PERTH, Australia, Aug. 30, 2021 (GLOBE NEWSWIRE) —

- Wyloo Metals’ proposal will provide each Noront shareholder with the option of either accepting a superior price for their shares or participating in Noront’s growth potential by remaining as a shareholder

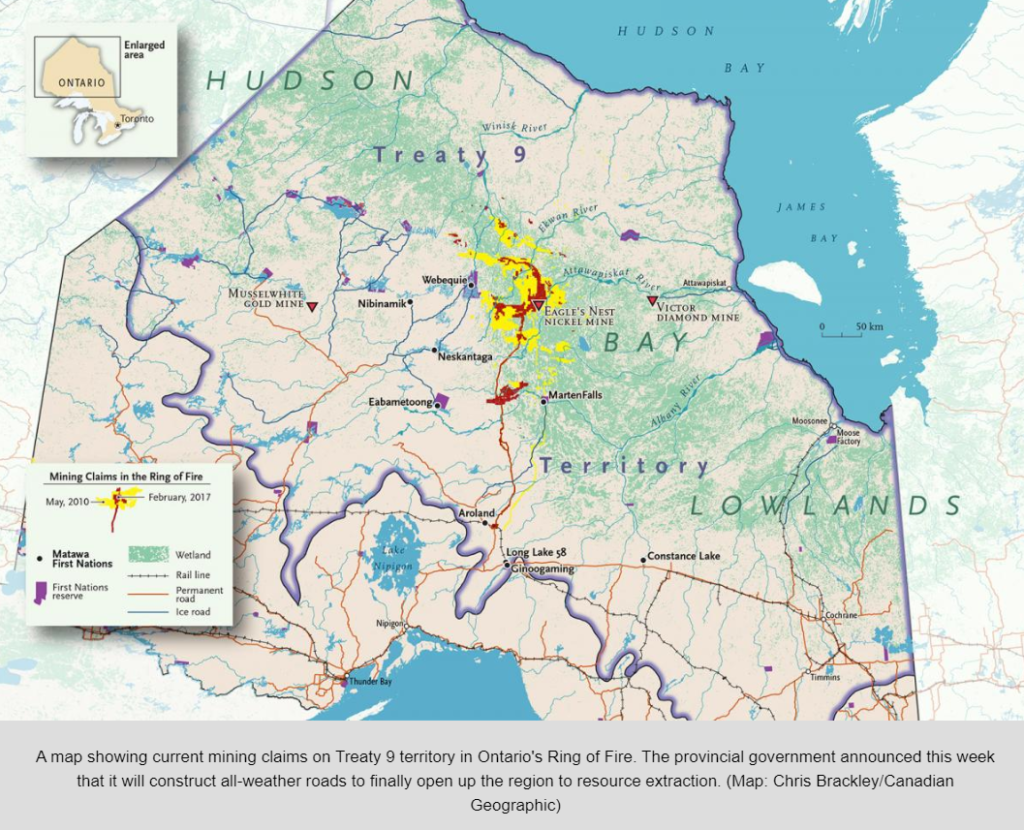

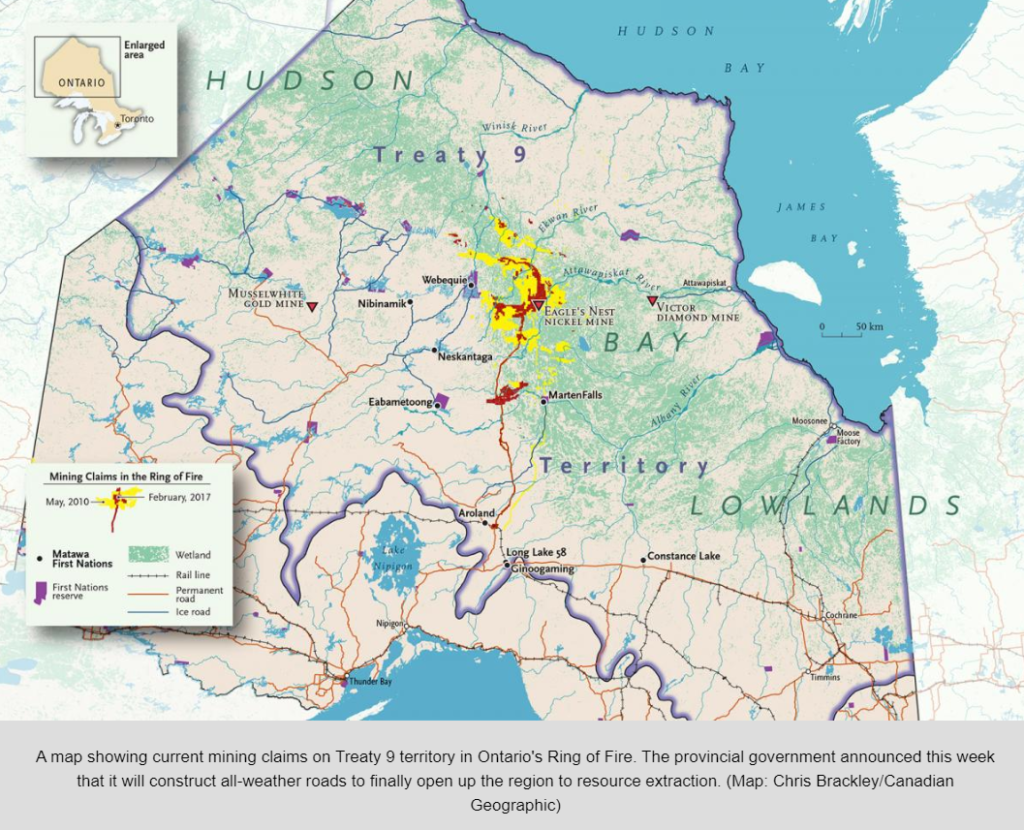

- Noront shareholders have a unique opportunity to participate in Canada’s next great mineral hub led by Dr. Andrew Forrest AO, the Founder and Chairman of Fortescue Metals Group (ASX:FMG), who intends to replicate his success at Fortescue with Noront’s Ring of Fire assets

- Consideration of Cdn$0.70 in cash per share represents a 192% premium to Noront’s unaffected closing price on May 21, 2021 and a 27% premium to BHP’s Cdn$0.55 per share take-over bid price1

Wyloo Metals Pty Ltd (“Wyloo Metals”) has today submitted a proposal (the “Acquisition Proposal”) to the Board of Noront Resources Ltd. (TSXV:NOT) (“Noront” or the “Company”) as part of a comprehensive strategy to rebuild the Company and unlock the future of the Ring of Fire. Under its Acquisition Proposal, Wyloo Metals will provide each Noront shareholder with the option of either participating in Noront’s growth potential by remaining as a holder under a new and proven leadership team, or accepting a superior price for some or all of their shares.

Overview of the Acquisition Proposal

The Acquisition Proposal will provide those shareholders who, like Wyloo Metals, believe in the long-term potential of Noront with the opportunity to participate in the Company’s growth potential by remaining as holders of some or all of their shares.

Alternatively, Wyloo Metals is prepared to acquire Noront shares at a price of Cdn$0.70 in cash per share. This price represents a significant premium of:

- 192% to Noront’s unaffected closing price of Cdn$0.24 on May 21, 2021, the last trading day prior to the date that Wyloo Metals first publicly announced its intention to make an offer for Noront; and

- 27% to the Cdn$0.55 price offered under the take-over bid for Noront by BHP Western Mining Resources International Pty Ltd. (“BHP”).

The acquisition will be made by a Canadian affiliate of Wyloo Metals and structured as a Plan of Arrangement under the Ontario Business Corporations Act.

Commenting on the structure of the transaction, Luca Giacovazzi, Head of Wyloo Metals, said:

“In April this year, we were deeply concerned when the Noront Board proposed to farm out Noront’s exploration projects to BHP for only Cdn$25 million. Rather than consenting to such a transaction, we decided to make an offer to acquire the Company. Our fears were justified when the Noront Board completed a deeply discounted 5% placement to BHP, giving away a strategic toehold in the Company to an obvious suitor.

Since our initial proposal, we have listened to the feedback from shareholders who, like us, believe in the future of the Ring of Fire. We believe Noront shareholders deserve the chance to decide whether to join us in rebuilding the Company, and not be pressured into selling all of their shares unless they want to.”

Benefits of the Acquisition Proposal

- Wyloo Metals’ Acquisition Proposal is clearly financially superior to BHP’s take-over bid.

- Wyloo Metals is providing existing Noront shareholders with the option of remaining as shareholders of Noront under new leadership and retaining some or all of their exposure to the immense potential value of the Ring of Fire mineral district, rather than forcing an exit upon them.

- Wyloo Metals’ Acquisition Proposal has a higher certainty of success than the take-over bid proposed by BHP given that Wyloo Metals owns approximately 37.5% of Noront’s shares (partially diluted) and does not intend to support or tender to BHP’s offer. Without Wyloo Metals’ support, BHP’s take-over bid transaction structure is unlikely to meet the minimum tender condition.

- Noront will be revitalized under the leadership of a world-class Board of Directors led by Dr. Andrew Forrest AO, who has an unparalleled track record in the development of remote mining projects and a proud and continuing legacy for partnering with Indigenous and local communities. Dr. Forrest led Fortescue from a junior exploration mining company to one of the world’s largest mining companies, with a current market capitalization in excess of A$65 billion.

- Wyloo Metals reiterates its commitments to the development of a Future Metals Hub in Ontario (see below), announced on May 31, 2021, should its Acquisition Proposal be successful.

For the rest of this news release: https://www.globenewswire.com/news-release/2021/08/30/2288390/0/en/Wyloo-Proposes-Offer-to-Participate-in-Noront-s-Future-Under-New-Leadership-While-Offering-Attractive-Cash-Alternative.html

NEWS RELEASE: Wyloo Proposes Offer to Participate in Noront’s Future Under New Leadership, While Offering Attractive Cash Alternative (Wyloo Metals – August 30, 2021)

PERTH, Australia, Aug. 30, 2021 (GLOBE NEWSWIRE) —

- Wyloo Metals’ proposal will provide each Noront shareholder with the option of either accepting a superior price for their shares or participating in Noront’s growth potential by remaining as a shareholder

- Noront shareholders have a unique opportunity to participate in Canada’s next great mineral hub led by Dr. Andrew Forrest AO, the Founder and Chairman of Fortescue Metals Group (ASX:FMG), who intends to replicate his success at Fortescue with Noront’s Ring of Fire assets

- Consideration of Cdn$0.70 in cash per share represents a 192% premium to Noront’s unaffected closing price on May 21, 2021 and a 27% premium to BHP’s Cdn$0.55 per share take-over bid price1

Wyloo Metals Pty Ltd (“Wyloo Metals”) has today submitted a proposal (the “Acquisition Proposal”) to the Board of Noront Resources Ltd. (TSXV:NOT) (“Noront” or the “Company”) as part of a comprehensive strategy to rebuild the Company and unlock the future of the Ring of Fire. Under its Acquisition Proposal, Wyloo Metals will provide each Noront shareholder with the option of either participating in Noront’s growth potential by remaining as a holder under a new and proven leadership team, or accepting a superior price for some or all of their shares.

Overview of the Acquisition Proposal

The Acquisition Proposal will provide those shareholders who, like Wyloo Metals, believe in the long-term potential of Noront with the opportunity to participate in the Company’s growth potential by remaining as holders of some or all of their shares.

Alternatively, Wyloo Metals is prepared to acquire Noront shares at a price of Cdn$0.70 in cash per share. This price represents a significant premium of:

- 192% to Noront’s unaffected closing price of Cdn$0.24 on May 21, 2021, the last trading day prior to the date that Wyloo Metals first publicly announced its intention to make an offer for Noront; and

- 27% to the Cdn$0.55 price offered under the take-over bid for Noront by BHP Western Mining Resources International Pty Ltd. (“BHP”).

The acquisition will be made by a Canadian affiliate of Wyloo Metals and structured as a Plan of Arrangement under the Ontario Business Corporations Act.

Commenting on the structure of the transaction, Luca Giacovazzi, Head of Wyloo Metals, said:

“In April this year, we were deeply concerned when the Noront Board proposed to farm out Noront’s exploration projects to BHP for only Cdn$25 million. Rather than consenting to such a transaction, we decided to make an offer to acquire the Company. Our fears were justified when the Noront Board completed a deeply discounted 5% placement to BHP, giving away a strategic toehold in the Company to an obvious suitor.

Since our initial proposal, we have listened to the feedback from shareholders who, like us, believe in the future of the Ring of Fire. We believe Noront shareholders deserve the chance to decide whether to join us in rebuilding the Company, and not be pressured into selling all of their shares unless they want to.”

Benefits of the Acquisition Proposal

- Wyloo Metals’ Acquisition Proposal is clearly financially superior to BHP’s take-over bid.

- Wyloo Metals is providing existing Noront shareholders with the option of remaining as shareholders of Noront under new leadership and retaining some or all of their exposure to the immense potential value of the Ring of Fire mineral district, rather than forcing an exit upon them.

- Wyloo Metals’ Acquisition Proposal has a higher certainty of success than the take-over bid proposed by BHP given that Wyloo Metals owns approximately 37.5% of Noront’s shares (partially diluted) and does not intend to support or tender to BHP’s offer. Without Wyloo Metals’ support, BHP’s take-over bid transaction structure is unlikely to meet the minimum tender condition.

- Noront will be revitalized under the leadership of a world-class Board of Directors led by Dr. Andrew Forrest AO, who has an unparalleled track record in the development of remote mining projects and a proud and continuing legacy for partnering with Indigenous and local communities. Dr. Forrest led Fortescue from a junior exploration mining company to one of the world’s largest mining companies, with a current market capitalization in excess of A$65 billion.

- Wyloo Metals reiterates its commitments to the development of a Future Metals Hub in Ontario (see below), announced on May 31, 2021, should its Acquisition Proposal be successful.

For the rest of this news release: https://www.globenewswire.com/news-release/2021/08/30/2288390/0/en/Wyloo-Proposes-Offer-to-Participate-in-Noront-s-Future-Under-New-Leadership-While-Offering-Attractive-Cash-Alternative.html