As I explained in my last article on Canada-based Quarterhill (OTCQX:QTRHF), the company has two primary lines of business: a patent portfolio segment that focuses on licensing IP and an International Road Dynamics ("IRD") segment that specializes in delivering intelligent transportation systems to the global market. While the primary investment thesis in my view continues to be the yet to be settled favorable "final judgement" award of ~US$109 million with respect to on-going litigation with Apple (AAPL), Quarterhill is not sitting around waiting for the check. The company has made a key addition to its IRD segment by buying Germany-based Sensor Line GmbH at an attractive multiple. In addition, its WiLan subsidiary made a strategic acquisition to its patent-portfolio with a purchase of ~2,000 patents from MediaTek (OTCPK:MDTKF). Both acquisitions, along with some recent contract and licensing deal, bode well for Quarterhill as it waits for the Apple litigation to proceed from "final judgement" to "final payment". The shares are very attractive and I reiterate my "Speculative BUY" rating.

The Sensor Line GmbH Acquisition

As I mentioned in my last Seeking Alpha article on Quarterhill (see Quarterhill Makes An Eagle In Q3), management was evaluating the M&A market for additions to its IRD segment. Sure enough, just after the turn of the new year Quarterhill announced it had completed the acquisition of Germany-based Sensor Line. Sensor Line is an intelligent transportation systems ("ITS") provider of fiber-optic sensors to monitor traffic, improve safety, and improve mobility - among other uses - in rail and road applications. Sensor Line is a pioneer in this field, has been around since 1996, and has more than 50,000 systems deployed in 50 countries around the globe.

Rish Malhotra, CEO of IRD, commented on the transaction:

This acquisition broadens our product suite and expands our geographic footprint further into the European market. Sensor Line's in-road sensors will further strengthen our enforcement and tolling solutions and IRD's distribution capabilities will open-up new opportunities to grow the Sensor Line business while serving its long-standing loyal customer base. We are very pleased to welcome the Sensor Line team to IRD and will maintain manufacturing operations at their facility near Munich.

As Malhotra said, the deal greatly improves QuaterHill's market exposure in Europe. That should enable the company to leverage that new exposure into addition sales for its other existing IRD tech-enabled infrastructure solutions.

Quarterhill paid C$6 million in cash for Sensor Line. In the press release, the company said it expected the deal would add C$4-5 million in revenue this year and C$700-$800,000 in adjusted EBITDA to the IRD segment. The mid-point of adjusted EBITDA expectations (i.e. C$750,000) implies a very attractive 9.2x multiple for the deal. Considering Quarterhill should be able to dovetail its existing IRD solutions with Sensor Line's technology and combined with large market opportunities (see the ITS TAM estimates below), the deal looks particularly auspicious for Quarterhill.

MediaTek Patent Additions

Just before the end of 2020, Quarterhill announced its wholly-owned Wi-Lan subsidiary had made a significant addition to its patent-portfolio by purchasing ~2,000 patents from MediaTek. Taiwan-based MediaTek is a fabless semiconductor company:

... that is considered a market leader in developing system-on-chip solutions for mobile devices, home entertainment, connectivity, and Internet-of-Things (IoT) products. The acquired patents relate to a variety of technologies including power management ICs, RF ICs, embedded and NFC microcontrollers, as well as image processors.

I quoted the press release because - as is typical with IP transactions - all other details of the deal were confidential. That being the case, shareholders have to put their faith in the fact that Wi-Lan's management team is adept at determining both the usefulness and the value of the acquired patents. After all, Quarterhill has a long and successful history of operating an IP licensing holding company.

Going Forward

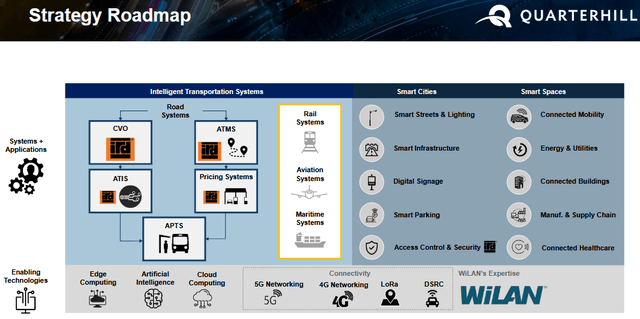

Quarterhill's two-pronged strategy roadmap is shown in the following graphic:

Source: Q2 2020 Strategy Update

Source: Q2 2020 Strategy Update

The company intends to expand its smart cities/spaces solutions across the global transportation infrastructure while continuing to grow and license its patent-portfolio of enabling technologies like cloud/edge computing, 4/5G networking, and AI.

Assuming Quarterhill didn't overpay for the MediaTek patents, both of the previously described acquisitions fit like a glove on the strategic roadmap and bode well for the future. Note the company reported it had C$129.7 million in cash at the end of Q3, so the C$6 million in cash paid for Sensor Line was just a drop in the bucket and at such an attractive multiple, it appears to be an excellent deployment of shareholder capital. Assuming the company didn't overpay for the MediaTek deal, it is safe to assume the balance sheet is still very strong since long-term debt at the end of last quarter was only C$260,000.

ITS is a relatively unknown and lightly followed global market, but as Markets and Markets reports the market for roadways alone:

... is expected to grow from USD 17.9 billion in 2020 to USD 36.5 billion by 2025, at a CAGR of 15.3%. The market growth can be attributed to several factors, such as increasing concerns toward public safety, growing traffic congestion problems, rising favorable government initiatives for effective traffic management, increasing adoption of eco-friendly automobile technologies, and development of smart cities across the world.

Add the rail, maritime, and aviation verticals and it is clear Quarterhill's IRD segment has a TAM opportunity way above its current size (QHill's market-cap is currently only $262 million).

Meantime, since my last article on the company Quarterhill has announced a couple of contract awards and a significant wireless licensing agreement:

- A $2 million follow-on contract in Ukraine to provide four high-speed weighing systems.

- A Weighing system in Oklahoma (terms not disclosed). The turnkey Weigh-In-Motion ("WIM") System is expected to go in-service in Q1 2021 and IRD will maintain the system for 5-years.

- A multi-year license of Wi-Lan's LTE license portfolio by an un-named handset manufacturer (ranked in the top-20 in US sales). The manufacturer will have rights covering all handsets sold globally. Terms were confidential.

Despite all these positive developments, and as I mentioned earlier and explained in more detail in my previous two Seeking Alpha articles on Quarterhill (see here and here), the primary investment thesis this year remains the potential that Quarterhill will, finally, receive a US$109 million check as a result of the Apple litigation. Given previous rulings (including the "final judgement") it appears not to be so much a matter of if, but when, Quarterhill receives and cashes a big check from Apple.

Earnings - What To Look For

The Q4 EPS report should be released toward the end of this month as the Q4 report last year was released on February 27. Note that was a very strong report, with strong revenue and adjusted EBITDA - $146.7 million and C$40 million, respectively - as compared to $77.4 and -$10 in the prior year quarter. The point is yoy comps may be tough. However, investors new to the company should understand that due to the nature of its IP licensing and IRD businesses, revenue, adjusted EBITDA, and earnings can be quite lumpy from quarter-to-quarter and yoy due to the impact of large licensing deals and the timing of IRD contract recognition.

Investors should also keep an eye out for the cash balance. Not only because it will give a better indication of what the company shelled out for the MediaTek patents, but because it will also reflect on how much the company spent on its buybacks. At the end of Q3, the company had been authorized to buy back as much as 10% of the outstanding share count (11.3 million shares). During Q3, it had spent ~$3 million to buy back 1.6 million shares at an average price of $1.89/share. So there is a long way to go to fulfill the entire buyback authorization.

At the end of Q3, the company had an average of 117,884,124 shares outstanding. That means the potential US$109 million Apple settlement equates to an estimated US$0.92/share.

Risks

The primary risk for Quarterhill is that the expected "final judgement" settlement with Apple does not come to fruition. I put odds of that happening at close to zero given the previous favorable judgements. It appears the only reason it is taking so long is because Apple is simply delaying the inevitable. But with litigation, one never knows. I suppose there is the possibility that Apple may agree to some kind of long-term licensing deal with Quarterhill in lieu of the full-payment, but that is pure speculation on my part and Quarterhill's hand appears so strong I see little rationale for the company to give an inch.

Summary & Conclusions

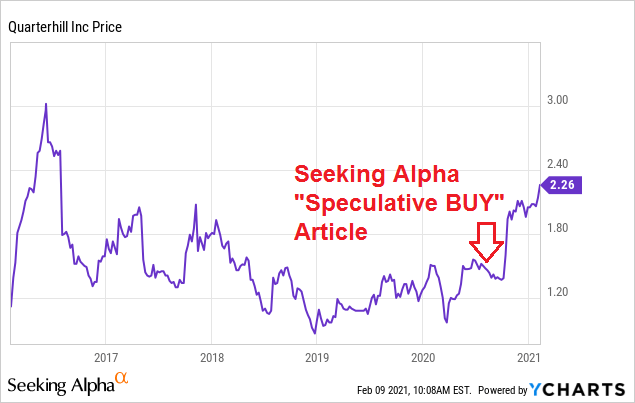

Despite the potential windfall coming from the expected settlement of the Apple litigation, Quarterhill is not resting on its laurels. The company has closed a very attractive deal in its IRD segment and significantly expanded its patent-portfolio. Contract and license agreements continue to roll in. In consideration of the cash position at the end of Q3, and even after the recent Sensor Line acquisition, Quarterhill still has likely has ~$1/share in cash (-ex the MediaTek acquisition and buyback costs). I left out the Wi-Lan patent acquisition because terms were confidential and we won't know what the buyback spend was until the Q4 report is released. But the larger point is that the company is likely still relatively cash-rich with perhaps $1/share in cash. Add to that the potential Apple settlement (an estimated $0.92/share) and investors practically get the IRD segment and entire patent portfolio for free because the stock is currently trading at only $2.26/share.

I reiterate my "Speculative BUY" rating on Quarterhill. The "speculative" part is only due to the company's rather small market-cap, the relatively opaque nature of lack-of-transparency with its IP licensing deals, and the unknowns of IP "litigation with the giant".

I'll end with a 5-year chart of the stock price:

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in QTRHF over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am an electronics engineer, not a CFA. The information and data presented in this article were obtained from company documents and/or sources believed to be reliable, but have not been independently verified. Therefore, the author cannot guarantee their accuracy. Please do your own research and contact a qualified investment advisor. I am not responsible for the investment decisions you make.

Source: https://seekingalpha.com/article/4404666-quarterhill-extremely-undervalued?mail_subject=qtrhf-quarterhill-not-sitting-around-waiting-for-apple-settlement-and-a-big-fat-check-extremely-undervalued&utm_campaign=rta-stock-article&utm_content=link-2&utm_medium=email&utm_source=seeking_alpha