Photo by PM Images/DigitalVision via Getty Images

Photo by PM Images/DigitalVision via Getty Images

I presented a bullish case on Exro Technology (OTCQB:EXROF) (TSX: EXRO) that Seeking Alpha published in December. A subsequent Seeking Alpha article on EXRO by an anonymous contributor presented a bearish case resulting in a share price shave of 45%. I took the opportunity to take a fresh look at the stock. This article is in response to the following questions raised by my readers:

- Does Exro offer a new technological advancement?

- How does a tiny company compete against companies with much greater resources?

- Does Exro have a business plan designed to capture market share?

- What's a reasonable valuation for Exro?

Establishing the technology

The bearish case scenario is that Exro is a tiny company applying an old and well-known technology, and there's no proof that their technology works. While Exro didn't invent coil switching technology, the company claims to be the first to apply coil switching technology to create coil drivers which allow for seamless real-time switching between high torque/low speed and high speed/low torque configurations to maximize efficiency.

We can see that Exro's claim is accurate by the 17 patents it has been granted. There are 18 patents currently pending, including expansion into applying the technology to improving electric battery performance. And we know that the Exro technology works because independent research conducted by Elen-Mechanical Consulting validated it.

David vs. Goliath

How can Exro compete against industry giants like Tesla is another common question? Exro does not compete with Tesla. Exro competes with electric motor-related companies such as Siemens, Toshiba, ABB, Nidec, and Rockwell Automation, the world's largest electric motor manufacturers. There are many other competitors but let's look at how these companies have become so large.

Large companies buy innovation. They acquire smaller companies that have developed new products because it is more effective to buy a company than to spend on R & D to play catch up. This phenomenon occurs across almost every industry.

Siemens has acquired 56 companies in its history, averaging about three per year. Toshiba has acquired 6 companies, while ABB has completed 16 acquisitions since 2015. Nidec has acquired 25 companies, including 14 in the last five years. Rockwell Automation has acquired 51 companies since 1985. It is safe to assume that if Exro manages to penetrate the electric mobility market, it will become an acquisition target.

Business Model

Exro has several partners collaborating to customize coil drivers for different electric mobility applications, including sleds, boats, farm equipment, buses, cars, and trucks. These partnerships, which allow the company to penetrate various business segments quickly, are expected to result in a commercially ready product at various intervals throughout this year.

The company recently received its first order for electric bikes, having completed its pilot project with Motorino. I learned in a recent conversation with CEO Sue Ozdemir that the company has expanded its sales staff to 16 engineers to market the different size coil drivers. Ms. Ozdemir also confirmed that she expects to sign on a Tier 1 OEM company later this year.

Exro is aiming to establish a low CAPEX, high margin operation by licensing their technology. To date, none of the partnerships are exclusive, allowing the company to pursue the various opportunities in the massive electric mobility market.

Valuation

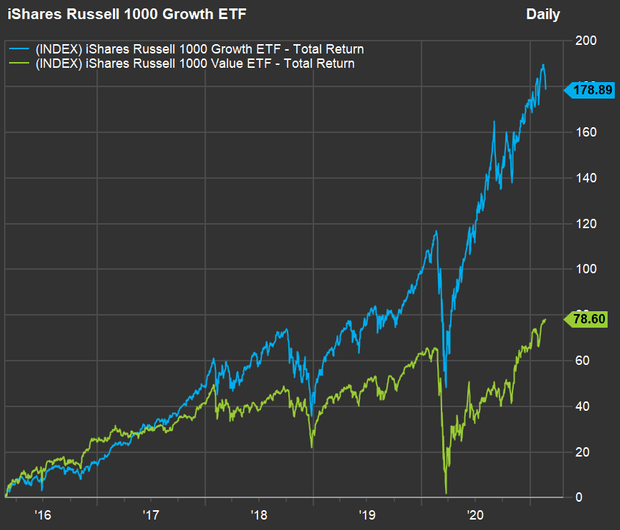

Exro's stock price, despite the recent sell-off, has risen about 1800% in the last year, joining the bullish trend in growth stocks. Analysts have been forecasting that a market rotation into value stocks is imminent.

COVID-19 vaccinations have provided a light to the end of the pandemic tunnel. As we return to normal, increased business activity will increase demand for oil and higher interest rates, which slow down growth. While the market may rotate into value stocks, investors will more carefully look at growth stocks, searching for growth stocks that also offer value. That's where growth at a reasonable price ("GARP") comes in.

GARP investors use the price to earnings ratio ("PEG") to determine a stock's value relative to its growth rate by dividing the stock's price to earnings ("PE") ratio by its earnings growth rate. The lower the rate, the more valuable the earnings growth is.

I applied the company's guidance of becoming EBITDA positive in 2023 and Raymond James' revenue estimates of $9 million for 2022 and $29 million for 2023 to do a GARP analysis on EXRO. The enterprise value ("EV") is about $340 million. The business model should result in gross margins of around 60% or better, which would be about $17 million in gross profits using the RJ estimate. The forward PE would then be 20 (340/17). The RJ model forecasts 150% revenue growth, but I am using 100% for earnings growth, to be cautious, which results in a very modest PEG of just .2 (20/100).

Risks

This is a start-up company just entering the commercial stage. There is no guarantee that Exro will be able to market its coil driver technology successfully. While there isn't any other company known to be pursuing a similar device, many companies are offering other electric motor improvements which may offer advantages over Exro's coil drivers.

Conclusion

Exro's patents and independent testing provide validation for their technology. The company has completed its pilot project to develop coil drivers for e-bikes and has hired a staff of engineers to commence sales. All of the other development projects will conclude throughout this year, opening up more commercial opportunities for EXRO.

The stock is selling at a discount to the analyst's projected growth rate based on an analyst's estimate that things will develop as planned. I applied a lower growth rate than the analyst to add safety and still came up with a very low PEG for Exro, indicating that the market is undervaluing the stock.