CXB Strong Reserve Growth Caps Off An Impressive FY2020 Summary

Calibre Mining released its FY2020 Reserve & Resource update last week, reporting reserves of 864,000 ounces, with a sharp increase in reserves at both the Libertad Complex and Limon.

This increased reserve life has provided added visibility and confidence regarding future production, with roughly five years of production based on Calibre's reserves alone, assuming a 175,000-ounce production profile.

While Calibre looks a little expensive on a reserve basis, it's worth noting that the company is sitting on a very large resource base of more than 2.80 million ounces.

Given the company's significant installed capacity at La Libertad which provides a foundation for significant organic growth, I believe Calibre is a name worth keeping a close eye on.

We've finally reached the end of the Q4 Earnings Season for the Gold Miners Index (GDX), which means that companies are busy reporting their year-end reserve statements. One of the most recent companies to release its results is Calibre Mining (OTCQX:CXBMF), a mid-tier gold producer focused in Nicaragua. While most miners struggled to add reserves due to smaller exploration programs related to COVID-19, Calibre had an incredible year for reserve growth, enjoying a 202% increase in its mineral reserves. Given the company's significant installed capacity at La Libertad, which provides a foundation for significant organic growth, I believe Calibre is a name worth keeping a close eye on.

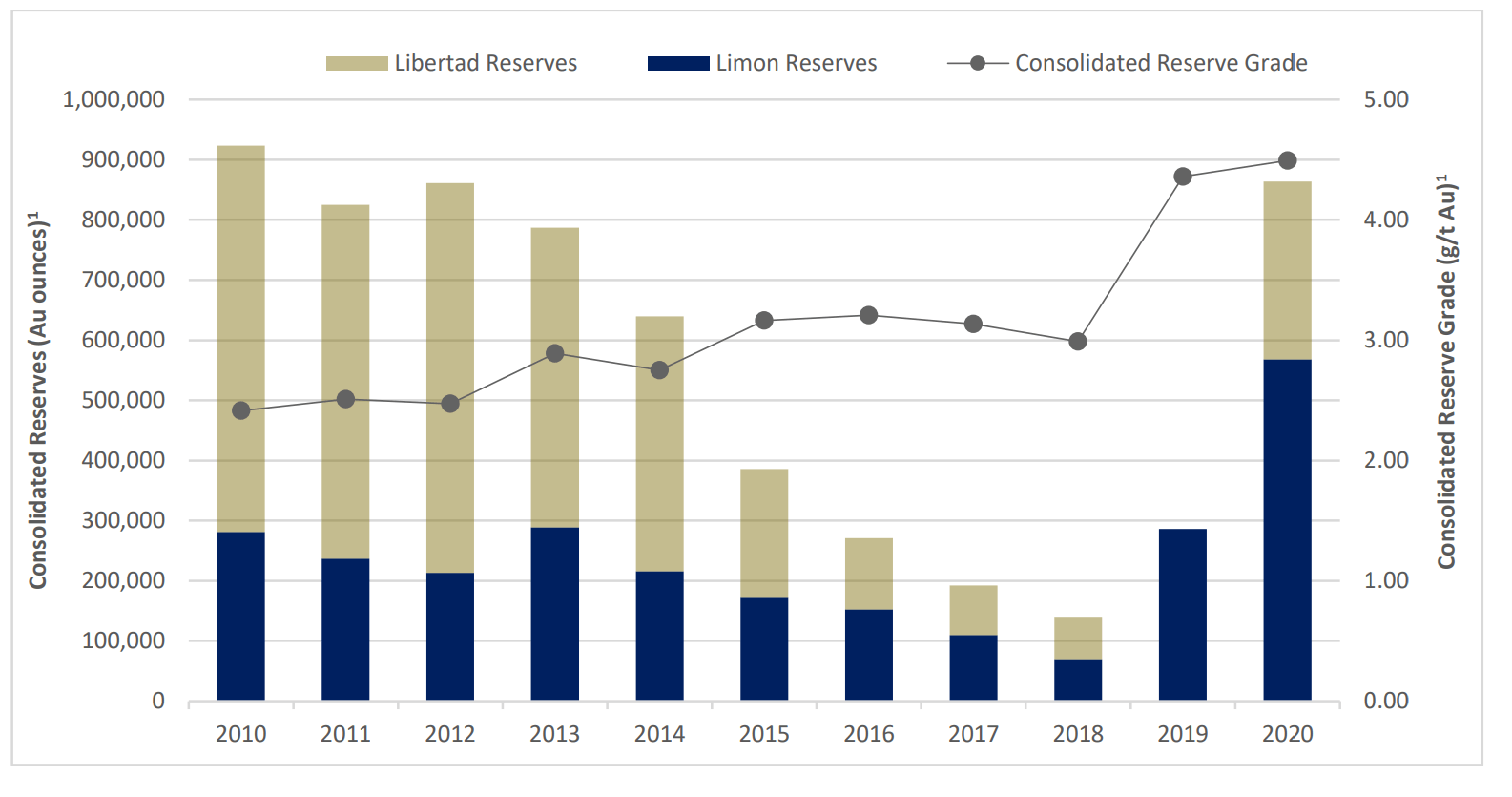

Calibre Mining released its FY2020 Reserve & Resource statement last week and reported a 202% increase in its total mineral reserves, with reserves ending the year at 864,000 ounces. This material growth in the company's reserve base was driven by a 137% increase in open-pit mineral reserves at Limon after depletion and a Pre-Feasibility Study [PFS] for the company's Pavon Mine, with Pavon home to 200,000 ounces of probable reserves at a grade of 4.86 grams per tonne gold. The company has already begun trucking ore from Pavon to its Libertad Mill as of January, both ahead of schedule and budget. Let's take a closer look at the reserve report below:

As shown above, the Limon and Libertad mines had a dearth of reserves when they acquired them from B2Gold (BTG) in Q4 2019, which was likely one of the reasons that Calibre got such a great deal for the asset. For those unfamiliar, Calibre paid ~$50 million in cash and 88 million shares, valued at roughly ~$50 million, for a total consideration of roughly ~$100 million for the Nicaraguan assets. At the time, the Nicaraguan assets were non-core for B2Gold, and we had not seen any real reserve replacement since 2010, with total mineral reserves down 80% from ~900,000 ounces to below 200,000 ounces. However, with Calibre's fresh set of eyes and hub & spoke model, we've seen exceptional growth since they took over the asset.

calibre-mining-strong-reserve-growth-caps-off-an-impressive-fy2020