While BEV’s scope is broad, it is mostly focused on “clean” products and technologies, such as greener steel and cement, long-haul transport and energy storage.

To be eligible for BEV funding, a start-up needs to showcase a scientifically sound technology that has the potential to reduce annual global greenhouse-gas emissions by at least 500 million tonnes a year. Global emissions currently measure about 34 billion tonnes a year, partly thanks to the curtailment of global economic activity and mobility in 2020 due to the covid-19 pandemic.

Investors’ new favourite

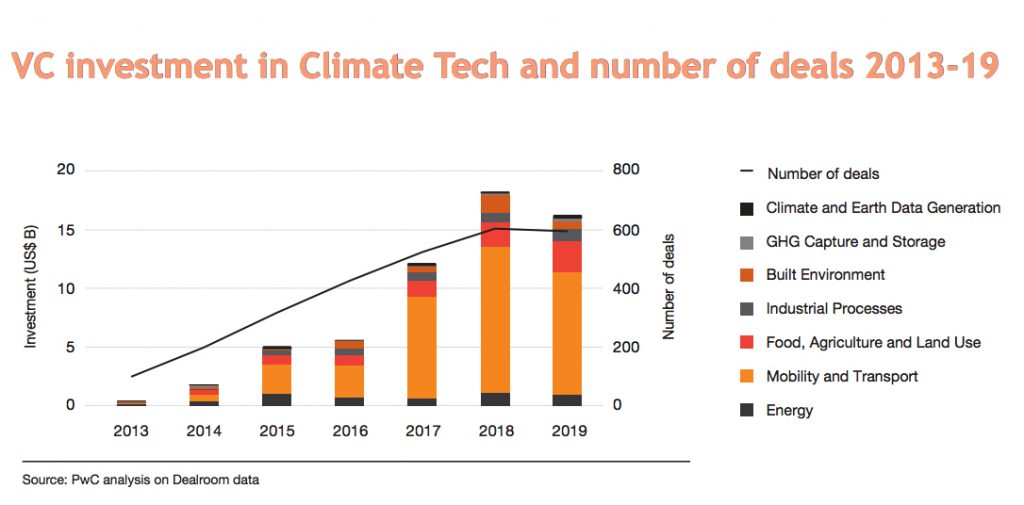

Investment in green technologies has soared over the past two years. According to the latest PwC report on the state of climate tech, venture capital money flowing into start-ups that can help cut emissions hit $16 billion in 2019, up from $400 million in 2013 — a 40-fold increase.

BEV’s first billion was directed to companies developing complex technologies to support clean cobalt and lithium mining, electric aviation, hydropower turbines and, most recently, emissions-free steel.

Source: The State of Climate Tech 2020: The next frontier for venture capital, by PwC.

Source: The State of Climate Tech 2020: The next frontier for venture capital, by PwC. “We have built a great technical team and our ability to close a second fund is a testament to their good work,” Eric Toone, BEV’s technical lead, told Bloomberg News.

The fund has had some newsworthy wins. QuantumScape (NYSE: QS), which makes next-generation lithium-ion batteries, listed on the New York Stock Exchange in September. Its market capitalization is currently close to $20 billion, up from $3 billion, even though its batteries won’t be available before 2025.