Excerpt:

The SLV and JP Morgan

While iShares Silver Trust (SLV) units holders do not own any physical silver (the Trust owns the silver), and unit holders cannot convert their units into physical silver, due to the structure of SLV, all dollar fund inflows into SLV will create demand for physical silver. That is, if you believe the SLV custodian Jp Morgan.

This is because based on the Trust structure and Prospectus, every dollar inflow into SLV is packaged into baskets of securities by the Trust’s Authorized Participants (dealers) and these baskets are then exchanged with physical silver bars which are allocated to the Trust by the SLV custodian JP Morgan.

But there is a catch. This is the same JP Morgan which has been repeatedly prosecuted for manipulating silver price, and was, for example, fined $920 million by the US Justice Department last September for defrauding investors over 8 years " involving tens of thousands of episodes of unlawful trading in the markets for precious metals futures contracts". So do you trust JP Morgan to be honest about how it sources silver for the SLV?

On paper (no pun intended), it’s the job of JP Morgan as custodian to execute allocations into SLV and source physical silver metal either in, or to bring metal into, the vaults where SLV holds its silver. For SLV, these are the vaults of JP Morgan in London and New York, and the vaults of Brinks and Malca-Amit in London.

BullionStar Youtube – #SilverSqueeze Series: What are the most important things to look at in the Silver market currently?

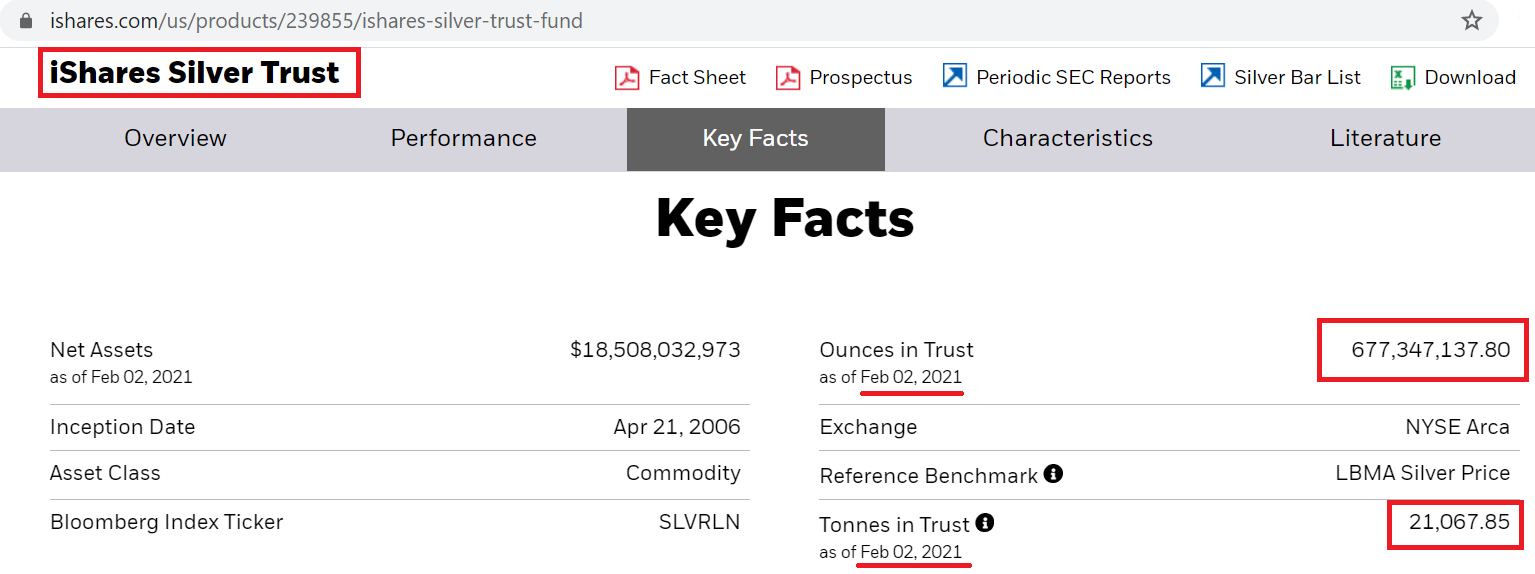

And so with huge dollar inflows into SLV, as happened on Friday 29 January, Monday 01 January and Tuesday 2 February, JP Morgan at short notice has claimed it has found enough silver to add to the iShares Silver Trust. And this is a staggering amount of silver.

In total, SLV claims to have added a mammoth 3415 tonnes of silver since last Thursday (28 January), which just happened to be lying around in the SLV sub-custodian vault of Brinks in Park Royal, London, which is the vault where the SLV weight list says the silver was added to. This 3415 tonnes is 14% of annual mine supply and 10% of all the silver the LBMA says is in London. But do you believe the custodian JP Morgan?

Who would part with 3415 tonnes of physical silver at the beginnings of a #SilverSqueeze? Not a price maximising investor. Perhaps the silver is being leased, but then that in itself could be against SLV rules and would be double counting.

2nd February 2021: SLV claims to have added 1,765.7 tonnes of silver on a day in whicb there is no silver to be had anywhere else

2nd February 2021: SLV claims to have added 1,765.7 tonnes of silver on a day in whicb there is no silver to be had anywhere else Conclusion

One of the big questions for the rest of the week then is whether large inflows into SLV continue, and whether JP Morgan will be able to find enough physical silver to add to the Trust. Its conceivable that the bullion banks knocked down the COMEX silver price on Tuesday 2 February specifically to try to dissuade investors from putting more money into SLV, so as to try to stop the huge physical silver additions that SLV is having to make (or claim to make) with every new dollar inflow. But if that was their intention, it did not work.

There are therefore potential added risks of buying into SLV in that in the event of the inability of JP Morgan to source enough physical silver, this would lead to a failure of SLV in following its Prospectus rules of investing in physical silver. But at the same time, if SLV does see continued massive dollar inflows, and if it hits a wall on not being able to acquire physical silver in London or New York, then this would cause shockwaves across the entire silver and gold markets, across all the banks involved in those market, and across the wider financial markets.

But given the risks of SLV and its opacity, in terms of the #SilverSqueeze, it is far more effective to buy physical investment silver directly. See BullionStar’s recent blog post “#SilverSqueeze: Physical Silver Shortage vs. Paper Silver" for more on this topic.