Rick_Thompson/iStock via Getty Images

Rick_Thompson/iStock via Getty Images

Tilray (TLRY) had a huge day back in July following earnings as the Canadian cannabis company promoted a $4 billion revenue future in a just a few years. The enormous growth potential propelled the stock higher, but Tilray has to obtain these revenues via major acquisitions causing some heartburn amongst shareholders. My investment thesis remains Bearish on the stock due to the rich valuation and major M&A plans ahead.

Questioned $4 Billion Plan

Just the week before the Labor Day weekend in the U.S., CEO Irwin Simon again reiterated the need for stockholder support in increasing the share count of the company. Tilray proposes increasing the authorized capital stock of the company from 743 million shares to 990 million shares (~250 million shares). The Canadian cannabis company currently has ~450 million shares outstanding after closing the Aphria merger.

Source: Tilray proxy card

Tilray has a special meeting of stockholders on September 10 this week to again vote on the proposal to increase the share count to authorize management to execute future deals. The original meeting was planned for July 29 and adjourned to August 19 before being postponed again to this week.

The company promotes having 49% of stock voting in favor of the deal, but Tilray needs a majority of 50.1% to approve the proposal. One can even suggest the company doesn't have the clear mandate of shareholders either way with at least 50% of shareholders against raising the share count.

The company has listed three pillars of growth for achieving the large revenue target by FY24:

- Expand Canadian retail market share from 16% to 30%.

- Push European market to $1 billion in medical use alone.

- Expand into the U.S. market via deals similar to MedMen Enterprises(OTCQB:MMNFF) or other deals when federal legalization allows with a target of reaching THC sales in excess of $1 billion.

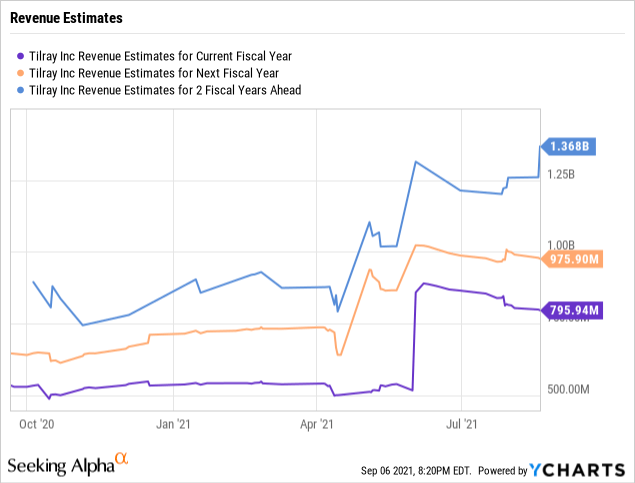

The key reason shareholders are likely balking on plans to drastically expand the shares outstanding is the vast difference between analyst revenue estimates and the company target for FY24. Remember, the company is already in FY22 with the fiscal year starting in June. The FY24 target is already less than 3 years away.

Massive Revenue Boost Required

Based on current analyst estimates, Tilray will need to more than triple FY24 revenue estimates to just reach these targets. The company will need to make massive deals in order to hit those targets.

On top of that, one needs to consider whether Tilray will even meet the objectives of growing revenues from the current run rate around $600 million to $1.37 billion in FY24 forecast. Analysts recently cut the revenue targets for FY22 to below $800 million.

Data by YCharts

Data by YCharts

A good place for Tilray to start is actually meeting current analyst estimates. Besides, some of the past deals haven't exactly worked out leading to additional fears the company is again chasing bad deals in order to just boost revenues.

Back in early 2019, Tilray bought Manitoba Harvest for up to C$419 million. The hemp foods company produced just $17 million in quarterly revenues for the February quarter and a similar run rate for May. Now two years after the deal, Manitoba Harvest is still under performing expectations. Not to mention, the Tilray/Aphria combination didn't exactly impress with the last quarterly results.

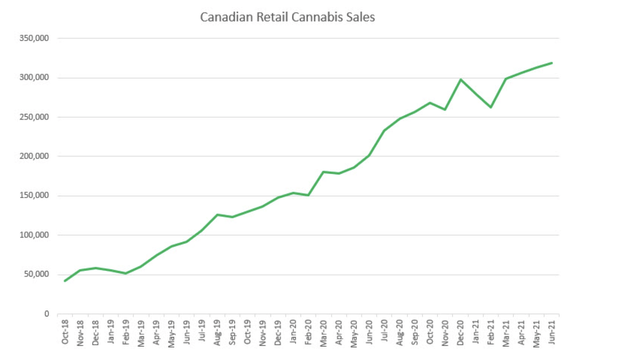

The biggest fear could be another acquisition in the Canadian market where deals by Canopy Growth (CGC) and HEXO (HEXO) make an already highly competitive cannabis market far more fierce. Most investors want to see a combined Tilray and Aphria reach 30% market share via taking share from smaller players, not via buying revenues. The Canadian cannabis market continues to grow, and these sales gains are evident in the recent quarterly results of most Canadian players.

Source: New Cannabis Ventures

In the last couple of quarters, the new Tilray took a massive hit in recreational cannabis sales. The talk by the former CEO of Aphria of reaching $4 billion in sales seems ill timed considering the difficulties with the company even consistently growing sales and hitting internal targets.

Either way the vote goes, the market would be far more excited about the stock with actual proven organic growth. The stock already has a $6 billion market cap and the cannabis focused revenues are only in the $400 million range due to the large portion of revenues from the distribution business in Germany and the hemp foods business in the U.S.

Takeaway

The key investor takeaway is that Tilray is an expensive stock trading at far above 10x current cannabis revenues (including beverages). Naturally, investors should have concern about more M&A while the company was supposed to have the scale to greatly expand sales in Canada and Europe without needing to dilute shareholders again. Investors should avoid Tilray as the company is likely to end up paying up for attractive U.S. or European assets making the stock less valuable.

link