metamorworks/iStock via Getty Images

Newcrest Mining (OTCPK:NCMGF) yesterday announced that it made a deal to acquire Pretium Resources (NYSE:PVG). Pretium's shareholders will have an option to choose between C$18.5 ($14.86) per share in cash and 0.8084 Newcrest shares per 1 share of Pretium. Shareholders who will not decide on time will get C$9.25 ($7.43) and 0.4042 shares of Newcrest. According to Pretium, the offer represents a 23% premium to the last closing price and a 29% premium to the 20-day volume-weighted average share price. The deal values Pretium at approximately C$3.5 billion ($2.81 billion).

The deal values Pretium's shares at multi-year highs. However, despite the unanimous support of Pretium's Board of Directors, the offer doesn't seem too exciting to me. Not due to the Brucejack mine alone, but due to the huge exploration potential, that is about to be acquired by Newcrest almost for free.

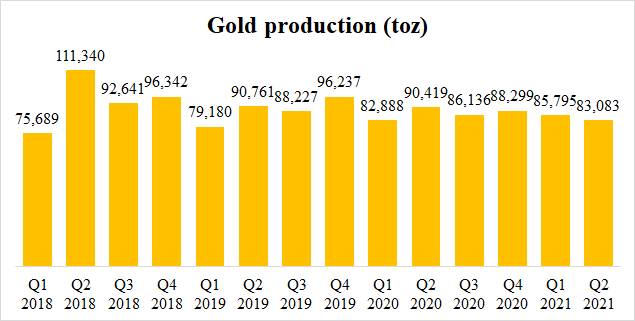

Pretium's Brucejack mine started production back in 2017. The ramp-up process was negatively impacted by issues with the gold grades that lagged behind the expectations significantly. As a result, Brucejack never became the monster cash machine it was supposed to be. Nevertheless, the mine became a solid profitable mining operation, with stable production rates of 80,000-90,000 toz gold per quarter, with AISC in the $1,000-1,100 range.

Source: own processing, using data of Pretium Resources

Over the last 2 years, Brucejack has been generating robust cash flows of $50-90 million per quarter. Over the last 12 months, the operating cash flows amounted to $307 million. It means that the acquisition price of $2.81 billion attributes Pretium a price-to-operating cash flow ratio of approximately 9.15, which is a reasonable value. Newcrest alone has a price-to-operating cash flow ratio of only 6.7. The industry majors like Barrick Gold (GOLD) or Newmont (NEM) have it at 7.37 and 9.68, respectively. This means that the current Brucejack mine operations are reasonably valued. But there is potential for significant expansion of the mining operations, as the recent drill results have been really great.

Source: own processing, using data of Pretium Resources

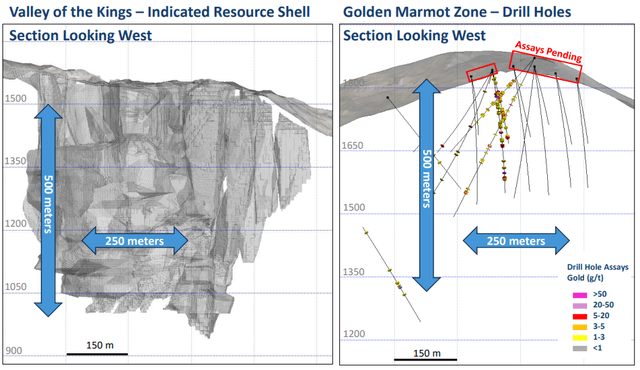

Pretium holds a large land package with great exploration potential. It has been long known that there is much more gold outside the Valley of the Kings deposit. However, Pretium had huge resources, and therefore, it focused only on the mine development for years. But the company is actively drilling again, and great results keep on coming.

On February 25, Pretium released some very good drill results from the North Block Zone, located directly to the north of the Valley of the Kings deposit. The high-grade gold intersections included 11.3 g/t gold over 27 meters, 19.3 g/t gold over 9 meters, 80.7 g/t gold over 12 meters, 136.5 g/t gold over 7.5 meters, 124 g/t gold over 9 meters, 2,100 g/t gold over 1 meter, or 2,590 g/t gold over 1 meter.

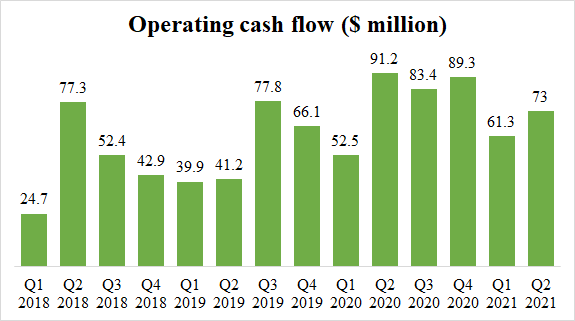

On May 3, Pretium released high-grade drill intersections made directly below the currently known deposit. The best intersections included 303.6 g/t gold over 5 meters, 254.9 g/t gold over 7.5 meters, 1,555 g/t gold and 1,665 g/t silver over 1 meter, and 1,400 g/t gold and 1,310 g/t silver over 1 meter.

Further drill results were reported on June 15. They came from the North Block once again. The best results included 31.6 g/t gold over 51 meters, 20 g/t gold over 22.5 meters, 60.2 g/t gold over 22.5 meters, 306.6 g/t gold over 19.5 meters, 561.6 g/t gold over 15 meters (including 8,400 g/t gold over 1 meter), 24.5 g/t gold over 42.5 meters, or 191.6 g/t gold over 14 meters.

The September 13 news release presented another group of great intersections from the North Block Zone, including 93.4 g/t gold over 34.5 meters, 3,590 g/t gold and 2,680 g/t silver over 1 meter, 3,150 g/t gold and 1,870 g/t silver over 1 meter, or 7,360 g/t gold and 4,400 g/t silver over 1 meter.

Source: Pretium Resources

The latest batch of drill results came from the Golden Marmot Zone, 3.5 kilometers to the north of the Valley of the Kings deposit. The initial results from this exploration target included 72.5 g/t gold over 53.5 meters, 46.1 g/t gold over 5.8 meters, and 22.8 g/t gold over 38 meters. The management believes that Marmot could be of similar size to the Valley of the Kings deposit (picture above). As stated in the news release:

The drilling completed in 2021 intersected gold mineralization over a zone that is approximately 150 meters in width, 250 meters in length, and 275 meters in depth. A historic drill hole intersected high-grade gold mineralization a further 225 meters below the currently drilled zone. The Golden Marmot Zone remains open and could be of similar size to the Valley of the Kings deposit. We are eagerly awaiting the assay results from the remaining 17 drill holes which we expect to release early next year.

Moreover, drill results from the Gossan Hill, Bridge Zone, and Hanging Glacier targets are pending.

Source: Pretium Resources

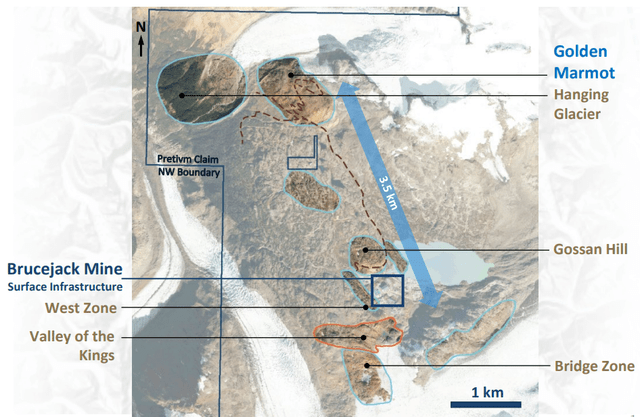

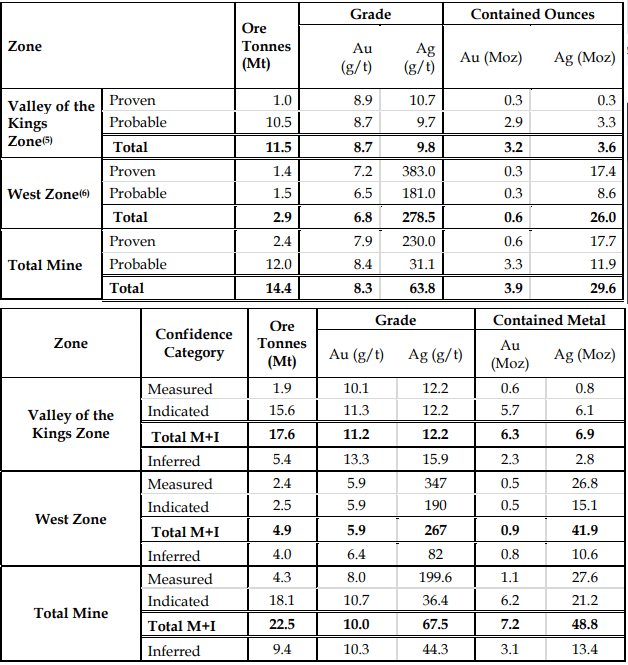

The Brucejack mine contains reserves of 3.9 million toz gold. The measured, indicated, and inferred resources contain 10.3 million toz gold (including reserves). Newcrest is technically paying $720/toz of gold contained in reserves, or $273/toz of gold contained in resources. This price isn't bad. However, once again, it doesn't take into account the huge exploration potential. If Golden Marmot really evolves into another Valley of the Kings, then Newcrest pays only around $150/toz gold in resources. And there are also other exploration targets. It is highly probable that further deposits will be discovered on the property.

Source: Pretium Resources

Conclusion

The deal values the Brucejack mine in its current shape reasonably. Newcrest attributes to Pretium price-to-operating cash flow ratio of approximately 9.15. It is willing to pay $720/toz of gold contained in reserves, or $273/toz of gold contained in resources. However, the recent drill results clearly confirm that there lies much more than only Valley of the Kings deposit under the large land package. Golden Marmot seems to be something similar to Valley of the Kings and numerous other exploration targets have been identified. Newcrest is about to get the huge exploration potential almost for free. This is why I believe that the deal is more favorable for Newcrest than for Pretium.