Fire & Flower (OTCPK: FFLWF) is a Canadian cannabis retailer that is shaping to be a consolidator in the fragmented market. While the Canadian retail market has struggled right out of the gate after the 2018 legalization, we think Fire & Flower has the potential to become a strong specialty retailer given its rapid expansion and corporate backing from global c-store giant Couche-Tard. The company also recently made headlines after announcing a deal with a small U.S. retailer and submitted an application to list on the Nasdaq.

(Source: Company; All amounts in CAD)

Cannabis Retail Industry

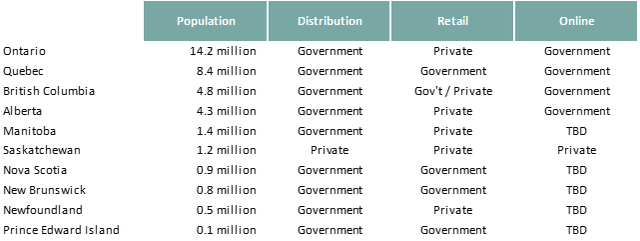

The Canadian cannabis retail sector faced significant challenges when the country legalized cannabis in 2018. As we detailed in "The Miserable Group Of Canadian Cannabis Retailers", the Canadian provinces were ill-prepared to roll out a retail network upon initial legalization which led to a lack of access for consumers and disappointing sales for LPs. On the other hand, there are a few companies that tried to consolidate the retail sector including Fire & Flower, High Tide (OTCQB:HITIF) which also acquired Meta Growth, Alcanna (OTCPK:LQSIF) among others.

By the end of 2018, the country had only a few dozens of retail stores open for a country of 38 million people. The largest province, Ontario, was the epicenter of chaos amid a government reshuffling that resulted in the province only had its first retail store on April 1, 2019. Ontario only issued 25 retail licenses in early 2019 which is absurd and Ontario customers could only buy cannabis on the provincial website for a long time after the legalization.

The Western provinces were a lot more nimble in handing out licenses led by Alberta and British Columbia. Some Canadian provinces opted out of the private retail model such as Quebec where the government is operating a chain of cannabis stores similar to how liquor is distributed.

(Source: Author)

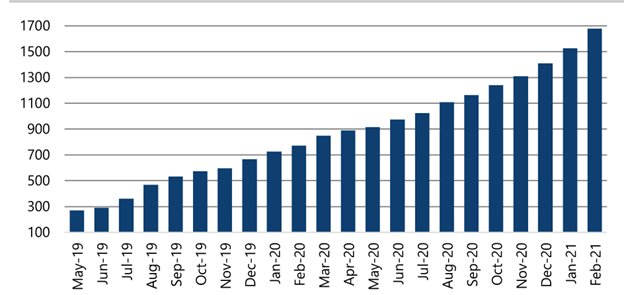

Luckily, the country has been making steady progress in expanding the retail network and there are almost 1,700 retail stores open in the country now. The bulk of the retail stores are located in Alberta (579), British Columbia (310), and Ontario (480). These are three markets that allow private ownership while Quebec remains underpenetrated with only 62 stores. Ontario is also approving new retail stores at a repaid pace including 120 new licenses each month.

We think Ontario could support ~1,000 stores by itself considering that there are currently 666 government-run LCBO liquor stores. Given the LCBO stores are larger and the government is not maximizing revenue given its near-monopoly over liquor sales, we think the number of cannabis stores in Ontario could be higher and likely around 1,000.

(Source: Provincial Data)

Business Overview

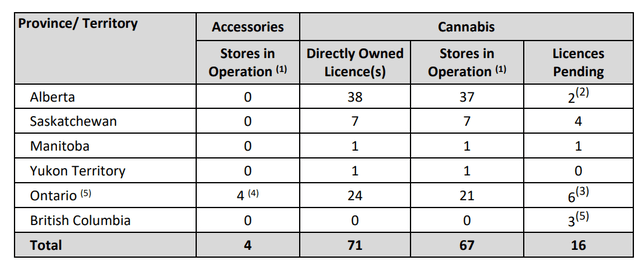

Against this backdrop let's take a look at Fire & Flower and its current footprint. Since the company began with only 9 stores in January 2019, it has expanded through both new store openings and acquisitions to grow to 75+ stores. The table below shows the distribution of 71 corporate-owned stores as of December 2020. Alberta is its largest market with 38 owned stores, followed by Ontario with 24 stores. Since Q3 ended, the company announced a number of acquisitions in Ontario, mostly single stores for just below $1M each.

It also announced a larger all-stock deal to acquire Friendly Stranger which is a chain of 13 stores in Ontario under its three brands " Friendly Stranger", "Hotbox", and "Happy Dayz". Fire & Flower will pay 32 million shares which equals ~$45M or ~$3M per store; the higher purchase price reflects the premium for larger assets with recognizable brands. Pro forma for the 9 stores in the queue and 13 stores from Friendly Stranger, Fire & Flower would have ~45 stores in Ontario.

(Source: Filings)

The retailer has grown its revenue consistently through new store openings and acquisitions. Gross margin consistently averaged ~35% which is good to see even after numerous acquisitions. The company became EBITDA positive last quarter which is a good development. However, it would be important to watch its EBITDA path in the coming quarters as the store fleet matures. For a specialty retailer, we think a 35% gross margin and 10% EBITDA margin would be a good profile for a stable business.

Therefore, Fire & Flower is still not there yet but its recent progress is encouraging. The company expects to grow its store count to over 100 by the end of next year and we think most of it will come from Ontario. For retailers, the single most important metric is same-store-sales but unfortunately, Fire & Flower does not disclose this number. Given the lack of information on organic growth and barely break-even profitability, the financial outlook remains uncertain.

(Source: Filings)

Fire & Flow currently has a market cap of ~$450M and trades at ~3x EV/Sales and 84x EV/EBITDA based on annualized Q3 F2020 results. The stock is not expensive compared to Canadian LPs that are generally trading at 10-50x EV/Sales. However, the closes comp for Fire & Flower is High Tide which trades at 4.3x EV/Sales and 35x EV/EBITDA. High Tide acquired Meta Growth (fka National Access Cannabis) in November 2020 which brings together two of the top Canadian cannabis retailers with a combined footprint of 62 operating stores, $148M annualized revenue, and $18M annualized EBITDA. Fire & Flower has a smaller footprint and lower profitability so we think its valuation discount to High Tide is appropriate.

Risk Factors

There are two major risks for Fire & Flower given its industry and competition. First of all, the cannabis retail sector has not performed well since the initial legalization in 2018. Due to the stringent regulation and different regimes in each province, the company's growth has been dictated by the pace of government action. For example, the Ontario retail market was non-existent on day 1 of legalization and only began to accelerate during 2020. Therefore, future regulation changes could have a material impact on the business.

However, we don't foresee any major regulatory risk at the moment. Secondly, Fire & Flower has spent significant amounts of capital on its retail footprint including acquiring Ontario stores from early license holders, but it faces increasing competition and potential risk of over-saturation as more retail licenses are handed out. We have observed that the Alberta market is already approaching saturation based on commentary from management.

As a mitigating factor, the Ontario market remains underpenetrated and Fire & Flower has established one of the leading market shares there. More importantly, Fire & Flower has the backing of c-store giant Couche-Tard which not only provides financial support but also lends credibility and retail expertise to the Fire & Flower team.

Outlook

The Canadian cannabis retail sector has significantly improved its outlook since the initial legalization in 2018 as Ontario regulators finally accelerated permitting. We expect 2021 to be another year of strong growth for retailers as stores come online and COVID restrictions beginning to ease towards the second half of the year. Fire & Flower is the second-largest cannabis retailer in Canada behind High Tide and both stocks are trading at similar levels.

We actually think the Canadian retailers are going to benefit from strong growth within Ontario and positive trends in Canadian cannabis sales. We are positive on both Fire & Flower and High Tide as together they are the two larges retailers with the financial capacity to consolidate a fragmented market.