Photo by NeilLockhart/iStock via Getty Images

Photo by NeilLockhart/iStock via Getty Images

We're nearing the end of the Q4 Earnings Season for the Silver Miners Index (SIL) and the most recent name to report its results is Americas Gold and Silver (USAS). While several companies had a rough FY2020 due to COVID-19 related headwinds, Americas Gold and Silver arguably took the cake for disappointments, with significant delays, material share dilution, and a massive drop in production in what was supposed to be a transformative year. Investors that had hoped the worst was behind us will be displeased to know that Q1 isn't looking much better, and there's still little clarity around a Cosala restart. Given the continued over-promising and under-delivering, I would view any rallies to US$3.20 as selling opportunities.

(Source: Company Presentation)

Americas Gold and Silver released its Q4 and FY2020 results this week, and to say it was a disappointing year for the company would be the understatement of the decade. This is because not only did Relief Canyon miss its annual production guidance by a country mile, but the ramp-up to full production looks to be running behind schedule, and investors have no guidance to look forward to for FY2021. Obviously, the strike at the company's Cosala Operations in Mexico did not help matters, nor did COVID-19, but if Americas Gold and Silver were firing on even half its cylinders, we'd have seen Relief Canyon pick up the Cosala slack last year and in H1 2021 while we figure out if the asset will move back online. Instead, Relief Canyon continues to miss expectations, with severe weather being the latest excuse. Let's take a closer look at the results below:

(Source: Company Filings, Author's Chart)

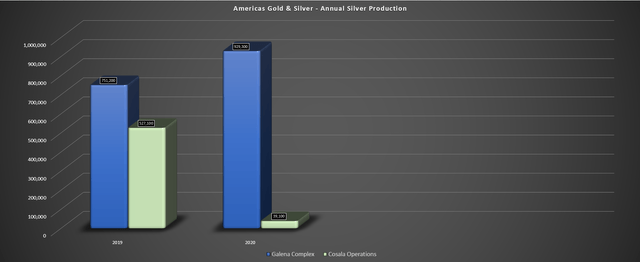

Beginning with Americas Gold and Silver's two silver operations, we saw a sharp decrease in production in FY2020, with this drop-off attributed to Cosala being on care & maintenance with an illegal blockade in place since February 2020. Americas Gold and Silver noted that it has made efforts to restart operations in a timely manner, but we haven't seen any progress to date, with the illegal blockade still in place. This significant headwind translated to a more than 95% drop in annual silver production at Cosala, with silver production coming in at ~39,100 ounces, down from ~527,100 ounces in FY2019.

(Source: Company Website)

Recently, Mexican President Andres Manuel Lopez Obrador stated, "if they (Americas Gold and Silver) don't respect the law, the government can revoke the concession." This comment was made concerning the current dispute, with Lopez noting that Americas Gold and Silver has to uphold Mexico's labor laws. Americas Gold and Silver noted that it is confident that there is no basis in the facts or in the law that would diminish the company's property rights and that it continues to work towards a resolution. While this is a positive sign, it certainly doesn't look like Cosala will be back to full production before Q3 2021 earliest, which should translate to another year of significantly lower production from the asset relative to FY2019 levels. Given that Cosala remained offline, FY2020 silver production fell to ~968,000 ounces on a consolidated basis (Cosala & Galena).

(Source: Company Presentation)

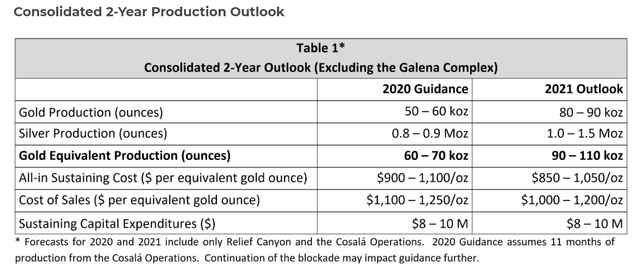

Moving over to Nevada, it was a very disappointing year, with commercial production initially expected before the end of Q2 2020 after its first gold pour that was announced in Q1 2020. The company then followed this up with annual guidance of ~65,000 gold-equivalent ounces [GEOs] in FY2020, which implied that Relief Canyon would produce at least ~45,000 GEOs in FY2020. The FY2021 outlook was that Relief Canyon would produce at least ~75,000 GEOs, but more than a year after this announcement, the FY2020 target was missed by a mile, and the FY2021 is looking far too ambitious. A minor miss given the headwinds from COVID-19 would have been acceptable, but as stated in the recent results, gold sales have come in at ~4,800 ounces from Relief Canyon, with silver sales of ~13,100 ounces. This is a massive miss, translating to a miss of roughly ~40,000 GEOs vs. estimates.

(Source: Company News Release)

The major delay in FY2020 was a failure of the company's radial stacker, required to get mining rates up to 16,000 tons per day. This resulted in lower stacking rates of 8,000 tonnes per day, which obviously weighed on FY2020 production estimates. However, it looked like the issues were finally behind us with the mended radial stacker back on-site and commercial production declared on January 11th, 2021. Unfortunately, this was wishful thinking.

As noted in the prepared remarks, an increase in COVID-19 cases on-site and severe weather have weighed on Q1 results. Therefore, the company is now pushing its expectation for full production out to the end of Q2 2021, which is a delay of nearly a year on the initial estimate of commercial production by the end of Q2 2020, and what should have been full production at Relief Canyon by August 2020. Some investors will take severe weather as an excuse, but it's worth pointing out that industry veteran and former Randgold CEO Mark Bristow would strongly disagree, based on his comments from Barrick's Q4 Conference Call. Questioned about Nevada operations with the cold snap, he stated that there wouldn't be any excuses relating to cold weather.

Mike Parkin

And I was wondering if there's been any negative impact to the Nevada gold mines operations due to that cold? Or is it anything that you would expect to maybe drive a bit of a soft Q1? Or it's something that would probably bounce back with the resumption of kind of normal temperatures?

Mark Bristow

Mike, I would just say that where our operations are located in Nevada, it's flipping cold this time of the year, regardless of whether there are cold snaps. We don't notice the cold snap. It was just cold. We look forward to the odd sunny day. We don't see it appropriate to use weather to explain why we can't run our mines. So our team is well equipped to manage weather in northern Nevada, just like we are in the Andes in South America. So you definitely won't see anyone using cold weather as an excuse.

- Barrick Gold Q4 Conference Call Transcript

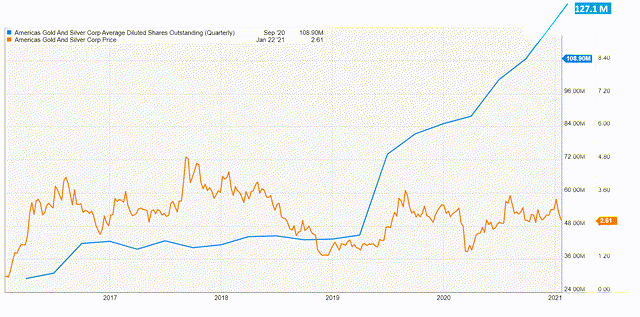

Given the disappointing results at Relief Canyon, continued shutdown at Cosala, and Galena working through a Recapitalization Plan with lower annual production, for the time being, the financial results were disastrous, to say the least. As shown below, Q4 revenue came in at $8.7 million, down 34% year-over-year. Meanwhile, FY2020 revenue fell by more than 50% to $27.9 million. This translated to a massive net loss per share of $0.21. While eternal optimists will point out that things can't get much worse from here, the damage has already been done, in my opinion, with the share count soaring by more than 150% since FY2019, to roughly ~130 million shares. So, even if we see a significant increase in earnings, this higher share count will translate to much more annual earnings per share.

Fortunately, the one bright spot in the results was Americas Gold and Silver's Galena Complex, which saw a sharp increase in production to ~1.71 million silver-equivalent ounces [SEOs]. This was an increase of more than 15% year-over-year, helped by higher grades and higher throughput. The company remains confident that it can get the operation up to a run rate of 2 million ounces of silver per year, but with Cosala offline, this is barely picking up the slack from the temporarily shuttered Mexican operation. So, while Galena might be a minor silver lining, it doesn't do much when the two major operations (Relief Canyon & Cosala) continue to disappoint.

(Source: YCharts.com, Author's Chart)

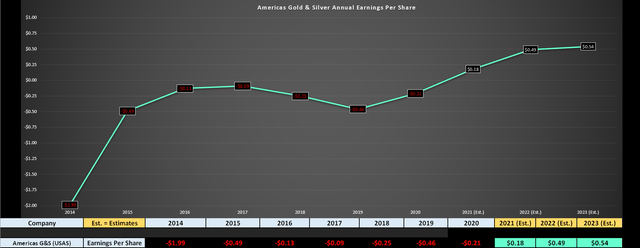

If we look at the earnings trend above, estimates continue to drop, with FY2021 annual EPS estimates now sitting at $0.18 and FY2022 annual EPS estimates sitting at $0.49. While this is a major improvement from net losses per share the past several years, it still leaves Americas Gold and Silver trading at an earnings multiple above 12 at $2.65 per share, which is very expensive for a company that has consistently disappointed. In terms of companies that have major uncertainty surrounding future operations and a recent track of under-delivering, I believe the fair earnings multiple is 6. Based on FY2022 estimates of $0.49, I have lowered my price target further to US$2.94. Obviously, the stock could trade much above this level. Still, I would be using rallies above $3.20 to invest in companies capable of meeting guidance and with less uncertainty surrounding future operations.

(Source: Company Presentation)

Previously, McEwen Mining (MUX) was one of the only companies that had found a way to consistently over-promise and under-deliver and manage to post steady net losses per share in a bull market for gold. However, Americas Gold and Silver has joined the club after its FY2020 results, and FY2021 isn't looking much brighter with no guidance provided. The only good news is that things probably can't get much worse from here, but that still is not an investment thesis. The key to outperforming in this sector is betting on the teams that consistently beat expectations. So far, Americas Gold and Silver has been the exact opposite during the best period in years for the gold price, leading to massive share dilution vs. windfall profits and a strong balance sheet. Therefore, if I were long the stock, I would be using sharp rallies to lighten or completely exit my position.