E3 Metals (OTCPK:EEMMF) is a Canadian-based junior lithium miner. Focused solely on the extraction and production of lithium chemicals, E3 has staked its future on the success of the metal. With the company’s only project still under development, the company has a high ceiling for its growth. However, with the high upside potential afforded by this unique situation comes with greater risk as well. Without any sales to date, E3 maintains a high risk as the development of their mine is not yet complete. With the recent release of the company’s preliminary economic assessment (“PEA”) results for their project, I am now able to form a cohesive thesis for the company. This article will aim to balance the risk associated with E3 with the company’s potential upside growth.

Company Profile

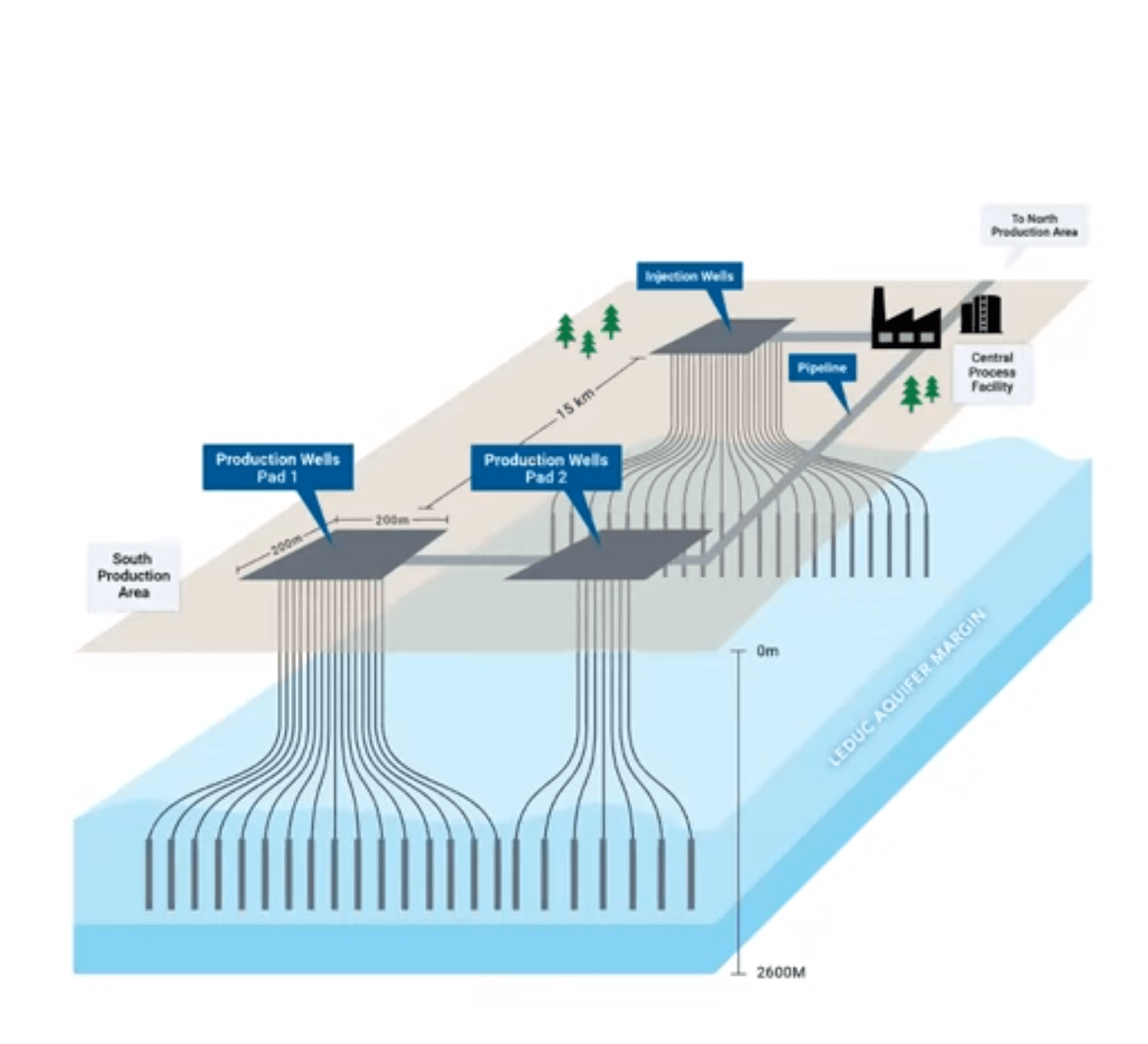

E3 Metals is currently in the development stage of a project in Alberta, Canada. The Leduc Reservoir is estimated to have reserves of 6.7 million tonnes of lithium reserves. In terms of output, the project is expected to produce 20,000 tonnes of lithium hydroxide each year over the course of its 20-year life. In terms of the rest of the industry, this is a fairly significant amount for just one mine. Analysts expect global production figures in the neighborhood of 297,000 tonnes for 2021, meaning E3 would account for just about 6.7% of that market.

When the company will bring their mine into production is still up in the air, but I will discuss my expectations in the following section. For now, I would like to remain focused on the company’s current operations and assets. E3 is pioneering a proprietary extraction method that the company is referring to as direct lithium extraction, or DLE. DLE is currently only utilized by Livent (LTHM), a company I’ve recently covered, which recently opted out of a deal to develop the technology further with E3. Both companies were quick to stress that this decision was not a result of poor results, but rather concerns over recourse and capital allocation caused the former to withdraw. In fact, E3 has seen some pretty promising results for their development of the technology.

The process of DLE allows miners to bypass evaporation ponds and extract lithium directly from the brine source. These evaporation ponds are large consumers of natural resources, requiring incredible amounts of land and water to operate. Though beyond being potentially harmful to the environment, these are expensive components to build and then operate due to their great footprint and high maintenance demands. These ponds are also not incredibly efficient, both in terms of lithium yield and the time it takes to get that yield, though the industry has accepted it as a necessary evil. However, E3, as well as Livent, aim to remove this costly component from their operations.

Source: E3 Metals

Source: E3 Metals

The DLE process allows the companies to remove lithium ions from brine without the use of evaporation ponds. First brought to light in 1973, the DLE process is an adapted version of the same process used to extract bromine in some mines. While only suitable in some instances, it does aim to bring with it significant rewards on the product quality, and quantity, front. E3 hopes to reduce the time spent extracting lithium from several months to mere minutes. While current DLE extraction usually takes a couple of hours, still a remarkable improvement over evaporation ponds, E3 has demonstrated the ability to reduce this time to 10 minutes with a 92% product yield.

The proprietary ion-exchange DLE differs from Livent’s own DLE method. While Livent uses a hydrated alumina sorption process that requires near boiling temperatures to operate, E3’s method can work at any temperature. Spending millions each year on natural gas supplies to heat their brine, Livent essentially forgoes the cost benefits associated with DLE. Equipped with a sorbent developed in partnership with the University of Alberta to, E3’s DLE is able to operate under high efficiency and low costs.

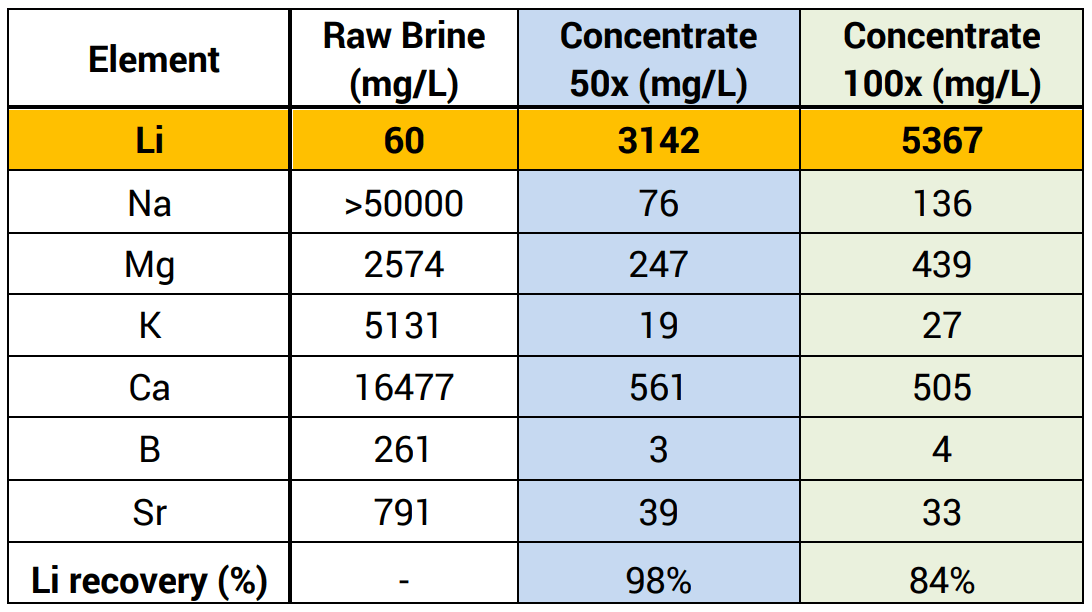

E3’s process is able to lead to high levels of purity and substance, citing concentrations of up to 5,367 mg/L of lithium. For E3, this is crucial for their project’s success. The brine itself is a rather low-grade lithium source. With a concentration of just 60 mg/L, the resource is not pure enough on its own to qualify as battery-grade material. The below figure demonstrates the improvement that the DLE process brings for lithium concentration, removing 99% of impurities. This more than qualifies the material for the minimum 99.5% purity threshold for battery-grade lithium hydroxide.

Source: E3 Metals

Another important thing to note here is that E3 still owns their project site outright. This is exceedingly rare among lithium juniors. With almost no sales to their names, most juniors are forced to sell off portions of their mines in order to obtain the funds necessary to complete the path to production. By retaining full ownership of the mine, E3 is able to maximize its future profitability and retain greater value.

I’d like to close this section with a discussion of the team’s management. The company’s CEO, Chris Doornbos, has strong experience in leading the exploration and development of resource projects. He was previously the Vice President of Exploration for MinQuest and the CEO of Revere Development. For a company that is currently working to bring its first mine into production, this skillset could not be more targeted. Risk management is listed as one of his key focuses, and the current developmental process of the project demonstrates this. By sourcing local abandoned wells, or those in the process of being abandoned, as testing sites, Doornbos is able to dramatically cut the capital expenses of his company. This incredible resourcefulness bodes well for the company’s future stability going forward. With strong capabilities throughout the team, I feel confident in saying that E3’s leadership is among the best in the industry.

Future Operations

E3 will not begin production for at least another four years, but more likely five. In lithium mining, the two most important reports for a project under development are the pre-feasibility study (“PFS”) and the definitive feasibility study (“DFS”). The PFS can bring with it the conversion of a project from a ‘geologic resource’ to a ‘reportable reserve.’ In other words, the project cannot be an official lithium asset without the PFS. The job of the PFS is to determine the best course of action to maximize a given reserve’s resources by analyzing a host of potential options. It is also a necessary step to receive any permits that the company requires to begin mining in the area. The PFS, through its determination of the most likely course of action, also creates far more reliable cost and sales projections. It is the first major step towards the development of a lithium project. E3 aims on releasing their PFS in the middle of next year, after the completion of a pilot plant necessary for validating production methods.

Now, the DFS is a similar study, but with some important distinctions. As the name implies, the DFS outlines, in meticulous detail, the planned operation for the mine. Far greater work, in terms of site exploration and mineral treatment processes, must be completed before the release of the DFS. It is a necessary step for financing purposes as it all but guarantees what the final costs of getting the mine up and running will be while also further narrowing in on the profitability of the mine. This is necessary for securing raising capital or finding a partner, if needed, and adds tremendous value to the project as there is far more clarity presented.

While this may seem like a pretty logical next step in the development process, it usually takes at least two years to complete the DFS after the initial release of the PFS. While there are a host of reasons for this, some of which I’ve already discussed, one of the largest is the permitting process. A DFS cannot be completed until the company’s planned course of action has been approved, as any necessary interventions to accommodate permits would void the document. Regardless, investors should not expect a DFS until early to mid 2024, but shouldn’t be shocked if it is pushed back to late 2024 or even early 2025. Even if the company guides for an earlier release, expect delays to bring the DFS to these later years.

With these two important steps out of the way, I can demonstrate how I arrived at my five year determination. With a DFS not coming for another two to three years, production dreams can be all but written off for 2024. With initial production usually coming around a year and a half after the issuance of a DFS, 2025, or four years from now, would be the earliest production could begin. However, investors should really expect production to begin on the earlier side of 2026. While the company has stated that they’re aiming to bring production online in 2024, given all that still remains, this seems a bit overly ambitious.

Upon the start of production, E3 is positioned to begin making some considerable profits. Keep in mind, all of the following figures, obtained from the company’s PEA, are subject to change, but serve as a valuable benchmark for expectations. With production of 20,000 tonnes of lithium hydroxide each year, revenues are bound to fluctuate with the lithium market. However, operating costs can be expected to remain stable and the company expects an expense of $3,656 per tonne of lithium hydroxide. This is far lower than the average cost of $5,580 per tonne for brine operations, which the company can attribute to their ion-exchange DLE process.

While hydroxide prices are unlikely to remain stable, I believe that this will work in the company’s favor as hydroxide prices rise. E3’s guidance is to expect prices of $14,076 per tonne of lithium, which would represent a profit of $10,423 per tonne of lithium produced. At a production rate of 20,000 tonnes per year, E3 believes that their product will enable an annual EBITDA of $208.6 million over the mine’s twenty year lifetime.

However, recent comments from the company’s CEO demonstrate that this 20,000 mark is only to aid in bringing initial production online. The mine, which is the seventh largest reserve in the world, can produce up to 150,000 tonnes per year for 35 years. Following Doornbos’ emphasis on risk management, this final capacity will take some time to reach as the company begins to acquire the capital necessary to reach this level. However, upon reaching such a level of production, E3 would become one of the largest producers in the world. If current operating expenses are scalable, the company would generate an annual EBITDA of $1.563 billion. This potential is simply incredible when coming from a company currently valued close to $150 million.

Beyond their mine, however, a successful operation will lead to another business for the company. While they will likely target other projects to develop as they grow, E3, if they develop the technology successfully, could also license its ion-exchange DLE process to other lithium companies. Brines comprise the vast majority of known lithium reserves around the world, presenting a large addressable market for E3. With the potential to attract many partners for this technology, E3 has a potential business to run outside of its own mine and lithium production.

Risk

No matter how much one prioritizes risk management, a company like E3 is bound to carry significant risk. The most glaring risk staring investors in the face is the lack of even a PFS. While expected to come this year, without it, investors are forced to simply trust that what E3 has is legitimate. As the name suggests, the absence of a PFS must cause investors to question the feasibility of the company’s goals. If the company’s ion-exchange DLE is not deemed to be a reliable, or scalable, extraction method, the project itself is likely to fail. As I stated above, the reserve itself is not a particularly high-quality source of lithium. Without an effective extraction process, the resources at the mine would struggle to become an economically viable source of battery-grade lithium hydroxide. This would likely result in the bankruptcy of the company as its only asset becomes

However, the outlook isn’t so grim. I have high expectations for E3’s DLE process. Industry analysts expect DLE to become the primary brine extraction method by 2025, with ion-exchange listed as one of the methods to be at the forefront. Additionally, E3 is currently working with Canadian chemical manufacturers to scale their proprietary sorbent to industrial levels. These steps are promising votes of confidence for the company’s chemical development. Additionally, the company’s completion of a lab scale facility to test and improve its chemistry indicates growing confidence in the prospective success.

Ignoring the lack of definitive performance for the company’s DLE process, the lack of a PFS also creates more uncertainty. A PFS provides more clarity towards the company’s planned operations and limits alternative paths. At the current stage, E3’s project does not have a definitive route and this uncertainty brings risk with it as the final decision could prove to follow a less lucrative path.

Even if E3 is able to demonstrate a strong path of operation, the company still needs to acquire the funds necessary to bring their mine to production. Estimated to cost $602 million, which includes a 25% contingency, E3 can’t rely on current operations as they don’t have any. The company has recently raised a total of around $14.5 million CAD, the vast majority of which will go towards further development of the DLE process. In fact, none of this capital is intended to be put towards anything past the year 2022.

This leaves the company’s $602 million CAPEX still unaccounted for. However, Doornbos recently stated that the company does not want to dilute shareholder equity any further. The executive went on to say that funds will be acquired via debt financing and potentially some offtake agreements as well. “We will try not to do it with equity. I think we would like to try to do a combination of debt financing and, you know, potentially some capital for some offtakes -- offtake rights.” While this drastically mitigates concern of dilution, taking on such a massive amount of debt is not without its own share of risk.

While the company’s operations are expected to allow for a payback period of just 3.4 years, this follows the assumption that everything goes to plan. However, this doesn’t account for interest payments that the company will need to make over the course of their debt holding. Still, this is a rather quick timeline and, if validated by a DFS, could aid in convincing loaners to supply capital to the company. The completion of the DFS would likely be when E3 would go about looking for financiers, as most juniors do, due to the strongly reduced chance of failure.

Providing offtake rights to other companies will also further encourage potential financiers and provide some capital of its own. An offtake right provides those who hold the right to purchase a certain share of the mine’s lithium for some time, even to perpetuity in some cases. For the right holder, this allows for them to hedge against future lithium price rises as a constant price is agreed upon. While this eliminates some upside for E3, at the point of the DFS, prices will have likely risen substantially. Regardless, the benefits outweigh this slight disadvantage. E3 will be awarded some capital upon the finalization of the agreement but, more importantly, the company further increases their appeal to lenders. By demonstrating that the company already has customers secured, at a definite price, lenders incur far less risk by providing loans as much of the unpredictability, or uncertainty, has been eliminated. The contract negotiations for offtake rights will likely take place just after the finalization of the company’s DFS, though the initial framework is already being laid out as the company plans to begin sending hydroxide samples to potential customers upon the completion of their pilot plant.

So, while E3 will still need to pay back a large sum of debt, the company is working on decreasing the risk that this will bring. It is impossible to be void of this risk due to the nature of their operations, but I believe that they will be able to attract financiers and be able to pay them back. The lower payback period is a key component of this, as is the offtake agreements the company looks to sign with battery manufacturers. While it is impossible for the company to avoid risk in this regard, I believe that this is the best solution for the shareholders as they avoid dilution and still mitigate risk. After funding is secured, E3 will be able to take their project to construction.

But before they can begin construction, E3 must obtain vital permits to allow their plans to come to fruition. However, the company believes that the 70 year oil and gas industry presence will aid the company in their efforts as they work to repurpose existing infrastructure on the site. Through this, they can not only minimize costs, but diminish their environmental footprint. The carry-over of equipment that has been used for decades should also, according to E3, help expedite the approval process as the regulatory framework has already been laid out for the company. As such, the ability to obtain necessary permits should not be of great concern for investors.

E3’s final risk is one shared among all lithium companies, no matter the size. Lithium itself has not yet established a stable price point and, as the company’s future source of income, this is a fair point of concern for investors. I would recommend reading my recent article covering Livent as it detailed my bullish outlook for lithium, hydroxide in particular, but I will recount the relevant points. As battery technology improves, lithium hydroxide will become far more widely used in EVs. This transition isn’t something for years down the line, Tesla (TSLA) has already adopted the material and most EV battery suppliers are working to get the chemistry in EVs within the next year. As such, even as demand for lithium as a whole grows at a rapid pace, hydroxide will outpace it. However, due to current market conditions favoring lithium carbonate, there is not enough capital being expended to bring more hydroxide mines online. It seems highly unlikely that hydroxide supply will be able to keep up with demand for the next few years and, because mines can take up to a decade to bring to production, there is little chance to remedy this issue. Following this outlook, hydroxide prices should strengthen. As such, rather than being a risk, I believe that the company’s decision to target hydroxide will prove to be an asset.

I’d like to close this discussion by reiterating that E3 currently has all of its eggs in one basket, riding on the success of their ion-exchange DLE process and the greater project operations. While I do believe the company will ultimately prove successful in validating these current uncertainties, they do still remain uncertainties that could bankrupt the company. This is incredibly important to remain cognizant of.

Valuation Discussion

Even though the company is still years away from generating any revenue, there is opportunity to add value on the horizon. Over the course of the next couple of years, E3’s value grows as the company’s risk wanes. With the PFS expected to be released towards the middle of next year, the short-term value is, more likely than not, going to see some substantial movement.

When Lithium Americas (OTC:LAC) released the PFS for their Nevada project, it sent the stock on a run that saw its value grow by more than 200%. While these gains didn’t last, the true value that this report brought the company is around 50%. Even with a mediocre PFS report, E3 is likely to benefit to a similar extent. A mediocre report eliminates the incredible downside of the possibility of a negative report, adding more validity to the company’s expectations.

After the PFS, growth will come at a slowed rate. While positive momentum in the lithium hydroxide market will benefit the company, there isn’t much that the company itself can do before the release of the DFS. The completion of the permitting process will create some growth, though this process is often regarded as a pretty secure bet and therefore doesn’t tend to generate astounding growth. However, it could represent growth of up to 20% if there is enough momentum behind the company.

However, the release of the company’s DFS is where the company’s true value starts to emerge. The DFS all but guarantees that the company’s outlook is achievable, leaving the only concern presented to the company acquiring funds. This acquisition of funds leaves much to still be determined though, as I’ve already discussed, will likely come via debt financing and offtake agreements.

Before production begins, and in between the release of the PFS and DFS, E3’s performance will be very closely tied to the price of lithium hydroxide. With the price per tonne of the metal expected to grow at a CAGR exceeding 10% through 2026, E3’s growth will likely proceed at a rate triple this. Due to the de-risking that this would provide the company with, as well as the implied greater future earnings, growth in hydroxide will lead to a greater bullish sentiment for E3 as a whole. Additionally, the closer the company gets to production, the more future sales can be priced into the company’s value.

Now, a 50% jump at the release of the PFS seems a bit high following a single-day, 21.56%, jump after a recent webinar. While the jump was mostly justified, I do believe that it has cut into the potential of the PFS to really wow investors. As such, I would lower expectations to expect a 25% jump after the release of the PFS. At this time, the company’s shares would then be worth around $4.4. After about two and a half years of growth relying upon hydroxide’s performance and the approaching production date, E3 will release their DFS. Before the DFS, the 30% CAGR seen by the company would have driven it to a value of around $8.55 per share. At this per-share value, E3 would have a market cap of around $420 million.

Because there is still so little known about the company’s final plan, I cannot provide a target for the company’s performance after the release of their DFS. While I do think the rise will be substantial, there is much that could change in that time. After the DFS, the company will trade off of the announcement of deals for offtake agreements and loans. Upon the beginning of production, E3’s ability to pay off their debt will be the next big step and then all eyes will be towards what’s next for the company. With goals to eventually produce 150,000 tonnes of lithium per year at the site, the company’s growth at this project is not limited to simply beginning production. However, again, this discussion starts down the avenue of speculation. Therefore, my target of $8.55 per share by the end of 2024 is as far as I feel is fit.

Investor Outlook

Even with the greatest benefits coming from a long-term hold, E3 has plenty of upside for short-term investors as well. As such, I would recommend initiating a long position in the company. Personally, I plan to wait until after the PFS is released to initiate a strong position, as its current value represents the potential for sizable losses following a poor PFS. While this does eliminate the chance for potential gains as a result of a positive PFS, it is a far safer play and, as outlined above, the company still has lots of room to grow after the release. It makes it less of a gamble and more of a value-driven play. I may choose to initiate a small position before then, however, if shares fall a bit more.

However, for those with a higher risk-tolerance, initiating a position now would be an opportune time. With a positive PFS, the investment would begin to pay off tremendously within just the first year of ownership. I will likely re-evaluate the company’s operations after the release of their PFS, at which time I expect to release a more bullish outlook on the company as it progressively de-risks itself. Personally, I’ve initiated a small position and plan to add to it upon the release of the company’s PFS.

If the project proves unfeasible, all of the company’s promise evaporates. This risk will be present until the company begins its production. While the gradual elimination of risk stands to provide strong growth for the company, there’s a reason for this. While I do believe that the risk currently disproportionately discounts the company’s value, the possibility of failure remains present.