The steel association wants China’s securities regulator to pay more attention to improving current futures rules — like the proposal for dynamic premiums and discounts for iron ore futures — instead of launching more products.

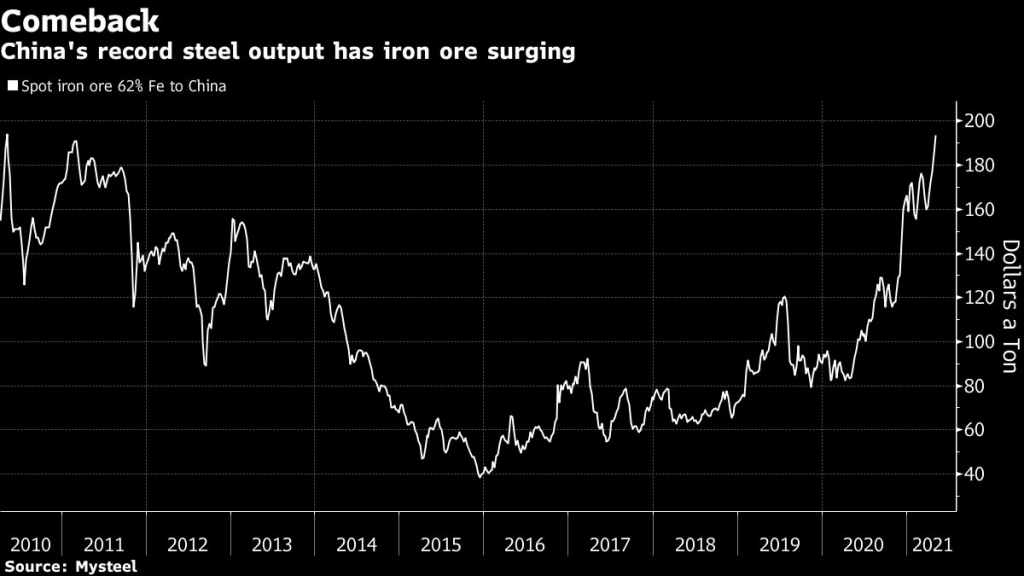

Iron ore prices extended the rally after hitting a fresh high on Monday.

According to Fastmarkets MB, Benchmark 62% Fe fines imported into Northern China (CFR Qingdao) were changing hands for $195.31 a tonne on Tuesday, up 0.89% from the previous day.

The high-grade Brazilian index (65% Fe fines) also advanced to a record high of $227.80 a tonne.

Demand for top-grade 65% iron ore has risen as the less-polluting material allows Chinese steel mills to meet emission control requirements while maintaining high output.

September iron ore on China’s Dalian Commodity Exchange ended daytime trading 1.9% higher at 1,158.50 yuan ($178.64) a tonne, boosting its year-to-date gain to 33.5%.

Chinese steel futures stretched gains, with construction steel rebar up for a sixth consecutive session, mirroring the trend in the physical market.

“Investors (were) speculating that Handan capacity restrictions and depleting nationwide rebar inventories (have) tightened the national steel supply-demand balance,” Singapore-based Navigate Commodities Pte Ltd told Reuters.

Following curbs in the top steelmaking city of Tangshan, Handan city in China’s steel hub Hebei province was expected to implement production control measures in its steel and coking sectors until June 30.

Sentiment was also buoyed after data showed profits at industrial firms in China, the world’s top producer and exporter of steel products, surged 92.3% in March from a low base a year ago.

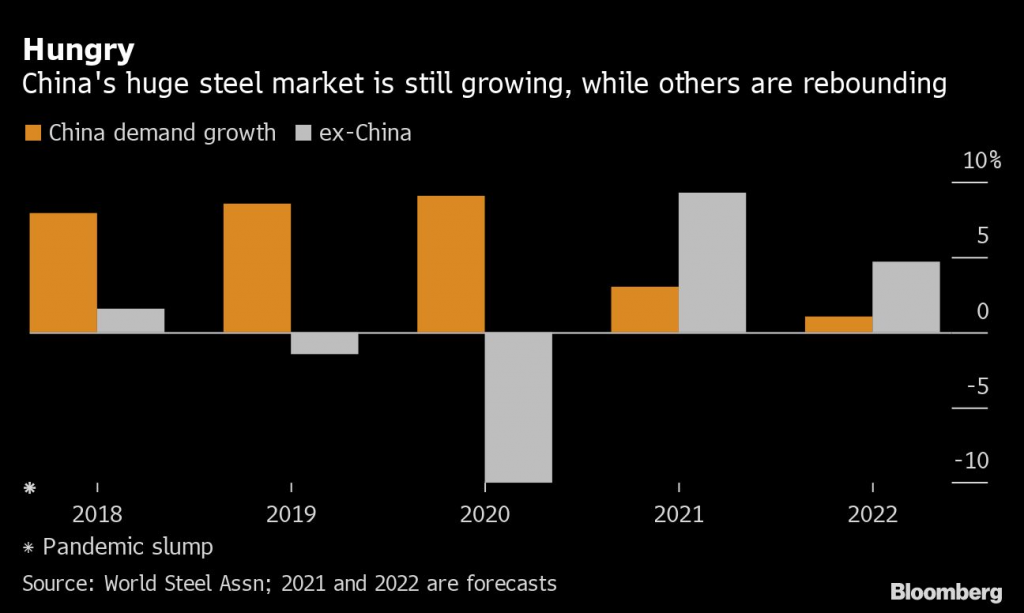

Hungry

Worldwide steel demand will grow 5.8% this year to exceed pre-pandemic levels, according to the World Steel Association. China’s consumption, about half of the global total, will keep growing from record levels, while the rest of the world rebounds strongly.

“Lead times are really, really long and some mills are saying they are selling for the third or even fourth quarter,” Tomas Gutierrez, analyst at researcher Kallanish Commodities, told Bloomberg.

“There’s optimism on the demand this year with the covid recovery, and a lot of stimulus plans. Demand outside China in April is higher than we’ve seen in many, many years,” Gutierrez said.

Total profit earned by major steel mills soared 247% in January-March to 73.4 billion yuan from a year earlier, compared to last year’s figures which plunged due to the pandemic and with an economic recovery now boosting growth, CISA said.

“(Steel mills) performance in the second quarter will remain good on peak seasonal demand, but growth is seen slowing,” said Qu Xiuli, vice chairwoman of the steel body.

Robust iron ore prices have bolstered earnings at the world’s top miners, even as they struggle to supply enough of the raw material. Vale beat first-quarter profit estimates, even after lower productivity at one mine and a ship loader fire.

(With files from Bloomberg and Reuters)