Coverage: article on White Metal Resources White Metal Advancing Major Gold System in Ontario, Heading to Resource on Copper-Silver Deposit in Namibia, and has an Impressive Portfolio of High-Value Assets

The article came across my RSS feed in the aftermarket

URL: https://miningmarketwatch.net/whm.htm (very compelling read, click to read full article)

White Metal Resources Corp. (TSX-V: WHM) (US Listing: TNMLF) (Frankfurt: CGK1) is a Canadian-based junior explorer mining company that has graduated from a pure project-generator model to now advancing two major projects; 1) its newly optioned Tower Stock Gold Project in Ontario, and 2) its 95%-owned Okohongo Copper-Silver Project in Namibia, in addition to holding an array of other projects.

White Metal Resources Corp. appears undervalued relative to inherent latent intrinsic value

WHM.V currently has a nominal market cap of ~C$13.7M (97,893,211 shares trading at ~C$0.14, click here to view a fully diluted schedule of warrants). The share price of WHM.V is apt to appreciate from the current trading price as continued news flow occurs, and as the significance of what White Metal possesses is better appreciated by the market, reflecting the significant growing intrinsic value on its many projects. The Company is well-capitalized (having closed a C$2.273 million private placement in February-2021) and is positioned to aggressively advance its flagship Tower Stock Gold Property in Ontario and its Taranis (Okohongo) Copper-Silver Project in northwestern Namibia, which includes taking the historical mineral resources of the Okohongo Copper-Silver Deposit to NI 43-101 compliance.

Transformation of White Metal Resources Corp.: The Company has a lot of moving parts as it also retains a vast portfolio of quality projects (see listing below) from its approach as a project generator. As is often the case with project generators, the sum of the parts is greater than the whole until market awareness kicks-in -- over time if management makes the right moves, cyclical markets cooperate, and geological/exploration success prevails, astute investors can be handsomely rewarded, WHM.V is certainly now at an inflection point. About 3 years ago, when commodities were out of favour, management of WHM.V decided to make a play for advanced copper-silver projects in Namibia -- instantly transforming WHM.V into a company with tonnage in the ground on two copper-silver projects (Okohongo & DorWit). This was a departure from advancing grassroots projects as a project generator. Several years later the opportunity to acquire Tower Stock Gold Project was presented through a contact and as a result this exciting gold project pushed the Namibian copper-silver projects off the front burner and DorWit was optioned-out (see details below, it is a valuable asset that the JV partner is advancing with no risk/cost to WHM.V which retains 25% ownership). Now factor in the other project generator assets of White Metal Resources and the inherent latent intrinsic value of WHM.V is immense.

------ ------ ------ ------ ------ ------ ------ ------ ------

The following is a synopsis/categorized listing of each project of White Metal Resources, followed by a more detailed look the two major projects White Metal is advancing on its own.

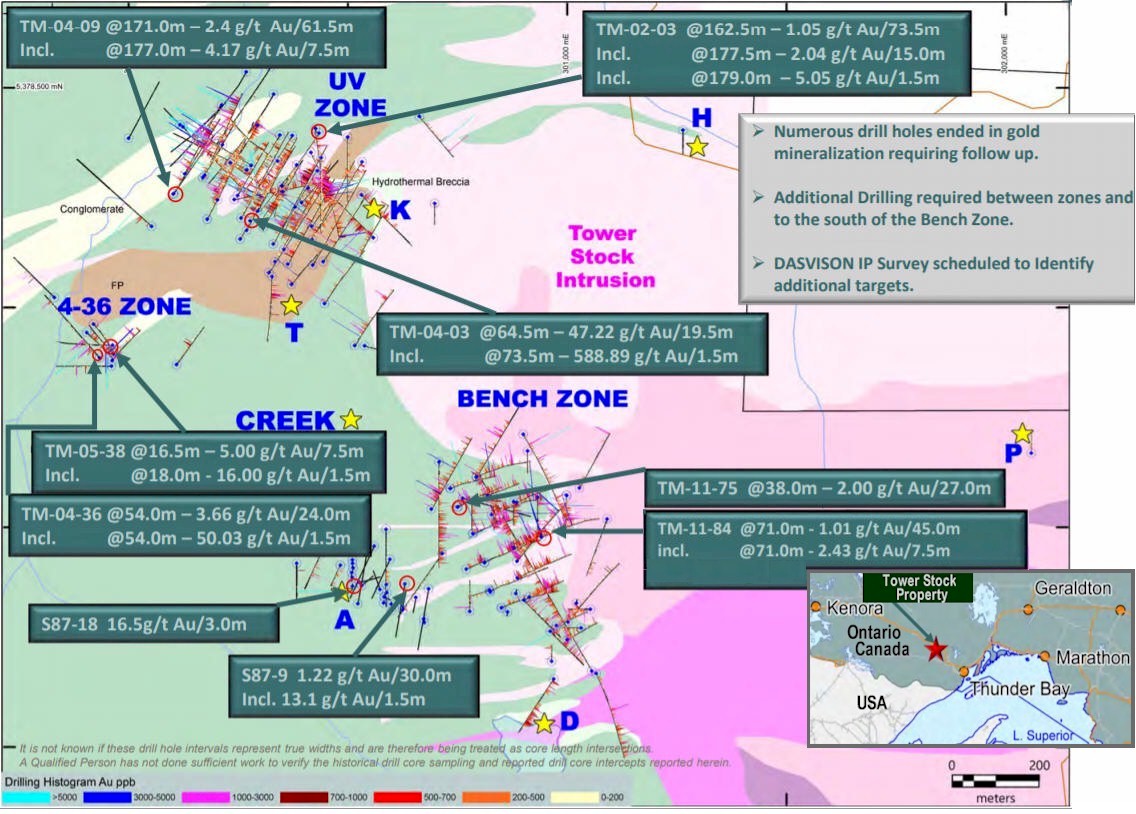

Major project #1) Newly Optioned Tower Stock Gold Project located in the Shebandowan Greenstone Belt ~40km west-northwest of the port city of Thunder Bay, Ontario, Canada. The project hosts an extensive syenite-associated disseminated gold system, a type similar to deposits in the Kirkland Lake and Malartic gold camps, and the Young-Davidson Mine (Alamos Gold). The project has a historical resource on the UV & Bench zones which has seen historical drilling from the likes of Inco, Noranda, Avalon, and finally ValGold -- previous work over the last 30 years has only scratched the surface (~200 m depths) in select areas along the contact region with the intrusive complex, and many holes ended in target gold mineralization. White Metal's geological team is taking an approach that looks at the big picture multi-million ounce gold potential of the syenite intrusive rock using a modern systematic approach and with an improved understanding. The project is currently undergoing a ~4,000 m drilling program on multiple zones. The Company is also in the process of wrapping up a DasVision Induced Polarization (IP) survey over exploration targets designed to provide insight at depths of +800m to get a handle on structural controls, and allow for 3D inversions and integration into its exploration model. The Company is targeting a ~2 km x 1.5 km area of complex alteration that has incredible gold endowment throughout; multiple occurrences have been discerned with many rock grab samples assaying >1.0g/t Au up to 16.2 g/t Au. There is anomalous gold everywhere; e.g. of 299 samples taken last summer across the project only 5 had no gold, and when >1 g/t Au samples are overlaid across the claim map many untested and underexplored areas are apparent -- White Metal Resources Corp. is highly prospective for major gold discovery..... See the full article at https://miningmarketwatch.net/whm.htm online. Article covers a lot of detail on varrious projects and makes one appreciate all the value drivers in place and is a good starting point for anyone unfamiliar with the opportunity.

Here is more from the article:

Figure 1. (above) Tower Stock Gold Project past drilling & mineralized zones and inset location map (note the impressive large swaths of quality mineralization; e.g., TM-04-03: 19.5 m of 47.22 g/t Au at 64.5 m, including 1.5 m of 588.89 g/t Au at 73.5 m. The project is in a stable mining-friendly jurisdiction, in a geological greenstone belt setting with proximal past gold producers and several gold deposits, and near the port city of Thunder Bay, surrounded by excellent infrastructure.

Exploration updates on Tower Stock Gold Project;

From Company release dated March 15, 2021 entitled White Metal Provides Update on Drilling Program and Options Strategically Located Patent, Tower Stock Gold Project, Ontario; White Metal has has completed 1,500 m of diamond drilling in 7 drill holes, with a total of 557 core samples submitted to Activation Laboratories in Thunder Bay, Ontario.

From Company release dated March 4, 2021 entitled White Metal Reports on Exploration Progress and Provides Corporate Update: "The first phase of the approximately 4,000 m diamond drilling program is well underway with five holes completed to date. The Company has also submitted 200 core samples to Activation Laboratories in Thunder Bay for analysis. In addition, the Company is nearing completion of the Abitibi Geophysics’ DasVision Induced Polarization (IP) survey, designed for deep mineral exploration up to 1,000 m depth. The survey, which is covering the Company’s main exploration targets that include the U-V Zone and the Bench Zone, will allow for 3D inversions and integration into our existing exploration model. The results of this survey will help to generate additional future prospecting and drill targets and also assist in delineating even deeper targets. Results from both the ongoing drilling program and geophysical survey will be reported as they are received, compiled and interpreted." [See a more detailed overview of the Tower Project further below in this article]

------ ------ ------ ------ ------ ------ ------ ------ ------

|  | Major project #2) 95%-owned Okahongo (Tarnis Deposit) Copper-Silver Project situated within the Kaoko Belt of northwest Namibia about 700 km northwest of Windhoek, is hosted by metasedimentary stratigraphy and is considered to be analogous with the stratiform sediment-hosted Central African Copperbelt (CAC) deposits of Zambia and the Democratic Republic of the Congo. White Metal's Okohongo deposit contains historical Inferred Mineral Resources of 10.2 million tonnes grading 1.12% Cu and 17.75 g/t Ag, using a 0.3% Cu cut-off (INV Metals Inc. NI 43-101 Technical Report, Effective Date March 31, 2011). This February-2021 White Metal Resources Inc. completed a 28 hole, 3,622 m drilling program and is now proceeding to bring the historical resource to NI 43-101 compliance and produce a technical report on the Okohongo Cu-Ag Deposit (expected Q2-2021). With both copper and silver now in favour as desirable elements for the modern/future electrical economy, the Taranis Cu-Ag Deposit resource alone justifies a sizeable marketcap for WHM.V beyond the current. The Taranis Deposit is apt to attract suitors looking to option the project from White Metal Resources and take advantage of the large exploration expansion potential to build on the coming resource. [click to view PDF corporate overview on Okahongo / Tarnis Deposit] See March 23, 2021 related exploration update news "White Metal Reports 1.54% Cu and 36 g/t Ag over 31 Metres from the Taranis Copper-Silver Project, Namibia". Figure 2. (left) Location of Okohongo (Dorwit is shown too, Dorwit is a project WHM.V has optioned out under JV already), the regional copperbelts are shaded in yellow. - See a more detailed overview of the Okohongo Tarnis Deposit further below in this article. |

------ ------ ------ ------ ------ ------ ------ ------ ------

#3) White Metal's Project-Generator portfolio of Joint Ventures -- the following are projects White Metal has optioned-out and are being advanced by others mining companies carrying the risk/cost:

a) DorWit (JV) Copper-Silver Project, Namibia: Option Partner, Noronex, is currently earning up to a 70% equity interest (with an option to acquire up to 95-100%). WHM.V received cash and shares and retains 25% ownership up to the partners earn in phase of the agreement. Located in the Kalahari Copper Belt, six historical copper deposits occur within these three licences along with other zones with anomalous copper in historical drill core intercepts which the Company believes can be expanded upon through future exploration. Exploration update: Excerpt from March 4, 2021 news release "(“Noronex”), has recently commenced an airborne electromagnetic (“EM”) geophysical survey over DorWit (see Noronex news release dated 12 January 2021). The EM survey is the first ever state-of-the-art airborne survey to be undertaken within the DorWit area. The use of the significantly improved modern technology and geophysical interpretation is intended to generate new exploration targets to expand on the 150,000 m of historical reverse circulation and diamond drilling that has already identified numerous sedimentary hosted Cu-Ag deposits. Noronex is also expecting to update the historical JORC Code 2012 mineral resource estimates which is currently being completed by MSA Group, with initial results expected soon." [click to view PDF corporate presentation on DorWit]

b) Startrek (JV) Au-Sb Project “Epithermal Gold” Newfoundland: Option Partner, 1259542 BC Ltd, can earn up to a 70% interest, [click to view PDF corporate presentation of Startrek], [click to view White Metal's web page on Startrek]. Note: The area has heated-up dramatically of late as other gold mining companies near Startrek have released impressive headline gold results (e.g. Queensway Property of NewFound Gold, and Moosehead Gold Project of Sokoman).

c) Far Lake (JV) Copper-Silver Project Shebandowan Area, Northwestern Ontario: In May 2020, WHM.V signed a letter of intent with Benton Resources Inc. (“Benton”) pursuant to which Benton may earn up to a 70% interest by paying the Company $205,000 ($25,000 received), issuing to the Company 1.6 million Benton common shares (300,000 received), and completing $1 million of exploration expenditures at Far Lake over a period of four years. Far Lake, located about 75 km northwest of the port city of Thunder Bay and north of the Shebandowan Greenstone Belt. Benton has recently commenced its second phase of drilling at Far Lake [click to view March 4, 2021 Exploration Update] [click to view corporate presentation on Far Lake] [click to view White Metal's web page on Far Lake] [click to view Benton Resources' overview of Far Lake -- Note: Benton Resources lists Far Lake as its "Flagship" project].

------ ------ ------ ------ ------ ------ ------ ------ ------

#4) White Metal's Project-Generator portfolio of properties available for Option (in Ontario, Canada) -- White Metal Resources owns a sizeable portfolio of high-value projects in Ontario that are currently available for Option:

a) Vanguard East and West Cu-Zn-Au-Ag Project & Iris -- Available for Option: Located about 150 km west of the port city of Thunder Bay and situated in the Shebandowan Greenstone Belt. The Vanguard West deposit consists of a historical mineral resource (non-43-101 compliant) containing 200,000 tons at 1.36% Cu, 1.5% Zn and 8.6 g/t Ag. The Vanguard East deposit consists of a historical mineral resource (non-43-101 compliant) containing 1.8% copper, 4.55% Zn, 6.8 g/t Ag and 5.0 g/t Au. [click to view related corporate presentation]

b) Seagull Lake PGE-Cu-Ni Project -- Available for Option: Located approximately 100 km north of the port city of Thunder Bay, about 50 km south of Impala Canada’s Lac des Iles Mine (previously North American Palladium), and about 28 km north of the Clean Air Metals Inc. Cu-Ni-PGE projects, previous discoveries made by Rio Tinto and Panoramic Resources (previously Magma Metals). The Seagull covers the Seagull Lake Intrusion (“SLI”), a 10 km diameter, circular intrusive situated in the Nipigon Plate. The Nipigon Plate area has been compared to the Noril'sk Region of Siberia, Russia, and is considered to be highly prospective for the discovery of new Cu-Ni-PGE deposits. Three styles of PGE mineralization have been identified in the SLI: (1) near surface, PGE-rich detrital “black sands”; (2) magnetite associated, PGE-rich layers or “reef-type”; and, (3) sulphide associated, basal Cu-Ni-PGE mineralization, interpreted as “Noril’sk-type”. Although the detrital and reef-type mineralization was the first style known in the SLI, the discovery of Noril’sk-type Cu-Ni-PGE sulphide mineralization became the focus for subsequent exploration programs, which reported from diamond drilling 3.6 g/t Pt+Pd, 0.34% Cu and 0.21% Ni over 2.1 m and 1.04 g/t Pt+Pd, 0.14% Cu and 0.16% Ni over 16.0 m (from Pettigrew, 2002). The SLI also contains anomalous concentrations of additional platinum group elements rhodium, iridium, osmium, and ruthenium. [click to view related corporate presentation]

c) Pen Au Property -- Available for Option: The Peninsula Gold Property is located ~275 km east of Thunder Bay in the Geraldton Beardmore Greenstone Belt, near Canterra Gold/Premier Gold Mines Hard Rock Deposit. [click to view related corporate presentation]

d) Umex Cu, Ni, PGE, Ag Property -- Available for Option: Located in the Pickle Lake Greenstone Belt [click to view related corporate presentation].

Figures 3, 4, 5 (below) -- Location maps showing all assets of White Metal:...

See the full article at https://miningmarketwatch.net/whm.htm online.