Investment Thesis

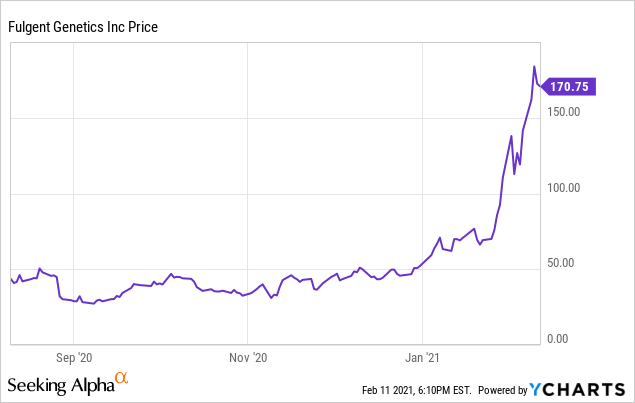

Fulgent Genetics (NASDAQ:FLGT) is an upstart in the genetic testing business. The company has a brilliant and well-aligned founder and a scalable, affordable platform that has been rapidly growing. The company has also enjoyed extraordinary success with its COVID-19 testing business. More recently, however, Fulgent shares have been caught up in the short squeeze game, causing them to rocket forward through end of January into early February. What is interesting is that this is one of the few short squeeze companies with a very good business underlying it. Shares are frothy here, and I don't want to play the game that is being played. This might be a good time to trim a little if you are a long-term holder with the plan of getting back in at a lower price later.

Introduction

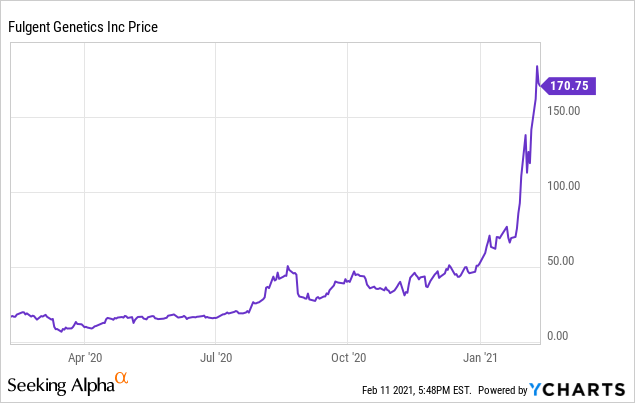

Fulgent Genetics has enjoyed a heck of a January.

Data by YCharts

Data by YCharts

I have been a long-time holder of Fulgent and have recently found myself staring at the ever rising stock price wondering... what the hell is going on?

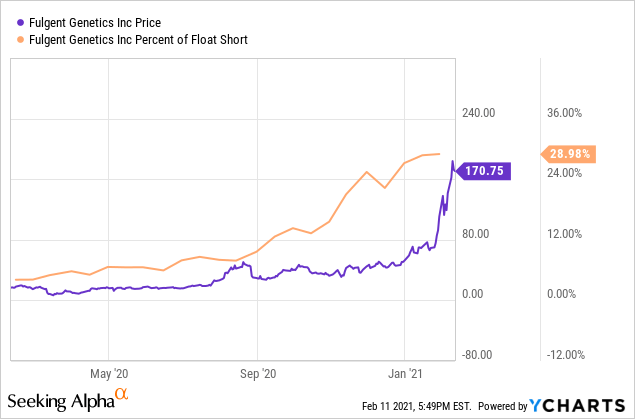

Of course, you don't have to look too hard to find the answer: Fulgent has been making appearances on "most highly shorted" lists.

Data by YCharts

Data by YCharts

Unless you've been living under a rock, in early 2021, highly shorted stocks only go up, and when they do, it must be a parabolic move.

I don't make the rules.

Here is the interesting thing, though: Fulgent is actually a good business.

In fact, it's a really good business run by a really smart guy. And not only is it a really good business run by a really smart guy, but it also found itself perfectly positioned to catch an extraordinary tailwind from the COVID-19 pandemic. And it's in the catchy, trend-worthy field of genetic testing. AKA, Fulgent is about as dangerous a short as shorts get.

But should we buy it today?

Let's unpack this a bit.

Genetic Testing

Fulgent Genetics is a genetic testing company. Fulgent aims to offer a comprehensive suite of genetic tests that offer clinicians medically actionable information. The company currently offers 18,000 single gene tests and over 900 genetic panels.

Genetic testing and related treatments are likely to be a future cornerstone of medicine, because genetic testing allows a disease process - or even just the risk of developing a certain disease process - to be caught and potentially intervened on early. Conversely, today's versions of genetic testing and treatment are in their infancy. Today, genetic testing is most widely used for pre-natal/neonatal screening, certain hematologic disorders, and for cancer diagnosis and treatment. However, in the future, it will likely be used far more commonly for both preventive and precision medicine.

Genetic testing allows a disease process or increased risk of developing a disease to be caught early when it can still be intervened on.

Allied Market Research believes that the genetic testing market will grow at a 10% CAGR between now and 2027, reaching a market size of $21.3 billion.

Frankly, I think the market could grow to be far in excess of that. Thus far, the genetic testing market has been limited by cost as well as by the question of what exactly we do with the information. We don't yet have a wide variety of targeted medications, therapies, or other treatments for genetically related disease.

The key word, of course is "yet."

It is coming.

Not only is it coming, but I also think its inflection point (when the combination of increasing rate of genetic treatments or medicines, lower genetic testing costs and wider availability, and payor willingness to cover genetic testing collide) is in the not too distant future. Consider that the first ever mRNA based vaccine is already being deployed all around the world. Consider the CRISPR-based gene therapies being developed for disorders from genetic blindness to sickle cell disease.

All of that - all of it - will require genetic testing.

That vision of the future is exactly what Fulgent is built upon.

The Two Businesses

When we talk about Fulgent's growth and how to value this company, it's really worth taking a moment to break Fulgent down into two separate components.

First, there is the underlying Fulgent Genetics business. This is a genetic testing company that is looking to provide clinicians with clinically relevant genetic testing results that are affordable and scalable.

Second, there is the COVID-19 testing business. This is a testing company that has scaled its testing platform in a way that is nothing short of extraordinary over the last 12 months. It has captured significant market share due to the speed, reliability, and scalability of its platform.

I'll get into the COVID-19 testing business a little later, but first, I want to talk about the core genetic testing business.

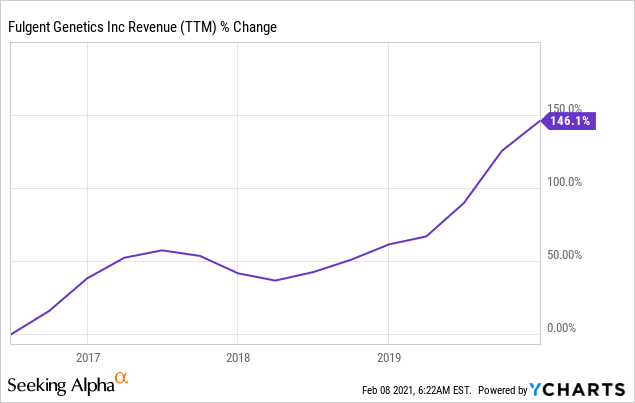

When it was founded, Fulgent recognized a need for a more accessible, cheaper, and scalable genetic testing platform. The results have been fairly impressive since the IPO in 2016.

Data by YCharts

Data by YCharts

You'll note that I left 2020 out of this chart, as COVID testing revenue massively distorts the picture.

Between 2016 and end of 2019, Fulgent was able to grow revenue from its genetic testing business at a CAGR of ~37%. Number of billable tests has increased nearly five-fold from 12,500 in 2016 to 58,500 in 2019.

Part of this is due to the growth in the genetic testing market itself as well as the increase in insurance providers willing to pay for this testing as it becomes more clinically actionable. Part of it is that Fulgent's flexible and lower cost platform has enabled it to gain market share and rapidly scale.

Right now, Fulgent is guiding for $40 million in revenue from its base genetic testing business for full year 2020, an increase of $8 million (25%) over its 2019 revenue of $32 million.

That is a very, very important thing that I want you to remember as we keep going: Fulgent is still growing its core business, and it's growing at an impressive rate and with a long runway in front of it.

And we haven't even gotten to the ownership.

Ownership

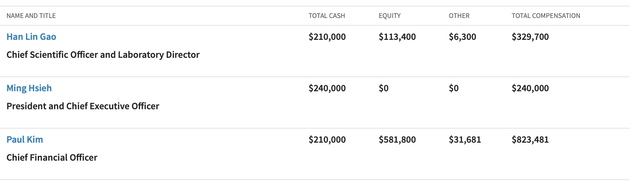

Fulgent was founded by and continues to be run by Ming Hsieh. Hsieh is, in short, a genius. He founded Cogent Systems in the '90s which was ultimately sold to 3M (MMM) for just under $1 billion, and today, in addition to running Fulgent, he also serves on the board of directors of Fortinet (FTNT).

Fulgent is Mr. Hsieh's baby.

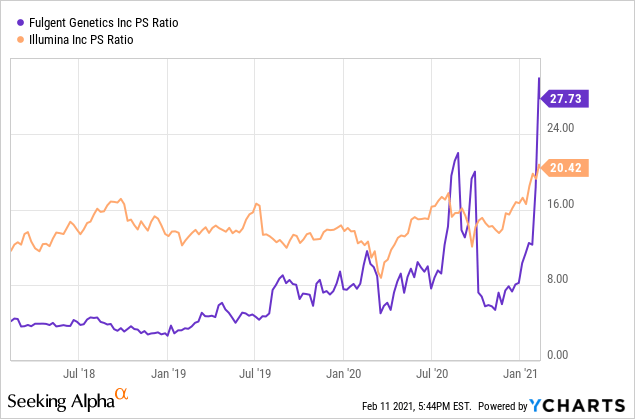

Hsieh collects a pittance of a salary from the company...

Source: 1Salary

...and has done so for years:

Source: Fulgent Genetics

Mr. Hsieh, however, is clearly aligned with investors, as he personally owns about 33% of the company, and insiders together own about 42%.

When you consider the heavy insider ownership and the comparatively unimpressive salary, it's pretty clear this team is in it for the long haul.

Enter COVID

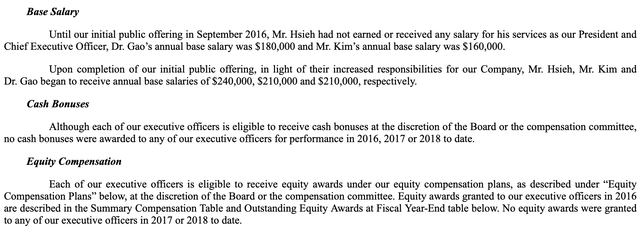

COVID had a, uh, impact on Fulgent's business.

Data by YCharts

Data by YCharts

Fulgent made a lateral move into the COVID-19 testing business and then rapidly scaled its ability to test in a way that, especially for such a small company, cannot be seen as anything short of extraordinary.

Last quarter alone, Fulgent performed 1.04 million billable tests, an increase of 5,000% over Q3 2019. Almost the entirety of that increase was due to COVID 19 testing.

The COVID testing business brought in probably $90-95 million of last quarter's $101 million in revenue and allowed the company to turn a profit of $46.6 million in that quarter alone.

Fulgent's advantage in COVID 19 testing from the way it has been able to leverage its technology and rapidly build out the IT infrastructure to get results to people in a timely fashion (when you think about the idea of running tests for hundreds of thousands of people from different sites as diverse as drive up sites to inpatient ICUs, the scale is overwhelming). Fulgent also offers a "Next Generating Sequencing" COVID-19 test that I suspect will be more in demand in the future as COVID variants with concerning pathogenic features become increasingly widespread.

Just take a moment to think how damn smart this is. Fulgent was faced with a situation where it knew its genetic testing business could be impaired to some degree over the near term (actually, it ended up being just fine, but that's just a bonus). So... it made a lateral move, leveraged technology it already had in place (COVID PCR tests are basically just genetic tests on a virus), and aggressively built up the required infrastructure to become a large-scale COVID-19 testing player.

When you think about it for a moment, it's incredible. This is the type of opportunistic move that changes the game for a small, growing company.

Last, it's worth quickly mentioning the balance sheet: the company is sitting comfortably in a position of strength with $75m in cash compared to $2.7m in debt.

The Future of COVID Testing

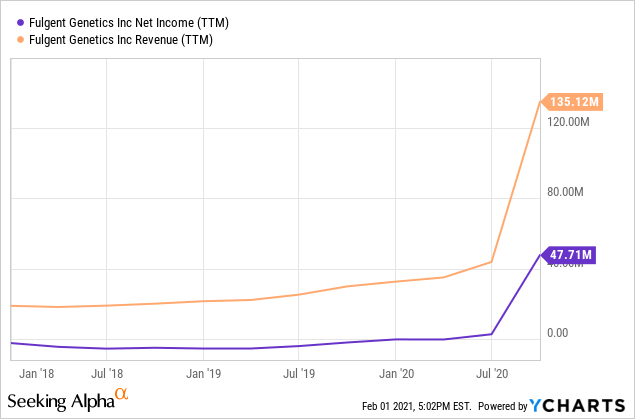

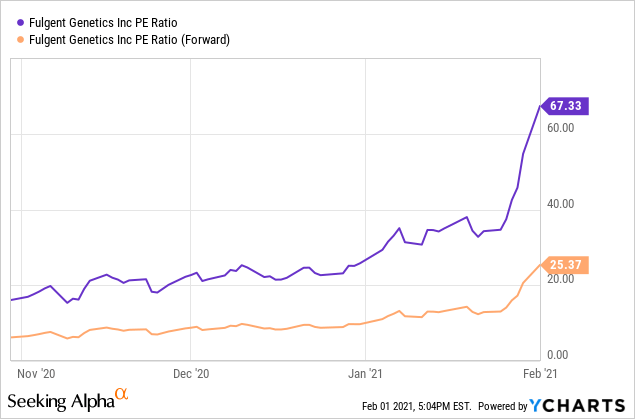

Fulgent's valuation - especially for a hyper growth company - isn't (or wasn't...) all that crazy.

Data by YCharts

Data by YCharts

In fact, Fulgent has traded at a fairly consistent discount to genetic testing peer Illumina (ILMN):

Data by YCharts

Data by YCharts

It wasn't even until the recent parabolic move that things started to even approach getting out of line.

We have to remember, though, there is a reason for this: the market is perpetually forward looking. Today's market is discounting the COVID-19 pandemic tailwind to Fulgent's business. While Fulgent has enjoyed extraordinary growth in revenue and income from the pandemic, as the vaccination program hits critical mass, the market believes the need for testing will enter a precipitous decline, wiping out this new source of revenue for Fulgent.

This is why we have to look deeper than simply glancing at a ratio.

I have very mixed feelings about this. On the balance, I think the market has been over-aggressively writing off the degree to which the COVID testing business will decline in the coming years.

First, you can color me definitively unconvinced that we are all going to get vaccinated, and COVID-19 goes away forever. PS, I received the COVID vaccine in early January and wrote about the experience here (TLDR, go get the vaccine, it's not a big deal).

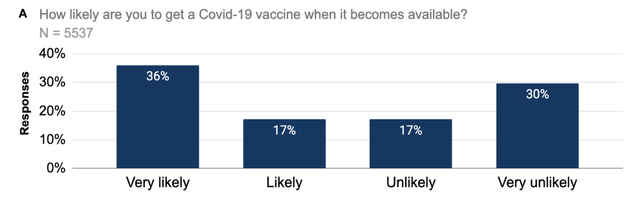

Vaccine hesitancy remains rampant. As a human being forced to co-exist with these others, it makes me tear my hair out crazy, but vaccine hesitancy is without question part of the bull case for Fulgent.

Source: Invisibly

Source: Invisibly

Not only are adults demonstrating vaccine hesitancy, but we haven't even touched on the realm of the vaccination of children. If you think people don't want to get vaccines themselves, just wait until they are told to get it for their children, and until there is widespread vaccination of the pediatric population, COVID will continue to have a breeding ground.

Second, there is the problem of vaccine efficacy and access to the vaccines. For example, the recent data on the JNJ vaccine candidate was heralded as a "key contributor to normalcy" because it reduced risk of moderate to severe COVID by 66% and risk of severe COVID by 85% in a single jab. Don't get me wrong for a second - if that was all I was offered, I would happily take it. But realize that this is without question incomplete protection. Right now, that's just something we are going to have to accept. That's the best many people are going to get, which is what it is. Oh, and FYI, that JNJ vaccine is going to leave a lot of people getting COVID testing.

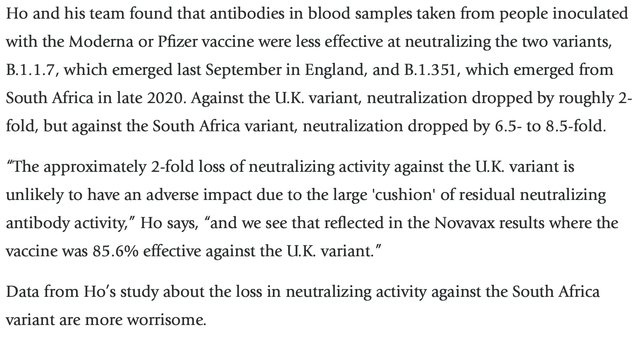

Last, there is the ever present - and increasing - risk of COVID variants that are resistant to the vaccine. Due to decreased efficacy of vaccine generated antibodies, vaccine makers are already working to develop updates.

Source: Columbia University

Additionally, even when the population is widely vaccinated, there is the risk that the virus will develop new variants that further make it resistant to the types of antibodies the vaccines help us generate. You can think of these new antibodies acting as a sort of evolutionary pressure on the virus. They stop most of the virus, but not those sub-populations with subtle differences that confer relative immunity. Those sub-populations can then find new hosts to infect and multiply, thereby creating a new variant with resistance patterns. This is already happening, and it will likely continue to happen even as the vaccines are rolled out.

Not only that, but also the increasing risk of variants is likely to lead to increased testing for variants as scientists are beginning to recommend. This, of course, plays right into Fulgent's wheelhouse, as it will be well positioned to adjust current tests to test for genetic variants and already offer a sequencing test.

I want to be clear: I'm not overall bearish on "life." The vaccines are going to be absolute gamechangers for how the world functions and will certainly succeed in damping down the societal burden of COVID-19. I just don't think the virus is going to up and disappear. I think we are going to be testing for this disease for a long time to come.

While a net reduction in testing might present something of a future headwind for Fulgent, I suspect the company will still be making a lot of money in this area in the future.

How Will COVID Testing Pay?

It's also worth noting that COVID-19 testing is likely to continue to be commoditized. Already, Fulgent has noted marked declines in average selling price of COVID tests with these falling from $493 per test to $98 between the second and third quarters. Obviously, this decline in ASP was more than offset by volume of tests sold. At the same time, however, Fulgent has become more efficient with testing procedures, yielding cost savings of 42% per test between quarters 2 and 3. There can be no doubt, though, that the decline in revenue per test will likely outpace the cost savings attributed to efficiency.

I suspect that Fulgent will over the short to intermediate term continue to enjoy expansion in volume of tests that offsets decline in ASP such that it continues to show robust revenue growth. However, over the longer term, I suspect that volumes will plateau and begin to decline as vaccination programs improve the COVID situation, while ASPs will find a relative floor.

In the end, Fulgent is going to be making less money selling COVID tests down the road than it will in 2020/2021.

While this means Fulgent likely does not have a future filled with extraordinary, eye-popping numbers past the intermediate term, there has been a tremendous net effect for the business.

The business which, pre-pandemic, was looking to hit its stride and only just flirting with profitability suddenly finds itself phenomenally well capitalized with millions of dollars pouring onto the balance sheet each quarter.

The benefits also go beyond the cash pouring into Fulgent right now. This has put the company on the map as a viable genetic testing option. It has allowed the company to build relationships with payors and hospitals, and as Fulgent continues to scale its underlying business, these relationships will pay off.

Not only that, but also Fulgent has been continuing to aggressively push its primary business as I mentioned above. On the most recent conference call, Fulgent's executives noted 57% sequential growth in the core business of genetic testing with record revenues of $10-11 million and projected Q4 revenue in the "low teens" and end of 2020 core business revenue of approximately $40 million. Compared to $32 million of core business revenue in 2019, this represents 25% year-over-year growth.

At the end of the day, Fulgent has:

- A strong, growing underlying business

- Well-aligned and high-quality management

- A tremendous tailwind within the realm of COVID-19 testing that will aggressively capitalize the balance sheet and help the company build key relationships

The question really becomes how to put all these factors together.

The only problem?

Data by YCharts

Data by YCharts

The run-up in shares is excessive and not based on fundamentals. The company is riding a wave of sentiment that is not reflective of the prospects of the underlying business.

What To Do Now?

So, let's start with the most important thing: I have legitimately no idea what Fulgent's share price is going to do over the next couple of months. Recent price action has seen Fulgent rising and falling by 20%+ almost daily.

The market has gone nuts. Anything is on the table.

Over the near term, I think there are two main factors affecting Fulgent's stock price:

1.) The short interest trade

2.) Fulgent is likely to record another absolute blowout quarter

If the short interest trade starts to fall apart or if Fulgent's quarter disappoints the lofty expectations in place, shares could be in for a haircut. Similarly, if the market moves towards a correction, highflyers like Fulgent will see a painful reversal.

In the end, this stock is not trading on fundamentals right now.

I am long term very bullish on Fulgent's business prospects, but as in all things, growth must be factored into value. It is difficult to see Fulgent as a value here. While I am not as pessimistic on the future of Fulgent's COVID testing business as the market was previously, there is too much uncertainty to aggressively value the company solely on this. Conversely, the underlying genetic testing business - projected for $40 million in FY 2020 revenue - cannot support the current ~$4.2 billion market cap.

This is likely a good time to trim shares if you are sitting on big gains. I suspect you will have a chance to buy into a phenomenal business at a better price later.

Author's Note: I apologize if there is a significant price change in Fulgent between the writing of and publication of this article. With the parabolic move in highly shorted names, it is possible that Fulgent is trading at a materially different price when this article is ultimately published. At time of submission, Fulgent shares trade at approximately $170.