Brad Scharfe invests in early-stage North American and Asian companies that have the potential for long-term sustainable growth.

The Scharfe Investment Group of Companies notes that it provides "venture companies with access to the potentially immense benefits of being a publicly listed company including: increasing exposure, building credibility, gaining accessing to large pools of public capital all accelerating companies' prospective growth."

The Scharfe Group has expertise in a broad range of industries including "natural resources, oil and gas, technology, biotechnology, media, alternative lending and telecommunications."

Streetwise Reports recently sat down with CEO and President Brad Scharfe on a sunny patio at Broadway and Fir Street in Vancouver.

When we asked Mr. Scharfe about the origin-story of his fund, he immediately balked at the term "fund."

"Let's talk openly," said Scharfe. "I manage a family office that has access to a considerable amount of capital. I'm not a registered fund; I'm not a licensed body."

Scharfe describes himself as an "ex-broker" who 25 years ago gained extensive experience on the brokerage side of things—"celebrated the successes and took responsibility for the failures."

"We've taken everything we've learned and used that knowledge to back management teams, and in particular to back founders on an early-stage financing basis," stated Scharfe.

Scharfe describes the five stages of financing.

"Stage 1 is typically my money and family-office money."

"Stage 2 involves my money, family-office money and a close group of associates, perhaps a broker from RBC, Leede Jones Gable and CIBC."

"Stage 3, we make introductions to new investors and follow up on those introductions."

"Stage 4, we open the doors to larger groups, who are willing to invest greater sums and act as long term, flexible capital partners."

"Stage 5, the project is maturing and likely moving out of our sphere."

Scharfe looks for "talented founders with great ideas who need $500,000 to create a legal, accounting and auditing team to help them go public."

The Scharfe group is 99% focused on the go-public process, which means a lot of good ideas need to be discarded.

Scharfe explains that the market is typically focused on hypergrowth stories. A solid, profitable, incrementally growing company is not a marketable commodity.

"The challenging side of the venture capital market is having the right amount of timing and patience," confirmed Scharfe. "Ideally, investors will take the time to understand what they've invested in. But that often doesn't happen."

"We've had deals that have come out the gates and were forced to pivot, and then needed a breather," added Scharfe. "But the only question on investors' minds is: 'when is the stock going to double again?' 'Why is the stock not up?'"

Scharfe observes that the regulatory environment adds to the challenges of a young publicly traded company.

"On the filing side of things, it's gotten so cumbersome that it's ridiculous," declares Scharfe, "I don't know if it's intentional, I don't know what the conspiracy theorists would say."

Investor impatience and regulatory red tape are not the only hazards in play.

Silicon Valley angel investor Marc Andreessen said this about technology start-ups:

"It's not Coke & Pepsi—and a bunch of others. It's winner take all. Second prize is a set of steak knives. Third prize is you're fired."

Andreessen stole the line from American playwright David Mamet—and his point is probably over-cooked—but he's right: the battlefield for new tech companies is littered with the bodies of soldiers who arrived too late.

The mantra of "first-mover status" echoes over the venture markets.

One of Scharfe's portfolio companies is Marble Financial Inc. (MRBL:CSE; MRBLF:OTC; 2V0:FSE), which uses machine learning, data science and artificial intelligence to empower thousands of marginalized consumers to achieve a positive financial future.

"The company also has a unique program that allows lenders to see beyond a credit score number," reported Streetwise Reports on June 29, 2021.

"Marble Financial is aggressively expanding its ground-breaking programs for the financially underserved, with plans for hockey stick growth from the current 20,000 users to 100,000 by year-end, and 1 million users in 2022."

"Nearly two-thirds of Americans, 63%, say they are living paycheck to paycheck, according to CNBC, and 53% of Canadians are in the same situation," BDO Canada reports.

"We are finding that people are very much paying attention to their debt and credit because they know that they have to better manage their financial fitness through these uncertain times," Mike Marrandino, Marble's executive chairman, told Streetwise Reports.

In April, Marble acquired Inverite Verification Inc., a banking verification artificial intelligence company, that connects with 275 financial institutions and calculates a risk score based on banking verification requests and loan behaviors.

"Marble is uniquely positioned to aggregate both credit and banking data with two major distinguishing capabilities: using artificial intelligence and personal recommendations to improve personal financial health, and its focus on the underbanked, whereas other industry players are focused on the segment of the population that is banked," confirmed Scharfe.

"The underbanked segment of the North American population has been significantly increasing over the past few years, and COVID has created an even bigger business opportunity for Marble, as well as opportunity to do considerable social good," Scharfe added.

"I think Marble is one of the most significant opportunities on the exchange," stated Scharfe. "It's one of those stories that has that scalability in the financial markets, the fintech is strong, the management team is in place."

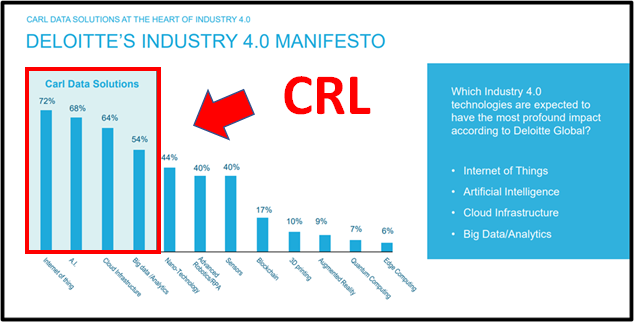

Another technology company in Scharfe's portfolio is Carl Data Solutions Inc. (CRL:CSE; CDTAF:OTC; 7C5:FSE).

Carl Data works with new cloud-based mass storage services and machine learning analytical tools to monitor large amounts of industrial and government data.

A developer of Big-Data-as-a-Service-based solutions and Industrial Internet-of-Things applications, CRL saves clients time and money by aggregating information from any sensor or source to create a real-time decision support system.

"Data generated from sensors attached to machines on factory floors worldwide enables a supply chain manager to remotely pinpoint potential problems," writes Margaret Harris of Oracle.

On April 9, 2021, CRL announced that it has entered into a collaborative agreement with Think Quality Assurance (Think-QA) to accelerate CRL's entry into the renewable energy sector.

Think-QA provides quality assurance and quality control inspection services for some of the largest electrical utility companies in the world.

The company has an existing customer base that generates thousands of distinct data points. CRL can analyze complex data, identify risks and generate elegant solutions.

Historically, Carl Data retains 97.5% of its clients annually.

The global utilities market was valued at $4.2 trillion in 2020, according to a Research&Markets report.

Carl Data has a market cap of $14 million.

It is one of the portfolio companies Brad Scharfe is enthusiastic about.