Geber86/E+ via Getty Images

Geber86/E+ via Getty Images Reliq Health Technologies (OTCPK:RQHTF) (TSX: RHT), through its iUGO Care technology platform, is a telemedicine provider for community patients with two or more chronic diseases. The company is the first mover and only publicly-traded company to target this market opportunity which accounts for most health care costs in developed nations.

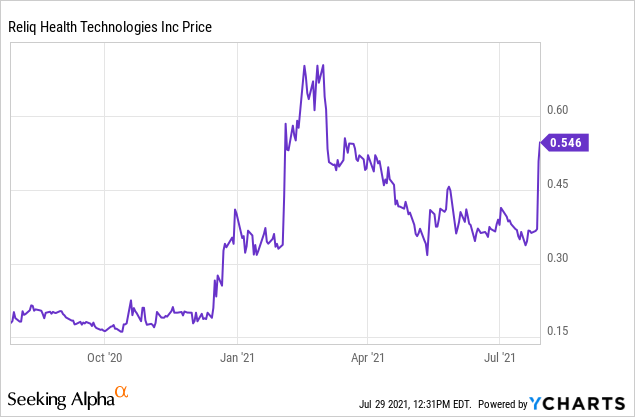

Investors drove the stock price to a gain of over 2000% between 2017 and 2018, but the stock price dropped as problems developed. The problems have been resolved, and the company is now battle-tested, having established its ability to reduce hospital readmissions, provide health care providers with new revenue streams and reduce health insurance costs. This is a formula for record annual earnings for the foreseeable future as Reliq has barely penetrated its addressable market.

The market is beginning to realize the positive developments detailed in this week's press release. Despite the recent stock price rally, the stock is still selling at low multiples. Nevertheless, the recurring revenue offers a reliable forecast of future earnings, pointing to a lucrative investment opportunity. In a recent call with CEO, Dr. Lisa Crossly, I asked, "What keeps you up at night." She responded, "Excitement!"

Data by YCharts

Data by YCharts The problem and the Reliq solution

Chronic disease patients left to manage their health on their own results in a high rate of preventable hospitalizations. The Centers For Chronic Disease Prevention ("CDC") reported that 75% of the over $2 trillion in healthcare costs in the U.S. in 2019 were due to chronic disease. In addition, the cost of treating chronic disease in the U.S. has been escalating from 6% of GDP in 2016 to 20% of GDP in 2019. Reliq, in concert with Medicare and Medicaid policy shift, is a first mover in providing a solution to curve the growth in chronic illness expense.

Medicare and Medicaid reimbursement models have changed from a fee-for-service basis to an outcome-driven model to lower costs from chronic diseases. As a result, caregivers are rewarded when the patient is successfully treated remotely and penalized when a patient returns to a hospital within 30 days to treat the same disease.

Reliq monitors patient’s vital signs while at home and provides alerts to medical teams when necessary. The IUGO platform also provides patients with reminders of when to take medicine and activity reminders for meals and exercise and provides reports that caregivers and family members can review. As a result, the company claims that its IUGO Care platform reduces hospitalization by 90%.

Revenue model

Reliq makes it a win for all parties involved. Patients stay healthier and at home. Medical care providers are hard-pressed to meet insurance requirements for monitoring patients but using the IUGO platform allows the medical team to perform more functions and adds new revenue streams of, on average, $315/month per patient. Medicare and Medicaid are glad to pay these fees as it is considerably lower than the cost of hospitalization. Proof of the Medicare/Medicaid seal of approval for remote and telemedicine services is the expanding billable remote services and fees.

Reliq receives, on average, $40/month per patient. The company has been adding services due to increased procedure approval from Medicaid and Medicare, and cross-selling new functions added such as virtual annual checkups, voice activation, and providing service in foreign languages. It appears we will see the average per patient revenue rise as several of the newly announced contracts are for $100/month per patient.

Private insurance companies are following the shift to outcome-driven reimbursement models by Medicare and Medicaid. I don't know how much that will impact Reliq as the company's typical patient population is mostly retired individuals,

The Reliq secret sauce

CEO Lisa Crossley explained why the larger telemedicine companies such as Teladoc (TDOC) aren't geared to serving community health centers. Community health centers can't afford multiple health records or systems that require more than a quick training session. Large telemedicine companies are focused on managing an employer's health insurance, while Reliq focuses on providing hand-holding to patients who lack the ability to help themselves sufficiently. Reliq's formula creates sticky customers who aren't likely to want to move their medical records to another platform once they sign on.

Reliq's average patient is an elderly person residing in a community facility, afflicted with chronic diseases, living below the poverty line, and on either Medicare or Medicaid. Patients with one chronic disease tend to have a second or more chronic disease. For example, patients with diabetes tend to have high blood pressure. 50% of chronic patients do not take their medicine as prescribed, resulting in complications because of memory or eye problems. Reliq's patients tend not to be tech-savvy and are reluctant to take their blood pressure or weigh themselves. The company caters to this population by connecting patients, clinicians, and healthcare administrators through the iUGO platform using wearables, sensors, mobile apps, and desktop computers; basically, any communication device will do, even data over cellular.

The bumpy start is in the rearview mirror

Reliq obtained its platform with the acquisition of CareKit Health in February 2016. The company improved and finalized the platform, hired a team, and began providing services in late 2017, perhaps a little bit too early. Medicare and Medicaid introduced the first reimbursement code for remote patient services in January 2018. Reliq wrote-off the entire revenue for one quarter as a bad debt expense due to coding issues.

Medicare and Medicaid have come to recognize the value that remote monitoring adds and now has 18 reimbursement codes for telehealth,upped the reimbursement maximum for care providers from $59 to over $300 per patient per month, and added coverage for more conditions. Texas followed suit with its remote patient monitoring program, which was initiated in 2014, covering only patients with hypertension and diabetes. Dr. Lisa Crossley said, “With the recent passage of Bill HB-3740, effective September 1, 2021, the Telemonitoring program in Texas is expanding dramatically to include an additional nine eligible conditions: pregnancy, heart disease, cancer, chronic obstructive pulmonary disease, congestive heart failure, mental illness, or serious emotional disturbance, asthma, myocardial infarction and stroke, more than doubling the size of the target patient population for Reliq in this state."

Coding issues were resolved, but then came Covid-19, which shut down operations for Reliq in Texas and Florida, where many facilities were converted for the treatment of Covid-19 exclusively. Reliq resumed onboarding new patients and providing services resumed to normal in May. The pandemic temporarily slowed down Reliq's growth, but it acceleratedthe growth of telehealth and remote monitoring, which Reliq is now reaping the rewards of.

The investor presentation states that 37 million Medicare/Medicaid chronic disease patients and 44 million private insured chronic patients. Including the 200,000 patient backlog results in the company having about 450,000 patients without adding any new customers. That's just 1% of their addressable market.

Financial

Insiders own about 8% of the shares. There are 158 million shares, 6.7 million warrants with a strike price of $.24 that expire Nov. 2022, 1.2 million warrants with a strike price of $.13 that expire between March 2022 and June 2024. Fully diluted, there are 176 million shares. The market cap is $93 M. There is $338 K in cash as of March 31, 2021. All of the warrants are in the money and can be converted to shares, adding to the cash position. Reliq expects to be profitable beginning next quarter. Revenue is predictable as it is recurring.

The company is on track to reach its target revenue of $8.8 million for this year and expects to be at a run rate of $1.6 million a month by the end of the year as it works through its backlog of 200,00 patients, which is expected to be completed over the next two years. The run rate will continue to rise as more of the backlog is worked through. Management guidance is for $25 million in revenue for next year with a 45% EBIDTA margin. The company estimate includes only existing customers and backlog. My estimate for revenues for next year is $50 million, as the company will gain new customers, which results in a price to earnings of 4x and price to sales of 2x. Beating forward guidance by a wide margin, achieving solid profitability at a fantastic growth rate is likely to take the stock price to more reasonable and higher valuation level.

The investor presentation states that 37 million Medicare/Medicaid chronic disease patients and 44 million private insured chronic patients. Including the 200,000 patient backlog results in the company having about 450,000 patients without adding any new customers. That's less than 1% of their addressable market.

Management has voiced their intent to uplist to Nasdaq early next year. I've noticed that Reliq isn't attending any investor conferences which are usually standard for companies doing a capital raise at the time of uplisting. Dr. Crossly confirmed that there won't be a capital raise unless the company signs on a large customer. In that event, a small capital raise will be done in order to upload the new patient data quickly.

Reliq's revenue growth is expected to be entirely organic. Dr. Crossley related to me that she hasn't come across any acquisition target that would be of interest and unlikely that one would come around in the future.

Risks

The company is dependent on private and government insurance policies, regulations, and reimbursement for its success. There is no guarantee that future insurance changes will not have a negative impact. While there is no direct competitor, telehealth has become a highly competitive industry. Reliq will need to continuously demonstrate that it is effective in reducing health care costs.

Conclusion

Reliq has a first-mover advantage in its niche, and the market opportunity is large enough for the company to thrive should competition arise. The company has survived early problems with insufficient reimbursement codes for Medicare and Medicaid and, more recently, work stoppage due to the pandemic. Despite the setbacks, Reliq has established that its platform reduces hospitalization rates for patients monitored, creates additional revenue streams for healthcare providers, and lowers the cost of insurance reimbursement. The company is on track to robust revenue growth and profitability. There is much room for stock price appreciation as forward numbers indicate the stock is selling at cheap multiples.