Photo by Bet_Noire/iStock via Getty Images

Photo by Bet_Noire/iStock via Getty Images Pyrometallurgical technology developer PyroGenesis Canada, Inc. (NASDAQ:PYR) recently announced financial results for the first quarter ending March 2021, seemingly taking traders by surprise. Sales increased seven-fold over the same quarter last year, from a mix of products and services featuring the company’s proprietary thermal plasma technology. The topline largesse yielded a whopping CA$2.1 million in gross profits, dwarfing profits of CA$267,414 in the year-ago quarter. On the news traders dramatically bid the stock price up through a line of volume-related price resistance at the US$5.00 price level for shares traded on the NasdaqCM.

Despite the favorable price movement, the company may still not be getting fair treatment. Investors seem unimpressed by a string of new business announcements that point to accelerating growth. Indeed, PyroGenesis, has fired up its business pipeline with a backlog of CA$30 million in signed contracts and plans to acquire a complementary biogas upgrading operation.

For investors willing to do some homework, PYR could prove to be a compelling growth opportunity. We take a closer look at PyroGenesis business pipeline and the potential for higher valuation for PYR.

Unfamiliar Technology Creating Market Opportunity

PyroGenesis stock may suffer as traders scratch their heads over the company’s seemingly scattershot products and services. The company’s first quarter earnings announcement cited contributions from five outwardly unrelated revenue streams. Admittedly, thermal plasma technology is not household terminology, but it is the common thread that runs through the PyroGenesis business pipeline. Plasma is the fourth state of matter, reached by using high temperature torches, fired up to 25,000 to 45,000 degrees Fahrenheit, to break compounds down to an elemental state of gas or powder.

Make no mistake, PyroGenesis’ troupe of sixty engineers and technicians are flat out experts in the use of plasma heat for processing metal ores and wastes. The company has over 120 issued and pending patents covering plasma torches and metallurgical processes. A recent conversation with the company’s chief executive office, Peter Pascali, revealed plans to file as many as 100 more applications around the world. Most recently, the European Patent Office approved patent protection for PyroGenesis’ proprietary process to produce high-purity spheroidal powders of metal alloys for use in additive or 3D manufacturing.

Indeed, high powered plasma generators are proving valuable as alternatives to conventional pyrometallurgical technologies. Metal alloy powders for 3D printing is just one example of potentially hundreds.

The ubiquitous nature of plasma technology allows PyroGenesis to address multiple applications either as substitutes for conventional metallurgical methods or by creating an entirely new process to solve customers’ problems. This means large market opportunity and the potential for reducing business risk through diversification into multiple industries.

Revenue Resourcefulness

The PyroGenesis team is already carving out a reputation for innovation and responsive customer service in several industries. PyroGenesis plasma technology applications have also opened the door to alternative strategic relationships that allow the company to share in value creation downstream. The company’s current customer relationships illustrate the possibilities.

Dross is an ordinary waste stream byproduct of the smelting process. It is a vexing problem for metals processors who desire high extraction rates, but find that too much ore gets lost in the dross. Usually, the dross is removed from the smelting area and, after cooling, the residual metals are mechanically recycled. It is an expensive and time-consuming process that also kicks off environmentally troublesome salt waste.

Dross is an ordinary waste stream byproduct of the smelting process. It is a vexing problem for metals processors who desire high extraction rates, but find that too much ore gets lost in the dross. Usually, the dross is removed from the smelting area and, after cooling, the residual metals are mechanically recycled. It is an expensive and time-consuming process that also kicks off environmentally troublesome salt waste.

Under the brand name DROSRITE, PyroGenesis provides dross processing and metals recovery equipment and services to aluminum or zinc producers. The company has put its plasma torches to work in a system that fits in-line with the smelter operation. There is no need to move the dross to another location, wait for cooling or run a mechanical recycling step. The DROSRITE system recovers as much as 98% of the aluminum in the dross, which is about 20% more than the conventional method. What is more, the operating cost is lower and there is no irritating salt waste. More efficient capture of metals also means a lower carbon footprint for metal smelters that are increasingly in the cross hairs of environmentalists.

PyroGenesis gives metal smelters the option of purchasing the DROSRITE system outright or contracting with the company for turnkey dross management services. DROSRITE system sales and services contributed CA$2.7 million to the top line in the first quarter 2021, well above the CA$2.5 million quarterly average in fiscal year 2020.

Silicon metals are the target of the company’s PUREVAP system. PyroGenesis has partnered with HPQ Silicon Resources (HPQ: TSX-V), a producer of nano-silicon materials and nanowires. Two systems featuring PyroGenesis’ plasma torches have been developed for exclusive use by HPQ subsidiary, HPQ Nano Silicon Powders: 1) the PUREVAP Quartz Reduction Reactor upgrades lower purity quartz to high purity silicon and 2) the PUREVAP Nano Silicon Reactor for additional processing of silicon into spherical powders and nanowires.

Silicon metals are the target of the company’s PUREVAP system. PyroGenesis has partnered with HPQ Silicon Resources (HPQ: TSX-V), a producer of nano-silicon materials and nanowires. Two systems featuring PyroGenesis’ plasma torches have been developed for exclusive use by HPQ subsidiary, HPQ Nano Silicon Powders: 1) the PUREVAP Quartz Reduction Reactor upgrades lower purity quartz to high purity silicon and 2) the PUREVAP Nano Silicon Reactor for additional processing of silicon into spherical powders and nanowires.

The PUREVAP systems are expected to replace conventional process that require higher operating cost. Both the PUREVAP systems can be operated with lower energy inputs and thus lower carbon footprint. HPQ is racing to be first to market with a game changing low-cost nano silicon material.

The collaborative relationship with HPQ is yielding an additional market opportunity. Recently HPQ and PyroGenesis issued a joint announcement of an evaluation for an innovative plasma process to convert silica to ‘fumed silica’ also called ‘pyrogenic silica’. Fumed silica is used in a variety of personal and health products as well as in adhesives, sealants and batteries, among a long list of high-demand consumer products. Global Market Insights, an industry research firm, pegged the fumed silica market at CA$1.6 billion in 2020 and estimated the industry could grow at a compound annual rate of 5.4% for the next five years.

The collaborative relationship with HPQ is yielding an additional market opportunity. Recently HPQ and PyroGenesis issued a joint announcement of an evaluation for an innovative plasma process to convert silica to ‘fumed silica’ also called ‘pyrogenic silica’. Fumed silica is used in a variety of personal and health products as well as in adhesives, sealants and batteries, among a long list of high-demand consumer products. Global Market Insights, an industry research firm, pegged the fumed silica market at CA$1.6 billion in 2020 and estimated the industry could grow at a compound annual rate of 5.4% for the next five years.

A large market opportunity for an environmentally-friendly and thus highly marketable fumed silica additive is compelling enough. Perhaps more important for PYR investors is that PyroGenesis is in an enviable competitive position by joining its critical expertise in thermal plasma technology to HPQ with its well-established sales and distribution network in fume silica. PUREVAP contributed a modest CA$625,086 or about 10% of total sales in the first quarter 2021, but appears capable of dramatic growth as these two well matched partners move forward.

PyroGenesis is also prepared to deliver turnkey equipment solutions to customers. For discerning investors, it is important to observe that such equipment sales contribute far more to the company’s business model than a one-time system sale. Waste processing is an example.

PyroGenesis is also prepared to deliver turnkey equipment solutions to customers. For discerning investors, it is important to observe that such equipment sales contribute far more to the company’s business model than a one-time system sale. Waste processing is an example.

The PAWD-Marine system was built to the exacting specifications of the U.S. Navy for waste handling and destruction on aircraft carriers. The U.S. Navy provided development funding and PyroGenesis delivered two systems using the company’s proprietary plasma torch technology. Even the most inexperienced seaman recruit can operate the ‘button on-button off’ system, keeping the ship very shape indeed.

Pleased with the result, the U.S. Navy has ordered another two additional PAWD-Marine systems for carriers currently under construction. The order is valued at $11.5 million. The PAWD-Marine system is included in the specification for every Gerald R. Ford Class supercarrier, nearly guaranteeing future orders for the system.

The company reported CA$2.6 million or 41% of total sales in the first quarter 2021, related to the PAWD-Marine system from replacement component sales and support services. A growing installed base of PAWD-Marine systems means a building source of recurring revenue.

Growth Momentum

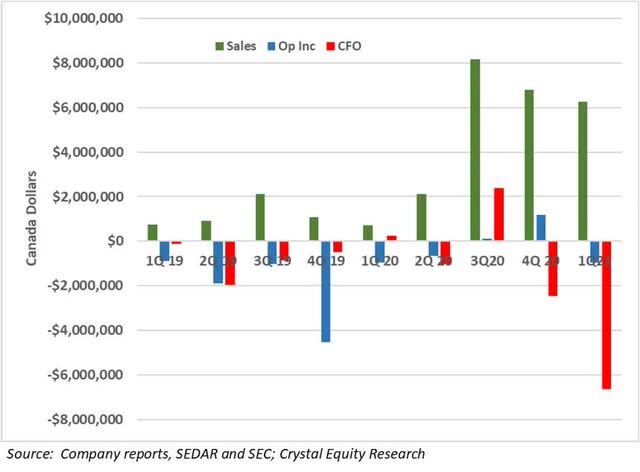

Traders are known for much hand wringing and teeth gnashing over even the slightest sequential or annual decline in sales or profits. It can be a stumbling block for stock price. A review of PyroGenesis’ quarter financial results reveals a bit of chop at the top-line that has filtered down to operating results. Most of the variance can be explained by the Company’s early stage of development when new products are coming online and revenue streams are limited to the first customers.

The growth trajectory - quarterly revenue variance along with it - is likely to be impacted significantly by two more projects underway at PyroGenesis. First, the company is investing in new capacity to produce metal powder for an aerospace application. Second, PyroGenesis has announced plans to expand through acquisition of a complementary operation in biofuel.

The growth trajectory - quarterly revenue variance along with it - is likely to be impacted significantly by two more projects underway at PyroGenesis. First, the company is investing in new capacity to produce metal powder for an aerospace application. Second, PyroGenesis has announced plans to expand through acquisition of a complementary operation in biofuel.

Powders. PyroGenesis is applying its thermal plasma technology to its new NexGen Plasma Atomization system, which has a production rate exceeding 25 kilograms of metal powder per hour. The first powders under test are titanium alloys that will be used by an unnamed aerospace company for additive manufacturing. An agreement signed in April 2021, has put PyroGenesis powders to qualification tests by the customer and could ultimately enable PyroGenesis to become an approved supplier. Potential order quantities and sales value have not been disclosed.

In the meantime, PyroGenesis has attempted to perfect several powder types, using titanium, zinc and other metals used in high valued-added applications. The company benefits from low-cost hydroelectric power available at its Montreal, Canada production facility, boosting profits through lower operating cost. The renewable power source also means PyroGenesis can offer metal powders with a lower carbon footprint, elevating competitive position in the additive manufacturing sector.

Strategic Acquisition. PyroGenesis recently announced plans to acquire Montreal-based AirScience Technologies (AST), a biofuel upgrading operation for $4.8 million. Based in Montreal, Canada, AirScience designs and builds upgrading systems that turn biofuel into renewable natural gas (RNG) and equipment for biodigesters and landfill gas applications. AST has particular expertise in purification of pyrolysis-gas and coke-oven gas.

Privately-held AirScience is thought to earn as much as CA$6 million per year in revenue.

Financial Foundation

The PyroGenesis team is busy, pursuing several different applications for the company’s thermal plasma technology in as many industries. Adequate working capital is critical. At the end of March 2021, the company has CA$28.1 million in working capital, composed primarily of CA$26.3 million in cash. The cash kitty was boosted by CA$10.9 million in proceeds from disposal of a strategic investments and CA$8.1 million in new capital from the exercise of warrants and compensation options.

The cash resource may seem excessive given the company’s revenue level. The typical profitable manufacturing company can get by with cash working capital around 20% of its sales. For PyroGenesis that would be about $CA$4.0 million. However, as is shown in the chart above, the company frequently goes through periods when operations use cash resources. While the company’s need for cash working capital may be higher than usual, it still appears PyroGenesis has excess cash available for growth investments.

Outstanding warrants that could be vexing source of dilution and stock price overhand in the minds of some investors. On the flip side, warrant balances also hold promise for new capital. At the end of March 2021, PyroGenesis had 3.0 million warrants outstanding with an average exercise price of CA$1.68 for an incremental CA$5.0 million when fully exercised.

Total assets are boosted by a strategic equity position in HPQ Silicon Resources, a partner in PyroGenesis’ project to product silicon powders and wire as well as fumed silica. The investment is composed of 10.1 million common stock shares and 25.8 million warrants in HPQ. Unfortunately, accounting treatments for the investment can roil PyroGenesis’ bottom line as the asset value must be marked-up (or marked-down) to fair value as the HPQ stock price changes. In the first quarter 2021, the HPQ investment was marked up by CA$5.6 million, boosting the bottom line to a profit CA$3.7 million despite an operating loss. This compares to a mark down of the HPQ investment by CA$492,024 in the same quarter in the previous year, which deepened the operating loss in that quarter.

Conclusion

A strong argument can be made that proliferation in customers and partners demonstrates a strengthening ability on PyroGenesis team to address the broad metallurgical market with effective, value generating solutions. The company is also cultivating long lasting relationships that lead to repeat orders, horizontal contract expansion and recurring revenue. For investors who can stomach near-term variance in financial results as well as the patience to wait for growth strategies to play out, the future could hold compelling returns in PYR.

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein.

Underwriters of the Prime series may have a beneficial interest in, serve as agents of, or act as advisors to the companies mentioned herein.