The Q4 Earnings Season for the Silver Miners Index (SIL) has finally begun, and the most recent name to report its preliminary results is Excellon Resources (EXN). The company had an exceptional quarter in Q4, with metals production up nearly 20% year-over-year to 556,300~ silver-equivalent ounces [SEOs]. This increase in output combined with a higher silver (SLV) should translate to a multi-year high in revenue of $13.2~ million, and Excellon should finally be able to begin reporting positive net income in FY2021. However, these improvements do not patch over the massive share dilution we've seen, nor the relatively short mine life at Platosa. Therefore, I continue to see the stock as an Avoid in favor of better producers elsewhere.

(Source: Company Presentation)

(Source: Company Presentation)

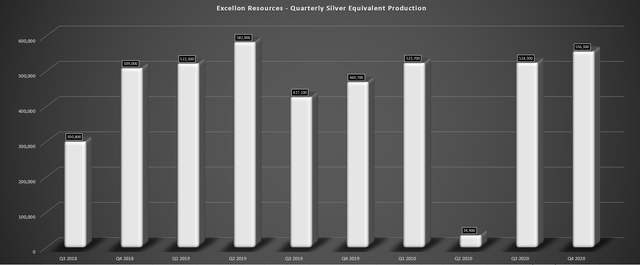

Excellon Resources released its Q4 results earlier this month and reported quarterly production of 556,300~ SEOs, an 18% increase from the same period last year. However, it's important to note that the company was up against a relatively easy comp from the prior year, with 469,700~ SEOs being the second-weakest quarter in the past two years (excluding Q2 2020 due to COVID-19 related shutdowns). Therefore, while this was certainly an improvement at the right time to benefit from higher silver prices, this wasn't a blow-out quarter by any means because it was lapping a decrease of 8% in the prior year. Let's take a closer look at the results below:

(Source: Author's Chart)

(Source: Author's Chart)

As shown in the chart above, Excellon has seen a sharp recovery in output since a rough Q2 following government-mandated shutdowns in Mexico related to COVID-19, managing to finish FY2020 on a high note. On a full-year basis, the company managed to produce 1.64~ million SEOs, a satisfactory performance vs. the 2.00~ million SEOs in FY2019, given that the company had to deal with a two-month headwind related to COVID-19. This strong production in H2 was driven by much higher grades at La Platosa in Q4 and a sharp increase in throughput, with the Miguel Auza Mill performing much better.

(Source: Company News Release)

(Source: Company News Release)

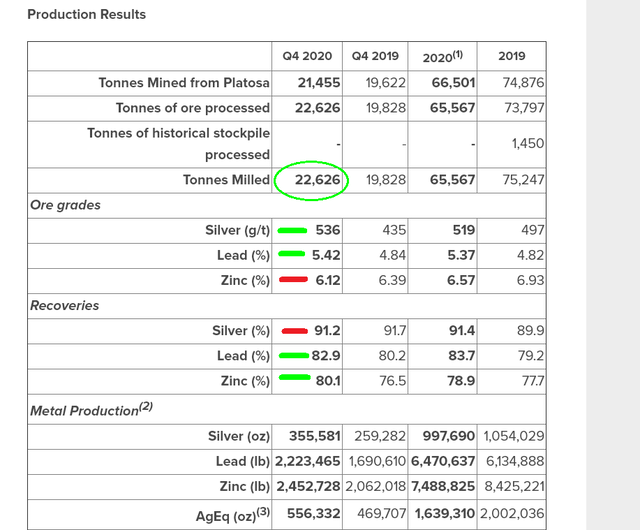

If we dig into the results above, we can see that Excellon processed 22,600~ tonnes in Q4, a more than 12% increase from the 19,800~ tonnes processed in Q4 2019. Meanwhile, the company benefited from much higher mined grades at La Platosa, with silver grades soaring by over 20% to 536 grams per tonne gold and lead grades up to 5.42% from 4.84% in the year-ago period. Finally, recovery rates also improved materially in the quarter for both lead and zinc, with metal recoveries up 270 and 360 basis points year-over-year, respectively. These solid operating metrics allowed for a great finish to the year and should lead to a massive increase in margins in FY2021, regardless of whether silver prices remain above $26.00/oz.

(Source: Author's Chart, Company Filings)

(Source: Author's Chart, Company Filings)

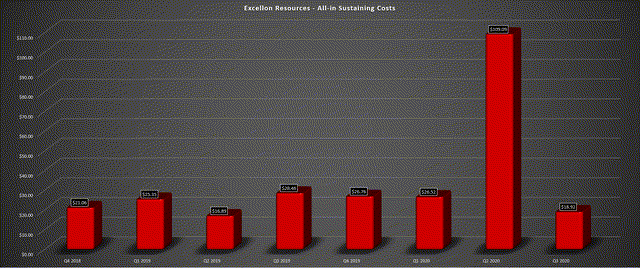

This is because the company has improved its shift scheduling, trimmed its workforce, adjusted its mining methods, and reduced electricity costs with a more favorable electricity contract in place with a Mexican energy provider. These cost optimizations (electricity & smaller workforce) should help out costs dramatically. A higher silver price would be an additional benefit to margins, with an average realized silver price of $21.59/oz in FY2020 and a current silver price above $26.00/oz. However, while the best silver miners are already enjoying 50% plus margins, Excellon will be lucky to report 40% margins, even on a $26.00/oz silver price. This is because costs have consistently come in above $20.00/oz on a full-year basis. I would be shocked if they dropped below $16.00/oz, even with the cost optimizations, given that this is a very small operation that doesn't benefit from economies of scale. Let's take a look at the financial results below:

(Source: Author's Chart, Company Filings)

(Source: Author's Chart, Company Filings)

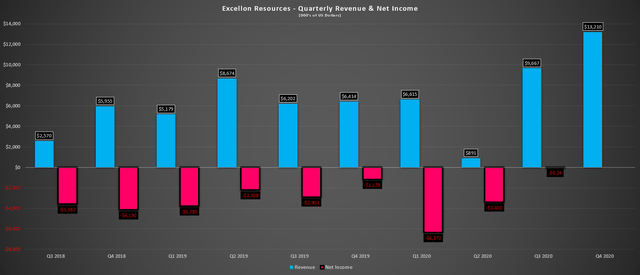

If we look at Excellon's quarterly revenue, we can see that Q4 is set up for a massive beat, with my estimates for Q4 being $13.2~ million in revenue. This is based on my projections for SEO sales of 540,000~ ounces at an average realized price of $24.46/oz. Assuming the company hits these estimates, this would translate to more than 100% revenue growth vs. Q4 2019, a drastic improvement that should allow the company to report positive net income in the quarter. If we assume that Excellon reports $50.0~ million in revenue for FY2021 or a slightly higher run rate due to a silver price closer to $26.00/oz, this would translate to a price to sales ratio of 2.0, which is reasonable, if things go according to plan.

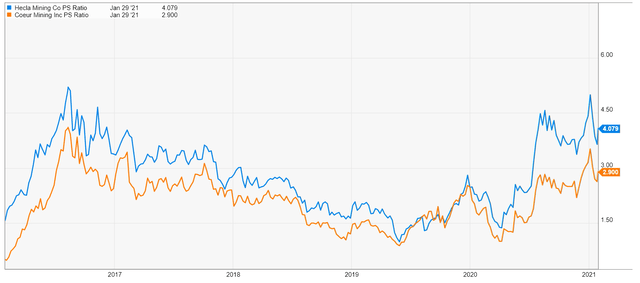

(Source: YCharts.com)

(Source: YCharts.com)

Some investors might argue that Excellon should command a much higher price to sales multiple when peers like Couer Mining (CDE) and Hecla Mining (HL) trade at above 2.90x sales. While this is true, it's important to note that these figures are based on trailing-twelve-month sales, and Excellon is trading at 2x forward sales. It's also worth noting that Couer Mining and Hecla Mining have mineral reserves in place that cover up to 10 years of production and operate out of safer jurisdictions on a relative basis. Conversely, Excellon has barely 5 years of mine life at La Platosa and operates out of a less favorable jurisdiction.

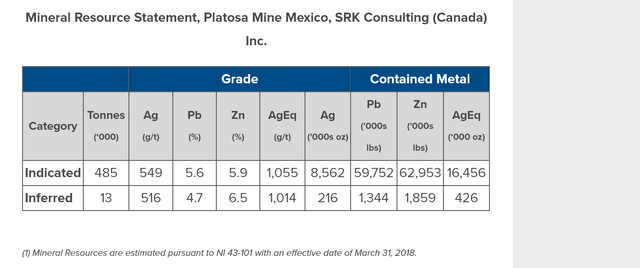

(Source: Company Website)

(Source: Company Website)

Based on an indicated resource of 16.46 million SEOs as of Q1 2018 and mine depletion of 5.3 million SEOs since the most recent resource update, the reserve life is one of the lowest among its peers. At a 2 million SEO per year run-rate (FY2019 run rate), the mine life stands at 5.6~ years, assuming no reserve additions. This is extremely low relative to the industry average, which runs closer to ten years, and with Pan American having a reserve life closer to 15 years if Escobal is included. Therefore, I would argue that a price to sales multiple of 2.50 is generous, suggesting a fair value for the stock of US$3.79. This is based on 33~ million shares outstanding and revenue of $50 million with a 2.50 multiple. $50 million x 2.50 = $125 million in revenue / 33 million shares = US$3.79.

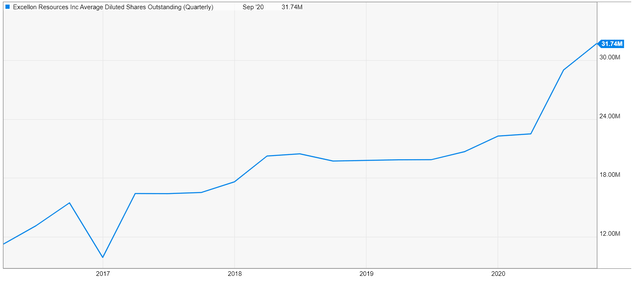

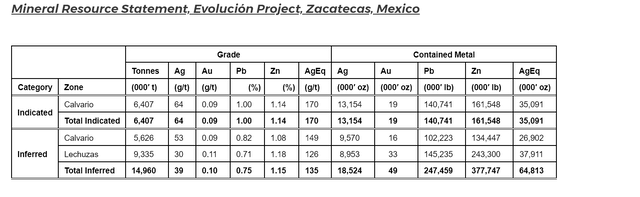

While the fair value for the stock sits nearly 30% higher if we assign a generous multiple of 2.50, it's important to note that this assumes no further dilution, something that the company has excelled at for years. As we can see above, the company's share count has grown by over 200% since Q4 2016 from 9.9~ million shares to 32~ million shares as of the Q3 report. One could certainly argue that dilution shouldn't be as much of an issue in the future if silver prices can remain above $26.00/oz. Still, I wouldn't rule out dilution entirely, given that Excellon is going to have to work hard to replace ounces and should be significantly increasing its exploration spend to closer to $15 million per year, not the sub $6~ million amount being spent currently. Therefore, investors should be aware that an investment case here rests on the assumption we see dilution come to a halt, and resources are replaced at La Platosa, or the company can rely on its Evolucion Project starting in 2026 for ore. While Evolucion's resource is large, it's no La Platosa, with grades that come in 75% lower at 135 grams per tonne silver-equivalent.

(Source: Company Website)

(Source: Company Website)

Excellon had a solid Q4 report, and FY2021 is expected to be much better with cost optimizations, a decent likelihood of a $26.00/oz silver price and strong revenue growth as the company laps a tough FY2020 due to COVID-19. This could justify a share price of closer to US$3.80 for Excellon. Still, investors must be aware that this is arguably the least attractive silver producer in the sector due to its short mine life, history of egregious share dilution, and a Tier-2 jurisdiction: Mexico. So, while it's possible Excellon could trade up to US$4.50, and above fair value this year, I would view it as an opportunity to book some profits. A share price of US$4.50 would bake leave Excellon more than fully-valued, and this would provide an opportunity to shift what's been dead money into better-run companies in the sector.