peterschreiber.media/iStock via Getty Images

peterschreiber.media/iStock via Getty Images

The complete article was published exclusively to members of The EV Supply Chain on 5/11/21. There have been more recent announcements from the company that warrants further research.

Nano One Materials (OTCPK:NNOMF) is a company looking to be on the forefront of rapidly changing cathode chemistries. The company isn’t a battery manufacturer, their focus is on developing next-generation cathode materials that they can license out to other producers. If they are successful in their endeavors, Nano One has the potential to become a major player in the battery manufacturing space. This article will look at how exactly Nano One plans to help revolutionize the battery space and the likelihood of success that they face.

Proprietary Manufacturing Process

How it’s Done

Metal to cathode manufacturing, or M2CAM, was announced fairly recently and, as the name suggests, allows manufacturers to go directly from the metal to the cathode. What this means is that, instead of the standard step of converting manganese, nickel, or cobalt into a sulfate before they’re combined as the cathode material, companies can now just use the raw metals. The same would be true for lithium, but instead allowing companies to use lithium carbonate in place of lithium hydroxide in applications that would require it.

This is where the significant reduction in weight comes in and, as a result, reductions in shipping costs. As CEO Dan Blondal explains (1:44), for every one molecule of nickel, there are six water molecules attached in a nickel sulfate crystal. As a result, the crystallization process turns what was just one kilogram of nickel, into five kilograms of nickel sulfate. The crystallization process itself is rather expensive and energy-intensive as well, requiring large quantities of sulfuric acid and high levels of heat.

Compiling the inefficiency of this process is what’s done once the materials reach the cathode manufacturer. Sulfates are dissolved back into their metal forms and the waste (water and sulfate) is discarded. This waste stream is 5x the volume of the actual product, a pretty extreme ratio for any product, especially one claiming to be green. It seems strange that manufacturers would continue to go through this process if it’s so blatantly wasteful, but the missing step was Nano One’s one-pot process.

The one-pot process mixes the metals, lithium carbonate, and the protective coating all in one step. As the company describes it, “It combines feedstock conversion, precursor formation, lithiation and coating steps into one reaction.” To translate this, feedstock conversion is desulfating the metals (all but lithium), precursor formation is combining all of the desulfated metals, lithiation is then adding the lithium to the mixture, and coating is the application of the protective coating. The mix that comes from the one-pot production process takes far less time to homologate in the kiln, hours instead of days, and a protective coating for every individual crystal is developed. The company calls these individually coated crystals “nanocrystals,” likely the basis for the company’s name. Cute. These are really all of the most technical details available as Nano One, understandably, is keeping a pretty tight seal on what’s available to the public.

To understand what makes Nano One’s cathode manufacturing process so special, it is important to understand what that manufacturing process looks like today. Once all metal sulfates arrive at the cathode manufacturer, they are combined to create a powder known as the Precursor Cathode Active Material, or PCAM for short. During this step of combination is when the sulfates and water is stripped from the metals, returning them to their pure form.

After this step, for today’s high-nickel cathodes, lithium hydroxide is added to the mix via a process of grinding and milling. Then, over a process of a few days, the lithium powders diffuse into the metal powders in a high-intensity kiln. The high temperature of the kiln melts the materials, forming a brick, that must be ground again so that the roasting process can proceed. Once this powder is fully homologated, a protective coating is baked onto the surface of the powder, bunching groups of crystals together. Basically, the end product is a few crystals bunched together by the protective coating, as opposed to Nano One's goal of providing each crystal its own protective coating.

Cathode Improvements

By reducing the waste produced by current manufacturing processes, Nano One believes they will be able to reduce transportation costs by 5x and cut $1,000s per tonne of material by removing the crystallization process. With this, the company expects its manufacturing process to drop cathode costs by around 13%-20%. Adding to the cost rewards is a less environmentally damaging process as well. Cutting out unnecessary energy and water use is beneficial for the whole industry, as it, obviously, positions itself as the green alternative.

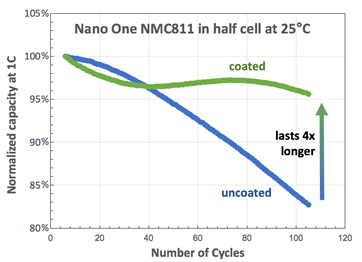

On the performance side, Nano One’s process will yield a more durable cathode material. Single coated crystals are far less resistant to cracking, meaning they retain their usability for far longer than standard cathode materials. As cathode materials expand and contract during charge cycles, they can cause the clusters to break apart. As clusters break apart, cracks emerge in the protective coating, which causes harmful reactions to occur with the exposed materials. The figure below demonstrates the incredible capacity retention that Nano One’s proprietary coating method provides over a standard cathode.

Source: Nano One

To translate this into operational advantages, manufacturers can create incredibly long-lasting vehicles. To give you an idea of the scale of this improvement, a single crystal structure is what Tesla (TSLA) is working to develop for its cathode to create its “million-mile battery.” As discussed in my article about solid-state batteries, greater longevity also enables a greater driving range, as manufacturers can utilize more of the full potential of the cell because they spare less capacity to act as a buffer. This increase in practical range could likely be in the realm of 20%, with no other changes other than the manufacturing process of the cathode.

Taking this a step further, the company expects capacity gains of around 5% as a direct result of their M2CAM process, which will also have a clear improvement to range. As these are preliminary test results, the company may be able to further refine this process and produce even stronger results, but 5% is still a noteworthy improvement. Both M2CAM and one-pot manufacturing are viable for the production of LFP and NMC cathodes, covering the two major cathodes in use in today’s EV market.

Product Viability

At this stage, Nano One has gotten quite a few companies on board. An undisclosed, major American OEM with global production, is reportedlyrather close to the project and where there’s big players, there’s promise. However, more importantly, is the company’s pilot line, up and running, utilizing the one-pot manufacturing process. Just one month after construction was completed in May, 2017, Nano One began producing its first cathode materials at the site.

The pilot plant represented a 100x increase in production volume from laboratory-scale production, demonstrating the scalability of this production process. The company’s recent capital raise went, in part, to funding an expansion of the production assembly. Based on the pilot plant’s performance, Nano One has crafted preliminary plans that would allow for production of up to 24,000 EVs, or 1.4GWh, per year. These figures give me tremendous confidence in the one-pot process as a scalable manufacturing process.

M2CAM has not, at least as far as the public is concerned, been a part of this pilot plant production yet. However, the company did say in its press release announcing the technology, that “Nano One’s patented One-Pot process has been successfully adapted for M2CAM.” We have no way of knowing to what extent “success” was achieved but I would wager that this was at the lab scale. Regardless, results are promising and I have faith that the process will be implemented in the pilot plant soon.

Market for the Product

Clearly, this is a desirable product. Lowering costs and increasing performance is something that rarely happens in one go. For a market that is expected to be worth $23 billion by 2025, Nano One expects to see an addressable market size of up to $1.4 billion. Instead of running their own production lines, they plan to do this via licensing deals and joint ventures. I feel that this is the best strategy; major battery manufacturers want to keep manufacturing in-house and this would allow them to continue to do so. It also keeps Nano One far less involved in the manufacturing side of things, which is something the company doesn’t have experience in.

For their licensing agreements, Nano One has a fairly attractive model in place. By saving customers upwards of $4/kg (per kilogram) on their cathode production, and improving quality, producers should be more than willing to pay a royalty of $1/kg. Looking at Tesla, with a current output of ~600,000 EVs per year, savings would be in the realm of $225 million per year (assuming Tesla's vehicle output would require 15 "standard" production lines from Nano One). These savings will only rise as production grows, indicating that there should be strong demand for the service.

By licensing their technology out to OEMs, Nano One is provided with a passive form of income with little to no risk, or operating overhead, incurred by the company. This hands-off approach is incredibly ideal for a company that has no major operational experience under its belt. Even for a more experienced company, limiting their required operations to generate sales is beneficial. And while $1/kg may not sound like a whole lot, the company expects to generate revenues of $5 million per production line each year.

Their other form of income would be via a joint venture. This is the more hands-on approach that requires direct involvement with Nano One. While their partner will likely be responsible for managing the production, Nano One will share the costs of assembly. So, while generating an estimated $100-$150 million per year in revenue per line, the margins would be far lower than selling manufacturing licenses. Regardless, both operations are highly beneficial for Nano One and represent a tremendous opportunity to grow in the market.

I’ll get into the more flashy aspect of their development plans in the next sector but the importance of this technology can not go underappreciated. Nano One is able to apply this manufacturing process to all existing cathode constructions, offering an improvement to all companies that rely on lithium batteries. As a licensed process, it does not interfere with any other component of a company’s manufacturing and simply creates a better, cheaper, product. This has clearly been noted by industry participants, who have now provided a pipeline of well over twenty strategic interests, one of which being Volkswagen (OTCPK:VLKAF). Something that is applicable to all lithium-dependant batteries is incredibly rare in today’s battery landscape and, as I see it, is worth billions.

Proprietary Cathode Chemistry

This is the part that excites me the most about Nano One, and not just from the perspective of an investor. Nano One is working on a Lithium Nickel Manganese Oxide (“LMN”) cathode, also referred to as a High Voltage Spinel (“HVS”) cathode. “LMN” expresses its chemical makeup, while “HVS” denotes the chemical structure, and an operational advantage, of the cathode. The former is the more conventional naming scheme and, to be quite frank, it seems that Nano One only adopted the HVS nomenclature because they thought it sounded nicer. To be fair, they aren't wrong, but Nano One has been using "LNMO" more often of late.

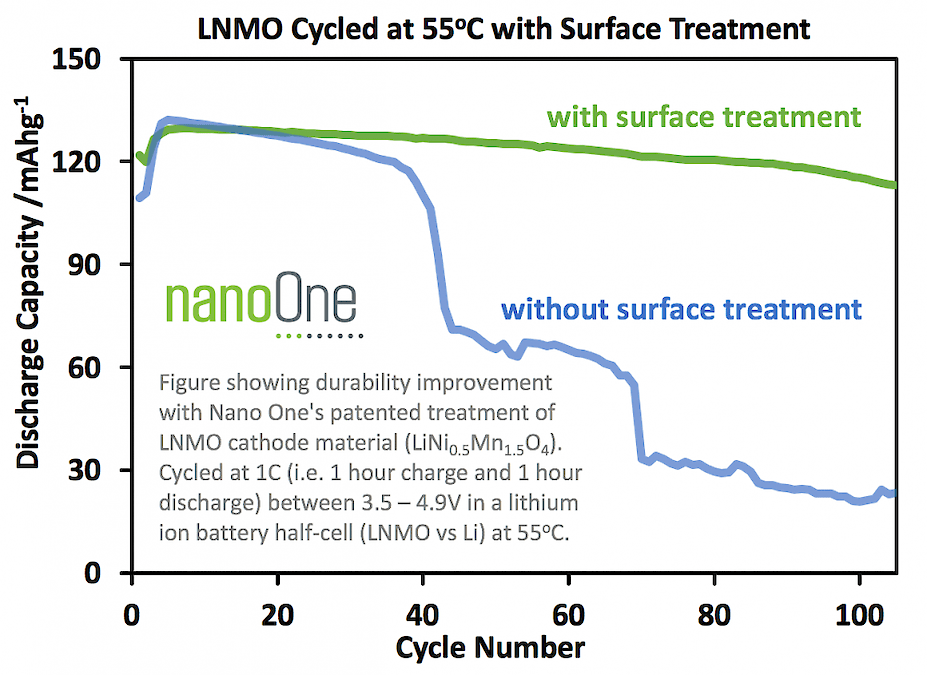

The construction of the cathode is made possible by the company’s one-pot manufacturing process. Previous attempts at the cathode were thwarted by an uneven distribution of the cathode metals, which made the chemistry uselessly unstable. The typical roast-grind-roast process for cathode manufacturing is largely responsible for this, so it’s fairly self-evident to see why Nano One’s process would rectify this issue. The image below demonstrates this superiority, even at rather elevated temperatures.

Source: Nano One

The company has been testing their cathode with “various automotive manufacturers” to validate the chemistry for use in EVs. The patentedchemistry has shown promise in recent solid-state battery tests as well. This compatibility with solid electrolytes is crucial for giving it a life beyond just this next decade, though the cathode is also compatible with today’s standard electrolytes.

One of the more mysterious, yet promising, aspects of the cathode’s development is Nano One’s partnership with “a multi-billion-dollar Asian cathode material producer.” As a quick aside, the fact that the manufacturer is based outside of China may help ease concerns over potential intellectual property issues. This undisclosed partner has a joint development agreement with Nano One for the LMN cathode; the comments below reflect some encouraging sentiment thus far.

“The work under this agreement is on schedule and on budget, and the LNMO materials have met phase one and two metrics for performance and economics,” said Nano One CEO Mr. Dan Blondal. “This partnership is built on trust and a common vision to launch a differentiated and sustainable cathode materials business and we are pleased to be reporting measurable progress towards these goals and the continued execution of our business plans.”

Last year, the company had successfully demonstrated its new cathode’s ability to complete 900 charge cycles at automotive rates, stabilized at a temperature of 25°C. The cathode was used in a 20-layer cell with a conventional electrolyte and anode. Again, the compatibility with standard lithium-ion battery components is incredibly important to note, but more important is the success achieved by the tests. Nano One currently has multiple automakers evaluating the technology for their own use. The company published an update to the fundings, increasing cycles to 1,000 at 25°C and demonstrating the ability to reach 500 cycles at 45°C. These tests are time-limited, as cells need to be repeatedly charged and discharged, so I expect further milestones to be announced in time.

The cathode development is clearly rather advanced at this stage and there is some circumstantial evidence that suggests Volkswagen plans to bring this cathode to production by 2023. During their battery day presentation, Volkswagen stated that it aims to produce batteries with high manganese content at a high volume by 2023. The company touted the performance benefits the new cells would bring and, with QuantumeScape’s (QS) cells not planned for introduction until 2025 (not that I believe that to be possible), it seems fair to suggest that Nano One could be the mastermind behind it. Not to be too speculative but Nano One is partnered with an American OEM that is a “Large Global Auto Producer” with an “Ambitious EV strategy” and Tesla announced at their own battery day presentation that they too plan to go cobalt-free.

Chemistry Superiority

As the name “HVS” suggests, Nano One’s new cathode will support incredibly high-voltage use. The company estimates around a 25% improvement, in fact, in the cathode’s specific power over standard high-nickel cathode materials. As I’ve discussed before, voltage is incredibly important for the efficiency and charge time of a battery. By allowing for a more rapid flow of electrons, batteries generate less heat while under stress, increasing efficiency, and can support faster charge times without degrading. The cathode also aims to improve longevity, though these improvements can mostly be attributed to the company’s one-pot manufacturing process.

From the perspective of keeping costs down and improving supply availability, the chemistry wins again. Nano One will utilize lithium carbonate as their lithium base for the LMN chemistry, which is cheaper than hydroxide, though half of the total material is manganese. The full chemical breakdown is half manganese, a third lithium, and just one sixth nickel. Eliminating the lithium from this equation, as is typically done with the “811” or “611” format, the breakdown is 75% manganese and 25% nickel. This combination allows the cathode material to undercut today’s most popular by more than half on the raw materials front. Specifically, Nano One estimates that their new cathode could reduce costs by upwards of 30%.