bunhill/E+ via Getty Images

bunhill/E+ via Getty Images

Shares of Cielo Waste Solutions (OTCQB:CWSFF) (“the Company”) have been supported by expectations the company was approaching commercial scale production, including achieving desulfurization capability in the very near term. Perception was driven by investor relations calls in which CEO Don Allan continued to hype Cielo’s progress, public events such as the groundbreaking of a new facility, and videos of the installation of critical equipment.

Source: Cielo

Source: Cielo

However, in our view, no meaningful progress has been made and the Cielo story is worse now than at the beginning of the summer. Cielo finally admitted being massively behind production expectations. It’s had to delay desulfurization - again. It’s been forced to restate its financial statements, resulting in the company being in technical default of disclosure requirements necessitating a management cease trade order.

In our last report on Cielo, we presented a bearish thesis based on three main premises. (1) The company’s highly touted joint venture partner Renewable U Energy (RUEI) did not have access to hundreds of millions of dollars in capital as claimed. Instead, RUEI had very little cash and was doing the corporate equivalent of panhandling by soliciting small retail investors, suggesting representations made by the company regarding the technology were not accurate. (2) Cielo conducted sales agreements and financing deals under baffling terms which signaled transactions completed for the sake of implying third-party validation. (3) And most importantly, Cielo’s technology has been overhyped by management as evidenced by years of missed milestones and delays.

Our view remains the same and the developments of the summer harden our conviction. Moreover, a professional engineer who viewed technical data at Cielo’s Aldersyde plant raised serious concerns about the technology. We think time is running out for Cielo and judging by recent price action, investors may be coming around to our view.

Desulfurization Delayed Again

Cielo has been promising the installation of a technology to desulfurize its fuel for years, representing this as a final hurdle to profitable production at scale. Large investors were supposedly waiting for desulfurization, an off-the-shelf technology, to be proven before investing in two $50m facilities. CEO Don Allan was guiding for desulfurization by the end of June. Widely followed CMC bull Robert McWhirter did multiple interviews repeating the same timeline.

Investor: Can you give us an update on the desulfurization process?

Allan: Yes, 90% of the equipment is on site today and our crews are working 7 days a week. We still have some work to do such as electrical connections and welding, but we are hoping to be commissioning between mid to end of June.

Source: ESG investor blog, May 2021

In a September 2 press release and webinar, Allan pushed back the desulfurization timeline again, this time to September 23. He blamed a chemical catalyst made in China which he claimed was defective. Allan told a convoluted story, claiming the catalyst was sent to Texas for repair and blaming the University of Calgary for selecting the Chinese manufacturer.

Allan has been promising and delaying desulfurization for years, so it’s unclear why investors would believe him now. Nor does it make sense that Cielo has been unable to achieve desulfurization at scale since it’s a technology with off-the-shelf options.

Note that Cielo gained possession of the catalyst in May, and since then Allan has repeatedly said the company was focused on desulfurization. So, we find it hard to believe that management only recently learned of this defect. Cielo has a problem disclosing material information or is grossly incompetent, or both.

Current Production Nowhere Near Guidance or Expectations

During the investor webinar, Allan admitted another enormous flop. Cielo has claimed it would eventually build dozens of plants in North America continuously converting garbage into high-quality diesel fuel at 4,000 liters-per-hour (LPH). The bull case is based on these blue-sky figures combined with locked-up access to nearly a billion dollars capital via RUEI. Exact production numbers had not been disclosed recently although Allan has implied that Cielo’s was progressing towards these levels. There are dozens of examples but see this October 2020 press release in which Allan claims Cielo was doing 800lph and would be at 1,000lph “shortly”.

But during the webinar, Allan admitted Cielo is currently only doing 100-200lph [15:00] – and he didn’t specify if this was continuous production (the relevant data point), so the key rate is potentially less. Note that at these production levels, whether or not Cielo can achieve desulfurization is irrelevant since the agreements with RUEI (if one assumes they are financially valid, which we don’t) require 500lph of continuous production.

We’re not surprised with the desulfurization delay or the production disappointment. And we expect Cielo to miss the new September 23 target. Cielo has been peddling the “we’re so close” story since its incorporation. It’s unlikely that this time is different.

What Do Investors Really Know About Cielo’s Process?

Considering how depressed Cielo’s production capability remains and how far it is from management’s past guidance, investors should review what’s been disclosed about the technology. We know Don Allan bought it from an unknown German firm in 2010. It’s based on a process known as Thermal Catalytic Depolymerization and Cielo claims it can convert many forms of garbage and all seven types of plastic. However, few specifics regarding performance have been disclosed.

We received a tip from an engineer who read our first Cielo article. He visited Cielo’s facility located in Aldersyde as a prospective shareholder. He expressed skepticism and suggested we ask Cielo for mass balance data:

Some time ago I visited [Cielo’s] plant and I received a mass balance calculation for their process. They were adding waste oil to the material they were "recycling" and the amount of diesel they were producing was less than what they should have produced simply by "cracking" the used motor oil. I have been told by some who are very bullish on the stock that that is no longer the case. But, I could not help but wonder if that was the source of the diesel production and the rest was just...? I have not had any contact with the company for over a year now... I thought you might want to check this out.

Mass balance equations are used to analyze physical systems such as biodiesel production processes. Based on the conservation of mass, engineers use the equations to account for inputs and outputs.

The engineer who viewed Cielo’s mass balance information suspected the diesel being produced was only from the conversion of used motor oil – not other inputs such as plastics and railway ties. We asked Cielo for the mass balance data and received the following reply:

Thanks for your interest in Cielo. Mass balances and engineering data will remain internal and cannot be shared.

After learning that Cielo is only producing diesel at 100-200lph despite implying higher levels for years, we think investors deserve more disclosure of technical performance data. Or at least proof that Cielo is producing more diesel than what’s implied by the used motor oil input.

Another Insignificant Deal With An Unknown Counterparty

In the same September 2 update, Cielo touted an off-take agreement for the sale of naphtha fuel with Kodiak Chemical Solutions. The agreement is a non-binding letter of intent. Kodiak appears to have been founded by a former fuel salesman in November 2020. It has no website and only two employees with LinkedIn accounts.

Source: LinkedIn

Source: LinkedIn

In our view, this is another example of Cielo attempting to create legitimacy by engaging obscure counterparties in what we believe are meaningless deals. See the zero-interest unsecured loan for land with anonymous lenders. Or the financing with unknown First Choice Financial (no website) loaded with broker fees and warrants. Or the $1.5m fuel sale with an undisclosed buyer who was awarded warrants that became worth 2x more than the deal value within a week.

New Directors Associated with Past Failures

We’re usually of the opinion that changes in a company’s board of directors aren’t impactful to an investment thesis. However, when long-term directors leave just as a company is purportedly around the corner from fulfilling long-promised targets, especially when said company shows a penchant for hyping and then missing targets, we believe it’s worthwhile to comment.

On August 27, two directors who served on Cielo’s board for 8 years resigned. Cielo characteristically hyped their replacements, but both are associated with failed public companies.

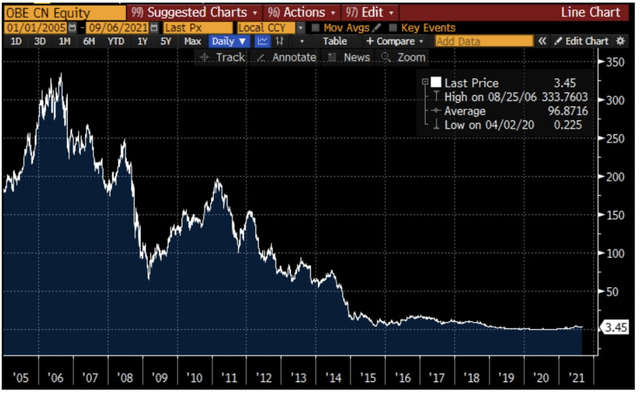

George Brookman is a real estate executive with involvement in various energy companies. Most notably, from the 2005 to 2018, Brookman was a board member at Obsidian Energy (OTCQX:OBELF) (TSX:OBE) (formerly Penn West Energy). In 2017, Penn West was charged by the SEC for accounting fraud which occurred during Brookman’s tenure and at the time which he headed the company's Governance Committee. OBE settled the complaint for $8.5m.

Source: Bloomberg

Source: Bloomberg

Larry Schafran is a private investor who has held directorships at several collapsed public companies. His involvement at SulphCo bears the most relevance to the situation at Cielo. He was a Director [Pg. 34], Audit Committee Chairman at SulphCo (last trading OTC with ticker SLPHQ) which coincidentally developed a technology it claimed could desulfurize oil efficiently. The company reached a $1B valuation before going bankrupt in 2011.

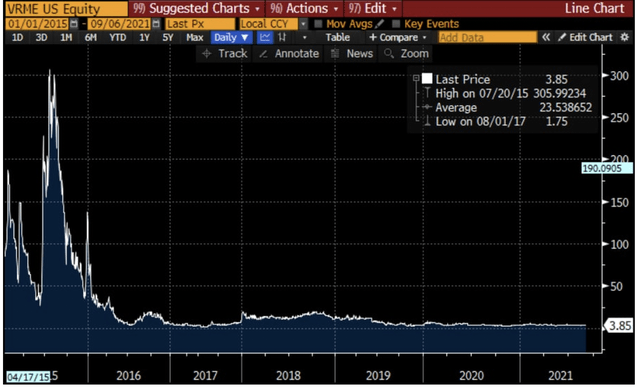

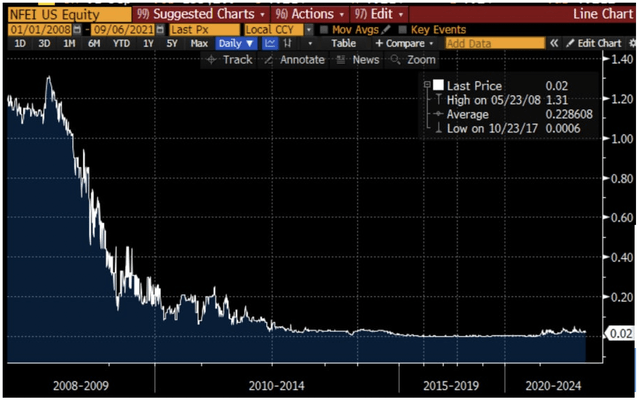

Schafran was also a director at VerifyMe (NASDAQ:VRME), a developer of authentication software, from 2015 to 2019, and New Frontier Energy (OTCPK:NFEI), a natural gas and crude oil explorer, between 2008 and 2011.

Source: Bloomberg

Source: Bloomberg

Source: Bloomberg

Source: Bloomberg

Forced to Restate Financials

Further down in the same August 27 press release, Cielo announced it was restating several figures from 2018 and as a result would delay the filing of its annual report. Cielo would miss its filing deadline and thus be in technical default of continuous disclosure regulations. In addition, Cielo applied for and was granted a management cease trade order (MCTO) under which Allan and the CFO are prohibited from trading Cielo stock.

Cielo claims this was done “voluntarily”, but if they had not applied for the MCTO, Canadian securities regulations stipulate that a general cease trade order (CTO) would ordinarily be issued when a company has failed to file audited annual financial statements. Under a general CTO, any trading of Cielo stock would be prohibited.

Note that last year Cielo was also late in filing its annual statement but avoided an MCTO because of a COVID-19 related provision.

Cielo only disclosed that the accounting restatement involved historic accounting for warrants and capitalization of interest. While perhaps only a minor accounting issue, we think this is another sign that Cielo isn’t the next ESG blockbuster.

Management Credibility on Fumes

Investors reacted negatively to the desulfurization delay and the production update. At the current price of C$0.75, Cielo still has an enterprise value of approximately C$475m. We think considerable downside remains.

We expect the new September target for desulfurization will be missed. And we think it's unlikely Cielo ever hits 500lph of continuous production of high-quality fuel, let alone 1,000lph.

Cielo claims it’s the first and only company that can convert all seven types of plastics into wildly profitable diesel, a huge step towards solving a global waste issue. Considering the ham-fisted developments of the past few months, investors should be extremely skeptical