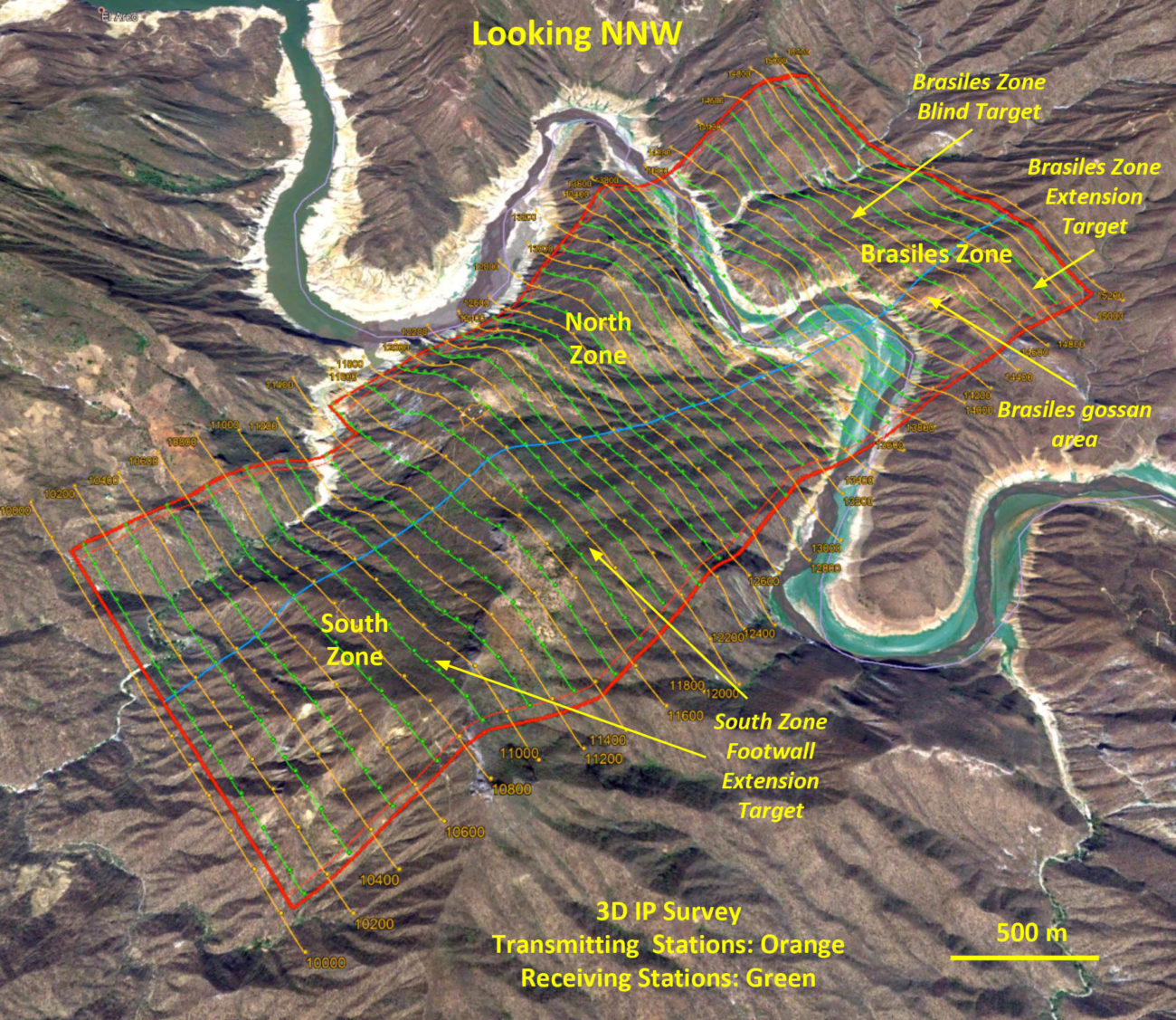

At the end of January, Oroco provided the market with an update on its ongoing 3D IP Survey. That extensive survey started a few months ago and the company is planning on covering the entire project area as the IP Survey helps to get a better understanding of the size of the chargeability anomalies.

The initial results in November were encouraging but at that point, the company had only completed the interpretation of the South Zone. A nice warming up exercise, but what we mainly were interested in was seeing the results of the North Zone and the Brasiles Zone as there is some low hanging fruit ripe for picking given the amount of data available for the North Zone.

The results of the IP Survey on the North zone are exceeding expectations on all fronts: the continuity and consistency of the anomaly is striking. Additionally, the anomaly seems to be running further than expected in the northeastern direction while the chargeability anomaly has been chased to a vertical depth of approximately 600 meters. And the 600 meter cutoff is mainly because the IP Survey can’t provide reliable data from anything deeper, so for all we know, the chargeability anomaly may even extend further at depth but that doesn’t really matter at this point as there’s plenty of stuff to like closer to surface.

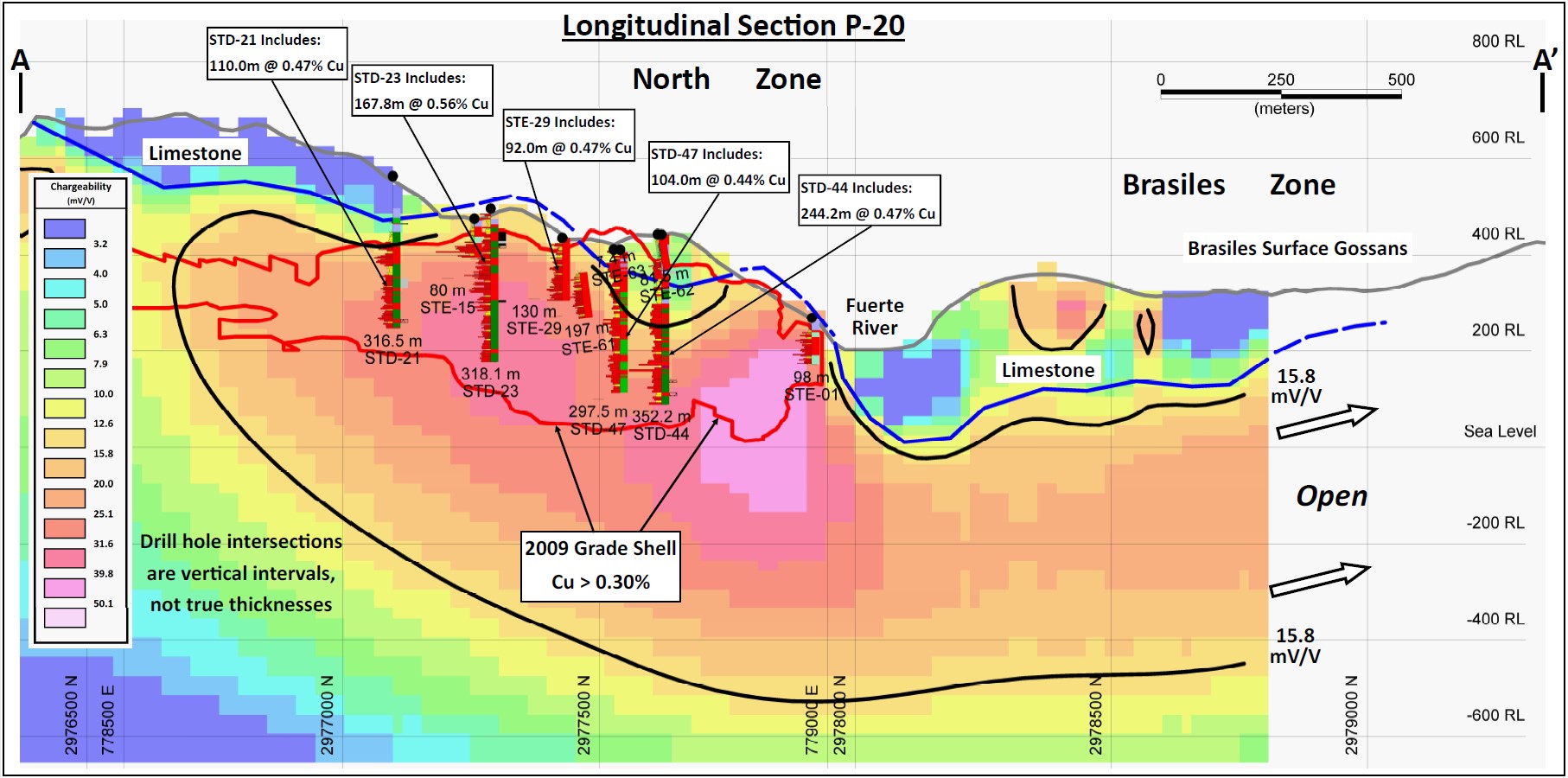

The image above shows a long section of a part of the IP Survey, and you can clearly see the correlation between the 2009 grade shell (the non-compliant open pit) and the chargeability highs. Keep in mind there is NO 1:1 correlation between chargeability highs and copper mineralization. The chargeability high simply means there’s a thick layer of sulphides present and the anomaly could be explained by pyrite and chalcopyrite as well so it doesn’t necessarily have to mean all the orange zones in the image above will have copper grades above a cutoff grade. A logical follow-up to test the chargeability high would be to test for conductivity, but really only the drill bit will be able to provide a hard confirmation whether or not the anomaly confirms the copper-bearing system extends much deeper and much further to the north-northeast than the current pit shell. While we can obviously expect the copper mineralization that has been encountered in the pit shell to be more widespread than just in the pit shell, it’s still too early to extrapolate the dimensions of the anomaly to an exploration target.

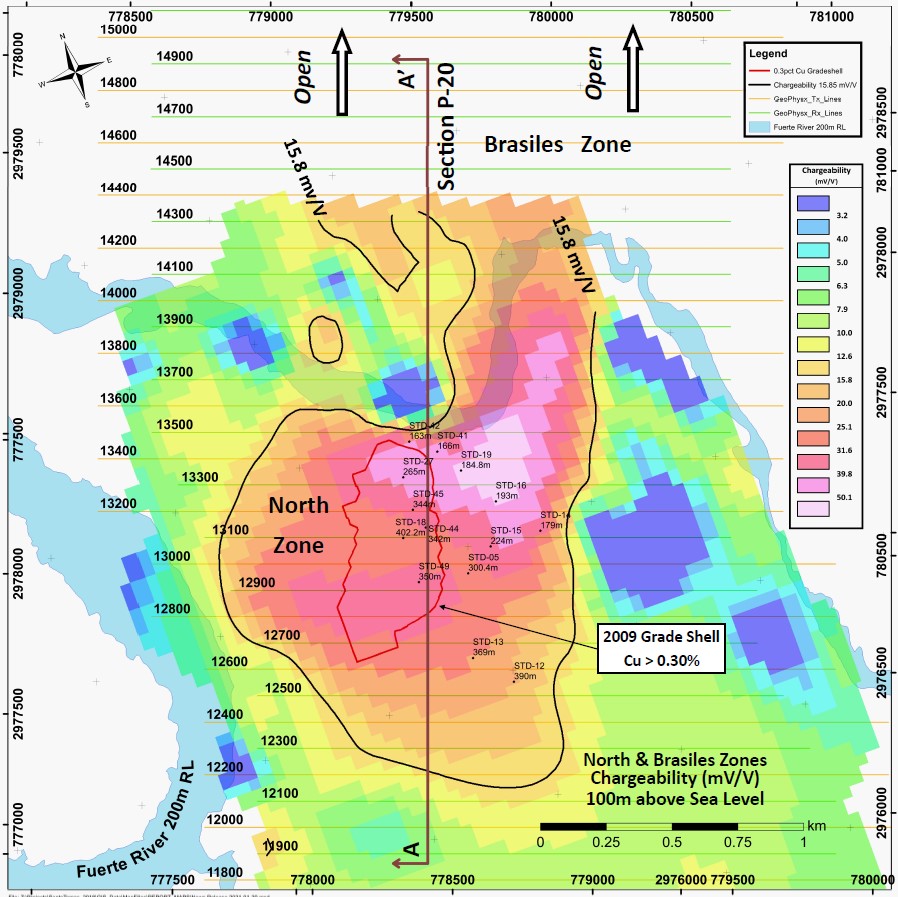

Will the north zone grow? Undoubtedly. Even if the anomaly does not fully consist of a copper-bearing anomaly with grades above reasonable cutoff grades, it’s hard to imagine none of those tonnes will contain copper mineralization. The second image provides us with more insight on the footprint of the anomaly.

As you can see, the chargeability high seems to be intensifying towards the northeast of the pit shell and we think this would be a very logical drill target for Oroco Resource Corp. to follow up on. Again, the anomaly only shows there are sulphides present and this does not necessarily mean the copper grades will tag along, but common sense tells you the copper mineralization likely won’t stop at the pit outlines (in red).

Is it reasonable to expect to find more copper directly adjacent to the pit outline? Absolutely. Is it reasonable to expect the entire anomaly to contain above cutoff copper grades? Probably not as there will be mineralization below cutoff grade (meaning the copper values would be too low to be economic) and portions of the anomaly will have been caused by the footprint of the pyrite and chalcopyrite. But we would love to be wrong and see the North Zone evolve into a multi-billion tonne super pit concept, that’s for sure!

The 3D IP Survey is now in its final phase and we hope to see the interpretation of the final batch before the end of the quarter. It will be very interesting to see the chargeability results of the Brasiles zone where three holes were drilled in the nineties. The data from these holes is not available although John Thornton who has been working on the project for years in the past few decades has some specific recollections of hitting 1% copper(-equivalent) intervals. Good to know, but we’ll have to wait for the drill bit to perhaps twin the original holes.

For now, Brasiles is just icing on the cake but should the 3D IP Survey confirm a high chargeability anomaly, we would expect Oroco to plan twinning the historical holes as soon as possible. The currently available results of the IP survey seem to confirm the mineralization continues across the river on the Brasiles zone so it would be reasonable to expect the company to encounter more copper mineralization, but it’s too soon too talk about size and grade right now. Let’s wrap up the IP Survey and punch a few holes into the Brasiles target before getting carried away. For now, the main value of the Santo Tomas project is still related to the North Zone which will be aggressively drill-tested.

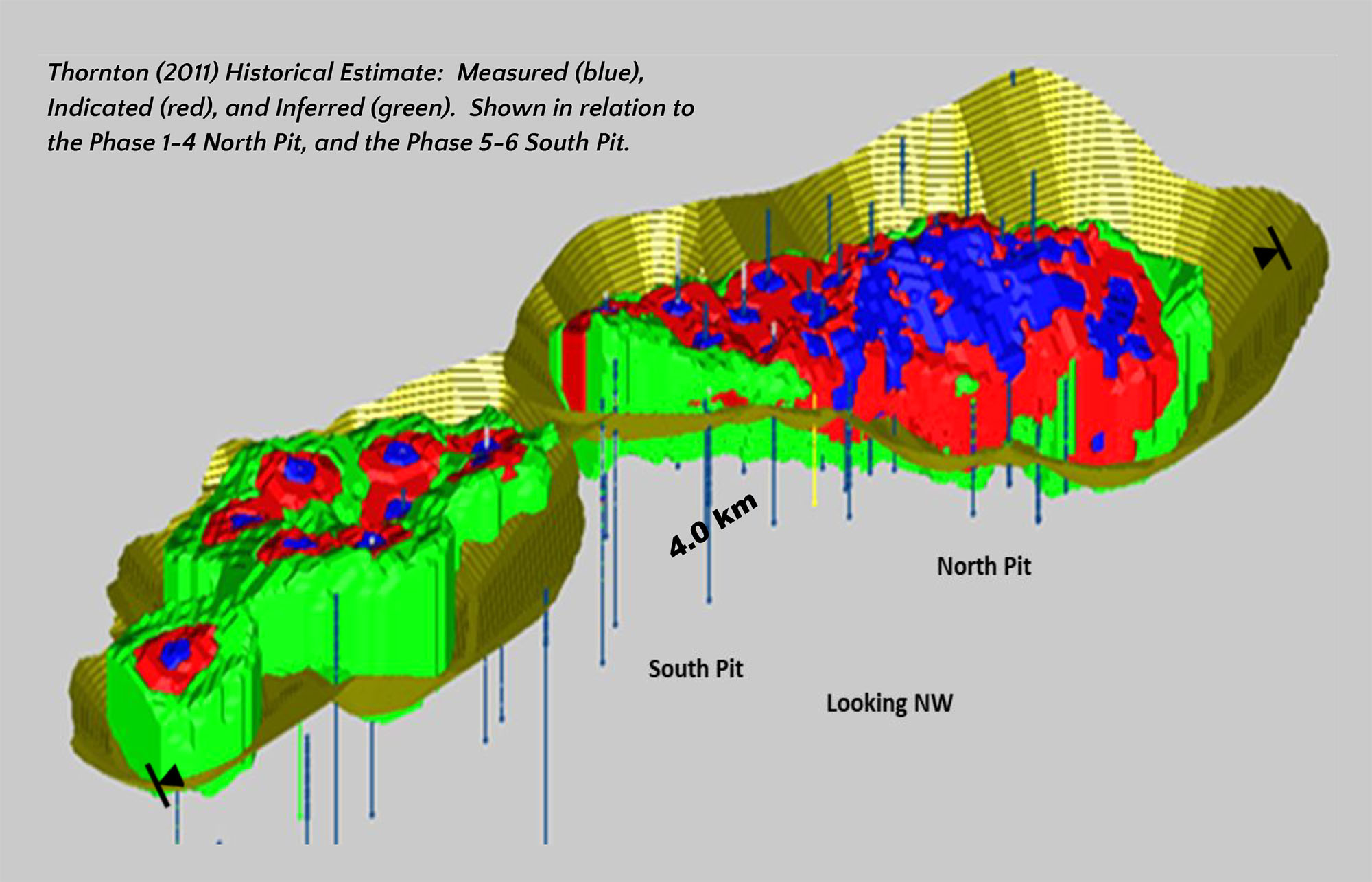

Historical Estimate

Historical Estimate