GlobalStock/E+ via Getty Images

(Please note that this NYSE listed company is a Canadian company that reports using Canadian dollars.)

Crescent Point Energy (CPG) (TSX: CPG) is a Canadian company that made a nice acquisition as the industry was recovering from the coronavirus demand destruction. Now that the acquisition is closed, management is moving quickly to integrate the operations and take advantage of the currently strong commodity prices. Like many acquisitions made throughout the industry, this acquisition was supposed to be accretive. So improved per share financial performance should be expected by investors not only in the immediate future but also during the next cyclical downturn.

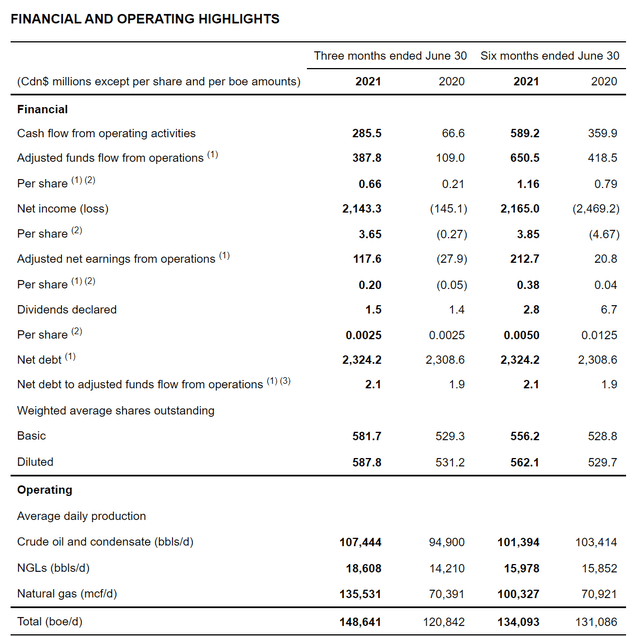

Source: Crescent Point Energy Second Quarter 2021, Earnings Press Release

Management has been rearranging the portfolio of projects for some time. This has meant disposing of older higher-cost projects while purchasing more desirable projects with better cash flow. The problem is that the higher commodity prices of the current fiscal year make many managements look like absolute geniuses because cash flow has exploded upward with the higher commodity pricing. That would have happened without the recent portfolio moves.

Now management is cautiously raising the dividend to C$.03 per share quarterly while also forecasting an optimistic amount of free cash flow. The combination of stronger than expected commodity prices and the integration process is quickly yielding some noticeable results.

Investors really will not know the success of the current management strategy until the company performance during the next period of weak pricing. Right now, I like the company's chances of outperforming the industry during the next downturn.

One of the other things that differentiates this company from many others listed on the NYSE is the ability of Canadian companies to recapture impairment charges as the recovery proceeds. That means that many Canadian companies will have fantastic earnings when compared to United States upstream companies due to this accounting difference.

Therefore, a better measure of progress is likely to be cash flow per share progress. Steady cash flow progress is unlikely to be influenced by the different accounting treatments throughout the world because the cash flow statement has to "tie into the company's checkbook". That is not to say there are no differences, but there is one absolute in that cash can only be spent or received basically one way. So the cash flow statement is more uniform throughout the world (as the only differences are classification differences, not the total amount spent).

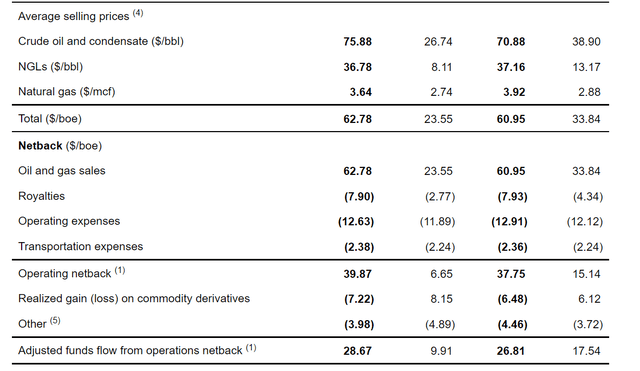

This company has high netback margins due to the very high percentage of oil and (in Canada) condensate produced. The pricing of both of those has remained strong in the current fiscal year. This will be aiding debt repayments and growth options. Management has increased the guidance in the latest quarter as production improvements progress continues throughout the industry. Nonetheless, production growth both with the company and throughout the industry is likely to be modest until balance sheet issues fade.

For many years, this was a highly leveraged debt-happy company. That changed a few years back as this company really just barely beat the latest coronavirus challenges by deleveraging before fiscal year 2020 began. Now the management attitude is very clear with the issuance of stock for the latest acquisition and the low (by historical standards) debt ratio that management wants to push lower.

Those debt ratios will automatically improve as the acquired properties continue to contribute to overall company profits. The debt used to acquire the properties counts 100% right away. But the profits from the acquisitions only contribute one quarter at a time until a year has passed. Therefore the debt ratios shown above are extremely conservative given what is to come unless commodity prices unexpectedly crash.

Dividends have likewise become a much lower priority under the current management. The low dividend strategy makes sense until debt is repaid to satisfactory management goal-driven levels and until there are no more bargains available to purchase. That makes the latest dividend increase especially significant. It means other higher priorities are being achieved faster than management originally expected.

This part of the industry cycle often offers a lot of profitable opportunities that far exceed any dividend goal one can imagine. If those opportunities are handled correctly, then anything accomplished now will provide ample opportunity for dividends when commodity price futures look grim enough to not justify more wells or more acquisitions. That usually happens at cyclical industry market tops and the beginning of industry downturns. Such a strategy would make the common stock a variable dividend instrument. But it could be a very profitable one.

Investors often wonder why companies take impairment charges for properties purchased near the bottom of the market if those properties are such a good deal. The reason this likely happens is those properties purchased were neglected by the seller due to other priorities. In addition, companies often forego maintenance and other essential activities when possible during the sales process. The impairment often "comes back" to shareholders through the usual cost reductions and operational optimization improvements that the buyer does to undo the neglect of the properties. This process often lowers the costs to enable far more reserves going forward than is envisioned with the cost structure at the time of the acquisition.

On the other hand, properties purchased near market tops often suffer permanent earnings and reserve losses because the purchase assumptions are often too optimistic (and usually funded with lenders who lack experience in the industry). This kind of impairment at best will only partially return during the next recovery and may affect corporate profitability far longer than shareholders realize (especially if an acquisition was made for shares).

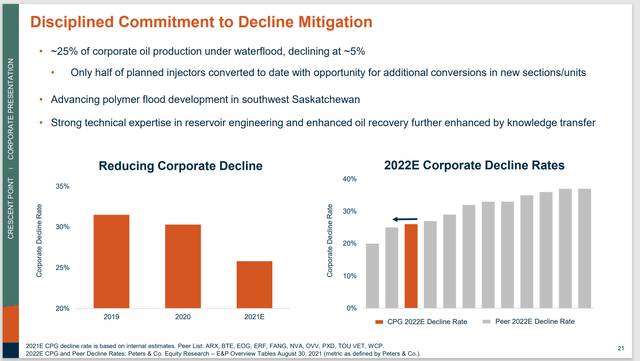

Source: Crescent Point Energy September 2021, Corporate Presentation

Crescent Point Energy has some waterflood projects that are both profitable and have low enough decline rates to offset the initial steep declines of the unconventional part of the company portfolio. This leads to a favorable comparison to much of the industry while keeping costs down. That is a very unusual combination.

Source: Crescent Point Energy Second Quarter 2021, Earnings Press Release

This management has determined that the higher costs of secondary recovery are more than compensated by the margins shown above. Investors need to decide for themselves whether or not that is true. What is clear is that the cash flow shown in the quarterly report earlier appears to justify that assumption.

So many investors tend to argue that low costs are the only thing that matters in the commodity industry. But here are occasions where a higher margin will more than offset the disadvantage of higher costs. This appears to be one of those situations. The cash flow in two quarters annualized is more than $1 billion. That is very satisfactory for the enterprise value. Now if management can optimize the operations of the acquisition, then this stock is likely to be a bargain at the current price.

Compare these results to Denbury Resources (DEN), another solely secondary recovery specialist that touts high margins. Denbury reported about 48K production for the latest six months and only $144 million of cash flow for that same six-month period. This is a clear case where the superior margins are not providing the necessary cash flow to keep the company from being a high-cost producer in the industry. Clearly, now that management has exited bankruptcy, the company has a lot of cost reduction work ahead. The other choice would be to keep debt very low so that industry downturns are not threatening. High-cost competitors survive by either not using debt at all or keeping debt levels very minimal in the current environment.

The future for the stock of Crescent Point Energy appears to be pretty bright. The enterprise value of the company is likely to prove to be quite a bargain if management is correct about the bargain price of the latest acquisitions. There could still be more purchases in this buyers market. The latest management has done a very good job of turning around a company that looked like a sure bankruptcy candidate had measures not been taken to reduce debt. Therefore, the future is likely to be very different from the past.