A short squeeze in the silver market may be igniting, but here are some other gold and silver surprises.

April 21 (King World News) – Egon von Greyerz at Matterhorn Asset Management (based in Switzerland): The U.S. Fed, like the vast majority of central bankers, has a long history of messaging fantasy over reality in the name of self-preservation and/or maintaining “market order.”

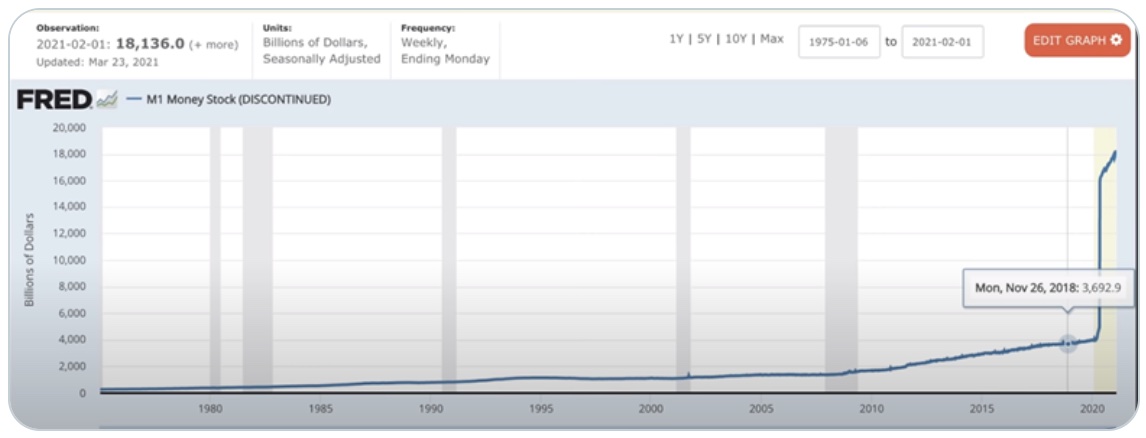

As of April 2021, the M1 supply has gone from $4.5T to $18.1, a rise of 450%. Such data represents a pretty bad report card for the Fed’s failed monetary experiment of unlimited QE. The Fed’s solution to the problem? Hide it.

The Monetary Madness Continues

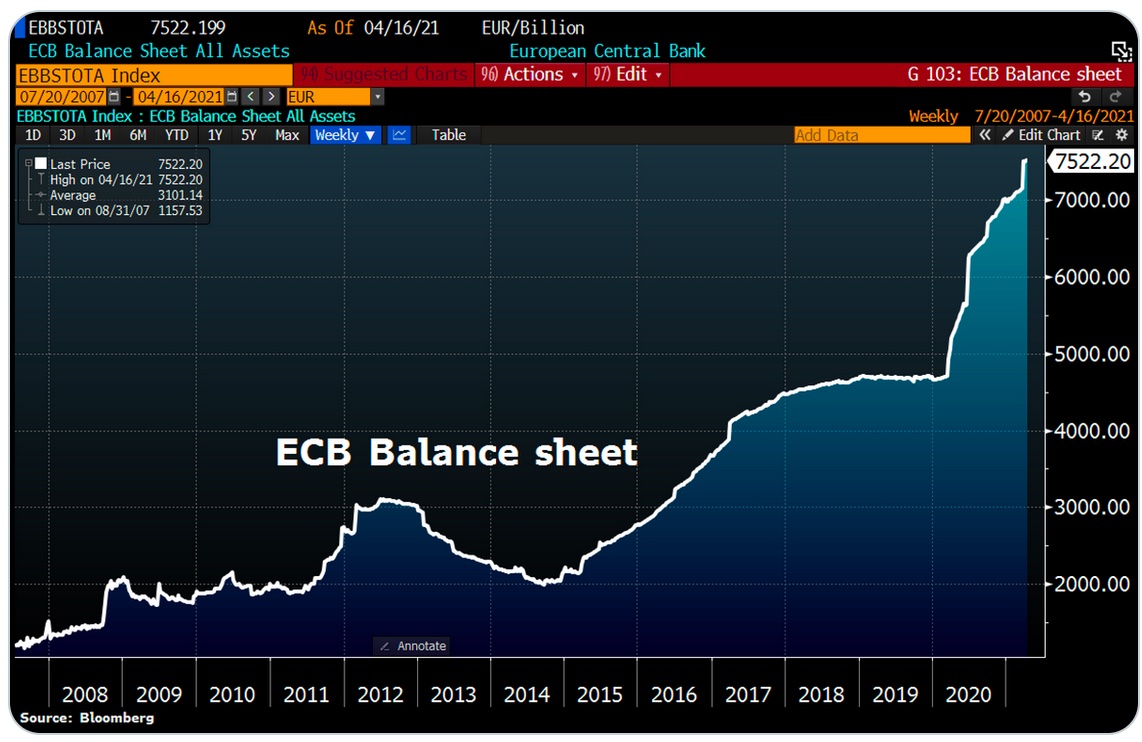

Holger Zschaepitz: ECB balance sheet hit fresh ATH at €7.522tn ahead of this week’s meeting as Lagarde keeps printing press rumbling. Total assets rose by €7.9bn on QE. ECB balance sheet now equal to 70.3% of Eurozone GDP vs Fed’s 36.3%, BoE’s 37.4%, and BoJ’s 130%.

Silver Squeeze

Fred Hickey: “They’re trying to engineer another silver squeeze. Will be very interesting to see how this plays out as I’m told (best source possible) the physical market is currently as tight as it has been in over a year. Physical market for gold is tight too, I’m told…

To learn about one of the most exciting silver plays in

the world click here or on the image below

Meanwhile, gold has quietly climbed back to just below $1800 -an important technical level with virtually no help from Western institutional investors (they typically come in with a lag). COT net long positions near the lows of the 8 month correction and a measly 2 tons inflow into GLD.

In other words, there’s a heck of a lot of buying power for gold when institutional investors are persuaded the rally is for real. I’m told breaking the $1800 level is the critical line of demarcation for that to happen.”

25 Year Low

Chris Ritchie: “Precious metals equities are close to a 25 year low in terms of their discount to the prices of the precious metals themselves. At the same time, commodities, as referenced by the GSCI (Goldman Sachs Commodity Index) are near 100 year lows relative to the DOW and S&P.

Very Nice Setup For Gold & Silver Space

With that as the backdrop, fund flows in the precious metals space have been negative for the last decade, which is leading to a very nice set up. Anyone investing knows the importance of heeding the mantra of “fear and greed” – it seems like greed is in the broader market and fear is in the precious metals market. Add to this the Pavlovian complacency created by government intervention, and what happens to the broader market if the government stops supporting the market? What happens if they don’t stop?

Meanwhile, inflation data has been starting to tick up and more importantly, it’s a topic of conversation. And any portfolio manager that’s not paying attention isn’t doing their job. Eric, 21% of all US dollars ever printed were printed in 2020, and 2021 is on pace for much of the same. Meaning, we are in the middle of MMT already, when people are wondering if we’re going to go down that path. When you consider that the velocity of money has been low while the quantity of money in the system is at extreme levels, a recovery in the broader market, could speed things up. So it’s possible that the roll out of a vaccine could stimulate velocity while another wave of covid could lead to the creation of more money in the system. So from a value and preservation of capital perspective, the sector is worth a look.”

Eric King