rest/iStock via Getty Images

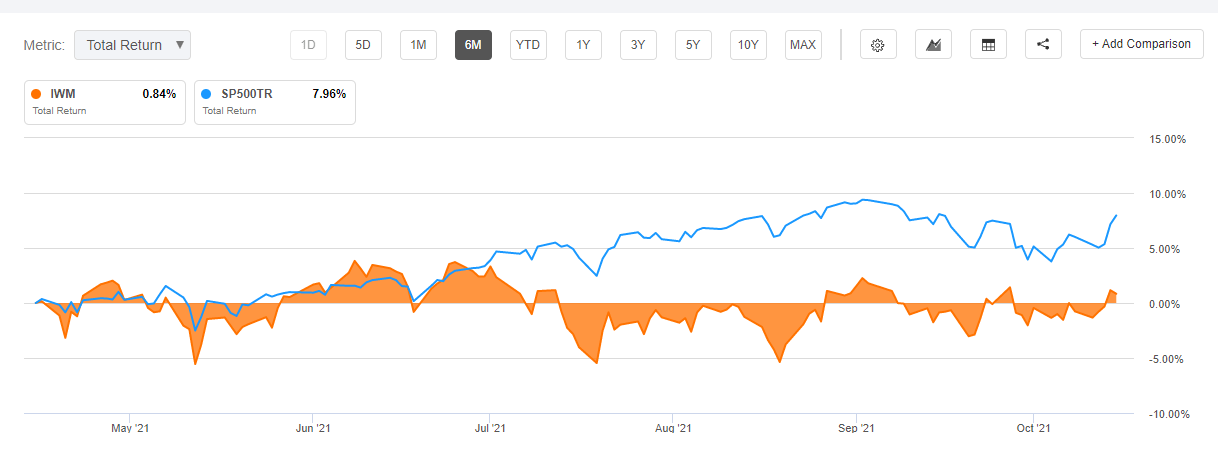

Small-cap stocks have had a good year. The trend has continued as they have outperformed large-cap stocks over the last several weeks and last 52 weeks. Investing starts somewhere, and starting small can be a great way to get acquainted with the market. The trick is identifying stocks with low prices that also possess strong fundamentals. We are re-introducing an old concept of buying stocks below a $10 stock price.

Seeking Alpha’s Stocks Under $10 Screener is a great and easy-to-use tool to identify these equities. The stocks are ranked by our proprietary quant model. Not only does it allow you to find hidden gems with the potential to be the next great stocks under $10, but you can also create your own custom screen from scratch. Typically, when the market rotates to value from growth and the economy is picking up, small-cap stocks perform well. “With the market at all-time highs, it’s about looking where people aren’t, and I think that’s small-caps right now,” says Jeff Mills, Chief Investment Officer at Bryn Mawr Trust.

Source: Seeking Alpha

Small-Cap stocks are typically companies with a market capitalization between $300 million and $2 billion. Small in size, small-caps offer great opportunities for long-term growth, but they come with increased volatility and responsibility, as they are the riskiest of U.S. equity asset classes. Because they are small companies going through high growth periods, they also tend to have higher leverage. Therefore, when the market slows down or begins to enter into a slowdown or recession, or contraction, they sell off more from a day-to-day trading perspective, compared to that of large-cap stocks. Small-cap stocks are not for risk-averse investors because of their volatility. However, over long periods of time, small-caps have outperformed large-cap stocks.

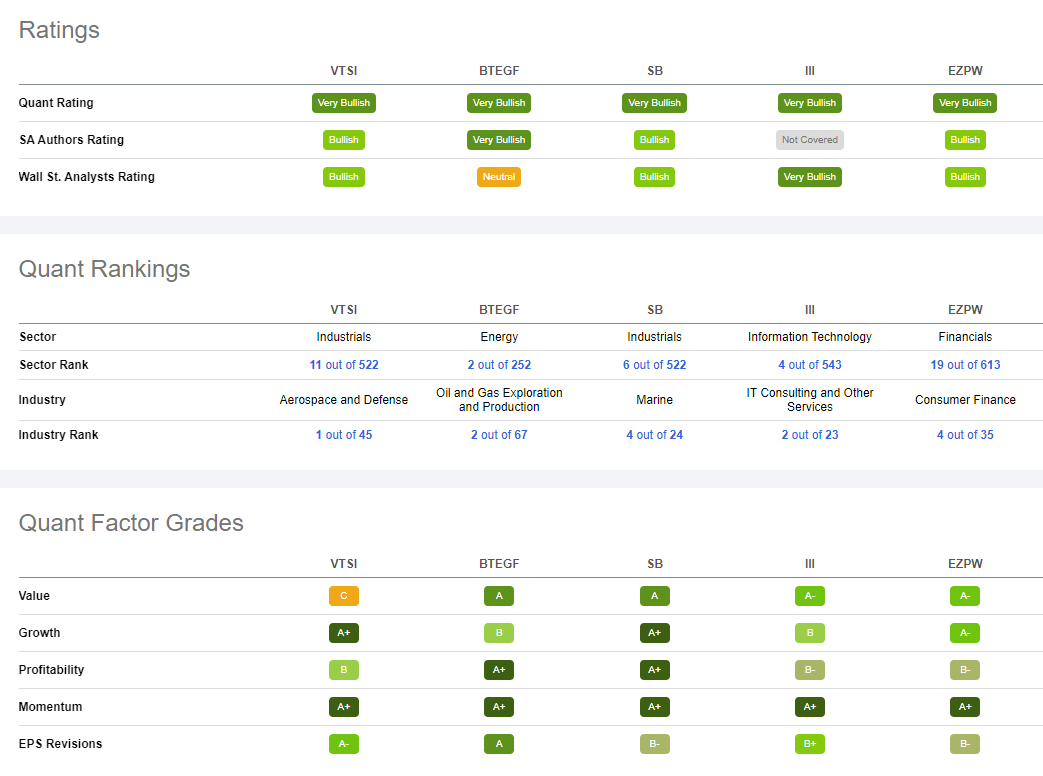

A few years ago, I wrote a piece in Forbes called Top 5 Stocks Under $10, and while past performance does not guarantee future results, a few of my picks, based upon the Seeking Alpha Quant System, have paid out handsomely. Typically, it is hard to find companies possessing the collective financial traits we seek; attractive characteristics of value, growth, strong EPS revisions, profitability, and strong momentum.

Fortunately, the power of filtering big data and our systematic trading model has helped Seeking Alpha identify five stocks under $10 that possess the above core fundamental metrics we desire.

Ratings And Rankings On Top Stocks Under $10

Source: Seeking Alpha Premium

Baytex Energy has emerged as a company to watch. Canada-based Baytex Energy Corp. acquires, develops, and produces oil and natural gas. This past Friday, its share price reached a 52-week high of $3.25 following Scotiabank’s increased local currency price target from C$2.75 to C$3.75. To begin 2021, Baytex expanded production through its Clearwater Appraisal Program and strategic land agreement with Peavine Mtis Settlement, the latter of which has five oil wells, increasing production this year from zero to greater than 2,300 bbl/d.

The Clearwater has emerged as one of the most profitable plays in Canada, and our 2021 appraisal program has delivered production results beyond our initial expectations. We have drilled five successful oil wells, and our Clearwater production has increased to greater than 2,300 bbl/d. In addition, we are excited to have expanded our partnership with the Peavine Mtis Settlement in northwest Alberta, increasing our land position within the settlement by a further 20 sections to 80 contiguous sections.

-Ed LaFehr, Baytex Energy Corp. President and CEO, 2021 Clearwater appraisal program update.

This stock has a Seeking Alpha Quant rating of Very Bullish, and its overall value grade is a C+. However, the underlying value metrics tell a more compelling story. The forward P/E is an A+, and at a multiple of 1.93x, it is at an 84% discount to the sector. The stock also gets an A- for EV/EBITDA, and at 4.8x, it is at a 40% discount to the sector. Despite some of Baytex Energy’s growth stats being a bit lumpy, the stock does stand out with a solid Green Cash Flow Per Share Growth rate of 19.62% compared to the sector at 15.7%.