ORIGINAL: Teuton's Joint Venture Partner Tudor Gold Reports Initial Mineral Resource Estimate at Treaty Creek : 19.4 Million Ounces of 0.74 Gpt AuEq of Measured and Indicated Mineral Resources and 7.9 Million Ounces of 0.79 Gpt AuEq of Inferred Mineral Resources

2021-03-09 12:00 ET - News Release

(via TheNewswire)

March 9, 2021 – TheNewswire - Vancouver, Canada –– Teuton Resources Corp. (“Teuton” or “the Company”) (TSXV: TUO ) (OTC:TEUTF) (Frankfurt-TFE) has received a report from its joint venture partner Tudor Gold containing the Initial Mineral Resource Estimate for the Goldstorm and Copper Belle Zones at their flagship property, Treaty Creek. The Property is located within the heart of the Golden Triangle of Northwestern British Columbia which is on-trend from Seabridge’s KSM Project located five kilometres southwest of the Goldstorm Zone. A total of 218 drill holes totaling 105,658.8 metres were used in the Mineral Resource Estimate completed by P&E Mining Consultants Inc. (P&E) . The constraining open-pit shell contains 14.15 million ounces of Measured and Indicated gold equivalent ounces (“AuEq”) at an average grade of 0.72 gpt AuEq and 5.26 million Measured and Indicated AuEq ounces at an average grade of 0.80 gpt AuEq for the out-of-pit Mineral Resources. Cut-off grades of 0.30 gpt AuEq were used inside the constraining open-pit shell and a higher cut-off grade of 0.46 gpt AuEq was used for the out-of-pit Mineral Resource Estimate which includes underground constrained blocks. The Goldstorm Zone remains open in all directions and at depth. The effective date of the Mineral Resource Estimate is March 1, 2021. A Technical Report prepared in accordance with National Instrument 43-101, Standards of Disclosure for Mineral Projects, will follow within 45 days of this news release and this will be posted on SEDAR and the Company`s website.

Tudor Gold’s Vice President of Exploration and Project Development, Ken Konkin, P.Geo., states: “We are very pleased with the results obtained from our Initial Mineral Resource Estimate. Only 10-12 % of the gold equivalent values are attributed to silver and copper mineralization indicating a strong gold-dominate system. However, due to the immense volume of the system, it contains large quantities of silver and copper. Further studies are required to investigate the potential economic impact of these two metals. Our preliminary metallurgical test work shows excellent gold recoveries to a gravity + flotation concentrate. From four composite tests, gold recoveries averaged 96.2% in pyrite concentrates with overall gold recoveries after concentrate extraction expected to be on the order of 88%. The mineralogical studies also demonstrated that no deleterious elements such as As, Sb or Hg were detected within the Goldstorm and Copper Belle Zones. The four tests were carried out by BV Minerals Metallurgical Division and supervised by metallurgical consultant Frank Wright, P.Eng.

Our plans for 2021 are to complete the drilling of the Goldstorm Zone; to define the limits of the 300 Horizon, the CS-600 and DS-5 Zones. In-addition, diamond drilling is planned for the Eureka and Perfect Storm Zones. We believe that the Treaty Creek Property contains excellent potential for continued discovery of gold-silver-copper systems such Goldstorm.“

Mineral Estimate Highlights include:

-

- The classifications of Measured, Indicated and Inferred Mineral Resources for gold, silver, copper and gold-equivalents and their respective tonnage are listed in Table 1 below. In addition to the 17.33 million ounces of gold Measured and Indicated Mineral Resource and 7.22 million ounces of gold Inferred Mineral Resource, there are 93.41 million ounces of silver estimated as Measured and Indicated Mineral Resources with an additional 40.57 million ounces of Inferred silver Mineral Resource. The Measured and Indicated Mineral Resource also estimates 1.096 billion pounds of copper with an additional 330 million pounds of copper as an Inferred Mineral Resource.

- A bulk density of 2.80 t/m3 was based on measurements taken by P&E during their field visits.

- 5m x 5m x 5m three-dimensional block model was used for the Mineral Resource Estimate. Measured Mineral Resources are informed by four of more drill holes within 100 metres; Indicated Mineral Resources are informed by four of more drill holes within 200 metres.

TABLE 1: INITIAL MINERAL RESOURCE ESTIMATE SUMMARY

------------------------------------------------------------------------------- |Pit Constrained Mineral Resource Estimate | |-----------------------------------------------------------------------------| |Classification|Cut-Off |Tonnes |Au |Ag |Cu |AuEq|Au |Ag |Cu |AuEq | | |AuEq gpt |Million|gpt |gpt|% |gpt |M oz |M |M |M oz | | | | | | | | | |oz |lb | | |-----------------------------------------------------------------------------| |Measured |0.30 |283.2 |0.71|2.9|0.03|0.76|6.49 |25.96|187.3 |6.89 | |-----------------------------------------------------------------------------| |Indicated |0.30 |326.6 |0.59|3.5|0.08|0.69|6.21 |37.25|583.2 |7.26 | |-----------------------------------------------------------------------------| |Meas&Ind |0.30 |609.8 |0.65|3.2|0.06|0.72|12.70|63.20|770.5 |14.15| |-----------------------------------------------------------------------------| |Inferred |0.30 |139.4 |0.72|3.6|0.04|0.77|3.22 |16.29|113.7 |3.46 | |-----------------------------------------------------------------------------| | | | | | | | | | | | | |-----------------------------------------------------------------------------| |Out-of-Pit Mineral Resource Estimate | |-----------------------------------------------------------------------------| | | | | | | | | | | | | |-----------------------------------------------------------------------------| |Classification|Cut-Off |Tonnes |Au |Ag |Cu |AuEq|Au |Ag |Cu |AuEq | | |AuEq gpt |Million|gpt |gpt|% |gpt | M |M |M |M oz | | | | | | | | |oz |oz |lb | | |-----------------------------------------------------------------------------| |Measured |0.46 |15.4 |0.71|3.9|0.06|0.79|0.35 |1.95 |19.0 |0.39 | |-----------------------------------------------------------------------------| |Indicated |0.46 |190.5 |0.70|4.6|0.07|0.80|4.28 |28.26|306.6 |4.88 | |-----------------------------------------------------------------------------| |Meas&Ind |0.46 |205.9 |0.70|4.6|0.07|0.80|4.63 |30.21|325.6 |5.26 | |-----------------------------------------------------------------------------| |Inferred |0.46 |172.3 |0.72|4.4|0.06|0.80|4.00 |24.28|216.5 |4.43 | |-----------------------------------------------------------------------------| | | | | | | | | | | | | |-----------------------------------------------------------------------------| |Total Mineral Resource Estimate | |-----------------------------------------------------------------------------| | | | | | | | | | | | | |-----------------------------------------------------------------------------| |Classification|Cut-Off |Tonnes |Au |Ag |Cu |AuEq|Au |Ag |Cu |AuEq | | |AuEq gpt |Million|gpt |gpt|% |gpt | M |M |M |oz | | | | | | | | |oz |oz |lb | | |-----------------------------------------------------------------------------| |Measured |0.30&0.46|298.6 |0.71|2.9|0.03|0.76|6.84 |27.91|206.3 |7.28 | |-----------------------------------------------------------------------------| |Indicated |0.30&0.46|517.1 |0.63|3.9|0.08|0.73|10.49|65.50|889.8 |12.13| |-----------------------------------------------------------------------------| |Meas&Ind |0.30&0.46|815.7 |0.66|3.6|0.06|0.74|17.33|93.41|1,096.1|19.41| |-----------------------------------------------------------------------------| |Inferred |0.30&0.46|311.7 |0.72|4.0|0.05|0.79|7.22 |40.57|330.2 |7.90 | -------------------------------------------------------------------------------

-

1. Mineral Resources are not Mineral Reserves do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues. There is no certainty that Mineral Resources will be converted to Mineral Reserves.

-

2. The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration.

-

3. The Mineral Resources in this news release were estimated in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions (2014) and Best Practices Guidelines (2019) prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council.

-

4. Metal prices used were US$1,625/oz Au, US$19/oz Ag, US$2.80/lb Cu with process recoveries of 88% Au, 30% Ag and 80% Cu. A C$16.50/tonne process and C$2 G&A cost were used.

-

5. The constraining pit optimization parameters were C$2.50/t mineralized and waste material mining cost and 50-degree pit slopes with a 0.30 gpt AuEq cut-off.

-

6. The out-of-pit parameters were at a C$10/t large scale bulk mining cost. The out-of-pit Mineral Resource grade blocks were quantified above the 0.46 gpt AuEq cut-off, below the constraining pit shell and within the constraining mineralized wireframes. Out–of-Pit Mineral Resources exhibit continuity and reasonable potential for extraction by a bulk underground mining method.

Click Image To View Full Size

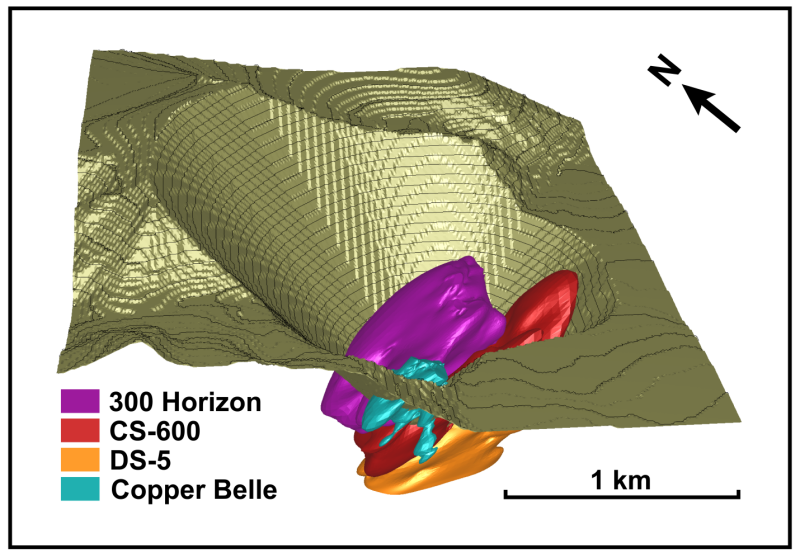

FIGURE 1 (View looking NNE): Image of the 3D Constraining Pit Shell showing the 300 Horizon (Purple), CS-600 Zone (Red) DS-5 Zone (Orange) and Copper Belle (Blue).

Walter Storm, President and CEO of Tudor Gold , stated : “We are extremely pleased with our exploration efforts and the resulting Initial Mineral Resource Estimate indicating that Treaty Creek could be one of the world’s largest gold discoveries of the decade. We completed a very difficult exploration year under strict COVID-19 protocols and maintained an excellent safety record. The Goldstorm Zone remains open on all fronts and to depth, and our priority for 2021 will be to complete the drilling to the Northeast and Southeast limits as well as to depth. The objective will be to convert as much of the 7.9 million ounces of Inferred Mineral Resource averaging 0.79 gpt AuEq to Measured and Indicated Resource classifications, in addition to finding the limits to the mineralized zones within the Goldstorm Zone. Our geological team is currently planning the 2021 exploration program that will also include drilling of the newly discovered Perfect Storm Zone as well as the Eureka Zone. The goal is to add to the current Au-Ag-Cu Mineral Resource of Treaty Creek”.

Dino Cremonese, P. Eng., President of CEO of Teuton Resources commented as follows: “This resource estimate has exceeded my expectations both in size and in grade and is a wonderful start to 2021! Again, I would like to thank all of the people in the Tudor Gold team from Walter Storm to Ken Konkin for doing such a tremendous job. Thanks also to Sean Pownall of More Core Drilling and Charlie Mooney of Yellowhead Helicopters. Everyone worked well together and brought about this incredible success.”

QA/QC

Drill core samples were prepared at the MSA Laboratories (“MSA”) Preparation facility in Terrace, BC and assayed at MSA’s Geochemical Laboratory in Langley, BC. Analytical accuracy and precision are monitored by the submission of blanks, certified standards and duplicate samples inserted at regular intervals into the sample stream by Tudor Gold personnel. MSA Laboratories quality system complies with the requirements for the International Standards ISO 17025 and ISO 9001. MSA is independent of the Company.

Qualified Person

Eugene Puritch, P.Eng. of P&E Mining Consultants Inc. is the Qualified Person, as defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects, who have reviewed and approved of the scientific and technical disclosure in this news release. Mr. Puritch is independent of the Company.

About Teuton

Teuton owns interests in more than thirty properties in the prolific “Golden Triangle” area of northwest British Columbia and was one of the first companies to adopt what has since become known as the “prospect generator” model. Ten of these properties are currently under option to third parties. Over $2 million in option cash payments (not including appreciable payments made in shares) has been generated from these properties since 2015, including properties where optionees have already earned their interest.

Teuton was the original staker of the Treaty Creek property assembling the core land position in 1985. It presently holds a 20% carried interest in Treaty Creek (carried until such time as a production decision is made). Interested parties can access information about Teuton at the Company’s website, www.teuton.com .

Respectfully submitted,

"Dino Cremonese, P.Eng."

Dino Cremonese, P. Eng.,

President and Chief Executive Officer

For further information, please visit the Company's website at www.teuton.com or contact:

Barry Holmes

Director Corporate Development and Communications

Tel. 778-430-5680

Email: barry@teuton.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements regarding Forward-Looking information

Certain statements contained in this press release constitute forward-looking information. These statements relate to future events or future performance. The use of any of the words "could", "intend", "expect", "believe", "will", "projected", "estimated" and similar expressions and statements relating to matters that are not historical facts are intended to identify forward-looking information and are based on the Company's current belief or assumptions as to the outcome and timing of such future events. Actual future results may differ materially.

All statements relating to future plans, objectives or expectations of the Company are forward-looking statements that involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's plans or expectations include risks relating to the actual results of current exploration activities, fluctuating gold prices, possibility of equipment breakdowns and delays, exploration cost overruns, availability of capital and financing, general economic, market or business conditions, regulatory changes, timeliness of government or regulatory approvals and other risks detailed herein and from time to time in the filings made by the Company with securities regulators. The Company expressly disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise except as otherwise required by applicable securities legislation.

Copyright (c) 2021 TheNewswire - All rights reserved.

© 2021 Canjex Publishing Ltd. All rights reserved.