assistantua/iStock via Getty Images

assistantua/iStock via Getty Images

The Melbourne Australian-based OceanaGold Corp. (OTCPK: OCANF) reported its second-quarter 2021 earnings results on July 29, 2021.

Q2 Snapshot

OceanaGold posted an excellent second quarter with gold production of 93.8K Au Oz and revenue of $182.6 million. The net income was $31.4 million compared to a loss of $31.4 million in 2Q20.

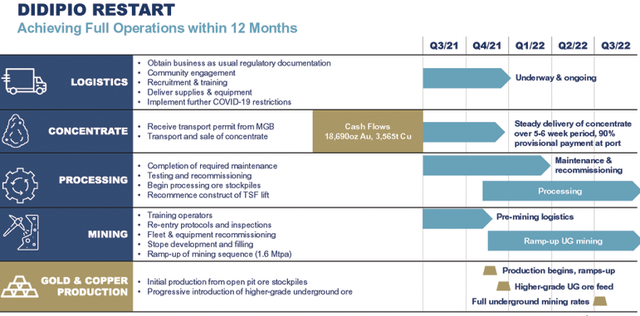

However, the big news this quarter was the Didipio mine restart after the company received the FTAA renewal signed by the Philippines government for 25 years with an unchanged 60% for the Philippines and 40% for OceanaGold split.

CEO Michael Holmes said in the conference call:

The renewal of the Didipio FTAA, which is the first FTAA reviewed in the country, of which we are very grateful to the government of the Philippines for their support through the process. This is an exciting development for us, and we are looking forward to recommencing the operations, which I will discuss during the presentation.

Processing and production at Didipio start in 4Q21, with the sale of concentrate commencing in 3Q21. Quarterly production is estimated at roughly 30K Au Oz and 3K Tonne of Copper. Entire operations are expected to be performed within 12 months.

On July 14, 2021, the Government of the Philippines confirmed the renewal of the Company’s Didipio Mine FTAA for an additional 25-year period, beginning June 19, 2019. The renewal reflects similar financial terms and conditions while providing additional benefits to the regional communities and provinces that host the operation. (press release)

Source: Presentation

Investment Thesis

The investment strategy that I suggest here is to trade the stock short-term and keep only a reduced long-term position with a year or two horizon.

I believe that OCANF will profit from the restart of the Didipio Mines. Still, the persistent gold price weakness erodes any chance for a quick reversal, and I recommend accumulating the stock below $1.71.

Stock performance

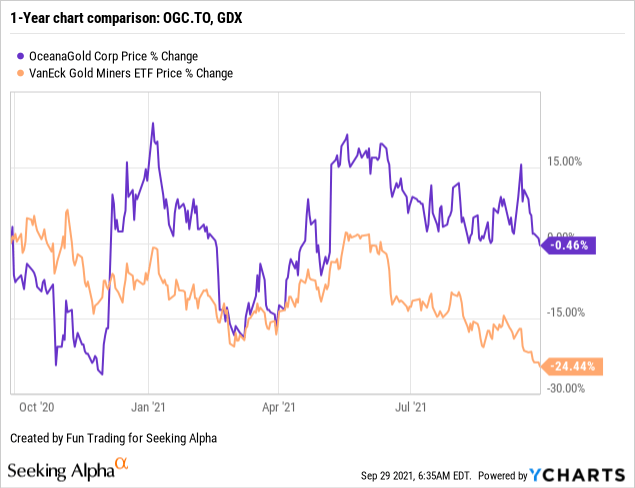

OceanaGold has outperformed the VanEck Gold Miners ETF (NYSEARCA:GDX) on a one-year basis. However, the stock is now down 0.5% year over year.

Data by YCharts

Data by YCharts

OceanaGold - Financial Snapshot 2Q21 - The Raw Numbers

| OceanaGold | 2Q20 | 3Q20 | 4Q20 | 1Q21 | 2Q21 |

| Total Revenues in $ Million | 95.8 | 97.9 | 168.2 | 148.9 | 182.6 |

| Net Income in $ Million | -31.4 | -96.8 | 3.9 | 16.0 | 31.4 |

| EBITDA from company $ Million | 15.3 | -55.3 | 76.7 | 60.7 | 90.0 |

| EPS diluted in $/share | -0.05 | -0.16 | 0.01 | 0.02 | 0.04 |

| Operating Cash flow in $ Million | 16.7 | 63.1 | -1.6 | 47.6 | 35.8 |

| Capital Expenditure in $ Million | 53.6 | 78.5 | 62.7 | 72.8 | 86.1 |

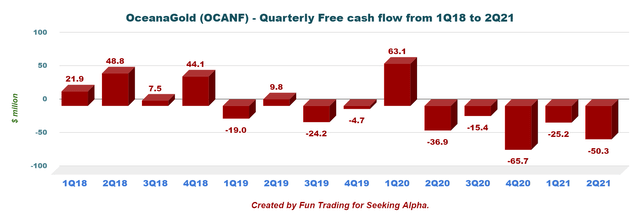

| Free Cash Flow in $ Million | -36.9 | -15.4 | -64.3 | -25.2 | -50.3 |

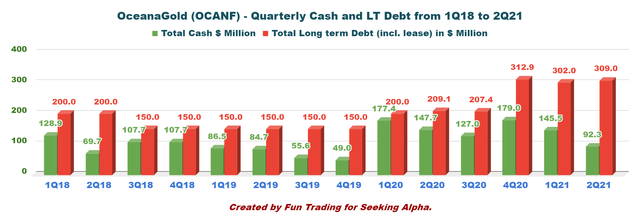

| Total Cash $ Million | 147.7 | 127.0 | 179.0 | 145.5 | 92.3 |

| Long term Debt (incl. lease) In $ Million | 209.1 | 207.4 | 312.9 | 302.0 | 309.0 |

| Shares outstanding (diluted) in Million | 637.5 | 637.2 | 702.0 | 713.5 | 719.6 |

| Producing assets | 2Q20 | 3Q20 | 4Q20 | 1Q21 | 2Q21 |

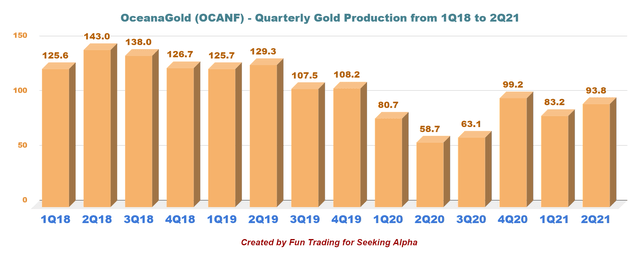

| Gold production in K Au Oz | 58.7 | 63.1 | 99.2 | 83.2 | 93.8 |

| Gold production sold | 62.0 | 60.8 | 96.4 | 82.8 | 95.9 |

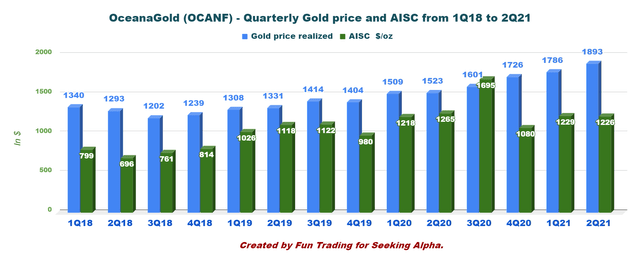

| Gold price realized | 1,523 | 1,601 | 1,726 | 1,786 | 1,893 |

| AISC $/oz | 1,265 | 1,695 | 1,080 | 1,229 | 1,226 |

| Mines | 2Q20 | 3Q20 | 4Q20 | 1Q21 | 2Q21 |

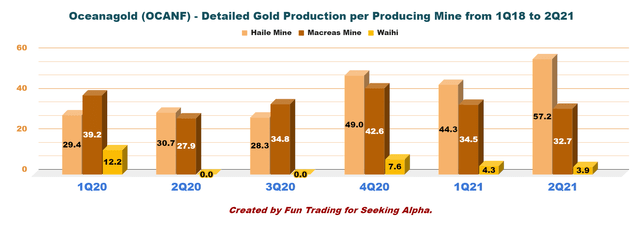

| Haile | 30.7 | 28.3 | 49.0 | 44.3 | 57.2 |

| Macraes | 27.9 | 34.8 | 42.6 | 34.5 | 32.7 |

| Waihi | 0 | 0 | 7.6 | 4.3 | 3.9 |

| Didipio | 0 | 0 | 0 | 0 | 0 |

Data Source: Company release

Gold Production And Balance Sheet Details

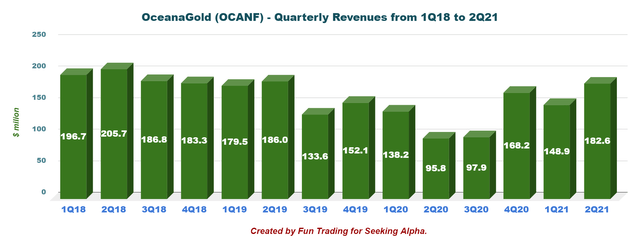

1 - Revenues were $182.6 million in 2Q21

OceanaGold reported second-quarter revenue of $182.6 million with a net income of $31.4 million. The company posted a net profit of $16.0 million in the first quarter or $0.02 per share. This quarter's revenue was higher due to higher gold sales volumes, mainly from Haile, and a higher average gold price received.

2 - Free cash flow was a loss estimated at $50.3 million in 2Q21

Yearly trailing free cash flow is a loss of $156.6 million, with a loss estimated at $50.3 million for the second quarter of 2021. The free cash flow shows that the company is investing too much in CapEx now. In the press release, the company explained why CapEx was high this quarter.

Consolidated capital expenditure in the second quarter of 2021 was $94.9 million, an increase of 37% quarter-on-quarter primarily due to increased investing related to the expansion of tailings and waste storage facilities at Haile and the ongoing development at Martha Underground.

3 - Gold production details. Total production was 93.8K Au Oz in 2Q21. (Sold 95.9k Au Oz).

The consolidated second-quarter gold production was 93,848 ounces at an AISC of $1,226 per ounce on 95,934 ounces of gold sales.

Production increased significantly at Haile.

Note: The Didipio Mine in the Philippines did not produce from H2 2019 until 30 June 2021 due to the suspension of operations. The first concentrate in Didipio is expected in 3Q21. In the conference call:

Haile's record performance was partially offset by lower sales from Macraes, which delivered a lower-than-expected first half performance, due to an extended mill shutdown and mining limitations. With these disruptions largely resolved, we expect a strong second half from the price.

The AISC stabilized this quarter at $1,226 per ounce, slightly below the AISC of 1Q21. The Site AISC for Macreas was $1,523 per ounce, up significantly from $1,335 per ounce in 1Q21.

4 - Debt and liquidity

The Cash and Cash equivalent was $92.3 million in 2Q21. Total debt is $200 million in a drawn revolver facility and $109 million in equipment leases. Liquidity is now $142.3 million, including $50 million available under the revolving credit facility.

5 - Full-year 2021 guidance revised

On a consolidated basis, the company has refined its full-year production guidance to 350k to 370k gold ounces (from 340K to 380K gold ounces), excluding Didipio, at AISC of $1,200 to $1,250 per ounce sold (from $1,050 to $1,200 per ounce sold) and cash costs of $825 to $875 per ounce sold (from $750 to $850 per ounce sold).

The company expects to provide updated, consolidated full-year guidance inclusive of Didipio.

CapEx for the full year 2021 has been come down to $275 million to $295 million.

Technical Analysis and commentary

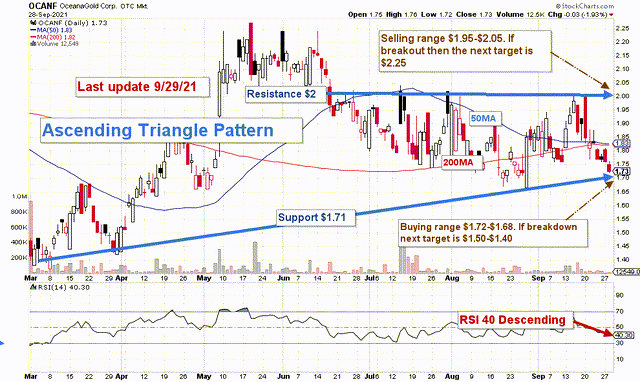

Fun Trading

OCANF forms an ascending triangle patternwith resistance at $2 and support at $1.71.

The trading strategy is to accumulate below $1.71 and take profits between $1.95 and $2.05. I recommend trading LIFO around a medium-long position for a potential breakout to $3.