tifonimages/iStock Editorial via Getty Images

tifonimages/iStock Editorial via Getty Images

It was almost 500 years ago that the first expeditions set sail from the ports of Spain in search of the rumored El Dorado, a city with unimaginable riches. Despite countless expeditions spanning hundreds of years and costing thousands of lives, the fabled city was never found. The analogy is relevant as Gran Colombia Gold (TPRFF) operates in the same regions in which these expeditions took place, with two mining titles that have millions of ounces of gold deposits.

It was immediately clear to me that Gran Colombia's market price was not an accurate appraisal of their prospects. Determining why took much longer − and understanding why something is mispriced is an important piece of the investment puzzle. Just ask Renaissance Technologies. In the early 2000s, Renaissance Technologies (the most successful hedge fund in history) was analyzing more than a terabyte of data each day, which was a remarkable amount of data back then. Statistically significant patterns found in the data were only considered investable if the reason for their occurrence could be identified. The Renaissance team recognized that if they were unable to understand why there was a pattern, they could hardly have conviction in the pattern's continuation. In other words, if it is believed that something is mispriced, but the proximate cause of the mispricing is unclear, it should cast doubt upon the conclusion that it is mispriced at all.

In the case of Gran Colombia, it is not so difficult to appreciate why an undervaluation exists. By and large, I believe many potential investors are daunted by the sheer complexity of the business - as that is precisely how I felt when I first encountered the company. My objective for this article, however, is to address the significant risks being perceived, and why I believe they are misunderstood. I do not intend to get into the details of the operations or recent events, as recent Seeking Alpha articles describe them well.

The most consequential of investor worries, as I see them, are the jurisdictions in which they operate, as well as the reserve life index for their Segovia operations. Furthermore, how can one invest in a gold miner unless they are reasonably assured that future gold prices will render mining economical? I will offer my perspective on this also. Before I address these concerns, let's look at Gran Colombia's valuation.

Valuation

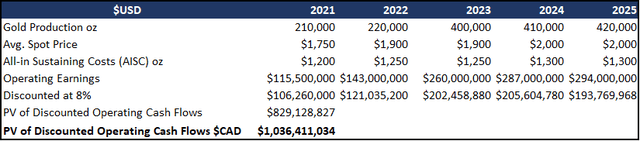

I like to approach valuation from the standpoint of being an owner of the entire business. Below are tables that explore production/profit scenarios using only their wholly owned mines (Segovia and Toroparu). I will seek to discern what the implied market values are for these core assets, and what kind of returns they might generate in the future. The tables that follow will help guide us through this valuation exercise.

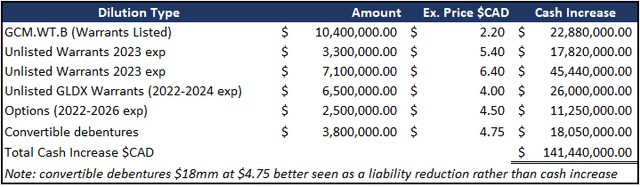

The chart below approximates the net cash increase or liability decrease that would result from the additional ~33mm share dilution (~98.5mm outstanding shares currently vs. 132.1mm fully diluted). Source: author's calculations

Source: author's calculations

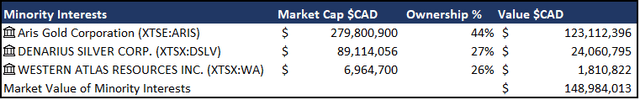

Since the focus here is on the core assets of the enterprise, I have deducted the minority equity investments. However, we can safely assume that management believes these investments are worth more than what they could receive in an orderly disposal in the public markets.

Source: author's calculations

Source: author's calculations

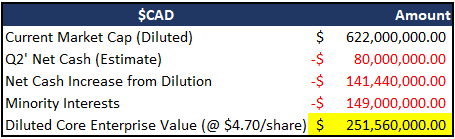

With the above calculations, we can now calculate the diluted core enterprise value.

Source: author's calculations

Source: author's calculations

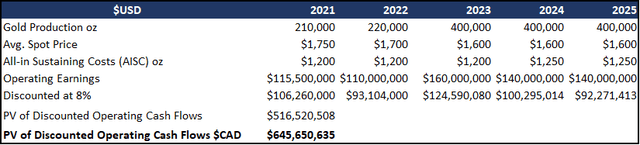

We now have an idea of what the implied core asset values are. Below are two tables that examine two return scenarios over a five-year period. For context, it is estimated that the Toroparu mine will begin producing ~180,000 oz/year within the next 24-30 months, and Segovia is currently producing 200,000 - 220,000 oz/year.

Source: author's calculations

Source: author's calculations

Source: author's calculations

Source: author's calculations

This means that Gran Colombia can be purchased at a core enterprise value of $260mm and they can plausibly produce $600mm - $1,000mm in discounted operating earnings from these core assets over the next five years. Another way to frame this is that the next five years of gold production can be purchased from GCM for $138 CAD/oz of gold ($220mm core enterprise value / ~1,600,000 oz over 5 years). It is conceivable that the company will generate $300-700/oz in operating profit over the same timeframe. It is also worth noting that Segovia's gold production has exceeded guidance (or the mid-range of guidance) each year since 2016.

Please note that the above table is not an NPV table. AISC, as the title implies, includes only costs to sustain a given level of production. I have not included the >$300mm in CapEx required for the development of the Toroparu mine.

Reserve Life Index Concern

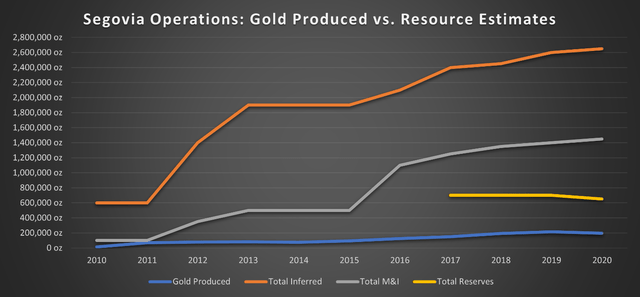

One of the primary concerns for investors is Gran Colombia's reserve life index. As of the most recent quarter, the reserve life index sits at approximately 2-3 years' worth of production. What if the M&I resources can't be translated to reserves over the next 24-36 months? I have created the chart below to ease this concern.

Source: author's calculations using 2011 - 2020 Annual Information Forms.

You will see in the chart that total reserves are roughly flat since 2017 despite ~750,000oz of gold being produced over the same period. Not to mention the fact that total M&I have risen. One could have made the same objection in 2017 about there being only a few years of reserves. That objection would have been misplaced then, as it is today.

Moreover, 2021 is set to be the most significant year of drilling yet (60,000m of drilling). The majority of which will occur in the other 24 known veins within the Segovia mining title that are not presently being mined. I expect that they will announce an increase in reserves by the end of the year as the result of this drilling campaign.

A friend of mine is a mining engineer, and I was curious to hear his take on the matter. "Exploration is expensive, why spend money translating M&I to reserves if it cannot be mined for several years anyway?". This was the answer I had anticipated. Though increasing the reserve life index might make investors feel more comfortable, it is not the best use of cash. Based on their exploration results, I believe the company will have a 2-5-year reserve life for many years to come.

Jurisdiction Risk

The unrest in Colombia has received global attention since the protests began in April of this year. The protests have stemmed from indignation related to poverty, economic disparities, and unemployment. The government has also received international censure for the use of excessive force, as well as "making protesters disappear" with dozens reported missing since the protests began in April. There have also been dozens of deaths and hundreds of injuries.

Though the situation is deeply lamentable, it has had no impact on Gran Colombia's operations thus far, nor is it likely to in the future. I have arrived at this conclusion in part through my own research, as well as through multiple conversations with management (who were very generous with their time). I inquired with the chairman, Serafino Iacono, whether a change of political administration might result in troubles of any kind for Gran Colombia. "We are friends with both sides of the political aisle," he replied. He also remarked that he has known the current president since he was a junior politician. Jurisdiction risk was one of the central themes of my conversations with management, as I felt that this was immensely important to understand.

From our conversations, it was easily inferred from management's remarks that maintaining a favourable perception in the communities in which they operate is of paramount importance to them. In my view, they have gone above and beyond any reasonable expectations with their community contributions, many of which are included in their ESG report. I don't intend to elaborate on this section much more, but it's worth including an anecdote which will not be found in their presentations.

Included in the Segovia mining title which Gran Colombia purchased from the Colombian government a decade ago were 1,500 homes being rented to mine workers and their families. To the delight of the community, Serafino Iacono, resolved that he would rather gift these homes to the occupants rather than collecting rent from them. Generous deeds like this are not isolated events and have resulted in a tremendous amount of goodwill being fostered within the community. Having the support of the people is arguably the best kind of political hedge a company can possess.

It is also worth noting Colombia's respectable ranking on the Democracy Index, published by the Economist Group. Colombia's ranking has steadily improved over the past decade, and now ranks 46th in the world as of 2020, ahead of countries like Brazil, Argentina, and India. In addition, they are diversifying their operations outside of Colombia - which has been covered in previous articles.

Long-term Gold Price

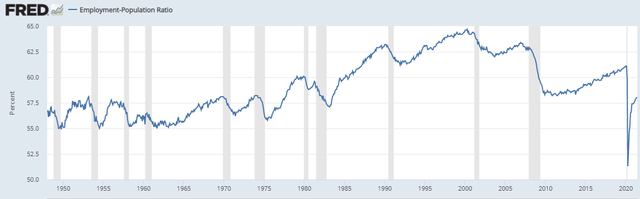

Global debt was already at historically high levels prior to the COVID-19 pandemic, on an absolute basis, and relative to incomes and revenues. COVID-19 has brought about a further explosion of consumer, corporate, and government debt. Given the perilously high levels of debt, major central banks simply do not have the latitude to raise rates all that much without causing widespread credit defaults. If given the alternative between moderate inflation and potentially triggering an economic shock through substantial rate increases, I think we all know which the central banks would rather tolerate.

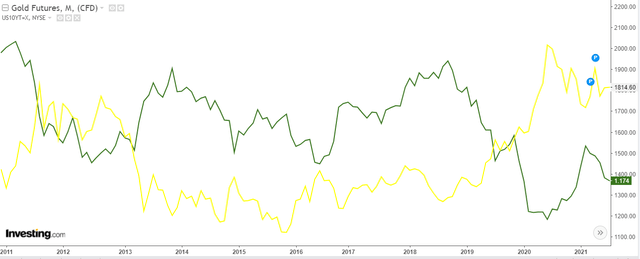

If this long-term low-interest rate view is correct, the implication for spot gold should be clear. Below is a chart over the last ten years comparing spot gold (yellow line) to the 10YR Treasury yield (green line). A very clear pattern inverse relationship can be observed.

Source: investing.com

Source: investing.com

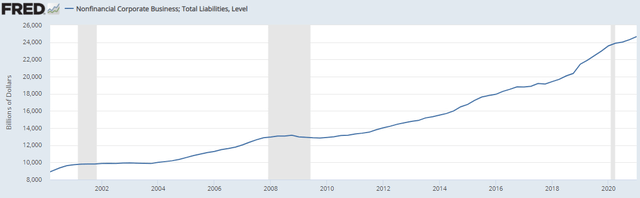

I do not think it is plausible that interest rates will exceed post Global Financial Crisis ((GFC)) levels. If this is the case, and the above pattern holds, the average spot rate of gold over the coming 5-10 years should exceed the average we have seen post GFC. I have included a few charts that I believe preclude the Federal Reserve from raising rates beyond post GFC levels.

Source: US Bureau of Labor Statistics

Source: Board of Governors of the Federal Reserve System

Source: Board of Governors of the Federal Reserve System

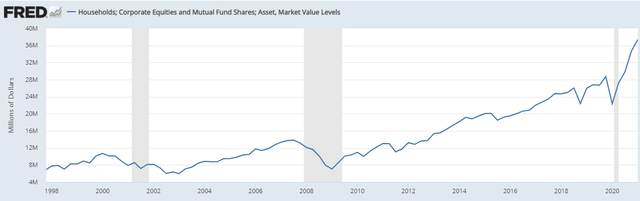

As we know, rising interest rates are generally not good for equities. Given household exposure to equities right now, and the so-called "wealth effect" of spending in the economy, the Federal Reserve will be highly cautious in raising rates to a level that would cause a significant contraction in equities.

Source: Board of Governors of the Federal Reserve System

Source: Board of Governors of the Federal Reserve System

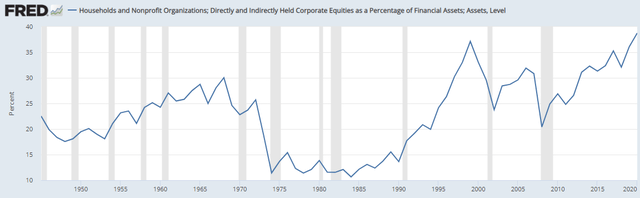

As you can see below, corporate equities as a percentage of financial assets for US households, are at an all-time high. For central banks, maintaining financial market stability is inextricably linked with maintaining economic stability.

Source: Board of Governors of the Federal Reserve System

Source: Board of Governors of the Federal Reserve System

It should go without saying that the US economy and Federal Reserve rate decisions are clearly not the only influence on the spot price of gold. However, I believe the economic indicators in most major economies point to long-term average interest rates that do not exceed post GFC levels.

Closing Remarks

Gran Colombia's valuation is unjustifiably low. Their solid net-cash balance sheet, and amply covered dividend provide downside protection to investors, while their under-appreciated assets provide substantial upside potential. I believe that those who invest in Gran Colombia in this range will be rewarded with excellent risk-adjusted returns over the next five to ten years.

Thank you for reading!