Alfio Manciagli/iStock via Getty Images

Alfio Manciagli/iStock via Getty Images

It's been a rough couple of months for the Silver Miners Index (SIL), and one of the worst performers has been Aurcana (OTCQX:AUNFF). While the silver price (SLV) is down 5% year-to-date, which is not surprising after an incredible run, Aurcana has slid more than 26%, massively underperforming its peers. While a restart for the Revenue-Virginius [RV] Mine is a positive upcoming catalyst, the issuance of more options in Q2 and significant warrants outstanding suggests that the current outstanding share count could grow materially. Given the potential for significant further dilution over the next year from warrants and options being exercised, I continue to see better opportunities elsewhere in the sector.

(Source: Company Presentation)

(Source: Company Presentation)

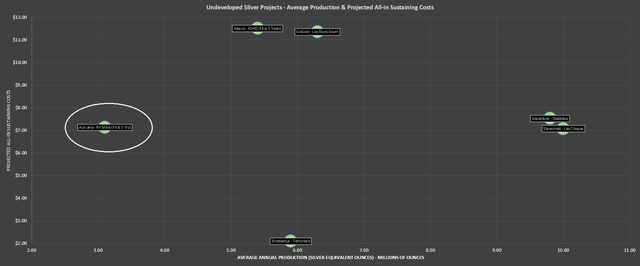

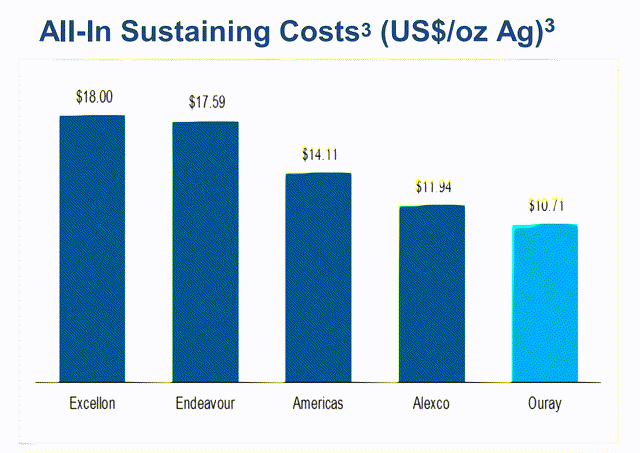

With September soon approaching, investors can finally look forward to the Revenue-Virginius Mine starting back up after a nearly 7-year hiatus. As noted in the most recent Feasibility Study, the Colorado mine is expected to produce ~3.1 million silver-equivalent ounces [SEOs] per year for its first five years at industry-leading all-in sustaining costs [AISC] of $7.38/oz after by-product credits. With higher zinc and lead prices per pound than used in the study ($1.20/pound and $1.00/pound, respectively), AISC could come in closer to $7.00/oz, making the RV Mine one of the highest-margin silver mines in the sector, with a premium for the company's Tier-1 jurisdiction. Based on the recent update, full production is expected by September, with a ramp-up beginning next month.

(Source: Company Filings, Author's Chart)

(Source: Company Filings, Author's Chart)

If we compare the RV Mine to other undeveloped projects above, we can see that while RV has one of the smallest production profiles of its peers (~3.1 million SEOs) vs. an average of ~8.0 million SEOs, it ranks quite well from a margin standpoint, being one of the lower-cost projects in the sector. While SilverCrest's (SILV) Las Chispas and AbraSilver's (OTCQX:ABBRF) Diablillos are expected to have similar costs, RV benefits from being in a much more favorable jurisdiction vs. Las Chispas in Mexico and Diablillos in Argentina. Besides, while the Feasibility Study was based on a throughput rate of 270 tons per day, unit costs would drop further if the company can fill the plant to its nameplate capacity of 400 tons per day.

(Source: Company Website)

(Source: Company Website)

As noted in the July update, development ore is expected to be delivered to the processing plant this month, with throughput being ramped up to 110 tons per day in August and to 270 tons per day (full production) in September. This should translate to the production of up to ~1.6 million SEOs between August and year-end. If we assume a conservative average sales price of $24.00/oz for silver, this would translate to ~$38.4 million in revenue, leaving Aurcana trading at 5.3x FY2021 sales. This calculation is based on an enterprise value of ~$204 million, with ~275 million shares outstanding, a share price of US$0.64, and $28 million in debt. Let's take a look at the valuation:

(Source: Company Presentation)

(Source: Company Presentation)

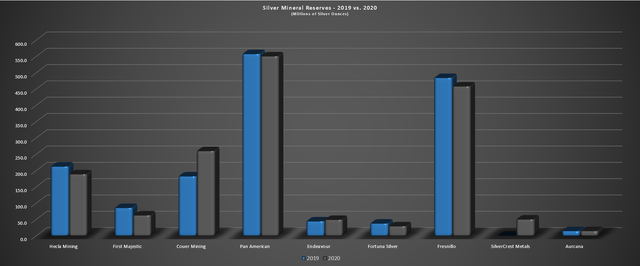

Given Aurcana's industry-leading projected costs and Tier-1 jurisdiction profile, which makes the company a stand-out name in a sector where most producers operate in Tier-2 jurisdictions (Mexico, Peru, China, Bolivia), I see a fair value of $10.00 per reserve ounce. If we multiply this figure by ~21.2 million ounces of reserves, we arrive at a fair value of $212 million, which is in line with the current enterprise value (I have excluded $26 million in cash in case extra cash must be spent due to a slower ramp-up than planned).

(Source: Company Filings, Author's Chart)

(Source: Company Filings, Author's Chart)

If we assume up to 10% reserve growth net of mining depletion (~23.3 million SEOs) once the company can begin using free cash flow to drill near-mine and regional targets, the fair value jumps to $233 million, or US$0.85 per share based on ~275 million shares outstanding. If there weren't a significant amount of outstanding warrants and options, this would suggest Aurcana might be undervalued. However, this isn't the case, and the fully diluted share count has grown even further recently.

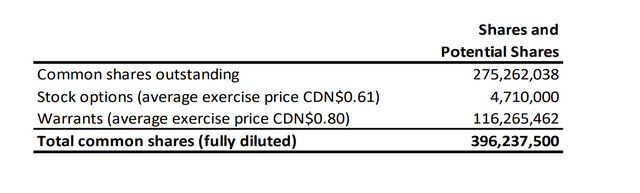

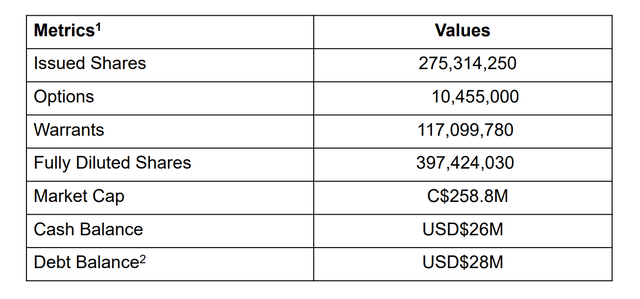

(Source: Management Discussion & Analysis)

(Source: Management Discussion & Analysis)

As shown above, while Aurcana has 275 million shares outstanding, it recently issued another 6 million incentive stock options at C$1.10, which is below 52-week highs, which is on top of ~4.7 million options at C$0.61. This has pushed the fully diluted share count to ~403 million shares, with ~117 million warrants outstanding at an average price of C$0.80 and just shy of 11 million options at an average price of C$0.89. Assuming 50% of options and warrants are exercised, this would translate to a more than 20% increase in the share count, affecting the stock's valuation. So, while the stock might look very reasonably valued based on the current share count, the valuation is less compelling with the potential for significant share dilution over the next year. Let's look at the technical picture:

(Source: Company Presentation)

(Source: Company Presentation)

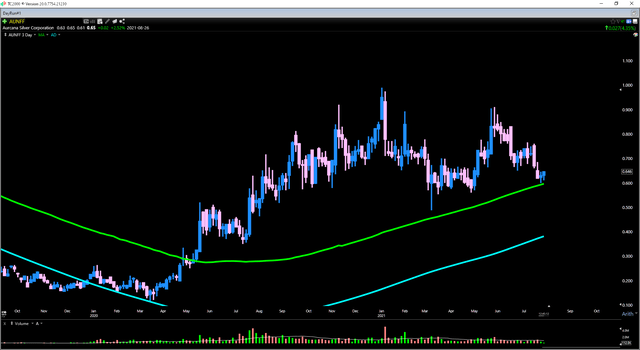

If we look at Aurcana from a technical picture, the stock is coming into a potential support zone near US$0.60 and could certainly put together a bounce with the announcement of commercial production less than six months away. This could easily translate to a 30% plus rally in the stock, with minimal resistance until the US$0.84 level. Having said that, there are several other names in the silver space that are also oversold, but with what I would argue to be superior fundamentals that are already generating free cash flow and don't have a strong likelihood of 10% plus share dilution in the next year. Therefore, while Aurcana would work as a bounce play here, I still see the stock as high-risk, high-reward.

(Source: TC2000.com)

(Source: TC2000.com)

From a trading standpoint, Aurcana is beginning to get oversold and remains in a long-term uptrend as long as it can hold above the US$0.56 level. As noted, it's certainly possible Aurcana could put together a strong bounce after a 30% correction since June. Still, with further share dilution likely, and less than 30% upside to its conservative fair value before potential dilution, I don't see a compelling investment thesis here. Obviously, a rising tide in the form of the silver price will lift all boats, but I think there are safer ways to get leverage to silver.