Copper price hits new high on low inventories Copper price hit a record high on Friday as surging power prices threaten to curb supply at a time when exchange stockpiles are at rock bottom.

Inventories available on the London Metal Exchange hit the lowest since 1974.

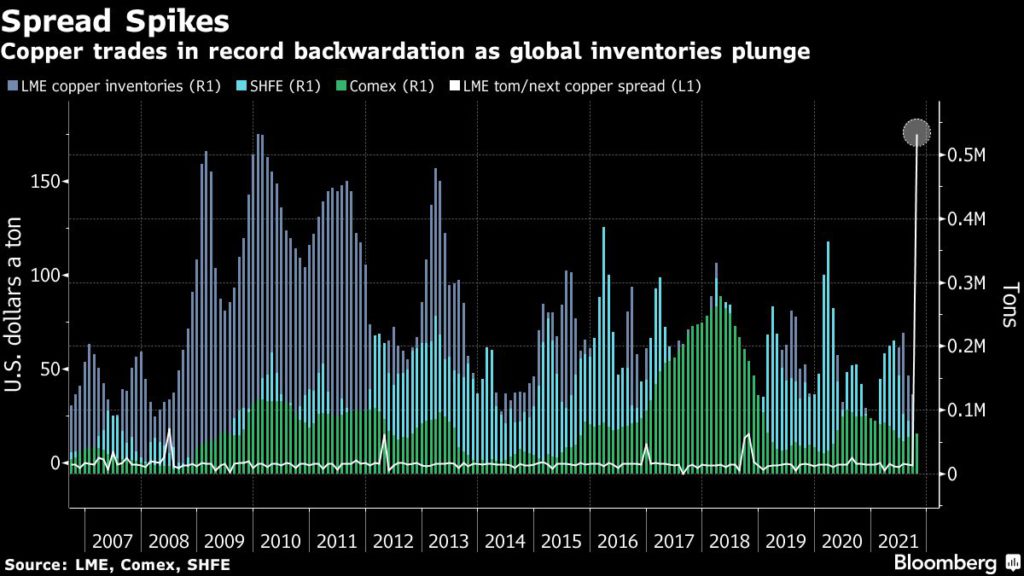

Copper tracked by LME warehouses that’s not already earmarked for withdrawal has plunged 89% this month after a surge in orders for metal from warehouses in Europe. Stockpiles have also been falling fast on rival bourses and in private storage, and LME spreads have entered historic levels of backwardation (prompt delivery metal pricier than futures), with near-term contracts trading at record premiums.

Copper for delivery in December rose sharply for the third day in a row on the Comex market in New York, touching $4.7810 per pound ($10,518 per tonne), the highest since May 12, 2021.

The rally fed through to producers, with shares in Freeport-McMoRan up 4%, Southern Copper up 2.4% and First Quantum Minerals up 5% on the day.

After fresh orders to withdraw metal on Friday, there are now just 14,150 tonnes of copper freely available in LME warehouses, in an industry that consumes about 25 million tonnes annually.

“If more metal doesn’t make it into the exchange, then it really is in a difficult position,” Michael Widmer, head of metals research at Bank of America, told Bloomberg.

“Right now the LME is running a physical contract that effectively is not really backed by physical metal.”

“High power costs are also inflationary and this is boosting demand from investors for copper and other physical commodities as a hedge,” said Saxo Bank analyst Ole Hansen.

“It looks like we’ve got clear air ahead of us to that May peak,” he said.

The international zinc and copper study groups said this month they expected both metals to be oversupplied next year, but analysts say the power crisis could change that.

While falling inventories across major exchanges point to a fundamental mismatch between supply and demand, some short-term relief could be seen if stockholders who have requested to withdraw metal in recent days instead decide to deliver it back to take advantage of sky-high spot prices.

There are currently 167,250 tonnes of copper scheduled for withdrawal from LME warehouses, but the steep backwardation creates an incentive for owners to immediately sell their holdings on the exchange and use the lower-priced futures contracts to buy the metal back at a later date.