Every investment connected to renewable energy and hydrogen increased immensely in price in the past year. Some fundamentals support this like increased government support and consumer interest in clean energy. There are a lot of investments hyped too much as well. In this article, I want to introduce the possible investments in hydrogen and its potential.

First, I'll go through the applications of hydrogen. Secondly, I'll propose lists of possible investments in companies active in hydrogen.

Source

Green Hydrogen vs. Other Colors

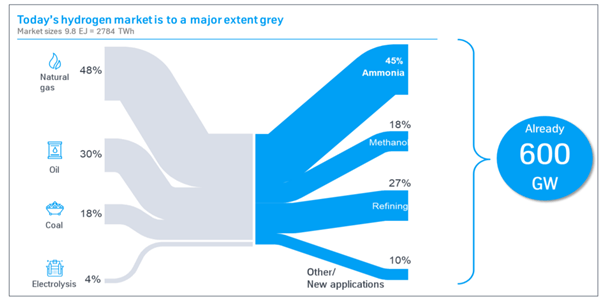

Hydrogen is as clean as the way it is produced. Most hydrogen produced today is so-called grey hydrogen. This means it is produced from natural gas and it emits greenhouse gas. It is created by a process called steam reforming. This isn't the type of hydrogen you were probably thinking about when you wanted to invest in it. This is however probably the first challenge and opportunity for hydrogen investments. There is a lot of grey hydrogen used today that can be replaced by green hydrogen. It is estimated more than 95% of hydrogen production in 2019 was grey. This is the first issue that should be tackled.

Hydrogen can be produced cleaner from natural gas. In steam reforming it's possible to capture 80% to 90% of the CO2 it produces. This CO2 is then stored or used in other processes. This creates blue hydrogen. A different technique that doesn't generate CO2 creates turquoise hydrogen.

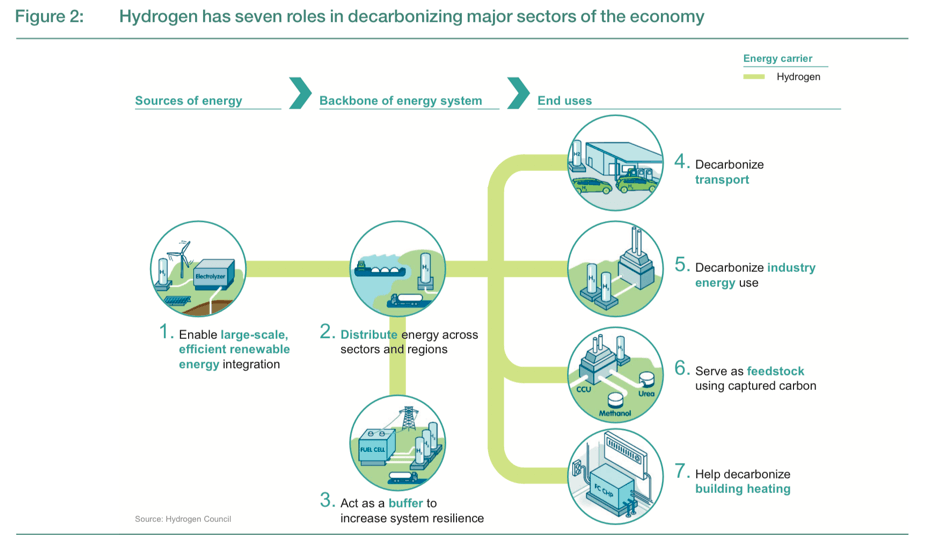

Hydrogen is a versatile energy carrier, which can help to tackle various critical energy challenges. Hydrogen can be produced from almost all energy resources, though today’s use of hydrogen in oil refining and chemical production is mostly covered by hydrogen from fossil fuels, with significant associated CO2 emissions.

Source: International Energy Agency

Hydrogen is often referred to as a fuel. It isn't a fuel like oil or coal. Green hydrogen is a way to store energy. Green hydrogen is an energy carrier that can be compared to a battery. It has some advantages and disadvantages against batteries. First, electricity is generated by renewable energy sources like wind, solar, or hydropower. This energy is then transformed into hydrogen by an electrolyzer. To use it as a 'fuel', it is transformed back into electricity by a fuel cell. This hydrogen can be used directly as well in some processes.

Source: Petrofac

Applications For Hydrogen

Source

Hydrogen as feedstock

Hydrogen's primary use today is as feedstock in chemical and industrial processes. The chemical processes include the production of methanol and ammonia. This ammonia is then used directly or indirectly as fertilizer. It is also used in oil refining to remove impurities from crude oil. In steel production, it can be used to replace cokes. These are all processes that exist today and use a lot of grey hydrogen.

Source: Thyssenkrupp (OTCPK:TYEKF;OTCPK:TKAMY) Investor Presentation

This presents a huge opportunity for green hydrogen. There is still a lot of room to add electrolyzer capacity. It is however important that costs come down. Green hydrogen is still a lot more expensive than grey hydrogen. This is only possible if renewable energy gets cheaper and by getting production of electrolyzers on a large scale.

The opportunity to turn grey hydrogen into green hydrogen is the clearest investment opportunity. As mentioned in the colors of hydrogen, there are a couple of ways to get this grey hydrogen cleaner. The cleanest way is by producing hydrogen from renewable electricity with electrolysis. For example, the EU targets 2x40GW of electrolyzers by 2030. It targets 40 GW in the EU and 40 GW in the neighborhood to export to the EU.

Hydrogen For Clean Transport

Fuel Cell Electric Passenger Cars: A Lot Of Challenges

There is a lot of hype around hydrogen in transport. It seems to make sense as a customer to get a fuel cell electric car or FCEV. Fuelling is more or less the same as petrol fuelling with a refueling time of 3 to 5 minutes. The driving range is also comparable to petrol and diesel vehicles, between 240 and 435 miles on a full tank. FCEVs have a lot of challenges as well. The whole infrastructure for hydrogen refueling still has to be built. This requires large investments and creates a chicken and the egg dilemma. People won't buy FCEVs without the infrastructure and it isn't profitable to invest in infrastructure without FCEVs. It seems unlikely this will provide a big breakthrough shortly.

Heavy-Duty Transport

A more interesting market is heavy-duty transport, trains, and boats. Fuel cells can provide an alternative to current diesel fuel. Hydrogen doesn't take long to refuel which is good for downtimes. The high energy density of hydrogen also makes it suitable for heavy goods vehicles.

Material Handling: Forklifts

Fuel cells are popular in forklift fleets. The big advantage for hydrogen-powered fuel cells is the time it saves as opposed to batteries. This is especially true in a three-shift operation. Fuel cells powered by hydrogen are also without greenhouse gas emissions, which is convenient indoors. Amazon (AMZN) and Walmart (WMT) use forklift fleets on hydrogen.

Stationary Power Systems

Fuel cells can also be used as power plants. They can be used as primary and backup power. They are reliable and can support the electricity grid or be used off-grid. These stationary fuel cells connect mostly directly to the gas infrastructure. It's also possible to power these systems on hydrogen.

Batteries vs. Hydrogen, Why Not Both

Ever since Tesla's (TSLA) Elon Musk called fuel cells 'fool cells' there has been a lot of discussion about the potential of fuel cells. In my opinion, there is enough space in the renewable energy department to support both. Both have specific advantages and disadvantages. The biggest disadvantage of hydrogen production, storage, and conversion to electricity, is the efficiency difference with batteries.

Investments In Hydrogen

There are a lot of companies active in the hydrogen economy. The largest companies are hydrogen producers which mainly use the cheapest method, steam reforming. Smaller niche companies purely focus on specific aspects of hydrogen. These can mainly be divided into electrolyzer producers and fuel cell producers. Some companies combine both to provide a fully integrated hydrogen producer.

Large Hydrogen Producers

The largest hydrogen producers today mostly produce grey hydrogen. These companies mainly use steam reforming to produce hydrogen. Most of them are moving towards green hydrogen, sometimes with joint ventures. Linde (LIN), for example, has a joint venture with ITM Power (OTCPK:ITMPF). ITM Linde Electrolysis provides industrial-scale turnkey solutions for green hydrogen production.

| Company | Market cap. | Revenue (TTM) | P/E (FWD) | P/S (TTM) |

| L'Air Liquide (OTCPK:AIQUY) | $75.32B | $23.87B | 26.84 | 3.17 |

| Air Products And Chemicals (APD) | $61.68B | $8.86B | 29.59 | 6.97 |

| Linde (LIN) | $132.41B | $27.05B | 52.72 | 4.69 |

These are all established companies with a long history in industrial gas. They are profitable. While their share prices increased along with the market, it can be argued that they are reasonably valued. These companies aren't pure hydrogen plays. They deliver other industrial gasses as well. Their main focus is grey hydrogen today. They are however shifting to cleaner solutions as well. These are a couple of interesting articles about these companies:

Companies Producing Electrolyzers

I believe electrolyzers are a very interesting way to invest in green hydrogen. There is a lot of new renewable energy coming online in the next couple of years. This will provide unstable production of electricity which is interesting for electrolyzers. By transforming this energy into green hydrogen it can replace the current supply of grey hydrogen. I believe electrolyzers are the best way to invest in hydrogen.

These are all smaller European companies with a steep valuation. They are pure-plays on green hydrogen and electrolysis which made them attract a lot of new capital in the past couple of years. These companies are unprofitable, this is why I didn't include the P/E ratio. They have expanding order books and should grow fast. More information about these companies in articles:

SunHydrogen (OTCPK:HYSR) could become an alternative to these electrolyzer companies. The company is working on an innovative hydrogen generator. The generator uses solar energy to directly split water into hydrogen and oxygen. The technology is still being produced and it is uncertain if the company will ever produce revenues. For more information, you can go to my article.

Fuel Cell Companies

Fuel cells are necessary to convert the hydrogen back into electricity. They can be used in transportation or stationary power systems. Fuel cells can also be powered by other fuels such as natural gas. Most companies are focusing on fuel cells powered on hydrogen or flexible fuel cells.

| Company | Market cap. | Revenue (TTM) | P/S (TTM) |

| Ballard Power Systems (BLDP) | $10.43B | $117.65M | 72.10 |

| Bloom Energy (BE) | $6.40B | $758.40M | 6.44 |

| FuelCell Energy (FCEL) | $5.82B | $70.87M | 56.53 |

| Plug Power (PLUG) | $28.76B | $307.54M | 66.94 |

| PowerCell Sweden (OTCPK:PCELF) | $2.75B | $10.31M | 266.12 |

These are very different companies that apply fuel cells in different ways so they aren't just comparable.

Ballard Power Systems focuses on integrating fuel cells in busses and trucks. It provides the fuel cell systems for other companies who integrate them into their vehicles.

Bloom Energy produces Bloom Energy servers. These fuel cell servers are stationary power systems mainly meant as backup power. It also produces electrolyzers and introduced a hydrogen strategy in July 2020.

FuelCell Energy is active in the same department as Bloom Energy. It produces power plants based on stationary fuel cells.

Plug Power wants to become a major green hydrogen producer. It acquired companies to produce its own electrolyzers and hydrogen fuel stations. Plug Power is working with green energy producers Brookfield Renewable Partners (BEP) and Apex Clean Energy to build hydrogen plants. It's building a nation-wide green hydrogen network. All these companies have steep valuations which make their share price vulnerable to corrections.

PowerCell Sweden produces fuel cells mainly for transportation systems. It has an interesting licensing deal with Bosch. Bosch could produce and distribute fuel cells based on PowerCell Sweden's design.

More information about these companies:

Large Industrials Jumping On The Hydrogen Train

As hydrogen came on the political agenda with rebound plans focusing on renewables, large industrial companies also jumped in.

| Company | Market cap. | Revenue (TTM) | P/E (FWD) | P/S (TTM) |

| Cummins (CMI) | $36.49B | $19.56B | 21.59 | 1.88 |

| Siemens Energy (OTCPK:SMEGF) | $28.66B | $32.20B | - | 0.90 |

| thyssenkrupp AG (OTCPK:TYEKF;OTCPK:TKAMY) | $7.07B | $33.89B | - | 0.21 |

These companies all have other larger and more important activities. Cummins introduced a hydrogen strategy in November 2020. The company acquired Hydrogenics in 2019 which added fuel cell technology and electrolyzers to the company. Siemens Energy has a hydrogen solutionsdepartment. In these hydrogen solutions, it seems to be focused on electrolyzers. thyssenkrupp describes itself as a "group of companies" and has many different businesses. It expanded production capacities for electrolyzers.

These large industrials aren't very interesting to invest in solely for their hydrogen capabilities and plans. It shows that public interest in hydrogen is rising. It is remarkable that, for example, Plug Power has almost the same market capitalization as these large industrials.

Hydrogen-powered Busses, Trains, And Trucks

Nikola (NKLA) is probably the most famous company focused on hydrogen trucks. Its stock-market career started with great success and diminished fast. Especially after a devastating report by Hindenburg. A company, ironically, called after the famous hydrogen zeppelin? Nikola almost partnered with General Motors (GM) to build a fuel cell electric vehicle. This didn't work out.

Together with Navistar (NAV) and OneH2, General Motors just announced plans to sell hydrogen-powered heavy trucks. Daimler (OTCPK:DDAIF, OTCPK:DMLRY) also recently announced a concept fuel-cell truck powered by hydrogen. Alstom (OTCPK:ALSMY, OTCPK:AOMFF) has a hydrogen trainin service at the moment.

Nikola is the only pure-play on hydrogen in this department. For the other companies, it is the same as with the large industrials. These hydrogen projects and concepts are interesting but small in comparison to other departments.

Conclusion

These are interesting times for renewables. There is a lot of interest in clean energy and this attracts a lot of money as well. Policies around the world are supporting these renewables. This creates an economically attractive environment for a lot of companies.

While there are many options to invest in the green hydrogen economy, the recent run-up in share prices pushed valuations higher. It is risky to get in when prices are at these high P/S ratios. These companies are still growing and need to reach larger scales to produce profits in the future. A good selection base on activities, valuations, partners, and management is important to invest in hydrogen today.

I believe companies with exposure to electrolyzers make the most interesting investments. These companies can profit from the transition from grey hydrogen to green hydrogen.

While I researched as many companies as possible, there is a possibility I missed opportunities. Feel free to make additions to the lists I present in the comment section.