Successful CEO Derek Wood has had many interviews about his up-and-coming gold exploration company Tocvan Ventures Corp. in Mexico. (CSE: TOC; WKN: A2PE64) given. But the new interview, which was published yesterday after the market closed, is without a doubt one of the best and most informative interviews we have seen so far. He explains in a factual manner what sets Tocvan apart from other exploration companies: The share structure, which means that shareholders are rewarded above average.

The interview with German voice actors is available below:

• The original English version of the interview is available here .

• At the beginning of the interview, Derek explains how his team managed to make Tocvan one of the best performing stocks in the gold market, emphasizing that there is still great potential for much higher stock prices.

Full screen / source

• Derek comes from a time when a successful mining project rewarded shareholders far more than the average today. With this in mind, Tocvan was founded. Everything was done to keep the group of shareholders as small as possible and as few shares as possible were issued, precisely for the benefit of the shareholders. How did he do it? By not issuing a huge amount of cheap stocks internally or to people who were there from the start.

• Tocvan has only 28 million shares outstanding and at yesterday's closing price of $ 1.40 a market valuation of $ 40 million, which leaves plenty of room for higher share prices in the future.

• Below is the article from yesterday when Tocvan reported on new drill results:

Tocvan Drill Results: New 500m gold deposit discovered parallel to the established Main Zone

Great prospects for growth: The planned open-cast mine is getting bigger and bigger and therefore more attractive for large gold mining companies

New drilling results have arrived!

• Today , Mexico-based gold explorer Tocvan Ventures Corp. (CSE: TOC; WKN: A2PE64) another round of very encouraging drill results, with which a new gold zone (4-trench extension) was officially discovered, which is 500 m long and runs parallel to the known main deposit (Main Zone). Since the gold grades achieved are higher than the minimum requirements (approx. 0.4 g / t gold) for an open pit mine in Mexico, the entire gold deposit could be greatly enlarged with today's drilling results, so that an even larger open pit mine can now be planned.

• Drill results from 3 additional holes are pending and should be released shortly.

• Approval for the US stock exchange listing is also expected at any time, with which US-Americans can trade Tocvan shares for the first time. Since Tocvan only has 28 million shares outstanding, the large US investor market can have a huge impact on the stock.

Tocvan's Chief Geologist, Brodie Sutherland, commented on the importance of today's news : "Drilling along the 4-Trench Extension target has begun to define a new trend for 500 meters adjacent to our Main Zone. We are seeing mineralization in every hole along the Trends with grades in excess of 1 g / t gold in holes JES-21-53 and JES-21-44 which are 100 meters apart This first drill run has begun to reveal the potential of a new trend parallel to our main zone , which we will continue to test with enthusiasm with our next drilling phase. "

As the map released today shows, drill hole JES-21-53 hit the bull's eye : 15.3 m @ 1.1 g / t gold (at just 37 m depth) and 1.5 m @ 4.6 g / t gold :

Full screen / Since this is the discovery of a new gold zone, it can be expected that follow-up drilling in this zone will achieve even better gold grades, as the zone can now be drilled more precisely.

The map shows the drilling results published today (in green), with which a 500 m long gold zone parallel to the main zone (red area) could be detected. The laboratory results of 3 further boreholes (in red) are still pending, whereby 2 boreholes have been completed far outside the main zone and the main zone can thus be enlarged very much. The results published to date from the Phase 1 and Phase 2 drill programs (in black) have been a great success and include strong gold grades over long distances near the surface of the earth, such as:

• 47.3 m @ 0.80 g / t gold equivalent directly on the earth's surface (drill hole JES-21-47; see here ): This stepout hole was able to enlarge the main zone by 100 m to the south.

• 35 m @ 0.72 g / t gold equivalent at 98 m (drill hole JES-21-43; see here ): This stepout hole was able to enlarge the main zone by 100 m to the east.

• 53.4 m @ 0.65 g / t gold (drill hole JES-21-38; see here )

• 94.6 m @ 1.6 g / t gold (drill hole JES-20-32; see here )

• 41.2 m @ 1.1 g / t gold (drill hole JES-20-33; see here )

• 24.4 m @ 2.5 g / t gold + 73 g / t silver (drill hole JES-20-36; see here )

For comparison : the planned San Francisco gold mine of Magna Gold Corp. (Market cap: $ 84 million) has 1.4 million ounces of gold (M&I) resource at an average grade of 0.446 g / t gold . Such gold grades are therefore the goal of Tocvan in order to be able to realize an open pit (or a takeover by a large gold mining company). The San Francisco gold mine is also located in Sonora (only 18 km from Tocvan's second project, Picacho , and approx. 200 km from Pilar).

The direct neighbors of Tocvan's Pilar gold project include the Santana gold mine of Minera Alamos Inc. (market capitalization: $ 265 million) with average grades of 0.65 g / t gold and the Colorada gold mine of Argonaut Gold Inc. (market capitalization: $ 997 million) with grades averaging 0.59 g / t gold . Both are highly profitable gold mines, which are mined with an inexpensive open pit.

Full screen / The Pilar project is located only 50-80 km from 2 major gold-silver projects: Argonaut Gold Inc.'s La Colorada gold mine and Minera Alamos Inc.'s Santana gold mine (production started recently).

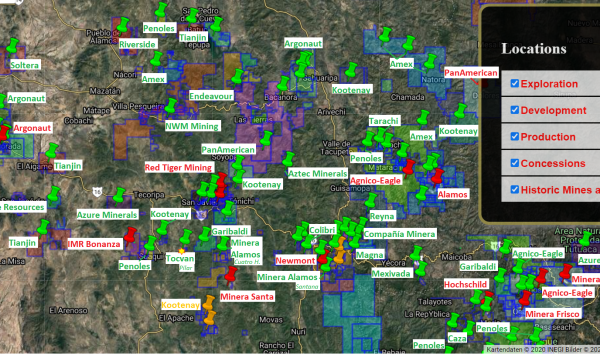

Full Screen / The Pilar Project is located near gold mines (red) as well as gold development (orange) and exploration (green) projects. Source: Mexico Mining Center

Tocvan: Takeover candidate # 1 in Sonora

For the mining and investment giant Osisko Gold Royalties Ltd. (Market capitalization: $ 2.8 billion) , good drilling results and a 50,000 t bulk sample were sufficient to test out at the young gold explorer Minera Alamos Ltd. to participate with $ 10 million, with which money the mine construction was financed. Today this once small gold explorer Minera Alamos Inc. has a handsome market value of $ 265 million. and with> 800% return in the last 2 years was one of the best performing gold stocks worldwide. Minera's Santana gold project is located just a few kilometers from Tocvan's Pilar gold project and is expected to be brought into production as quickly as Santana. According to his own statements, Tocvan is already in negotiations with several large companies to dismantle a large sample. A corresponding announcement would make Tocvan an immediate prospect for mines.

The Pilar Gold-Silver Project: In the midst of large gold mining projects

Tocvan's Phase 1 drill program (December 2020) has sometimes achieved better drill results than most of the drill results from Argonaut Gold Inc. and Minera Alamos Inc. ( see here ).

Both Argonaut and Minera have successfully proven over the last few years that gold grades in the range of 0.5 g / t gold are sufficient to operate a highly profitable open pit mine in Mexico, as the production and mining costs there are comparatively low.

Santana gold project

Owner: Minera Alamos Inc. (TSX.V: MAI; shares in market: 444 million; market capitalization: $ 265 million CAD)

2018 Phase 1 drill program (highlights; see here , here , here and here ):

93.5 m @ 0.65 g / t gold (from 2 m depth)

80.4 m @ 1.05 g / t gold (from 19 m depth)

95.7 m @ 0.85 g / t gold (from 32 m depth)

127 m @ 0.81 g / t gold (from 23 m depth)

• Shortly after this drilling, Minera Alamos also successfully mined a bulk sample for test mining purposes: 50,000 t of ore achieved an average gold grade of 0.65 g / t , so that approximately 1,000 ounces of gold were extracted. Since Tocvan has almost 3 times as much gold directly at the earth's surface ( 28 m @ 1.89 g / t ) , Tocvan could extract around 3,000 ounces of gold worth $ 7 million CAD with a 50,000 t bulk sample . With this alone, the costs for mine and plant construction (approx. $ 10 million) could be almost completely covered.

• The drilling and bulk sampling results obtained by Minera Alamos (even without resource estimates and feasibility studies) were sufficient for Osisko Gold Royalties Ltd. (TSX: OR; market capitalization: $ 2.8 billion CAD) to acquire a stake in Minera Alamos in 2019, which gave Explorer the money (approx. $ 10 million) needed to develop Santana into a mine.

Conclusion & outlook

Tocvans CEO Derek Wood has already talked last year about how happy the whole team with the Pilar gold project is, as in the Main Zone already 17,000 meters were completed on holes (from previous operators mainly recorded in the 1990s, when the gold price below $ 500, and in the 2010s when the price of gold was in a long-term correction).

But now, after 2 successful drilling programs and a gold price well above the production costs of an open pit mine in Mexico, the real size and the realistic gigantic potential of Pilar is evident. Tocvan did everything right, at an impressive pace during a global pandemic that has brought many things to a standstill. In Mexico, however, the clocks tick differently and the project was able to move forward without significant delays: drilling programs were approved and implemented quickly, while the laboratories in Mexico delivered the drilling results at an impressive pace (in other parts of the world shareholders waited more than 6 months for drilling results, not to mention approvals from the authorities).

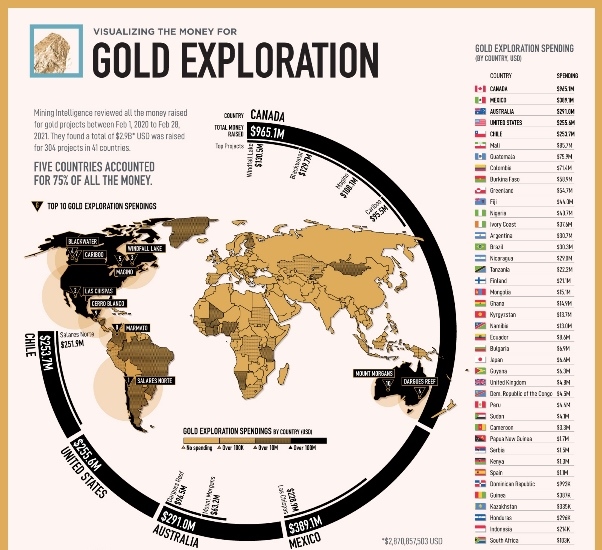

Especially during the Corona crisis, many investors became aware of the advantages of a gold project in Mexico. As the graph below shows, Mexico ranks 2nd among all countries in the world in terms of gold exploration spending. That says (almost) everything: In no other country (except Canada) flows as much money into gold exploration as in Mexico. The mining and exploration companies know exactly why Mexico is so attractive. Mind you, this graph is up-to-date and relates to global exploration spending between February 2020 and February 2021:

Full screen / source

In Pilar's long history, Tocvan was the first company to venture outside of the Main Zone to enlarge the deposit. Such step-out drilling is always riskier than drilling in areas of known gold mineralization. This courage has more than paid off, because Tocvan was able to detect minable gold grades directly or near the earth's surface with his drillings outside the Main Zone. The laboratory results of 3 further holes are still pending and should be published shortly.

Take Minera Alamos, for example : the gold explorer has impressively demonstrated over the past 2-3 years how quickly a gold project in Mexico can be brought into production. Minera acquired the Santana Project from another company at an opportune time when the price of gold was low. Minera completed 2 drilling programs and extracted a 50,000 t bulk sample, which demonstrated minable gold grades averaging around 0.6 g / t gold. Since the price of gold has risen sharply in recent years, these results alone were enough to win Osisko Gold Royalties Ltd. (Market capitalization: $ 2.8 billion) as a strategic partner who financed the mine construction (approx. $ 10 million) (ie without an official resource estimate and feasibility studies). In other parts of the world it takes a lot longer to get a gold project into production. The Santana gold mine was built in record time, recently completed and is now set to become a showcase of how fast things can go in Mexico.

The advantage of Tocvan : The Pilar project is only a few kilometers away from Santana and is geologically absolutely comparable, if not more highly mineralized with gold than Santana. It is only a matter of time before a "senior" like Osisko knocks on the Tocvan door and wants to become a strategic partner. To get on the same stock market valuation as Minera Alamos ($ 265 million), Tocvan's stock needs to be $ 9.32 increase (currently $ 1.38). That may sound high, but Tocvan only has 28.4 million shares in the market and, despite the considerable share price increase in recent months, still has a comparatively cheap stock market valuation of only $ 39 million. So the journey for us shareholders has only just begun and we can look forward to it which "Senior" will become Tocvan's strategic partner.

In any case, the interest is already there, as CEO Derek Wood recently told in an interview ( see here ): A group has offered Tocvan $ 20 million to acquire a 33% stake in Tocvan. But Derek Wood turned it down because he wanted to keep the stock structure in check. He is not ready to sell so many company shares at this price (which means that the current stock market valuation is still far too cheap for him). Right from the start he always emphasized how important it was to him to protect his shareholders from dilution as best as possible. Success proves him right.

For several weeks now, we shareholders have been waiting with great excitement for approval for a US stock exchange listing . So far, Tocvan can only be traded in Canada and Germany. Since there are very, very few stocks in the market (28.4 million shares issued), the huge US investor market can have a huge impact on stock prices. A new interview with popular US radio host Ellis Martin ( see here ) could noticeably increase the demand pressure on Tocvan shares, as US investors are known for their interest in Mexican gold-silver projects.

New gold price upswing in the starting blocks

Full screen / source

Full screen / source

Updated chart

Junior gold stocks like Tocvan enable the highest possible return in the gold market

Full screen / The GDXJ Junior Gold Miners ETF vaneck indicated that young ( "Junior") Goldexplorer- and gold mining companies are at the beginning of a strong uptrend. Junior gold stocks in particular offer significantly more opportunities for returns than established seniors, who can usually only achieve growth by taking over juniors. source

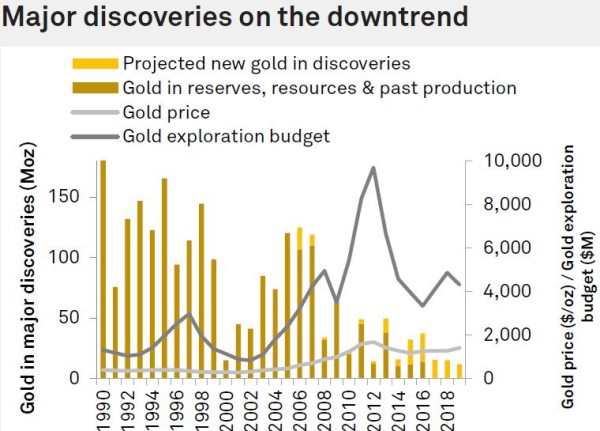

New gold discoveries have become a rarity (i.e., all the more interesting for seniors)

Full screen / source

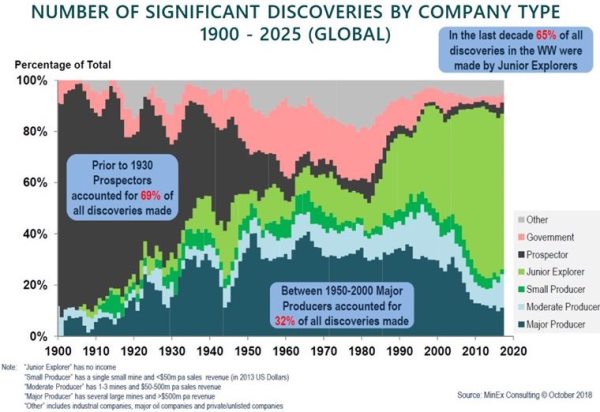

Gold explorers like Tocvan are responsible for most new discoveries (and therefore enable the greatest possible return in the gold market)

Full screen / source