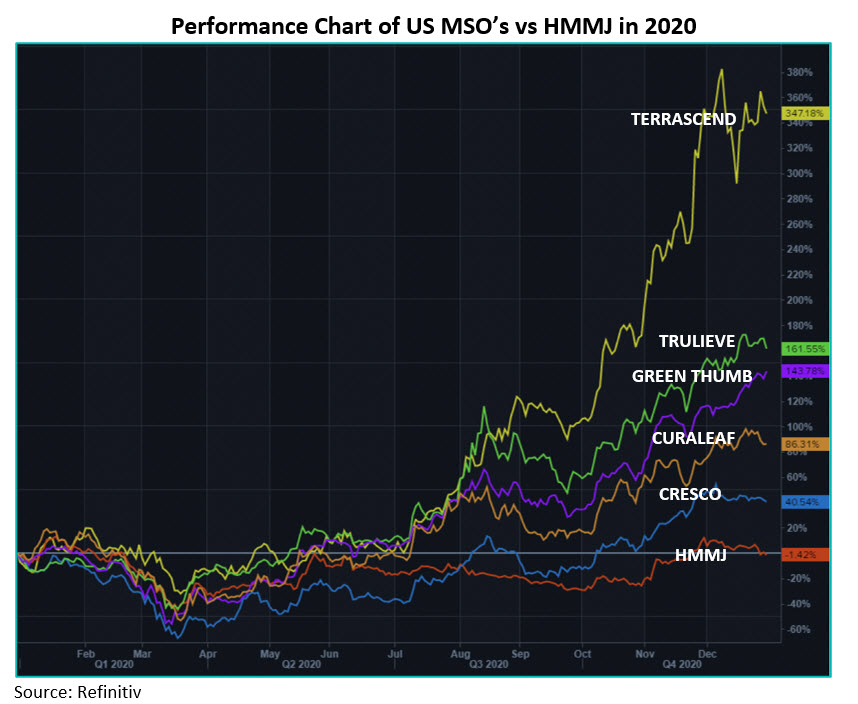

We are pleased to report that the Ninepoint Alternative Health Fund had a successful year, outperforming its benchmark index as well as other sub-indices that some investors compare our Fund with. For the year ending December 31st, 2020 the Fund generated a return of 39.21% for Series F and 37.72% for Series A. We have outperformed the S&P Healthcare Index that generated 11.24% for the year and significantly outperformed HMMJ that generated a loss of -1.42%.

Our strategy takes advantage of changing dynamics for alternative health, how it is delivered and what consumers and patients demand. Overall, the ability to be proactive, investing in new names, taking profits when certain companies have short term outperformance, and re-allocating capital to companies we like, all contribute to outperformance relative to index strategies. This is a diversified approach that has benefited in 2020 from increased interest in pharma and awareness of healthcare, as well as the changing marketplace in cannabis across North America. 2020 in many ways was a launchpad for cannabis as it became an Essential Service in most jurisdictions in the U.S. and Canada, which served to push demand fundamentals forward.

In 2020, the Fund benefited from positions in leading U.S. MSO’s such as TRUL +161.55%, GTII +143.78% that the Fund held throughout the year, and TER +122% for the period since mid-Sept when the company was added to the Fund and CURA that generated +86.3%.

For 2021, we believe these companies continue to provide growth opportunities as their operations expands in new markets.

- Trulieve Cannabis (TRUL) is a medical cannabis company in the state of Florida, that has approximately 51% of the Florida market. TRUL has 66 dispensaries in Florida, and 71 dispensaries nationwide. It has expanded out of its core FL market and now has operational contributions from MA, CT as well as its recent PA acquisition that closed in November.

- Green Thumb Industries (GTII) is an Illinois based cannabis company with 13 manufacturing facilities, with 96 licensed dispensaries across 12 States in the U.S.

- Curaleaf (CURA) is a Massachusetts based cannabis company that after acquisitions over the last 24 months now operates in 23 States, with 93 dispensaries, operating 30 processing facilities.

- Terrascend (TER) has vertically integrated operations in Pennsylvania, New Jersey, and California in addition to operating as a licensed producer in Canada.

The Fund’s Canadian LP’s provided strong returns to the Fund led by Village Farms International (VFF) +56.8% and Aphria Inc. (APHA) +37.9%. Both VFF and APHA are among the lowest cost producers of cannabis in Canada with growing market share in important provincial markets including Ontario, Alberta and British Columbia. With many of the Canadian LP’s struggling during the year and posting negative returns, we are very pleased with the overall performance of our Canadian cannabis portfolio allocation.

Non cannabis companies also contributed significantly to the Funds overall performance. Innovative Industrial Properties (IIPR) the NYSE listed cannabis REIT generated a return of +143% while the Fund also benefitted from wellness and supplements company Jamieson Wellness (JWEL) +38.7%.

Synopsis for 2021

We believe that 2021 will provide continued opportunities in the alternative health care space. Within our sector allocation, the cannabis sector continues to hold significant upside with continued U.S. market expansion and de-regulation. In addition, U.S. MSO’s continue to scale offering efficient operations and stronger cash flows. We see the prospect of M&A heating up in the space as companies on both sides of the border, in Canada and the US, position themselves for U.S. market participation and a growing global market.

We continue to allocate more capital to the U.S. cannabis market relative to the Canadian market. Our view is that U.S. companies are sound, having overcome significant obstacles in the last 24 months. There has been a slow and plodding review of all M&A from the Dept. of Justice since early 2019 and that is while MSO’s deal with higher effective tax rates, higher cost of capital and liquidity challenges listing on the CSE relative to the desired NASDAQ or NYSE where leading Canadian LP’s have listed and continue to attract U.S. investor interest. Despite these challenges, the leading U.S. MSO’s have reached scale and generated +25% EBITDA margins at a time when most Canadian LP’s continue to focus on right-sizing in order to reach break-even cash flow margins. As many of these challenges are now in the rear view mirror and regulatory changes promote a larger market opportunity, we believe 2021 will be a strong year for the leading MSO’s and the Fund.

Tailwinds for the Fund in 2021

For 2021, we believe there are fundamental and structural tailwinds for the Fund to provide superior risk adjusted returns with significant growth opportunities. We believe that as the new year starts, the Fund offers a great entry point for many investors. For those that have individual cannabis holdings, you may have done well in the last part of 2020, it might be time to take profits and buy this fund to stay invested in cannabis yet take advantage of a diversified actively managed strategy.

This is also a solid fund to invest in to gain exposure to the Healthcare sector. We see growth through a resurgence of normalized activity and that includes healthcare usage; hospital visits, elective surgeries, demand for services that we see rising in 2021.

We also offer a great alternative for those investors that are looking for opportunities in high growth sectors like technology, e-commerce, and the “work from home” stocks that had a great run in 2020. Given that the distribution of vaccines and normalization trends are building globally, the WFH stocks may not perform as well as they did in 2020 as they will have difficulty generating the same levels of growth. However, with the structural changes taking place in cannabis we see continued cash flow growth and top line revenue growth in the cannabis sector that will provide continued growth for portfolios in 2021.

In 2021, there are significant tailwinds providing growth for the Fund. In Canada we are finally seeing store growth in larger provinces, Ontario is now on an 80 store opening trajectory per month which adds significant brick and mortar convenient locations to Canada’s largest province. Having a strong retail network is key in opening distribution of regulated product while also reducing reliance on the black market.

In the U.S., the Ballot Initiatives that succeeded in November have created momentum for further market expansion at the State Level. As more states move towards adult use, additional pressure is being put on Congress to deal effectively with cannabis as a major employer in the country. In addition, as state governments respond to budget deficits caused by COVID-19 lockdowns, Governors are looking to create alternative revenue sources to help with those deficits. With 15 States legal for adult use and the tremendous tax revenue that has been generated, States can’t ignore this sector.

U.S. Multi-State Operators in 2021

We continue to see continued growth for the U.S. MSO’s. Fundamentals continue to show strength, with top line double digit revenue growth QoQ with operational scale, as well as stronger and growing EBITDA. In addition to the fundamental strength and growth, recent election results will have a significant impact on cannabis in 2021. We have seen dramatic growth in operating cash flow this past year as many companies now have the scale and efficiency to add new State markets and cultivation capacity while controlling expenses, leading to bottom line positive cash flow results.

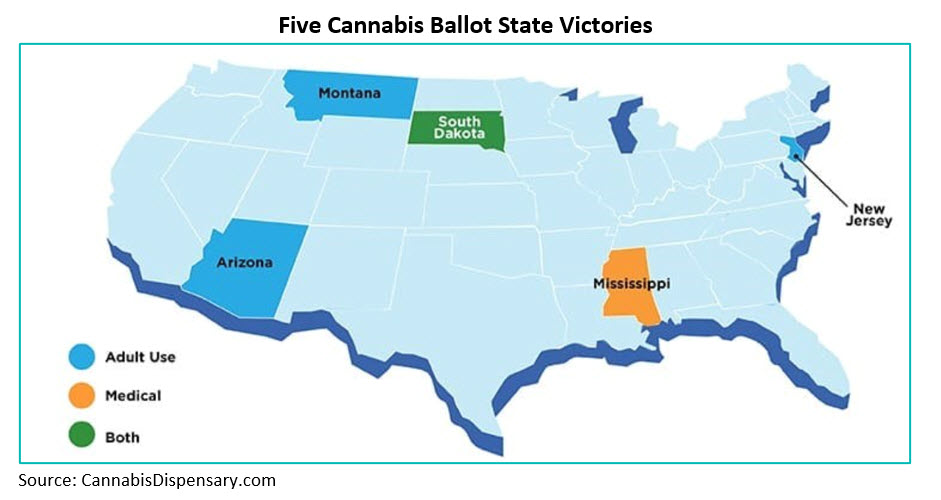

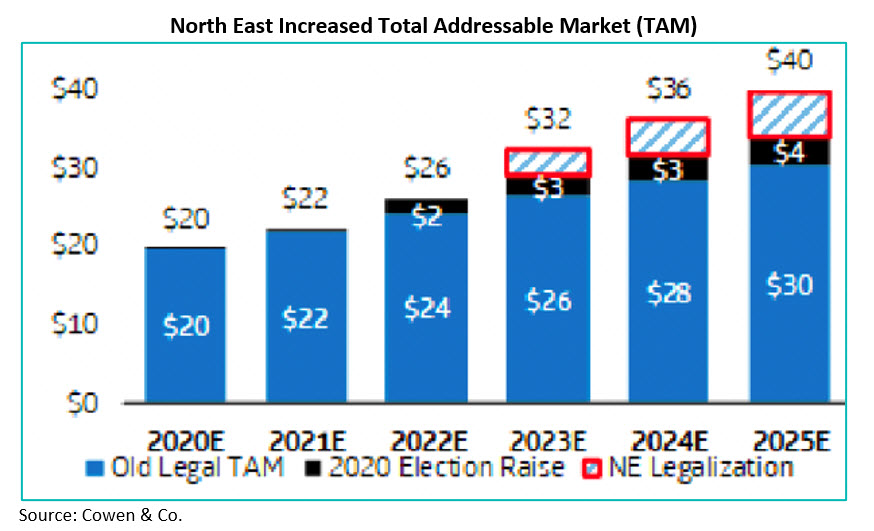

Then we add the positive results of recent Ballot Initiatives in 5 States; Arizona, New Jersey, South Dakota, Mississippi and Montana, we continue to see an expanding cannabis market where the total addressable market for multi-state operators continues to grow larger.

We also see the dynamic of a domino effect where there is pressure on neighboring states to legalize due to lost tax revenues and employment. We believe this is particularly relevant in the Northeast, as the states are generally smaller and more interconnected. NJ is leading a domino in the north east with NY, PA, CT, MD, all looking at legalization in 2021. Tax revenue and budget shortfalls have a lot to do with it.

New Jersey

Following up on the successful ballot initiative from the November 3rd election to legalize adult use, the NJ Senate Judiciary Committee, the House and Governor Murphy are putting the finishing touches on the laws that will govern cannabis use in the State. Although some State Representatives are upset that bills were signed prior to Dec 31st, we estimate that legal adult use sales should begin on schedule within 6 months. There are only 12 companies currently licensed to serve the state's medical program which also leads to limited supply and significant opportunities for wholesale distribution. Each licensee can open 3 dispensaries, meaning the statewide limit is 36, with only 13 opened to date. The reason so few dispensaries are open, relate to challenges at the local level where there is still some opposition to allowing the opening of medical and/or adult-use cannabis dispensaries. As a result, we see investment growth in incumbent MSO’s in NJ such as CURA that has dominated state wide medical sales with a 30%+ market share and 145,000 sq.ft of production capacity; GTII that has a production footprint of 120,000 sq.ft. and TER that has recently opened its first dispensary. The combination of a large population base in its neighborhood, limited licensing and capacity constraints, we see NJ as providing strong upside in the back half of 2021 for MSO’s.

Governor Murphy of New Jersey recently stated that NJ has a budgetary shortfall of $5.7 billion over original 2020 projections. The state urgently needs to find new revenue streams, and while cannabis related tax revenues cannot replace the deficits entirely, they can go a long way to assist it. Looking at Illinois, in its first year alone, the adult-use cannabis market generated over $150 million in tax revenue.

New York

Projects a $59 billion budget shortfall through the end of the 2022 fiscal year primarily the result of the pandemic and resulting lockdowns. Pennsylvania has a $5 billion deficit over the next two years, while Connecticut, Comptroller Kevin P. Lembo suggests an anticipated $2.1 billion budget shortfall. Cannabis tax revenue is a new source of revenue that Governors can’t ignore. So, the question about further adult use legislation is not, whether these states will legalize adult-use cannabis, but when. Companies in the portfolio that have operations in the State include CCHW, CURA, GTII, and CL.

Governor Cuomo announced in the first week of January, his intention to table adult use cannabis legislation detailing the various fiscal benefits related to legalization. Specific aspects of the legislation include; the legal age limit of 21; assistance21; assistance programs and licensing opportunities for minority entrepreneurs, as well as an office of cannabis management that will oversee both the recreational and medical markets. State officials suggest a tax framework where initial estimates for annual taxes from sales could reach $300 million.

Senior policymakers in the region have remarked that passage of cannabis legalization in neighboring New Jersey underscores the need for their states to advance the reform in a regionally coordinated manner. In Connecticut, Democrats increased their majority in the state legislature after the November election, further increasing the chances that legalization moves forward in 2021. The governor said the policy change is “on the table” and that it could bring in the needed tax revenue.

Illinois

Has now successfully operated for twelve months under adult use legalization. The state announced December adult use cannabis sales of $87 million, up 16% from November. This brings Q4 legal adult use sales to $301 million. December medical sales in the state reached $34 million, up 12% over November. Together, adult-use and medical cannabis sales in IL are on a run rate of over $1.4 billion. When we consider IL, we see the dramatic expansion of sales when the transition occurs from medical to adult use. With a population of 12.7 million people, and a run rate over $1.4 billion for the adult use market, we can estimate that NJ (population 8.8 million) and NY, (population 19.5 million) represent significant sales opportunity in adult use sales 12 months after legalization. Companies in the portfolio with strong operations in IL include GTII, CL and CURA.

California

California (population 35 million) counties have been hard hit by continued lockdowns and restricted movement of residents. The state’s adult use cannabis dispensaries are semi-exempt from lockdown orders. Dispensaries are still “essential businesses” and can remain open. The shutdown orders continue to put cannabis in a unique position. With millions stuck at home in anxiety inducing isolation, cannabis sales have skyrocketed. Marijuana businesses are the envy of bars, restaurants, and retail, all of whom have seen revenue streams reduced significantly.

California is on pace to collect $1 billion in taxes from licensed cannabis sales in 2020, despite the challenges from regional and municipal lockdowns during the coronavirus pandemic over the last 9 months. In the third quarter alone, the state brought in $306.7 million in excise, cultivation and sales taxes, bringing the overall year-to-date total to $777 million. The large majority of cannabis taxes are collected by the state, drawing the attention of Governors of states that are suffering from budget deficits resulting from the lockdowns.

We have grown more positive on the California market recently. While significant challenges, in particular the fragmented patchwork of regulation county by county remain, we believe that the State has finally begun to make some headway in dealing with the illicit market. Given the size of the California market, even small improvements have the potential to benefit incumbent companies.

Other Potential Adult Use States

Florida

Many investors are under the false assumption that Florida (population 21 million) is already an adult use state, however it is medical only, despite the success of companies like Trulieve Cannabis. Medical sales in FL continue to be among the strongest state results of any medical only state. A Ballot initiative was initiated but due to submission deadlines that occurred during the early lockdown in the Spring, pro-cannabis supporters were not able to get adult use on the ballot in 2020. It is expected that it will be ready for a 2022 vote. Portfolio companies with operations include market leader TRUL, CURA.

Texas

Texas (population 29 million) legislators have already set the tone for legislation to legalize adult use. Several bills have been proposed that aim at decriminalizing or legalizing marijuana use and possession. There is even support for legal changes from police officials since the legalization of hemp in early 2019 has led to difficult prosecution with challenges to understand the difference between hemp and cannabis. In addition, State officials see money being left on the table, not properly collecting tax revenue at a time when State coffers are challenged by COVID lockdown. There are 3,519 Texans registered with the state to use medical marijuana, though advocates say 2 million people are eligible based on current laws. Up until early 2019, Texas’ list of qualifying medical conditions only had intractable epilepsy on the list. The 2019 expansion of the law added diseases such as terminal cancer, multiple sclerosis, Parkinson’s disease and ALS (Lou Gehrig’s disease).

Virginia

The state of Virginia (population 8.5 million) similar to the population size of NJ, is a new medical cannabis market, highly concentrated with just 5 active licensees. Each licensee is allowed to open 6 dispensaries in an assigned region, giving them a local market control. Governor Northam has declared his support for adult-use legalization, with plans to work with the legislature drafting legislation in 2021.

Additional Adult Use States

Other States that are also working on adult use cannabis legislation include; Rhode Island, Delaware, Maryland, Minnesota, Nebraska, New Mexico, Pennsylvania, Wisconsin.

U.S. Congressional Changes

Another tailwind created from the State by State legalization trend is political pressure that is now being exerted on the federal government to act. The President-Elect is not necessarily a proponent of cannabis reform, however many of the key people in his Cabinet have been vocal supporters of changes in legislation. Vice President Harris, in her previous role as Senator from California was the lead Senate sponsor of the Marijuana Opportunity, Reinvestment, and Expungement (MORE) Act. It’s important to note that cannabis holds promise as a cross over issue that is supported by elected officials on both sides of the aisle. It is important to note that many States where cannabis is legal have Republican Senators including Pennsylvania, Montana, South Dakota and Mississippi.

It was anticipated prior to Jan 5th that The SAFE Act could be part of an upcoming stimulus package working with a Republican controlled Senate. SAFE provides cannabis businesses with access to federal banking services. Federal banking services would allow electronic transactions using (VISA/MC),while), while also providing access to business insurance, conventional mortgage financing all serving to lower the cost of operations for MSO’s, further strengthening MSO cash flows.

Change of Control in the U.S. Senate

On Jan 5th, the balance of power in the Senate changed from a Republican controlled Senate to a Democrat controlled Senate. With Democrats gaining control of the Senate the likelihood of federal cannabis reform has increased substantially. We believe that a Democrat controlled Senate is a catalyst, further de-risking cannabis and assisting the U.S. MSO’s. We believe Democratic control of the Senate could open a path for ongoing cannabis regulatory changes that help provide better access to capital, alleviate operating headwinds, potentially change tax treatment for MSO’s and help drive industry growth.

It must be stated the Democrats have a thin margin in the Senate that can complicate the path of reform. Another aspect that must be considered is the presence of some Democrat Senators that are not supportive of cannabis. We believe that there is a path for significant federal changes in cannabis, but investors may need to temper their enthusiasm in terms of timing and just how far this reform is able to be pushed in the near term. Full legalization may not yet be achievable in the near term, but we believe the current composition of the Senate ultimately benefits the incumbent MSO’s we hold in our portfolio, giving them time to entrench their market positions.

We see a potential policy path whereby a modified version of the STATES Act is approved in both chambers of Congress, leaving each state to decide the legality of cannabis. Part of the legislation would cover banking and capital markets access. Congress could then work on adjusting tax treatment with respect to Sect 280E of the Tax Code, followed by the creation of a federal excise tax.

The elimination of 280E is a meaningful positive for free cashflow generation. Access to banking and financial services such as insurance will lower the cost of capital and reduce regulatory burden for the industry. Access to the U.S. capital markets would be a meaningful positive for providing liquidity and access to U.S. investors. As a result, these changes will put U.S. MSO’s on similar footing to Canadian LP’s that have had an advantage to listing on U.S. Exchanges for 3 years. To date U.S. MSO’s have been relegated to Canadian exchanges, without the benefit of national banking.

The STATES Act would not allow for interstate commerce, and would not serve as a triggering event for international or multi-national competitors to enter the U.S., as cannabis would not be federally legalized, and would remain a Schedule I controlled substance. This would keep the competitive moats that exist for the MSOs in place.

The industry employs over 250,000 voters, some of whom have elected Republican Senators. Cannabis is one of the few socio-economic issues all parties can agree with. It’s not that Congress is accepting cannabis so much as elected officials realize the significant tax revenue that can be generated to help offset the costs related to the COVID-19 lockdowns.

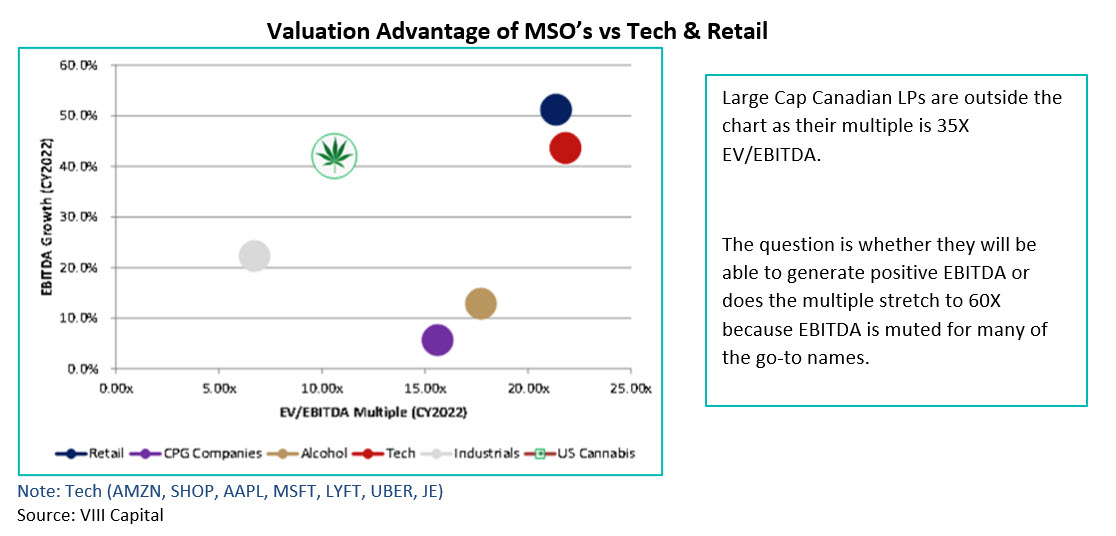

Another reason we continue to see upside in the leading U.S. Cannabis MSO’s is that even with strong returns in 2020, MSO’s currently have a valuation advantage relative to Canadian producers as well as undervalued relative to other high growth industries. If we compare U.S. MSO’s and their high growth rates of quarterly cash flow to technology companies or Retail leaders, we see that MSO’s trade at 10X EV/EBITDA (2022) vs Tech and Retail that trade at 23X and 22x respectively. The higher the multiple, means investors end up paying more for each dollar of EBITDA generated. We continue to see opportunities for valuation expansion as investors realize the potential of MSO’s reaching scale and operational efficiencies that can propel their valuations.

We also note the incredible year that Large Cap Tech names have had this year as work-from-home stocks were embraced at valuation metrics that reached extremely overbought levels. It’s very clear that investors want to own high growth companies in this environment. When you consider that you can get high cash flow growth at lower multiples with an expanding market in the U.S. cannabis sector, we believe an investment in the Fund to capture the growth that we see in 2021 is an attractive option relative to the tech names that have already been pushed to stretched valuations.

It’s important to realize that legislative changes do not occur in a vacuum. Sometimes laws move ahead of societal norms, and sometimes they play catch up. Social norms are changing, creating less resistance for cannabis reforms in the US. Examples of this abound. The National Basketball Association (Yes, the NBA) is extending its policy of not randomly drug testing players for marijuana for the 2020-2021 season amid the coronavirus pandemic. And insiders suspect that the relaxed cannabis rules will continue indefinitely. Marijuana testing was first suspended earlier this year as players finished out their season in the so-called “bubble” arena in Orlando. Michele Roberts, the head of the National Basketball Players Association (NBPA) who joined the Board of Directors of Illinois based MSO Cresco Labs last year, predicted in a recent interview that the formal change could come in coming months. The NFL has also moved towards similar cannabis policies making the decision to end suspensions related to cannabis testing as well as limiting the testing windows under the collective bargaining agreement between the league and the players association.

The global cannabis market also had breakthroughs in late 2020 as The United Nations Commission on Narcotic Drugs (CND) accepted a World Health Organization (WHO) recommendation to remove cannabis and related products from Schedule IV of the 1961 Single Convention on Narcotic Drugs. The vote could have far-reaching implications for countries that rely directly on the UN and WHO for legislative direction with respect to drug policy. As a result, it could help boost medical cannabis legalization efforts around the globe. In the 1961 Single Convention on Narcotics, cannabis was grouped with heroin and fentanyl, all requiring the highest levels of international control. These global initiatives can only serve to help cannabis growth around the world.

Canadian Cannabis in 2021

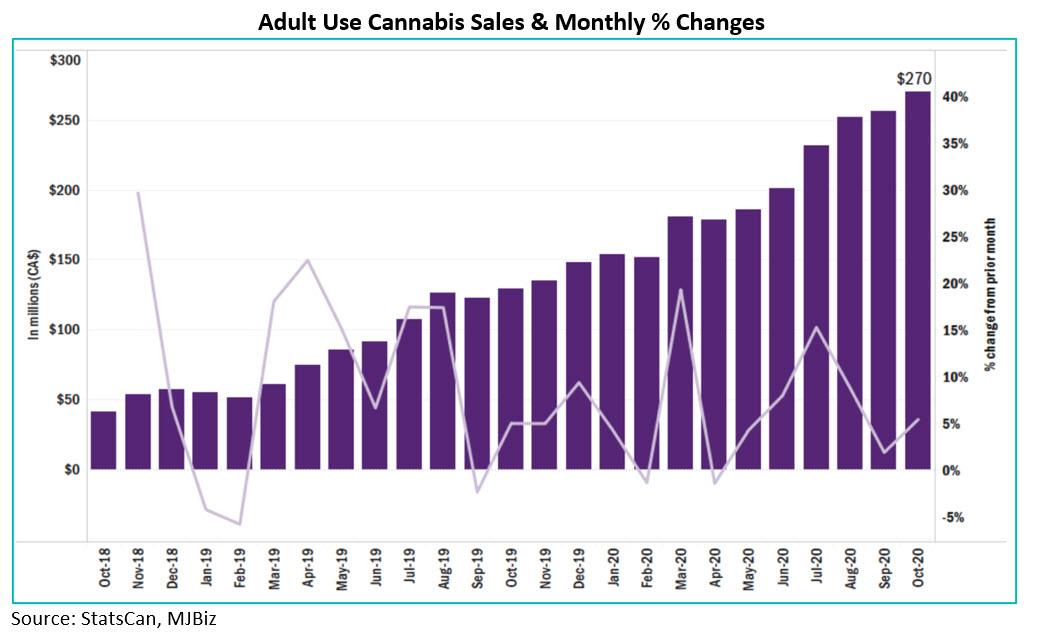

Canadian adult-use cannabis sales continue to grow moderately relative to growth seen in many state markets in the U.S. with national sales in Canada reaching $270 million in October, a 5.1% monthly increase. This implies an annual run rate of roughly $3.24 billion for Canada’s adult use cannabis sector. October sales in Canada’s largest province, Ontario, increased 7.6% over September to $83.9 million; with Quebec, the next-largest province by population, reported sales of $48 million, a 6.7% month-over-month increase. Alberta, which has the most licensed cannabis stores of any province, retained its spot as the country’s second-biggest marijuana market with monthly sales increasing by 5% to $56.4 million.

We continue to remain cautious on the Canadian cannabis market as only a select group of companies are able to grow top line revenue, expand market share while generating stronger cash flows. The value segment continues to be a primary focus for many companies and yet only a select list of producers are able to produce at a low cost in order to generate positive cash flows. Store counts continue to grow and new product formats continue to enter the market, so we will be opportunistic in our approach. We note that in mid-December, Health Canada announced a request for comment to industry participants with respect to amending the regulatory framework to allow for cannabis research and cannabis testing. Also, part of the review are potential changes to product labelling. Our view is that any adjustments to the current regulatory framework that serve to reduce the bottlenecks associated with distribution and retail are welcomed and will be helpful to building confidence in the Canadian market, though we expect that any regulatory changes will be modest.

Canadian LP’s vs U.S. MSO’s

When looking at investment in cannabis, our Fund continues to focus on the U.S. MSO’s vs the Canadian LP’s. The Canadian LP’s have rallied recently, ostensibly due to their ability to enter the U.S. market if federal legalization is implemented. We are not convinced that this potential supports the valuation increases. With a few exceptions, there is no compelling reason to believe that Canadian LP’s have the skills and experience to compete effectively in the U.S. market. Their main advantage has been access to capital due to their ability to list on major U.S. exchanges. It is important to remember that federal legalization, the event that will allow them to enter the US, will simultaneously remove that advantage.

There are investors that believe that Canadian LP’s have a significant near term opportunity to exploit in the U.S., however there are some key issues that need to be understood. The U.S. at this point is still not legal for cannabis (medical or recreational) at the federal level, as a result, foreign operations will continue to be left out of the U.S. market. The Canadian market continues to grow only moderately, (see above) and with continued retail price pressures, we are selective, only investing in companies that we analyze are growing positive cash flows. The incumbent MSO’s operate State by State and have an expanding market share in 35 States. The best States to operate in are limited license States. One needs to consider that after federal legalization or what some suggest federal permissibility occurs years from now, new operations will likely need to have State licenses, similar to the way the alcohol distribution business operates currently. Canadian operators, as well as other foreign operators would be starting from the beginning, having to acquire state licenses. They would need to build the regulatory infrastructure, establish a retail dispensary network and build their brands. With the U.S. Senate still controlled by Republicans federal permissibility is a way out. It is true that Canadians have advantages including being able to list in the U.S. as well as having access to global banking. That leads to another temporary advantage for Canadian LPs, with federal legalization in Canada, they have a temporary lower cost of capital lead, however if we assume any U.S. legislative changes discussed above, that lead is ending.

Do Canadian LP’s have a U.S. presence ?

Canopy Growth (WEED) has market capability to exploit and compete. They have investments in MSO’s; they have non cannabis products distributed in the U.S. and they have licensed their cannabis brands such as Tokyo Smoke. Investments include a long term warrant structure involving Acreage Holdings, as well as a direct investment in Terrascend, that recently saw an increased investment from WEED in exchange for exiting its previous investment in Canopy Rivers (RIV).

Aphria (APHA) is another Canadian LP that has potential. APHA is led by Irwin Simon, the founder and former CEO of Hain Celestial. Simon knows how to build brands in the US. Recently, APHA bought Georgia based craft brewer SweetWater Brewery to build awareness of its brands. SweetWater is distributed in over 27,000 locations across the US.

We also note that APHA recently announced an all-stock merger the merger of APHA with Tilray Inc. (TLRY) creating what the two management teams stated will be the world’s largest cannabis company, with 19% of the Canadian Recreational market, 2x sales of the next largest player in domestic market, WEED. APHA shareholders controlling 62% of the new company while the new company would trade under the TLRY banner.

The reasoning stated for the merger is the potential synergies in the combined entity of ~C$100 mm within two years. We are cautious on the overall announcement as the Canadian cannabis sector still suffers from oversupply issues, low flower retail prices (below US$5 per gram which are even lower than in the U.S. northwest where they average is $7-8 per gram). In addition, dragging profitability are cost bases that on average are still bloated from previous years of over-spending. In addition it is important to remember that although the companies are positioning the deal as being ready for the large and growing U.S. market, it is our opinion that U.S. “federal permissibility” is still ~3-4 years away as per most estimates. As a result, we believe the Canadian LPs will remain blocked out of the U.S. for the time being.

We understand the rationale for this merger, particularly since TLRY and APHA have different and complimentary assets especially in international markets. But we believe the benefits (beyond the initial synergies) will take a considerable amount of time to be realized for APHA shareholders. Our view is that despite TLRY’s stock performance over the last two years (from $150/sh to $8/sh), this is not an “inexpensive” acquisition for APHA.

Going forward to full access, remember that U.S. federal legalization or permissibility comes long after the SAFE ACT that will reduce the cost of capital for U.S. MSO’s to access U.S. national banking and then SEC changes will allow U.S. MSO’s to list in the US, all reducing the cost of capital advantage that Canadian LPs have over MSOs.

Healthcare & Pharmaceuticals

When we consider our allocation to pharmaceuticals, some of these companies are game changers in the fight against coronavirus, bringing renewed awareness of innovation, IP and global distribution of various medications and treatments. And additionally, as part of the re-opening of the economy, we see increased demand for health services where we have exposure through our holdings.

We see the portfolio in 2021 benefiting from our exposure to the Pharmaceutical and Healthcare sectors. During the Spring of 2020 when the market sold off during the early lockdown period, these positions held up well for the portfolio. Names such as Pfizer (PFE) and AstraZeneca (AZN) have now begun distribution of their COVID-19 vaccines in various countries. The PFE vaccine uses a messenger RNA technology similar to Moderna has a 97% efficacy rate, similar to traditional breakthrough vaccines like the measles and chicken pox vaccines. Logistics are key in getting the medicine around the world especially since the RNA vaccine needs to be kept at very cold temperatures -70 degrees Celsius making logistics integral to its roll-out. The AZN vaccine uses a spike protein based vaccine with similar efficacy rates and can be stored using standard refrigeration, as opposed to the freezer needed for the other two vaccines, which makes it much more practical for global distribution. It also comes at a lower cost to manufacture. Our portfolio also includes top ten holding Johnson & Johnson (JNJ) that is weeks away from providing its clinical trial results for its COVID-19 vaccine. The JNJ product uses an established vaccine platform that has been proven to be safe in diseases like Ebola and HIV. We believe that the JNJ vaccine should provide strong opportunities for growth similar to what we have seen with our other pharma selections. We believe staying in the largest diversified pharma names reduces risk and provides the portfolio with stable growth as these leading companies provide ongoing development of medications and devices beyond the corona-virus pandemic, including oncology and diabetes.

With vaccines on the way and the world beginning to see a “new normal”, that means going back to more normal activities and healthcare visits and elective surgeries are part of that normalization trend. During the Fall it was estimated that ~100 million people in the US, in high risk categories have been avoiding care in 2020. As a result, we see a resurgence in healthcare activity 2021 and beyond and look to position our exposure through Humana and UNH as they offer access to healthcare activity but are not reliant on location such as hospitals which may see government regulatory changes, as they provide coverage for various services.

The U.S. still has significant issues in terms of spending on healthcare. Even after enactment of the Affordable Care Act 10 years ago, the U.S. has still not been able to streamline healthcare services to its entire population. Healthcare costs can be expensive and there are mounting pressures to contain this as a percentage of overall government budgets. The Democrats would like to expand access to health care, but the Republicans are vehemently against a move towards more government involvement. In our view, any changes will have to work within the existing system, a complete overhaul is not realistic at this time when the government is already faced with other ongoing issues.

As a result, we believe that large healthcare service providers, Humana (HUM) and UnitedHealthGroup (UNH) are well positioned to benefit. HUM has invested significantly in technology and healthcare service businesses over past few years and is focused on the highest growth market within managed care, Medicare Advantage.

UNH is the largest managed care provider combining growth and scale. Its Optum Division, the technology/services part of the business represented 48% of profit in 2019, continues to grow and is scalable. We believe that the significant investment in technology that both companies have spent act as a moat that will continue to build their value ahead of competition. In early January, UNH acquired Change Health Healthcare further strengthening its technology offering to optimize healthcare delivery and workflow.

The Ninepoint Alternative Health Fund, launched in March of 2017 is Canada’s first actively managed mutual fund with a focus in the cannabis sector and remains open to new investors, available for purchase daily. Utilizing our actively managed approach we are able to generate industry leading risk adjusted returns.

Charles Taerk & Douglas Waterson

The Portfolio Team

Faircourt Asset Management

Sub-Advisor to the Ninepoint Alternative Health Fund