In fact, business jet charters for March 2021 were 30% higher than March 2020 and 8% lower than March 2019. In tandem with BDRBFs focus on and expertise at being a pure-play business jet manufacturer, the company is well set up to achieving profitability. Unfortunately, these prospects are being drowned out amidst the noise of the many follies of the company and how it is doomed for the gallows.

I believe that with the right corporate governance, Bombardier can use this opportunity to recover and strengthen its position as a leading business jet manufacturer.

-The company generated revenues of $6.5B in FY20 with 114 aircraft deliveries for an estimated ASP of $49M per aircraft. Bombardier has also enjoyed a book-to-bill ratio of 1.05 over the last five years.

Company Valuation

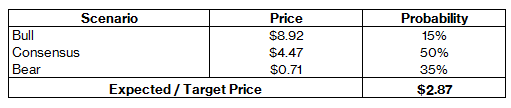

I built a DCF model to value the common stock of the company. The revenues were driven by forecasts of the number of aircraft deliveries by the company. Further, a total of three scenarios (Bull, Consensus, Bear) were created, which were then used to run probability weighted Monte Carlo simulations to arrive at the expected price of a share. A safety margin of 25% was used.

Image 1 - Intrinsic Value of Common Stock. Source - Sanket Karve

-I believe that the company's common stock is worth $2.84, and thus has a large potential upside. It is imperative to note however, that this valuation includes both - class A (with 10 votes) and class B (1 vote) shares. In the last two years, the class A shares have traded at an approximate 20% premium to the class B shares

-Strong Product Portfolio

Bombardier possesses a strong aircraft portfolio and is now focusing on its medium and heavy/large jets, where it already enjoys a market share of 41% and 37% respectively. It is also critical to mention that medium and large jets drive the majority of the revenue generated by business aircraft sales, and thus this will allow Bombardier to improve its gross margins by doubling production of a limited portfolio. As per Wright's Law, a former aerospace engineer, there should exist cost savings of up to 20-25% for doubling of capacity.

These factors should allow Bombardier to maintain its stronghold in the market and thus generate its target revenues by FY25

-Stability of Business Aviation

Business aviation as a business has proven to be more steady than commercial aviation markets during the pandemic and have also recovered faster. This bodes well for the company which may expect a larger number of orders in the near future.

Further, a quick analysis indicates that within the last two decades, every recession has coincided with a huge surge in the earnings of corporations. Although paradoxical, perhaps recessions allow companies to streamline their operations (aka layoff unlucky employees) and thus reduce unwanted costs and improve productivity.

-The above chart confirms this explanation of productivity. Lastly, a comparison of corporate profits vs business jet deliveries may prove that companies tend to place orders for business jets when they expect a strong earnings season. Considering the propulsion of profits by the COVID pandemic to the tech sector and some other companies, this indicates a bright future for Bombardier (see chart below)

-Aggressive Accounting and Insider Holdings

Even aggresive accounting methods in the past have not allowed the company to post profits. Most notable is the company's propensity to include one-time sales in its income from operations, as well as Bombardier regularly paying out a large number of dividends to its preferred shareholders (who are family). Some may construe this as embezzlement of cash for personal gain. For context, the company has paid out a total of $94M in dividends with net losses exceeding $3B over the last five years.

-Conclusion - A Cautiously Optimistic Proposition

Although the company does have a leveraged balance sheet and uses aggressive accounting, it is my belief that management's decision to pivot to becoming a business aviation pure-play is a masterstroke, especially with its timing.

If the company can strategically refinance and pay off its debt and continue to optimize its margins, the engineering excellence of Bombardier jets will allow the company to realize higher than expected profits in the next five years.

Overall, I am fairly bullish on this stock and feel that it is a purchase for investors with an investment horizon of 3-5 years and an above-average risk appetite.