pixelfit/E+ via Getty Images

pixelfit/E+ via Getty Images I began writing about Quipt (QIPT), a home healthcare services company, in October 2020, with my first article outlining why I believed the company had a clear path to triple. Since that time, and despite recent headwinds, the company has made many changes (all positive, I believe, as I will outline below) and has also nearly doubled the S&P 500’s return over that timeframe. And yet I still believe the company can triple in value over the next three years, with now being a perfect time to establish a core position in the stock. Why?

Despite the recent positive changes for the company, some of these changes have either led to confusion or possible investor turnover. In addition, and I would argue most importantly, the stock is currently facing significant headwinds relating to a warrant overhang from a previous offering that was used to make smart, accretive acquisitions. As I will explain in more detail below, the pressure on the stock should subside relatively soon, with in-the-money warrants expiring on June 29, 2021.

What changes has QIPT made since I began following them? (1) the company changed its name from Protech to Quipt; (2) the ticker symbol in the US changed from PTQQF to PTQQD (due to a reverse split) to now QIPT (due to the name change); (3) the company uplisted to NASDAQ; (4) the company executed a 1-for-4 reverse split as part of their uplisting; (5) the company began reporting in USD instead of CAD. I will discuss all of these changes below, which have caused short-term confusion, but will benefit the company significantly long-term. Ultimately, I believe the company could still triple over the next three years, with a 60% near-term improvement in share price once the warrant overhang subsides.

For more background details on the company, see my previous articles here and here. (IMPORTANT NOTE: All of my previous articles referred to dollar amounts, besides US share price, in CAD; this article will refer to prices in USD due to QIPT’s change in presentation discussed further below). I will not repeat many of the basic details from those articles, but will instead focus on why the current headwinds exist, and why I am using these headwinds as a buying opportunity. Simply put, despite the headwinds on the share price, the company itself continues to execute on its business plan and is stronger than ever.

Warrant Overhang

On June 2, 2021, QIPT filed its March 31 quarterly report with the SEC. As of March 31, the number of warrants outstanding would result in an additional 2,491,106 shares being issued to shareholders on a stock that, until recently, was illiquid, often trading fewer than 100,000 shares per day between the US and Canada. The exercise price on the warrants, post-reverse-split, is CAD $6.40, or roughly $5.20/share USD.

So, these warrants have been in-the-money since November 2020, and were well in-the-money since about February 2021. The exercise and sale of the warrant shares has been weighing on the stock ever since, and has only intensified as we near the expiration date of June 29, 2021. Let me explain for those unfamiliar just how much of an overhang these warrants can create.

Much like a stock option, warrants give the holder the option to buy stock in QIPT at a specified price by a specified time. However, unlike an option, the warrant is essentially “free” to the original warrant holder. In the case of QIPT warrant holders, they received these warrants in exchange for purchasing common shares of QIPT stock during the company’s last capital raise. In this case, warrant holders can purchase shares of QIPT for $6.40 CAD. This creates a unique opportunity for the warrant holder. How?

If I hold a warrant to purchase a share, then I know I can buy the share at any time prior to June 29 for $6.40 CAD. Therefore, if the stock starts to trade at $10/share CAD, as it did earlier this year, I can short the stock at $10 (or any price above $6.40) with no risk. Why? Because I know I can buy the shares back to cover my short position at $6.40. Even if the stock goes up to $1,000/share, I can cover my short position at $6.40 instead of the current market price, making a profit between $6.40/share and the price at which I shorted.

So, at any price above $6.40/share CAD, a warrant holder can guarantee they make money on the warrant by shorting the stock. It is for this reason that warrants are so valuable. In having a warrant, you expose yourself to zero extra risk (beyond the risk of the original transaction) for possibly significant upside reward.

Based on multiple conversations with people familiar with QIPT, as well as people familiar with this warrant hedging process, I believe the current warrant overhang/hedging is weighing significantly on QIPT’s share price. This argument seems to be supported by the evidence, as well, since I noticed that IIROC’s short reports indicate increased shorting activity picking up drastically on QIPT over the past month. Yet, there are several changes the company has recently made that may also be weighing on shares, despite the fact that the company remains fundamentally stronger than ever and these changes are all beneficial for the business long term.

Changes, Changes, Changes

In the introduction, I noted four recent changes that could have confused investors or caused some turnover in share ownership. I will deal with each of these in more detail now.

Name Change

Source: Quipt Home Medical Website

On May 11, QIPT announced its intention to both change its name and consolidate its shares. I will deal with the share consolidation below. With respect to the name change, I think this move caught investors off-guard. But the change is actually going to be quite beneficial for the company. The company’s previous name, Protech Home Medical, was a name known only to capital markets. That is to say, you could not find any of Protech’s medical equipment under the Protech name.

Rather, Protech’s products were branded under all sorts of different names. For example, in Atlanta, the company had at least three different prominent brand names. Most physicians and patients using their products had no idea that one and the same company made the different products. In changing its name to Quipt, QIPT will now re-brand its actual products under that new name, helping to create brand identity and loyalty. This should also help to drive organic growth as the company cross-sells its products into existing markets. It also creates a name in the capital markets that aligns with the company’s actual products on the ground.

Ticker Symbol Change

QIPT’s ticker symbol changed in both the US and Canada. In Canada, the ticker symbol changed from PTQ to QIPT. In the US, the change was even more confusing. The company had been originally listed as PTQQF on the OTC market. Consistent with its approach to such situations, when QIPT executed the reverse split noted above, the OTC market symbol became PTQQD.

Not only did the symbol change, but many investors were unable to buy or sell the stock for a few days, creating confusion. Finally, when all was said and done and the company was uplisted to NASDAQ, the symbol changed to QIPT. All of these changes happened within the month of May.

NASDAQ Listing

Normally, uplisting to NASDAQ is something viewed quite positively by investors. With QIPT, this is no exception - long term. But in the short term, I believe many Canadian investors see the writing on the wall. QIPT does 100% of its business in the US. They were listed on the Canadian exchange initially due to historical circumstances I covered in my introductory article linked above. Although the company remains dually-listed in both Canada and the US, many Canadian small-cap investors prefer to hold stocks that are primarily based and/or traded in Canada, just as US investors tend to prefer stocks traded primarily in the US.

I think there is reason to believe that the uplisting to NASDAQ has created some temporary turnover of QIPT shares. Most Canadian investors have already made large returns on QIPT, and so selling to move their money into an actual Canadian company may now be preferred in this situation. Regardless, the move to NASDAQ for QIPT is undoubtedly a long-term positive move. Not only does the NASDAQ provide significantly more liquidity, but larger institutions will now be potential buyers.

The company already has multiple Canadian institutions who cover them, and I expect over the next couple of years we will see a similar situation in the US, with US institutions and analysts beginning to follow the stock and the company’s impressive story. For its part, according to my sources, the company will be aggressively marketing itself to both US institutional and retail investors over the next few months.

Reverse Split

As noted already related to the company name and ticker symbol change, QIPT executed a reverse split in May. Many investors are wary of reverse splits as they are quite often made from a position of weakness. In the case of QIPT, the reverse split was necessary to be uplisted to NASDAQ and coincided nicely with their name/ticker symbol change. Again, while this has created short-term confusion or hesitancy, it should have no impact on the value of the company.

Reporting Change

Earlier this year, and consistent with its move to the NASDAQ, QIPT changed its financial reporting from CAD to USD. While this again has zero impact on the actual value of the company, it does create opportunities for further confusion. Most especially this is the case in comparing financials from previous years. Since CAD are less valuable than USD, it appears at first glance that QIPT’s headline numbers are not as good as expected. While people might be inclined to write off that impact and assume all investors will understand and properly translate, I have had several investors reach out to me in the past with questions that resulted from confusion around converting CAD to USD.

By themselves, none of these individual changes should have too large of an impact on QIPT’s share price. But when you combine all five of these changes—all of which happened almost simultaneously - and then add in the warrant overhang, you have significant pressure and confusion around a company and its stock. But instead of worrying about this temporary situation, I have been taking the opportunity to buy even more QIPT shares. Why? Because their fundamental business, organic growth, and acquisition pipeline is stronger than ever.

Acquisitions & Organic Growth

When I tell the QIPT story to fellow investors, I inevitably hear of two concerns. The first is that the company has been and remains acquisitive, and most investors have rightfully become cautious of companies that focus on “roll-ups” or who stumble in integrating acquired companies. The second point of caution is that QIPT’s organic growth has been rather weak lately. I wish to address both points.

Acquisitions

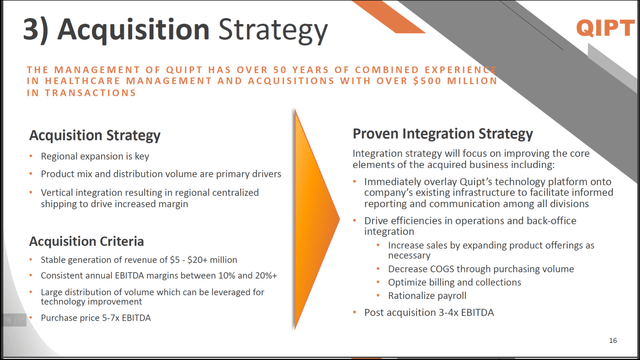

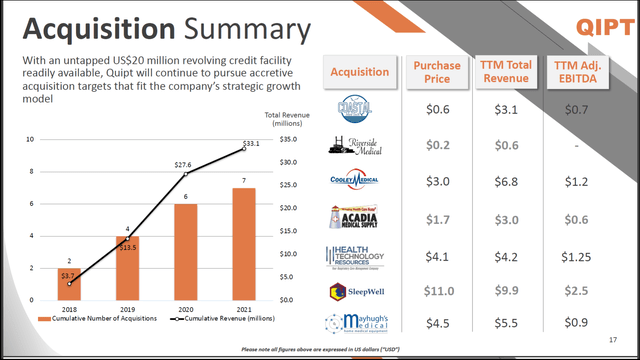

I cannot overemphasize the fact that QIPT is first and foremost, an operating company in the home healthcare services space. That is to say, QIPT is NOT a company specializing in financial engineering via roll-ups. This is a key distinction. QIPT’s CEO Greg Crawford is an entrepreneur in this space, having started his own company from scratch and eventually being acquired and brought into QIPT’s fold. With all due respect to Greg, he is not a financial wizard, but a respectable and competent operator who is laser-focused on acquiring businesses he knows he can integrate into QIPT, making them more efficient than they could ever be as a stand-alone company.

Further, Mr. Crawford and team emphasize finding acquisitions that they can operate well post-closing. They have zero interest in acquiring companies for purely financial reasons. At the same time, the company refuses to overpay for another company, recognizing there are literally hundreds of possible acquisition targets throughout the US, meaning they have dozens of opportunities. In fact, according to the company’s most recent earnings call, they have over a dozen possible acquisition targets in their pipeline.

Source: QIPT Investor Presentation

Source: QIPT Investor Presentation

Once QIPT acquires another company, they are able to integrate them into their system rather seamlessly. Usually, within two quarters, QIPT sees the acquired company’s EBITDA margins come into line with its own, as they highlighted on the earnings call. This is accomplished through synergies in operations, as well as by plugging the newly-acquired company into QIPT’s technology-driven ecosystem.

For example, using QIPT’s technology, acquired company’s patients can easily join QIPT’s automatic re-order system, which at appropriate intervals sends the patient new supplies and bills their insurance accordingly. Most acquired companies do not have this type of technology and, therefore, see less regular and consistent business. In addition, QIPT is able to cross-sell their existing product lines into acquired customer accounts where some of those products were not previously offered.

For example, if QIPT enters a market through acquiring a sleep wellness company, they can then use the acquired salespeople to cross-sell their oxygen products to acquired customer accounts, as well as to other, potential new customers in that region.

Organic Growth

To date, QIPT’s organic growth has underwhelmed many investors. I believe that is about to change. The primary reason for the lack of organic growth has been Covid-19. QIPT, as a stand-alone, is a relatively new company. Just as they were prepared to enter a period of strong organic growth following some nice acquisitions, Covid-19 hit. Along with most everyone else in the world, QIPT’s best-laid plans were interrupted. However, with the worst of Covid seemingly behind us, QIPT has already started to show significant improvement in organic growth. To wit, the company posted organic growth of 13% in its first two quarters of fiscal 2021, as highlighted in the linked earnings press release above.

During Covid, QIPT salespeople were able to have only limited contact with physicians and patients, severely hampering their ability to increase sales organically. This especially hurt QIPT’s ability during 2020 to cross-sell into newly acquired accounts, as I noted above is their goal and plan when acquiring companies. As we continue through 2021, I expect QIPT’s organic growth to continue well into the double digits, drastically outpacing their prior-year results.

Risks

Any time a company acquires another company, there is a risk the integration will not work according to plan. So far, QIPT has a history of strong integration (see immediately below slide 17 in the linked investor presentation).

While management has talked, including on the last conference call linked above, about a possible larger acquisition (in the $30-75M revenue range), they mostly focus on the $5-$20M revenue range. These relatively small companies are obviously easier to integrate, on average, than potentially larger acquisitions. But regardless of size, there is always a risk integrating two companies.

While management has talked, including on the last conference call linked above, about a possible larger acquisition (in the $30-75M revenue range), they mostly focus on the $5-$20M revenue range. These relatively small companies are obviously easier to integrate, on average, than potentially larger acquisitions. But regardless of size, there is always a risk integrating two companies.

Another possible risk for QIPT shares is a capital raise, most especially one that involves warrants. As their most recent investor presentation indicates, the company currently has roughly $27M of cash on hand. In addition, they have a $20M revolving credit facility at LIBOR plus 2.0-2.5%, depending on the amount outstanding. According to sources familiar with the company, QIPT could expand that credit line, but currently is not doing so because it is not cost efficient until such time as QIPT might actually want the additional money.

As a result of available cash and credit, QIPT should only need to tap into the capital market for a large, accretive acquisition. Since they are now in a position of relative strength, one would expect they would be able to find a deal that does not include warrants, so as to avoid scenarios like the current overhang.

Another risk with QIPT is that they are subject to possible changes in reimbursable rates. The vast majority of their revenue comes from Medicare/Medicaid and health insurance providers. This risk has been significantly mitigated by CMS’s cancellation of the 2021 bidding program. The company has highlighted the extremely positive impact of this cancellation as it relates to their specific business on slide 9 of the investor presentation linked in this section. The result of this cancellation is that QIPT has clear insight into reimbursable rates for at least the next three years.

Valuation

Simply put, QIPT’s fundamental business has never been stronger. They continue to seamlessly integrate acquisitions and are now showing strong organic growth, which is expected to continue post-pandemic. For the reasons I outlined above, I believe their stock has suffered and may continue to experience some headwinds until or slightly after the June 29, 2021 warrant expiration. After that, I expect the stock to be free to run towards fair value.

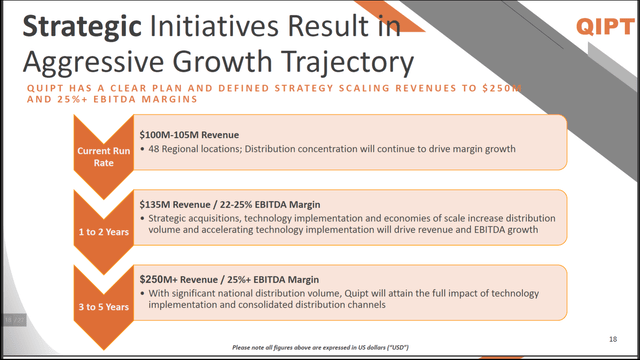

What is fair value? As QIPT’s investor presentation linked above shows, industry peers tend to command 9-15x EV/EBITDA valuations on expected current year EBITDA estimates. Keeping in mind that over 75% of QIPT’s revenue is recurring (see the latest earnings release), I believe it is fair to value QIPT at a minimum of 10x EV/EBITDA on its estimated EBITDA run rate within one calendar year. Currently, based on both company guidance and analyst expectations, I am comfortable assuming that QIPT’s annual run rate of revenue within one year will be $125M.

Source: QIPT Investor Presentation

I also assume that margins will continue to expand by that time to the 23% range. That would lead to an EBITDA run rate of $28.75M. Putting on a 10x multiple and adding back in the adjustments from EV to market cap leads to a market cap of roughly $290M and a share price of roughly $9.50/share. From the current price range, this valuation would lead to 60% returns. And, to be clear, I believe QIPT would be fairly valued NOW at that $9.50/share price range.

But what about the future? What about beyond this next year, with QIPT looking to grow the business significantly more? Well, according to management guidance on the earnings call and in the investor presentation, I think it is reasonable to estimate QIPT’s annual revenue run rate in three years from now at roughly $215M. I also believe by that time QIPT will meet or exceed EBITDA margins of 25%, per their guidance, leading to an annualized EBITDA run rate of $53.75M. With the 10x EV/EBITDA margin plus minor adjustments for market cap, I believe the company should be worth over $540M, or over $17.50/share. That share price represents a triple from the current share price range.

Although these projected returns are impressive in their own right, I would like to highlight three possible scenarios for even further upside: (1) management has historically exceeded their own guidance/targets for both revenue and EBITDA, meaning my estimates could be low; (2) the 10x EV/EBITDA multiple could expand significantly as QIPT receives more institutional coverage and has a longer track record; a 12-15x EV/EBITDA valuation is within the range of possibilities, especially given the recurring nature of the majority of QIPT’s revenue; (3) QIPT is likely to become an acquisition target itself as they continue to grow, which could command further upside from my estimates.

Conclusion

In summary, while the current warrant overhang, combined with the multiple changes at QIPT highlighted in this article, can be frustrating for investors, the situation also offers us an attractive opportunity to pick up additional shares on the cheap. The warrant overhang and other headwinds are likely to resolve around the end of this month.

At that point, given the strength of QIPT’s core business and the increased exposure to US investors, I expect the stock to return closer to current fair value, which I estimate to be around $9.50/share (60% upside from current prices). Furthermore, as QIPT continues to execute on its organic and inorganic growth initiatives, I believe the stock could triple within three years.