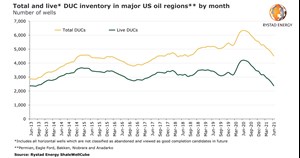

DUCs ‘Live’ DUC count hits 2013 low as the US continues to frac more than it drills

US tight oil operators have for several months been depleting their inventory of drilled but uncompleted wells (DUCs) and, amid a slower drilling response, the number of ‘live’ DUCs in the country’s major oil regions slumped to 2,381 wells in June 2021, the lowest level since 2013, a Rystad Energy analysis reveals.

The total number of horizontal DUCs in the Permian, Eagle Ford, Bakken, Niobrara and Anadarko regions combined fell to 4,510 wells by the end of June. That implies a reduction of 1,800 wells from the peak of 6,340 in June 2020 and an average depletion of 150 wells per month over the past 12 months. The last time the size of the inventory was at this level was in the second half of 2018.

However, the total includes so-called ‘dead’ DUCs – or wells that were drilled more than 24 months earlier and remain uncompleted. Empirical evidence shows that more than 95% of wells drilled are typically completed within the first two years, and hence the probability of those more than two years old getting completed now are low. Therefore, including ‘dead’ DUCs to gauge future activity or forecast production is often more speculative.

click to enlarge

“Looking at the number of remaining ‘live’ DUCs, a significant oil supply response from the US onshore industry to the $70-$75 per barrel WTI market is practically impossible before the first half of 2022. Any further increases in fracking, and subsequently well completions, will now require producers to first expand drilling by adding more rigs,” says Artem Abramov, head of shale research at Rystad Energy.

Live DUCs have declined across all major oil basins, with the Anadarko region the only exception. In the Permian, only about 1,550 horizontal live DUCs remain as of end of June – a decline of 37% from the 2,470 wells in the same month last year. As rig activity in the Permian has remained more robust since the start of the Covid-19-induced downturn, the total live DUC inventory count has not returned to the 2013 level, as is the case for all other basins combined.

>>>>>> $100 oil by Xmas