Investment thesis – market reaction is not reasonable

Real Matters (OTCPK:RLLMF) is a tech-based network management solutions company for the mortgage lending and insurance business. The company’s stock story debuted in 2017 as a significant Canadian technology IPO but has been facing market exhaustion in the past 6 months losing almost 50% of its value. Shares faced a considerable sell-off after the company reported earnings last week, dropping more than 15% before recouping a small portion of the losses. The negative sentiment was further reinforced after analysts at Scotiabank, BMO & Raymond James cut their targets.

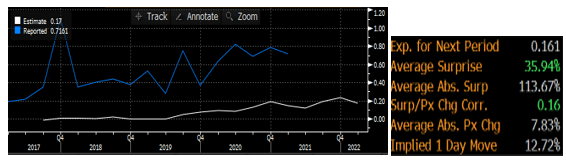

Real Matters bet EPS estimates every quarter – Source: Bloomberg Terminal

In my view, the negative sentiment is tied to expectations at the US appraisal segment but appears overblown, creating interesting entry points at current levels and considering real estate conditions. Even with price cuts from agencies, the consensus price target remains 20%+ higher than current market price and earnings were far from being disappointing. I do think markets are missing the underlying potential of this company. With 2020 revealing good technological success stories (e.g.: Kinaxis, Shopify, Lightspeed), the attention may end up turning to the undervalued Real Matters company.

Quarterly earnings were far better than what the 10%+ market drop is suggesting

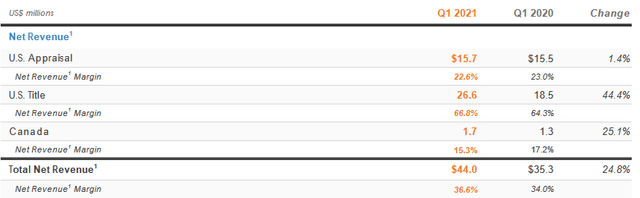

Real Matters reported what can be considered as relatively robust Q1 results considering that net revenue increased almost 25% and adjusted EBITDA being up approx. 20% (source: firm’s financial results). Revenue growth came primarily from the U.S. Title segment where Real Matters improved margin thanks to transaction flows. It also developed its pipeline of new client launches and went live with two new lenders. The good news to me, and highly under-appreciated at this stage is the strong results in the Canadian segment. Real Matters historically generated most of its earning streams from the U.S. market despite being a Canadian company but has been able to alter the trend this quarter. Canadian revenues were up roughly 40% on increased market share and volume.

Q1 2021 Non-GAAP Measures – Source: Conference Call Presentation

Against these strengths, the U.S. Appraisal segment may have been the driver behind the pullback and not rightfully so. The performance was quite flat due to mortgage origination market volumes, yet origination revenues increased over 9% year-over-year. In my opinion, the market is disappointed by the expected synergies from lower interest rates which should have largely driven origination volumes. Considering that the company is still developing its network and earning new lenders as evidenced with Tier 2 channels, I think we should expect continuous growth / sustainability in the appraisal segment. Investors should also take comfort in the over-performing Title segment where the addressable U.S. market was up 60% YoY. The whopping growth is set to make the Title segment the main contributor going forward with estimated net revenue margins of 60-65% by 2025 based on MDA disclosure.

Real Matters U.S. Market scale – Source: MD&A

Real estate conditions represent a window of opportunity

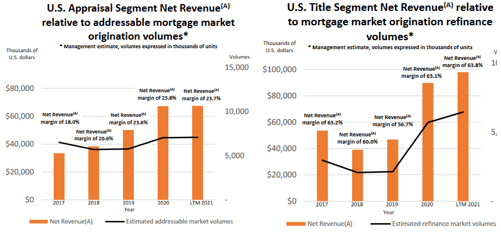

Market dynamics underlying Real Matters’ business – namely real estate conditions - are cyclical by nature which naturally entail appetite for volatility. However, as evidenced with a buoyant purchase market in both the U.S. and Canada, mortgage origination remains highly favourable to Real Matters’ business. More particularly, refinance activity is set to kickoff thanks to record low interest rates brought by the pandemic. The MBA in its latest published data highlighted the 20% increase in U.S. mortgage refinancing – the highest level since last March.

Quarterly mortgage originations estimate (data from MBA) – Source: Investing Room

With COVID-19 increasing physical boundaries, Real Matters is well positioned to navigate the pandemic with increased margins. The recent pressure on asset quality for banks and uptick in unemployment are clear drivers behind demand for refinancing. Canaccord Genuity’s recent comment further emphasizes that perception:

At the other side of the pandemic, Real Matters will have achieved greater scale with a stronger balance sheet with capital to execute on M&A and internal growth priorities. From Robert Young at Canaccord Genuity.

Valuation isn’t cheap but my concluding thoughts are bullish

Real Matters trades at half the 52-week high value but displays a P/E ratio of around 33x, a premium of ~20% vis-a-vis comparable peers. The P/B of 6.4x may not look astonishing for a tech-based company yet appears high by standards. These multiples mitigate the positive perception we have discussed and doesn’t make the entry a ‘no-brainer’. Relying upon the last free cash flow estimates (2021: $73mios) and a discount rate of 8%, I have run a high-level DCF model to estimate the fair value of Real Matters. While this is only on side of the coin, the fair value shows the price is 4.6% overvalued.

EBITDA multiple method

| Current Price (CAD) | 16.75 |

| Consensus Price Target | 28.38 |

| DCF Estimated Value per Share (CAD) | 16.00 |

| DCF Estimated Upside | -4.6% |

Against this high-level valuation, I believe that the drivers that led the stock price to reach the CAD33 mark around August are still valid to this date. Once investors make it past the relatively flat appraisal figures – which are still contributing positively – and acknowledge the market share gains in Canada, over-performing Title segment in the U.S. and current market conditions (low interest rate environment), the stock should bounce back quite well. I also haven’t addressed the company’s potential as a buyout target but that should not be excluded. Finally, the company hasn’t redeployed much capital into acquisitions in recent years but could use its network management and data synergies to further expand.

Candlestick chart, REAL TSX listing – Source: Bloomberg Terminal