Photo by Joe Raedle/Hulton Archive via Getty Images

Photo by Joe Raedle/Hulton Archive via Getty Images Summary:

Baytex Energy (OTCPK:BTEGF) is a cheap, levered oil stock, with assets in the Eagle Ford and heavy and light unconventional Canadian oil resource plays. The stock has upside to $2.50 from here, almost a double, just from trading up in line with comps at $60 oil. As oil rises, Baytex's financial leverage and large development inventory provides substantial upside "torque". And Baytex just discovered oil, in a discovery that may be worth 15-50% of its current market cap and has not yet been press released. There is upside to $10-15 per share, from recent levels of $1.30-1.40. All numbers in Canadian dollars.

Baytex Discovery!

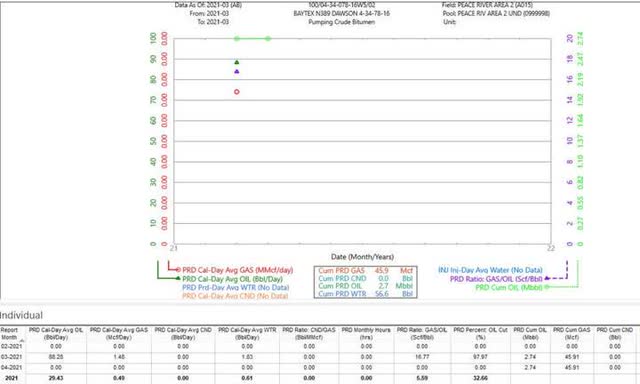

Baytex hit oil! In the recently monthly update from the Alberta Energy Regulator, despite the "confidential" well status, Baytex's Dawson N389 well was disclosed to have produced 2,740 barrels of oil in March, with an online date on or near March 15. This implies over 150 barrels of oil per day for a 2 lateral well, with potential development mode peak productivity of 350 bopd with 5-6 laterals and $1 - 1.5 million well costs.

Source: AER, Geoscout

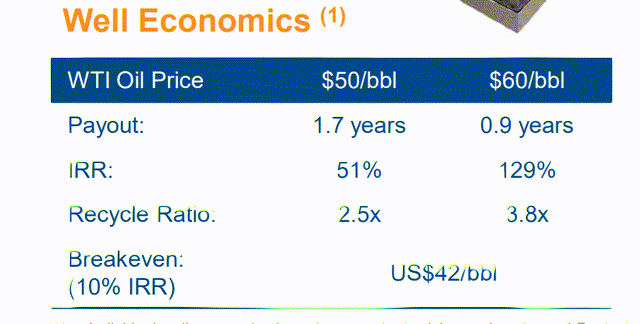

Baytex helpfully shows economics from their existing Peace River Heavy Oil fields (the region this discovery is in), for $2.5 million wells and similar productivity to this discovery:

Source: Baytex April 2021 Presentation

Source: Baytex April 2021 Presentation

But it gets better. This stunning triple digit IRR is for a $2.5 million well cost. Clearwater wells of the sort Baytex just drilled come in at $1.5 million (their test well was likely $800k). Investment banks that cover the Clearwater play estimate core area well payback in months - at $60 oil, perhaps 3-6 months.

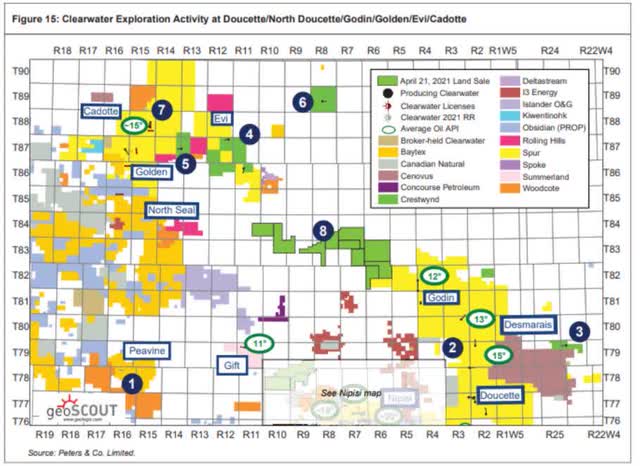

Peters & Co does a great job of covering this play, likely a benefit from advising on multiple large recent transactions. Their Clearwater map shows Baytex's discovery location, #1 on the bottom left, close to the core Nipisi area but not adjacent:

After seeing intriguing data and economics from the AER, Geoscout, and multiple investment bank research reports, I reached out to local area experts. One in particular reviewed this discovery closely and shared his thoughts. In his assessment, a discovery in the Clearwater requires 3 factors in his view to be material:

1) Viscosity – function of the crude gravity and ability of it to flow

2) Pay thickness – how much oil is in place

3) Permeability - reservoir rock conduciveness to oil flowing through it

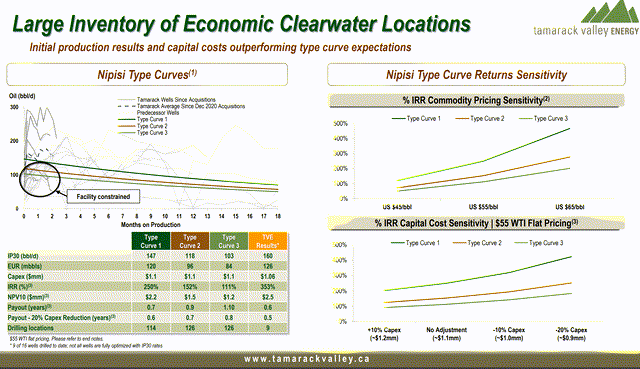

If all 3 work, and it can be quite localized, it can be one of the best commercial plays in Alberta. And his assessment is that this well, based on its high productivity from only 2 laterals, likely meets all 3 criteria. A local area operator in the Nipisi area helpfully shows their assessment of the play economics:

Source: Tamarack April 2021 Presentation

They show hundreds of locations at Nipisi, with 100%+ IRRs and initial oil production rates similar to Baytex's preliminary rate. Their actual results are shown with greater than 350% IRRs, and 160 barrels of oil per day in the first 30 days.

If Baytex's discovery at Peavine is 1/5 the size of Nipisi, it could be worth $100-300 million, or a meaningful portion of Baytex's current market cap. And the local area expert explained that almost every highly productive Clearwater well has had a number of offsets, meaning that Baytex's discovery could easily have dozens of offset locations. This helps validate the $100-300 million potential discovery value. If all 60 sections of Baytex's land were similarly productive and economic, it could be worth more than Baytex's current market cap at $60 oil, but that is unlikely.

Background on Baytex:

Baytex is a levered smid-cap Canadian oil producer (TSX: BTE). Prior to de-listing from the NYSE, Baytex had traded as levered oil beta, with eye watering rallies on huge volume and large crashes at times of oil pull-backs. And prior to that, it was a $50 per share energy trust, paying out high consistently growing distributions for years.

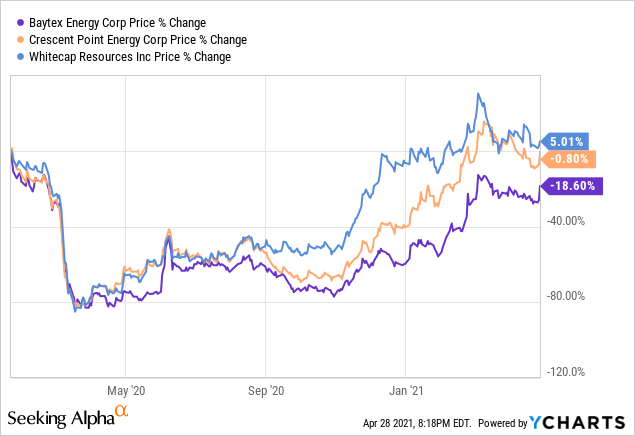

Baytex fortunately termed out its debt in January 2020, which allowed the company to stay out of bankruptcy during the Covid policy and OPEC price war driven oil crash of 2020. The stock has rebounded, but it is still down substantially versus peers Crescent Point (CPG) and Whitecap (OTCPK:SPGYF) since that time:

Data by YCharts

Data by YCharts Oil Price Torque:

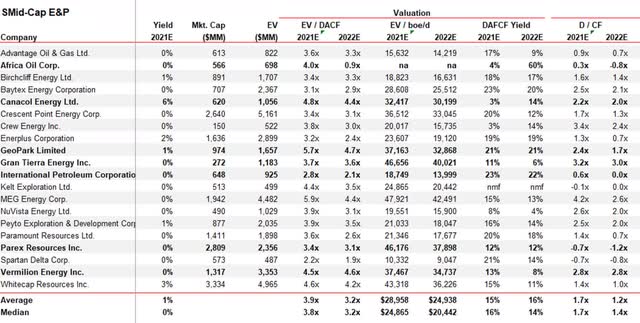

Baytex is relatively levered to oil price movements versus its peers. This recent "comp" table from a Canadian investment bank shows Baytex's comparatively high debt adjusted free cash flow yield of 23% for 2021. It also shows Baytex as comparatively high debt and a comparatively low enterprise value to cash flow versus peers like Crescent Point and Whitecap. This implies substantial "oil price torque" - meaning at $70 or $80 oil it might generate a lot more incremental cash flow per share vs these peers:

Source: Bloomberg, Factset, Scotia

Source: Bloomberg, Factset, Scotia

Another simplistic way to see it is Baytex is conservatively guiding to 73-77,000 barrels of oil per day for 2021. Based on this Peavine Clearwater discovery, joint venture partner Marathon's (MRO) operational success in the Eagle Ford, and other success, Baytex is more likely to produce 80,000 bopd in 2021. It has a market cap of $707 million, per the table above, versus Crescent Point's market cap of $2.6 billion and Whitecaps' $3.3 billion. Crescent point is guiding to 132-136,000 boepd for 2021, with a similar % oil to Baytex. And Whitecap is guiding to 102-103,000 boepd for 2021, with a lower % oil than Baytex and Crescent Point:

| | $ mm mkt cap | BOEPD | $/BOEPD |

| BTE | $707 | 80,000 | $ 8,838 |

| CPG | $2,640 | 136,000 | $ 19,412 |

| WCP | $3,334 | 103,000 | $ 32,369 |

Obviously this is simplistic and excludes debt. However, it highlights how much more upside there is to higher oil prices for Baytex shares than Crescent Point and Whitecap - in other words, "oil price torque." It is worth noting Baytex's oil derivative position is frequently cited as reducing this torque, but it is similar to Crescent Point and Whitecap.

Torque + Oil Discovery + Cheap Valuation = ?

Investors in Baytex today are the beneficiaries of years of Baytex's Peavine Clearwater discovery and of the financial leverage offered by Baytex having termed out its debt pre-Covid and surviving into the current higher commodity price environment. Baytex is misunderstood by investors and research analysts, with only 1 buy recommendation and 9 holds. Its valuation is cheaper than similar sized peers, and it didn't need to issue large numbers of shares to bulk up to a decade+ of high IRR inventory. Prior to the market digesting this recent discovery, Baytex could have easily traded up to $2.50 per share, or closer to in-line with its peers' valuations. And with the discovery and rising oil prices, Baytex could materially out-perform its peers, with a shot at a $10+ share price if oil were to rise to Goldman Sachs' recent $80 target for Q3 2021.