Torq Options Margarita Iron-Oxide-Copper-Gold Project, Chile https://torqresources.com/news-media/news/2021/torq-options-margarita-iron-oxide-copper-gold-project-in-chile/

Torq Options Margarita Iron-Oxide-Copper-Gold Project in Chile

March 8, 2021

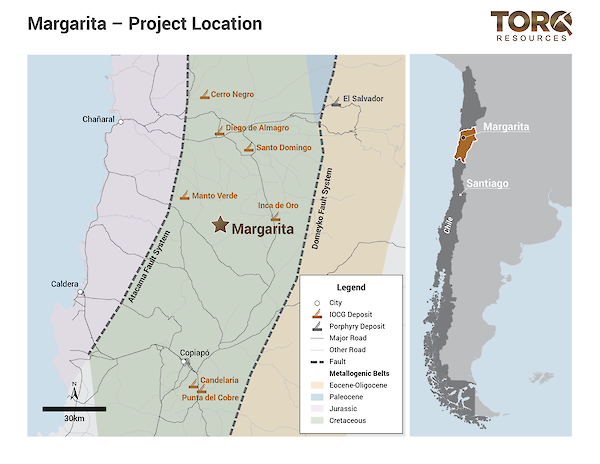

Vancouver, Canada – March 8, 2021 – Torq Resources Inc. (TSX-V: TORQ, OTCQX: TRBMF) (“Torq” or the “Company”) is pleased to announce that it has successfully acquired the option to earn a 100% interest in the Margarita Iron-Oxide-Copper-Gold (IOCG) project located in Chile, 65 kilometres (km) north of the city of Copiapo. The property is located within the prolific Coastal Cordillera belt that hosts the world-class Candelaria (Lundin Mining Corp.) and Manto Verde (Mantos Copper Holding) IOCG mines, and porphyry-skarn deposits such as Santo Domingo (Capstone Mining Corp.) and Inca de Oro (PanAust/Codelco) (Figure 1).

A Message from Shawn Wallace, Executive Chair & Director:

“Margarita is the first in what will be a series of acquisitions of high-quality copper-gold exploration projects with district scale potential in Chile, which hosts some of the world’s largest and most profitable copper mines. Shareholders and stakeholders can look forward to an exciting flow of news as we initiate exploration at Margarita and continue to add to our portfolio.”

Margarita Property:

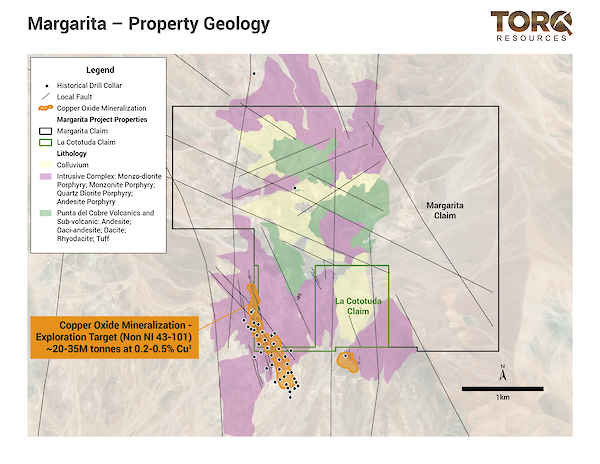

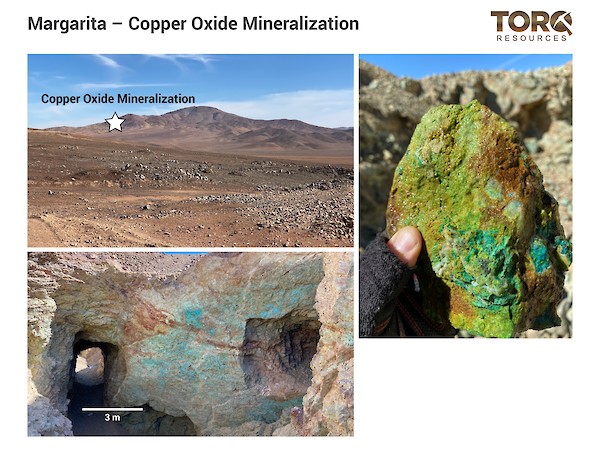

The project is comprised of approximately 1,045 hectares and is flanked by secondary copper oxide mineralization on the southwestern boundary of the property (Figures 2-3). This copper oxide mineralization is defined by 39 drill holes totaling 3,984 metres (m) and represents an exploration target of approximately 20 - 35 million tonnes at 0.2 - 0.5% copper1 (non NI 43-101 compliant). The presence of the oxide mineralization is important as it demonstrates the potential for the primary copper sulphide source to occur within the Margarita property as no copper sulphide mineralization has been found on the property to-date. The geological and geophysical characteristics of the project suggest the potential for a large-scale copper sulphide target within the property boundaries.

A Message from Michael Henrichsen, Chief Geologist:

“The Margarita project represents excellent discovery potential for a major deposit due to the strength of the alteration system, large-scale magnetic targets and the presence of copper oxide mineralization along the southwest flanks of the property. With the previous exploration work that has been conducted on the project we can rapidly move to drill stage and provide a high-quality exploration opportunity in a matter of months.”

Geology:

The property has a set of geological characteristics that suggest high potential to discover a large-scale IOCG or porphyry copper deposit. This includes a strong argillic–silica hydrothermal alteration system over 15 square kilometres (Figure 4), numerous specular hematite-silica hydrothermal breccia structures, silica–pyrite altered monzonite porphyry bodies, a subparallel system of andesite porphyry dikes and several north-northwest to northeast trending fault zones that are parallel to the Atacama and Chivato crustal scale fault zones (Figure 2), which are important regional controls on copper mineralization.

Geophysics:

A magnetic survey over the Margarita project shows a circular magnetic low surrounded by magnetic highs beneath the hydrothermal alteration system (Figure 4). The magnetic highs are associated with less altered, andesitic to rhyodacitic rock units that may correspond to dome structures, which are considered to be part of the mineralizing intrusive hydrothermal system that characterizes the property. The lower magnetic responses correspond to strongly altered units that include various porphyritic and breccia bodies as well as andesitic dykes and provide a clear large-scale 1.5 km by 1.5 km geophysical target within the property boundaries.

In addition, two 3 km lines of induced polarization geophysics have been historically surveyed over the project area crossing the alteration system in NE and NW directions (Figure 5). Both lines show coincident high chargeability and low resistivity responses that are consistent with hydrothermal alteration with associated sulphide mineralization. Collectively, these responses show the potential for copper sulphide mineralization at shallow depths.

Historical Copper Oxide Drilling:

Out of the 39 drill holes with known assay results available that define the copper oxide mineralization, 13 are within the land package of the Margarita - Cototuda agreements, totaling approximately 1500 m. The historical drill holes are located in the southwestern corner of the property in a zone of strong hydrothermal alteration. Copper oxide mineralization with reported grades of 0.2 – 0.6% copper were encountered to 210 m vertical depth with drilled widths ranging between 30 – 120 m. Importantly, none of these drill holes encountered primary copper sulphide mineralization.

Exploration Plan:

Torq plans to advance the Margarita project to drill stage rapidly by conducting a geological mapping program and a property-wide induced polarization geophysical survey to define drill targets. The first drill program on the property is being planned for Q3 of 2021.

Option Terms:

The Company acquired the rights that constitute the Margarita project through two option agreements: 1) The Margarita claims with Minera Viento Norte (MVN), a local Chilean company, and 2) The La Cototuda claims with a small-scale mining company (Figure 2). Under these option agreements the Company can acquire 100% interest in the project, subject to a net smelter royalty (NSR) through combined cash payments and work expenditures as detailed below in Tables 1 & 2.

Table 1. Margarita Claims: Minera Viento Norte

| Period from Signing Definitive Agreement and Initial Payment | Cash Payments (USD) | Work Expenditure Requirement Until $6,200,000 is paid |

| Within 60 days of signing the Definitive Agreement | $50,000 (Initial Payment) | | |

| within 6 months | 50,000 | 400,000 |

| within 18 months | 100,000 | 1,150,000 |

| within 30 months | 300,000 | 1,500,000 |

| within 42 months | 1,200,000 | |

| within 54 months | 2,000,000 | |

| within 66 months | 2,500,000 | |

| Total | $6,200,000 | $3,050,000 |

The Margarita NSR is 1% with 50% (being 0.5%) buyable for $2,000,000.

Table 2: La Cototuda Claims: Small-scale mining company

| Period from Signing Definitive Agreement and Initial Payment | Cash Payments (USD) | No Expenditure Requirement |

| Upon signing the Agreement | $50,000 (Initial Payment) | |

| within 12 months | 250,000 | |

| within 24 months | 250,000 | |

| within 36 months | 350,000 | |

| Total | $900,000 | |

There is no NSR relating to the La Cototuda claims.

In relation to the option arrangement of the Margarita project, a finders fee of 466,666 shares of the Company will be issued, subject to customary TSX Venture Exchange acceptance.

Figure 1: Illustrates the location of the Margarita project within the Cretaceous Coastal Cordillera belt and its proximity to major deposits in the area.

Figure 2: Illustrates the basic property geology of the Margarita project and the location of the copper oxide mineralization that flanks the southwestern margin of the property.

Figure 3: Illustrates the copper oxide mineralization along a fault zone on the southwestern margin of the project area.

Figure 4: Illustrates the large-scale clay-silica alteration system that is centered on the Margarita property.