Teck Resources, a CA$26 billion company, is the 2nd largest steelmaking coal producer in the world. In its Investor Day presentation earlier this week it reiterated the long-term strength of the seaborne coking coal market. Colonial Coal is also 100% coking coal, with two valuable projects for sale in B.C., Canada.

On September 21st copper, zinc & steelmaking coal producer

(TECK:TSX - TECK:NYSE)

$36.01 -1.42%

2021/9/25 9:41:47

Volume: 300

Market Cap: 279.64m

PE Ratio: 120.40

Year High: $42.50

Year Low: $18.90

Shares Out: 7,765,503

Float: 532,500,000 | Institute Hold'gs:

0.10% (as of 08/31/21)

Institutions Bought Prev 3 Mo: 15,000

Non-Corp. Insider Hold'gs: Not Available

Insiders Bought Prev 3 Mo: Not Available |

Streetwise Reports Articles

See More Live Data

Teck Resources Ltd. (TECK:TSX; TECK:NYSE) held its annual investor day, a three-hour webcast highlighting very robust global demand for steel and the small number of critical materials essential in making it.

"However, steel is absolutely essential in building the very renewable power plants & electrified transportation systems the world needs to decarbonize."

Teck is the 2nd largest coking (metallurgical / met) coal producer in the world behind BHP. Anglo American is #3.

Teck’s investor day had been anxiously anticipated. A week earlier there was a rumor that the Company wanted to divest its steelmaking coal business due in part to (as per the rumor) pressure from shareholders & prospective investors calling for companies to dump coal.

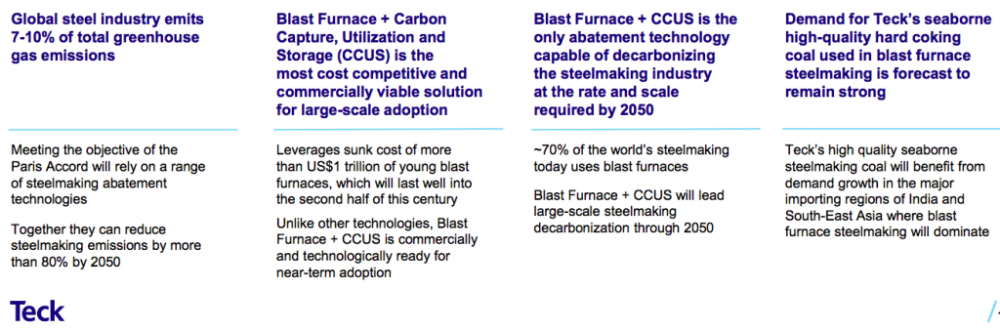

A key takeaway from the event was that seaborne met coal (Teck’s specialty) will remain in high demand as several Asian countries, especially India, are building a substantial number of blast furnaces that can only be supplied by exporters like BHP, Teck & Anglo.

There’s no doubt that burning coal, be it thermal (used to generate electricity) or met (to make steel) is bad for the environment, producing greenhouse gases that are warming the planet.

However, steel is absolutely essential in building the very renewable power plants & electrified transportation systems the world needs to decarbonize.

In assessing steelmaking coal’s role in global warming it’s imperative that we separate it from thermal coal. Thermal coal is already being fazed out — readily & cost-effectively — replaceable by nuclear, hydro, wind, solar, biomass, and geothermal sources.

Teck is a prime beneficiary of thermal coal’s demise. According to steelmaker ArcelorMittal’s website,

Each new MW of solar power requires 35 to 45 metric tonnes of steel. Each MW of wind power requires 120 to 180 tonnes. Utility-scale wind farms typically produce a 100 to 300 MW, and up to 1,000 MW. ” Annually, hundreds — eventually thousands — of giant wind farms will be installed.

Steelmakers have been trying to diminish the power that met coal, coke & iron ore producers hold by finding alternatives to blast furnace steel fabrication. That initiative has only grown with increased environmental concerns. Yet, 70% of steel still comes from 20th century blast furnaces.

New technologies are on drawing boards, but none are expected to make meaningful inroads anytime soon. New methods have their own carbon footprints to contend with. Instead, new technology is being deployed at the steel plant level.

Carbon capture and other methods (such as the advent of Li-ion battery powered container ships) offer no silver bullets, but they’re reasonably affordable & fairly effective. Unsurprisingly, Teck is a big fan of carbon capture & fossil-free shipping!

Tens of trillions of dollars in debt-fueled economic stimulus packages in the 2020s alone will buy a staggering amount of steel, which will continue to consume vast amounts of met coal. There’s no practical, large-scale substitute.

"Teck is a big fan of carbon capture & fossil-free shipping."

Although I believe met coal should be given more slack, some good projects will, inevitably, fail to get funded or die on the permitting vine. This suggests that met coal prices are likely to remain stronger for longer. Teck forecasts the potential of a meaningful deficit in the seaborne market from 2025-2030.

According to Teck’s presentation, the 10-year avg. inflation-adj. met coal price is ~$180/Metric tonne (“Mt”). Fastmarkets lists four hard (and premium hard) met coals ranging in price from ~$336 to $601/Mt (Sept. 22nd), and averaging $475/Mt. That average price has quadrupled from its 2020 low!

Will prices in the next 10 years average $180/Mt? No, my guess is prices might return to $225-$275/Mt.However, can steelmakers take the chance of multi-yr. stretches of $300-$400/Mt pricing? Vertical integration into met coal is a move that all steelmakers should seriously be considering.

Teck’s trailing 12-yr. normalized (adjusted) annual EBITDA {from presentation slides} is $2.2 billion. At a “new normal” avg. long-term met coal price of say $240/Mt, EBITDA would be closer to $2.95 billion = CA$3.75 billion.

In my view, the valuation of Teck’s steelmaking coal biz. in today’s bull market is > CA$12 billion. If a robust bidding war were to break out, with prices at, or near, all-time highs, I believe the transaction value could surpass CA$16 billion.