Bet_Noire/iStock via Getty Images

Bet_Noire/iStock via Getty Images Discovery Silver (OTCQX:DSVSF) is a Canadian company focused on the development of the world-class Cordero silver-zinc-lead project in Chihuahua, Mexico. Discovery has also other exploration projects, but since the acquisition of Levon Resources (the former owner of Cordero) back in the summer of 2019, Cordero became the main focus of the company.

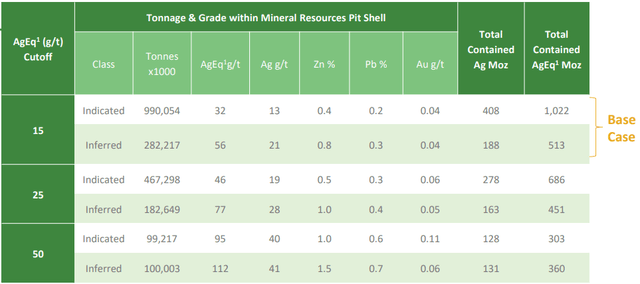

Discovery has a different approach to the project compared to its previous owner. While Levon focused on outlining a large deposit and building a big mine, Discovery prefers quality over quantity. This is why the drilling focuses on expanding the higher-grade zones. The new resource estimate should use a much higher cut-off grade. While Levon used 15 g/t of silver equivalent, Discovery will use 50 g/t of silver equivalent. This move is expected to increase the mill feed grade from 46 g/t of silver equivalent to more than 100 g/t of silver equivalent. According to the 2018 resource estimate, at a cut-off grade of 15 g/t, the deposit contains inferred and indicated resources of 596 million toz silver and 1.54 billion toz of silver equivalent. At a cut-off grade of 50 g/t, the deposit contains 259 million toz silver and 663 million toz of silver equivalent. Although the decline in the volume of contained metals is significant, the deposit is still very robust. Moreover, the new resource estimate will include also more than 60,000 meters of drilling made by Discovery. There is a good chance that the high-grade resources will be notably bigger than 663 million toz of silver equivalent.

Discovery has a different approach to the project compared to its previous owner. While Levon focused on outlining a large deposit and building a big mine, Discovery prefers quality over quantity. This is why the drilling focuses on expanding the higher-grade zones. The new resource estimate should use a much higher cut-off grade. While Levon used 15 g/t of silver equivalent, Discovery will use 50 g/t of silver equivalent. This move is expected to increase the mill feed grade from 46 g/t of silver equivalent to more than 100 g/t of silver equivalent. According to the 2018 resource estimate, at a cut-off grade of 15 g/t, the deposit contains inferred and indicated resources of 596 million toz silver and 1.54 billion toz of silver equivalent. At a cut-off grade of 50 g/t, the deposit contains 259 million toz silver and 663 million toz of silver equivalent. Although the decline in the volume of contained metals is significant, the deposit is still very robust. Moreover, the new resource estimate will include also more than 60,000 meters of drilling made by Discovery. There is a good chance that the high-grade resources will be notably bigger than 663 million toz of silver equivalent.

Source: Discovery Silver

Source: Discovery Silver

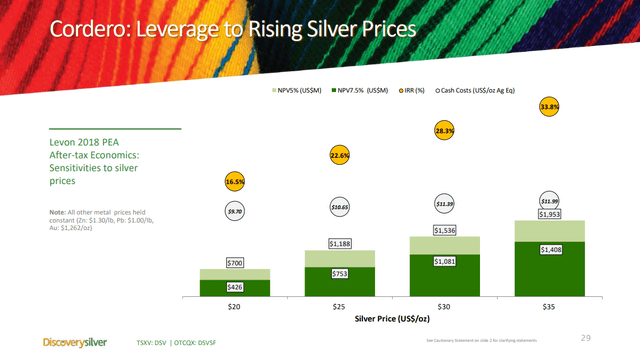

As the ore grade will be more than twice higher, Discovery will be able to reach similar production levels using a smaller mill, leading to lower up-front CAPEX. While Levon envisioned a 40,000 tpd operation (with an initial CAPEX of $570 million), Discovery plans to start with a 15,000 tpd operation which should be later expanded to 30,000 tpd. This should lead to lower CAPEX, moreover, significantly higher silver equivalent grades should reduce the operating costs notably. The old PEA envisioned an average annual production of 7.9 million toz silver, 11,931 toz gold, 68.7 million lb lead, and 98.7 million lb zinc (or 18.6 million toz of silver equivalent) over 29-year mine life. At a silver price of $25/toz, zinc price of $1.3/lb, lead price of $1/lb, and gold price of $1,262/toz, the after-tax NPV (5%) equaled $1.19 billion. Although the new PEA will present a staged development and therefore probably lower annual production volumes, the lower initial CAPEX and lower production costs should help to maintain the after-tax NPV (5%) above the $1 billion level.

Source: Discovery Silver

Source: Discovery Silver

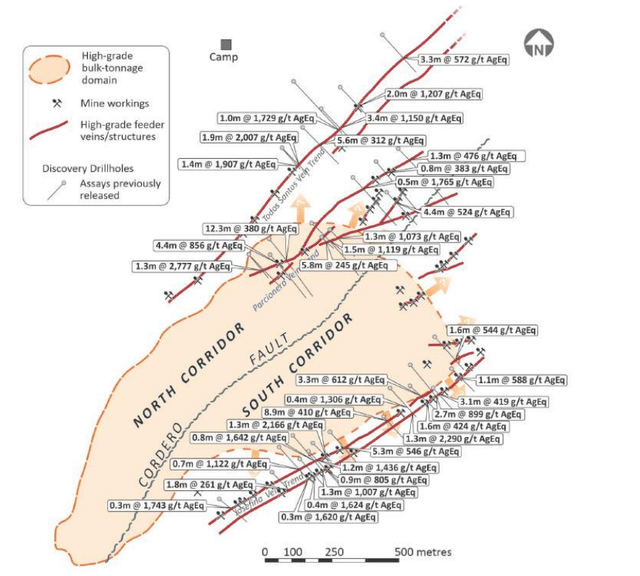

Only recently, Discovery completed a drill campaign totaling 91,000 meters in 223 holes. The drill campaign was really successful. It was initiated in September 2019 and the original plan was to drill only 30,000-35,000 meters over the following 12 months. The first four drill holes were a huge success, intersecting numerous long intervals of silver, gold, zinc, and lead mineralization at good grades. In April, Discovery reported several high-grade vein intersections, including 2,153 g/t of silver equivalent over 1 meter, and 2,929 g/t of silver equivalent over 0.6 meters (only 82 meters below the surface). The best interval graded 117 g/t silver, 1.96 g/t gold, 1.7% lead, and 1.1% zinc (361 g/t of silver equivalent) over 68.1 meters. In May, 27.7 meters grading 103 g/t silver, 0.2 g/t gold, 2.2% lead, and 4.4% zinc (378 g/t of silver equivalent) was reported. In June, an intersection of 2,489 g/t of silver equivalent over 0.7 meters was reported. Discovery also announced its decision to expand the drill campaign by a further 20,000 meters. Also the July news confirmed that the deposit contains numerous high-grade zones, including 857 g/t of silver equivalent over 4.4 meters drilled in hole C20-336, or 3,214 g/t of silver equivalent over 0.8 meters drilled in hole C20-337. In August, Discovery reported 2,007 g/t of silver equivalent over 1.9 meters.

The second year of the drill campaign that was originally planned only for one year, started with the September announcement that in hole C20-343, 401.7 meters grading 134 g/t of silver equivalent was intersected. The mineralization started at a depth of only 66.9 meters, and the intersection included several higher-grade intervals including 888 g/t of silver equivalent over 14.7 meters. The October news release delivered 1,150 g/t of silver equivalent over 3.4 meters or 1,207 g/t of silver equivalent over 2 meters. In November, Discovery reported an intersection of 138 g/t of silver equivalent over 139.1 meters.

In February 2021, Discovery reported an intersection of 118 g/t of silver equivalent over 131.6 meters, starting at a depth of less than 50 meters. In March, Discovery reported the intersection of numerous high-grade veins, including 2,290 g/t of silver equivalent over 1.3 meters, 2,166 g/t of silver equivalent over 1.3 meters, or 1,605 g/t of silver equivalent over 2.9 meters. The April news release presented several long but lower-grade intersections including 165 g/t of silver equivalent over 128.2 meters. In May, 1,043 g/t of silver equivalent over 4.1 meters, or 1,736 g/t of silver equivalent over 1.2 meters were reported. In June, Discovery announced 258 g/t of silver equivalent over 65.9 meters, and in July 3,934 g/t of silver equivalent over 1.1 meters and 3,424 g/t of silver equivalent over 1.1 meters. The early August news releases reported 132.6 meters grading 260 g/t of silver equivalent, including 21.5 meters grading 748 g/t of silver equivalent. On August 25, Discovery reported an intersection of 217 meters grading 194 g/t of silver equivalent.

The drill campaign helped to delineate a sizeable high-grade bulk-tonnage domain that is still open in multiple directions (map below). Moreover, the known strike extent of the high-grade veins exceeded 5 kilometers.

Source: Discovery Silver

Source: Discovery Silver

The Phase I Drill Campaign is over now. In the end, it ballooned to 91,000 meters drilled in 223 holes. These drill results, supplemented by the historical results from 133,000 meters drilled in 292 holes by the previous operators of the project, will be used to prepare a new resource estimate that should be released by the end of Q3. Subsequently, a new PEA should follow by the end of this year. At the same time, the Phase II Drill Campaign is underway. It should focus on reserve definition, resource expansion, and high-grade vein delineation.

The Risks and Opportunities

The upside is clear. Discovery owns a huge polymetallic deposit. It consists of high-grade vein zones and thick zones of lower-grade mineralization. It should enable Discovery to develop a relatively small mining operation focused on the high-grade material, with the potential to be later expanded to extract also the lower-grade portions of the deposit. It is reasonable to expect that the new PEA will present a CAPEX notably lower than the $570 million envisioned by the old PEA. But the after-tax NPV (5%) will probably remain above the $1 billion level. It compares favorably to Discovery's current market capitalization of $446 million and an enterprise value of $375 million.

An obvious risk is related to the mine construction financing. It is yet unknown how high the pre-production CAPEX is going to be, we only know that it should be notably less than $570 million. As of the end of Q2, Discovery held cash of $70 million. This looks like a lot, however, Discovery's aggressive drilling is expensive, therefore, the current cash on hand most probably won't be able to contribute to the mine financing. Even if everything goes really well, the mine won't get into production before 2025. In 2021, Discovery budgeted expenditures of approximately $20 million for Cordero. Assuming that the burn rate remains similar also in the coming years, the current cash on hand should be sufficient until the end of 2024. In other words, it is possible that Discovery will need to raise slightly more than the initial CAPEX, in order to cover some other corporate expenditures before the mine starts generating cash flows. The updated CAPEX estimate is yet unknown, therefore, also the future share dilution is hard to predict. Fortunately, at the current market capitalization of nearly $450 million, the share dilution wouldn't be too painful, probably up to 50% at maximum. It is not a disaster and there would be significant upside potential left.

However, the abovementioned timelines are dependent on a smooth permitting process. While there doesn't seem to be a meaningful opposition to the project, delays may happen. And there is also the jurisdiction risk. Although Mexico is usually regarded as a mining-friendly country, several miners encountered major problems with the locals and also with the government in a not-so-distant past. For example, Equinox Gold's (NYSE:EQX) Los Filos mine encountered two illegal blockades over the last 12 months. The first one lasted for nearly 4 months, the second one for nearly 2 months. Something similar was experienced by Americas Gold and Silver (USAS). At its Cosala mine, a blockade lasted for 18 months. Therefore, it is important for Discovery to maintain good relations with the locals.

And of course, the metals prices present not only upside potential but also downside risk. Although Discovery markets Cordero as a silver deposit, it contains significant volumes of zinc and lead too. Therefore, the investors should watch not only silver but also zinc and lead prices more closely.

Conclusion

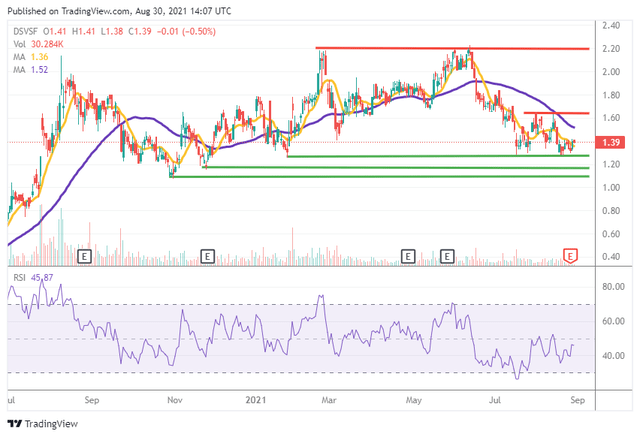

Discovery's share price has been moving between $1.2 and $2.2 for the better part of the last 12 months. Right now, the share price stands at $1.4, near the lower boundary of the trading range. It made several unsuccessful attempts to break the support at $1.3 over the last two months. Right now, the RSI is below 50 and growing. The 50-day moving average is below the 10-day one, but they are moving closer to each other. If the support at $1.3 really holds, Discovery's share price should re-test the resistance in the $1.6-1.65 area. If it is broken, the next more meaningful resistance lies only around $2.2.

The technical analysis shows that there is potential for Discovery's share price to grow in the near term. Also the fundamentals are positive, with the updated resource estimate expected soon. Moreover, it seems like the silver price reached the bottom in the $22.5-23/toz area and it is going back up. In the longer term, Discovery offers interesting upside potential too, however, its true extent is still unknown. It should be uncovered only later this year after the updated PEA is released. The current share price offers an opportunity to accumulate a position before the arrival of the two major catalysts, the new resource estimate, and the updated PEA.

The technical analysis shows that there is potential for Discovery's share price to grow in the near term. Also the fundamentals are positive, with the updated resource estimate expected soon. Moreover, it seems like the silver price reached the bottom in the $22.5-23/toz area and it is going back up. In the longer term, Discovery offers interesting upside potential too, however, its true extent is still unknown. It should be uncovered only later this year after the updated PEA is released. The current share price offers an opportunity to accumulate a position before the arrival of the two major catalysts, the new resource estimate, and the updated PEA.