Most price forecasts aren’t worth more than an umbrella in a hurricane. There are so many factors, so many ever-changing variables, that even the experts usually miss the mark.

Further, some forecasters base their predictions on one issue. “Interest rates will rise so gold will fall.” That’s not even an accurate statement, let alone a sensible prediction (it’s the real rate that affects gold prices, as I’ll show below).

But there is value in considering predictions. It can solidify why one has invested, offer factors that may have been overlooked, or even cause one to revise their expectations.

So while we take predictions with a grain of salt, let’s look at what might be ahead for gold price in 2021 and the next 5 years. We’ll first summarize what many analysts are predicting, and then look at the factors that are likely to have the biggest impact on gold. I’ll conclude with the probable prices I see based on those factors, as well as some long-term projections.

This will be fun, so let’s jump in!

Gold Price Prediction Chart

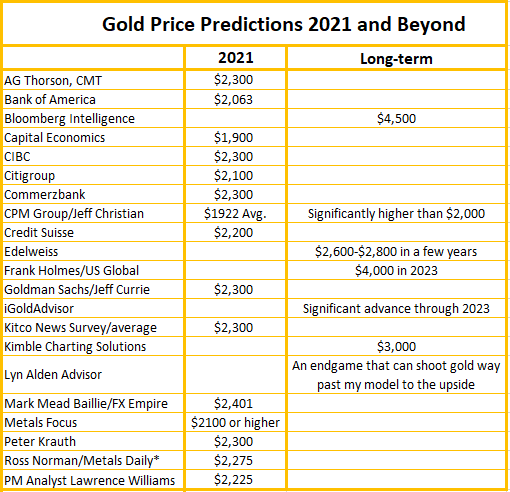

I’ve compiled gold price predictions from a number of banks and precious metals analysts.

The table below shows the gold price prediction from various consultancies and independent analysts. Not all gave a forecast for both time periods, but I’ve listed what they’ve stated publicly. Here’s what they think is ahead for gold.

You can see that most analysts predict gold will exceed $2,000 per ounce in 2021. Two project it will average in the $1,900-range. And of those I found, all are very bullish long-term (though this survey is not exhaustive, as there are always analysts who are bearish).

A couple interesting points to highlight from these analysts…

CPM Group’s projection is lower than most, but if gold averages $1,922 in 2021, it would represent an 8.2% increase over 2020 and a record annual average. They also state that “we expect prices to rise sharply at some point in the future, to new records significantly higher than $2,000. Such an increase would be expected to be caused by investors buying increased volumes of gold in a future economic and political crisis… the period 2023 – 2025 is perhaps the most likely time period to expect such.” (Their outlook and projections can be viewed in more detail in their monthly Precious Metals Advisory on their website.)

Meanwhile, we’ll note that analyst Ross Norman has won first place in the LBMA gold price survey nine times. He predicts gold will rise 20% this year.

Last, the average 2021 gold price forecasts from these analysts is $2,228.

So what is my 2021 gold price prediction? To answer that question we have to look at the various factors that are likely to have the biggest impact on the price, both positive and negative.

2021 Gold Price Forecast

Based on my experience in the gold sector, here is a review of the factors I believe will have the most influence on the price this year.

Monetary and Fiscal Stimulus

Monetary stimulus (from the Fed) is not expected to let up this year. As one example, Chicago Fed President Charles Evans said, “Economic agents should be prepared for… an expansion of our balance sheet…”

And fiscal stimulus (from congress and the president) is likely to explode in 2021. The interesting thing about this type of stimulus is that it bypasses the banks and puts funds directly into the hands of people who will have a propensity to spend it.

President-elect Joe Biden has explicitly stated that his “first priority” when he takes office is a stimulus package. And with the return of Janet Yellen—now as Treasury Secretary—further stimulus will be supported. During her tenure as Fed Chair and in recent communications, the message is very clear: more fiscal stimulus is coming.

Fiscal stimulus amounts are not finalized as we write, but based on what has been said publicly so far, we should expect something in the range of at least $3 trillion in fiscal spending in 2021.

Monetary and fiscal stimulus is arguably one of the strongest catalysts for gold, not to mention the ramifications that can come from it. Of course if they don’t enact stimulus, or much less than expected, it would be a drag on the gold price. But that isn’t likely to happen, at least this year.

If stimulus efforts play out as expected, the gold price will increase…

Low Interest Rates

The Fed has signaled ultra-easy monetary conditions for at least the next year. Chicago Fed President Charles Evans said, “The Fed’s policy stance will have to be accommodative for quite a while… economic agents should be prepared for a period of very low interest rates.”

The “real” rate (10-year Treasury minus the CPI) is already negative in the US. And many analysts expect the spread between the nominal interest rate and inflation to widen if the economy begins to recover. In other words, even if nominal yields stay flat, the real yield would continue to fall if inflation picks up.

- The relationship between gold and real yields is one of the most consistent predictors of the gold price.

Inflation-adjusted yields are likely to remain negative. If so, the gold price will increase…

U.S. Dollar: Because gold is universally priced in U.S. dollars, they are usually inversely correlated. As such, a weak U.S. dollar is supportive of higher gold prices. Ongoing stimulus efforts will keep the USD under pressure—and given the amount of fiscal expenditures expected this year, the dollar is likely to fall, which will push the gold price up...

If the virus is contained and the Fed and congress scale back on their stimulus efforts, the dollar would rise and gold would probably decrease...

Inflation Threat: Since the Fed has expressly stated it is comfortable with inflation rates exceeding 2%, a higher CPI is a distinct possibility. Consider what else is transpiring that could lead to higher inflation rates this year…

Debts and deficits have reached record territory, which historical studies have shown lead to higher rates of inflation. The federal debt ended 2020 at 135.6% of GDP, a level unmatched in modern history. And the federal deficit is now $3.2 trillion, more than twice the level of the Great Recession and a level not seen in U.S. history.

Meanwhile, the last reading of the Purchasing Managers Index (PMI) in 2020 showed that while new orders dropped, input prices rose. In the case of the services PMI, input prices jumped to the highest on record for the second straight month, while input prices in the manufacturing survey hit the highest level since mid-2018.

Commodity prices have also jumped. Many are up double-digits from a year ago, with lumber prices up triple digits.

Meanwhile, St. Louis Fed President James Bullard said his bank has gotten reports of supply constraints of various kinds that are “intense” and led to a big increase in prices. “The quiescence of inflation that has characterized the last decade may not be a good guide for what’s going to happen in 2021, where I would expect possibly higher inflation than we’re used to.”

And Kansas City Federal Reserve President Esther George, one of the “hawks” at the central bank, said she is “worried inflation is brewing and could surprise to the upside.”

Last, if one subscribes to the theory that inflation can’t happen without higher wages, I’ll point out that 20 U.S. states mandated higher minimum wage rates that started in January. And four more states, plus Washington DC, will raise their minimum wages later in the year.

If rising consumer prices visit us in 2021, investors are bound to look for inflation hedges, gold being an obvious choice and one that will push the price up...

Continued Covid Fallout: A new variant of COVID-19 appears to have emerged in the UK and South Africa. This could extend lockdowns and border closures. We also have to consider the possibility the current strain of the virus isn’t contained.

The vaccine is a positive step for the world, but there are still many unknowns. If fallout from the virus continues, gold will see support and increase...

If the vaccine proves effective and leads to a resurgence in the economy, then the gold price is likely to decrease...

Prolonged Recession: Despite the U.S. stock market currently near record highs, many businesses continue to struggle, with ongoing closures still being reported. Bankruptcies are likely not over, nor is elevated unemployment levels. A double dip recession has been discussed by many pundits. Since gold usually performs well in recessions, the price would likely increase...

Black Swans: A black swan is an event that catches investors off guard. And 2021 is ripe for such an event—potential candidates include a messy Brexit, social unrest, or a stock market or real estate crash. Another shock to society or the markets would put a spotlight on gold’s hedging abilities, just like it did in 2020, and push the price up...

Gold Price Predictions for Next 5 Years

When looking at the potential price of gold over the next five years, there are a lot of factors that could propel it higher. That’s one advantage gold ownership offers: it isn’t about one factor or another, it’s about any factor that increases fear or uncertainty on the part of investors. And there are a lot of risks surrounding us at this point that could cause any type of crisis.

But probably the biggest catalyst right now is monetary dilution. When a currency is debased, it makes real assets like gold (and silver) more valuable, since they can’t be created with a few computer key strokes.

And the U.S. now has both monetary stimulus and fiscal stimulus. Monetary stimulus usually goes first to the banking system and ends up inflating asset prices. But fiscal stimulus are funds injected directly into the economy and immediately spent. It’s like me giving you $100 and you deposit it in a savings account vs. spending it that day on groceries.

You probably don’t need me to say it, but the U.S. doesn’t have trillions of extra cash to spend on fiscal stimulus packages. It already can’t balance a budget. Some claim they’ll “collect” on the backend; as jobs are created and the economic grows, tax revenue will increase. But the debts and deficits are so high now they’re mathematically unpayable. And history clearly shows they will lead to inflation (higher consumer prices).

Where will the funds come from for these stimulus programs? They have to be created (digital and otherwise), which will add to the already bloated deficit.

It only takes a 6th grade education to understand that the more you create of something, the less valuable it becomes. As more and more currency units are created for these massive spending plans, the US dollar will become less and less valuable—and gold more valuable.

As Mike Maloney has said, there is no vaccine for the coming monetary crisis. The only way he’ll be wrong about gold and silver is if they stop printing—and that won’t happen anytime soon. Austerity is completely off the radar in the world we live in right now. This is a built-in catalyst for higher gold prices.

Because of this, my most confident prediction is that over the next five years, possibly longer, the gold price is going to…

My 2021 Gold Price Prediction

My forecast for the gold price in 2021 is based on the current environment of negative real yields, a weak dollar, rising inflation expectations, and ongoing monetary and fiscal stimulus. We also have to consider the Fed’s diminishing ability to respond effectively to crisis—their “toolbox” is indeed getting low.

As a result, I expect the gold price to be higher in 2021. Here are my predictions.

The most important message from this analysis is that even if I’m wrong, it has rarely been more important to own gold. That means any dips in price should be bought, especially for those that don’t hold a meaningful amount.

There are many factors that could impact the gold price, of course, in both the short and long term. To learn more about investing in gold and silver and what might be ahead, especially for fiat currencies, download Mike Maloney's best-selling book for free, Guide to Investing in Gold & Silver.